- Investors seemed to be buying XRP as its exchange outflows spiked

- Altcoin will face resistance at $0.55 if it heads north

As a seasoned researcher with years of experience in crypto analysis, I can confidently say that XRP seems to be gearing up for a potential bull run. The recent surge in exchange outflows suggests investors are buying XRP, which could indicate accumulation and a possible price increase.

Over the last week, XRP’s value has mostly held steady, showing little fluctuation in its price graph. Yet, it’s worth noting that there could be a shift in its market direction within the next few days.

Now, does this mean XRP bulls are preparing for a rally?

XRP awaits a golden cross!

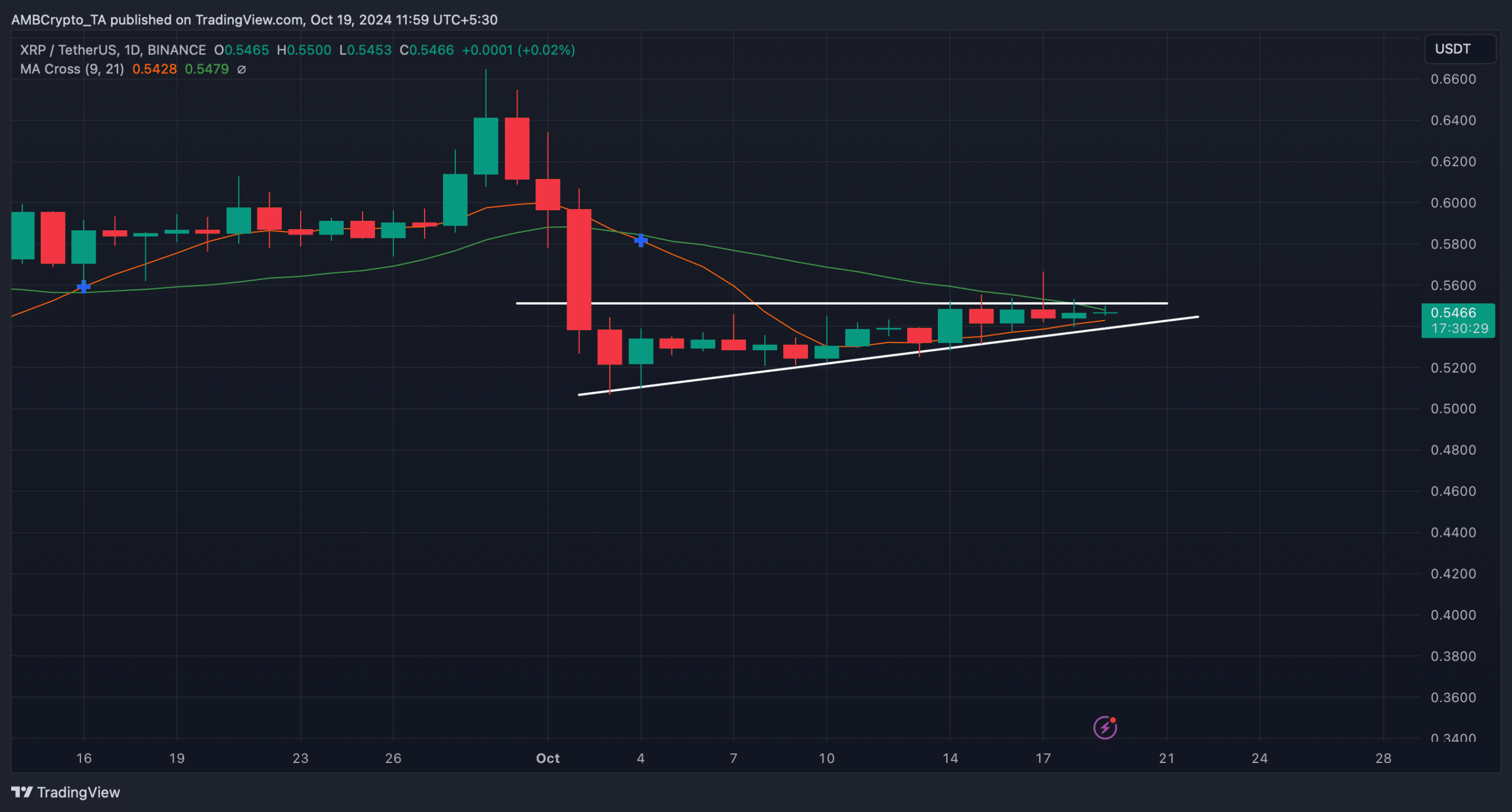

At the current moment, Ripple (XRP), the seventh largest cryptocurrency, showed minimal growth over the past day. Its value was recorded at around $0.5474 on various trading platforms. Yet, there’s a possibility of an upcoming bullish trend for XRP. This assumption is supported by AMBCrypto’s analysis, which indicates that XRP might be on the verge of experiencing a ‘golden crossover,’ as hinted by the Moving Average Cross technical indicator. In simpler terms, this means that there could be a potential increase in the value of XRP based on this particular technical signal.

