- XRP maintained a higher timeframe bullish structure.

Its inability to fight beyond the short-term range was concerning.

Before the deadline, Ripple (XRP) experienced some growth, with Bitcoin‘s price leap from $69,200 to $71,200 leading the way. Although this increase was only around 3% for XRP, it set a positive tone for the week’s trading.

In simpler terms, the demand for purchasing this token was increasing, yet there wasn’t an overarching upward trend observable in longer timeframes. This token has been trading between specific price points since August 2023 up until now.

There were some signs of accumulation- should investors start buying more XRP?

The Fibonacci support levels were critical for XRP bulls

Earlier this year, the price rose from $0.485 to $0.744, but then took a significant step back. At that point, the 78.6% pullback level had not been reached following the formation of the local peak.

Meanwhile, the OBV continued to trend upward since February.

Significant purchasing activity was evident, suggesting the build-up of demand for XRP. This could potentially lead to a price surge for XRP at some point in the future. Nevertheless, it may still be premature for such a rally to occur.

For about a month now, the RSI reading has hovered around 49, which is near the neutral mark of 50. This prolonged position indicates a weak trend on the daily chart for XRP. Similarly, XRP has failed to break free from its short-term price range between $0.57 and $0.64.

On-chain metrics show selling pressure was prevalent