When a golden cross event occurs, this typically indicates a significant increase in the likelihood of price growth. Additionally, we’ve noticed an ascending triangle formation on the daily graph of the token as well.

A breakout above that mark could kickstart a major bull rally.

As a crypto investor, I find it wise to examine XRP’s on-chain statistics meticulously to gauge the probability of a bullish surge or the occurrence of a golden cross.

What to expect from XRP?

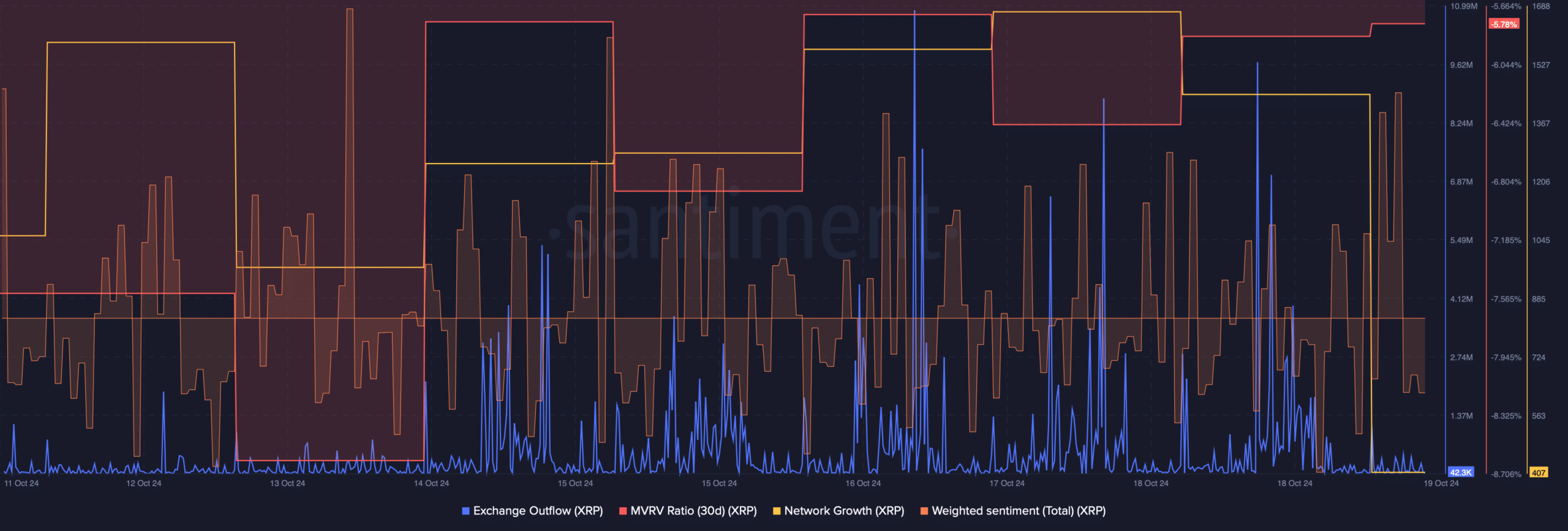

According to our analysis of Santiment’s data, we found that the overall sentiment towards XRP leaned heavily towards positive territory. In other words, a majority of the market felt optimistic about the token.

Additional indicators were pointing upward too, suggesting an increase in price. To give you an example, the MVRV ratio showed significant improvement.

The expansion of XRP’s network was significant, as an increasing number of accounts were set up to facilitate the transfer of tokens. Furthermore, outflows from exchanges for XRP saw a rise. An increase in this indicator typically indicates that demand for buying is escalating. Such trends frequently lead to upward movements in the token’s price on charts.

Another optimistic metric was revealed when we checked Coinglass data. We found that the token’s long/short ratio rose over the past few hours. This indicated that there were more long positions in the market than short positions – A bullish development.

Additional technical signs on the price graph seem to hint at an upcoming bullish surge within the next few days.

For instance – The MAC displayed a clear bullish advantage in the market. However, the bears might as well take control of the market as the token’s Money Flow Index (MFI) registered a downtick.

Read XRP’s Price Prediction 2024–2025

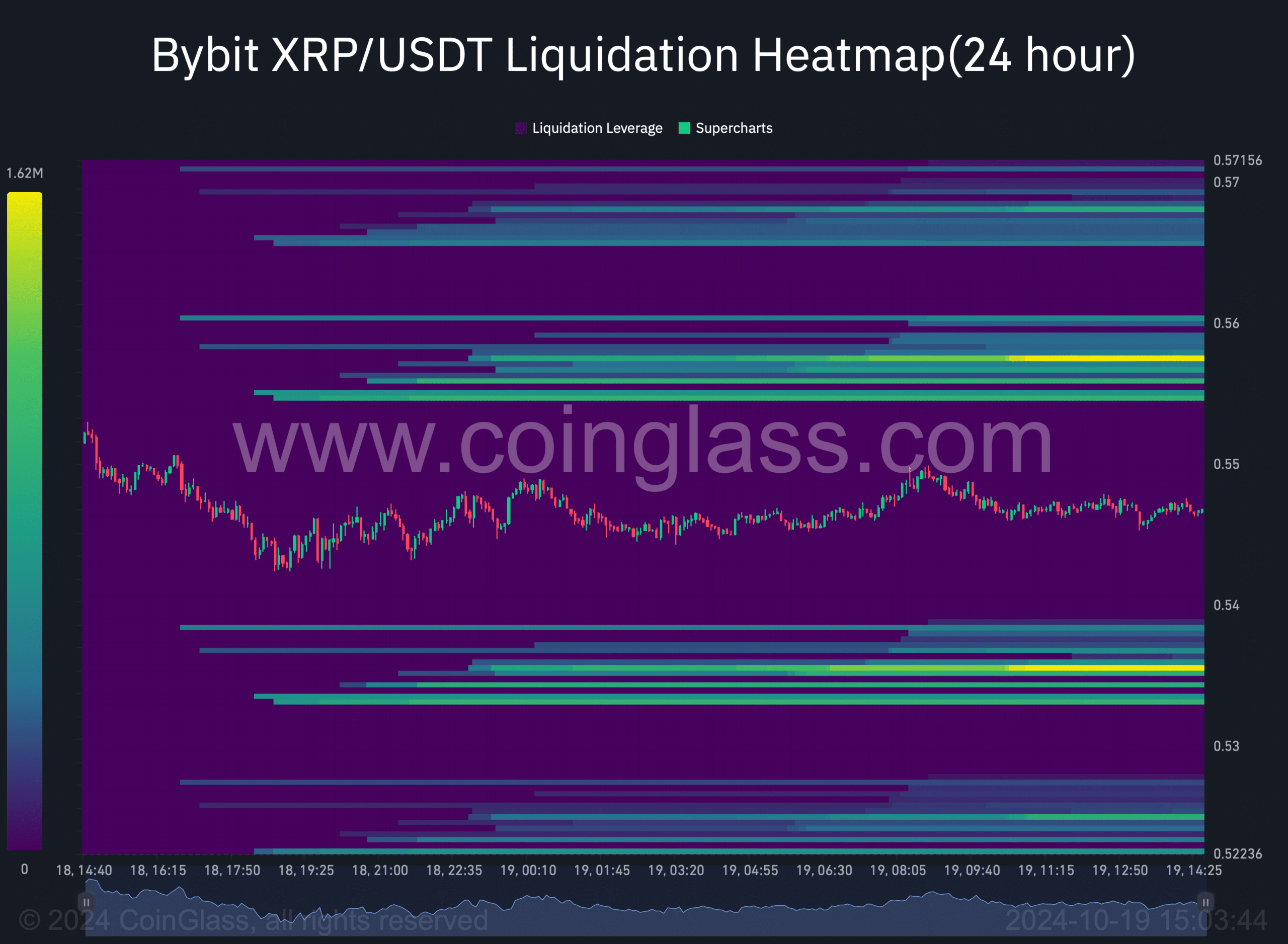

Ultimately, we examined the liquidation heatmap for XRP to locate any potential resistance points that may appear if there’s a bullish trend surge.

According to our examination, should a bullish breakout occur, it’s essential for the token price to surpass $0.55. This point is significant because liquidations will surge significantly at this level. Conversely, if the bears gain control, XRP could dip temporarily to around $0.53.

Read More

2024-10-20 05:11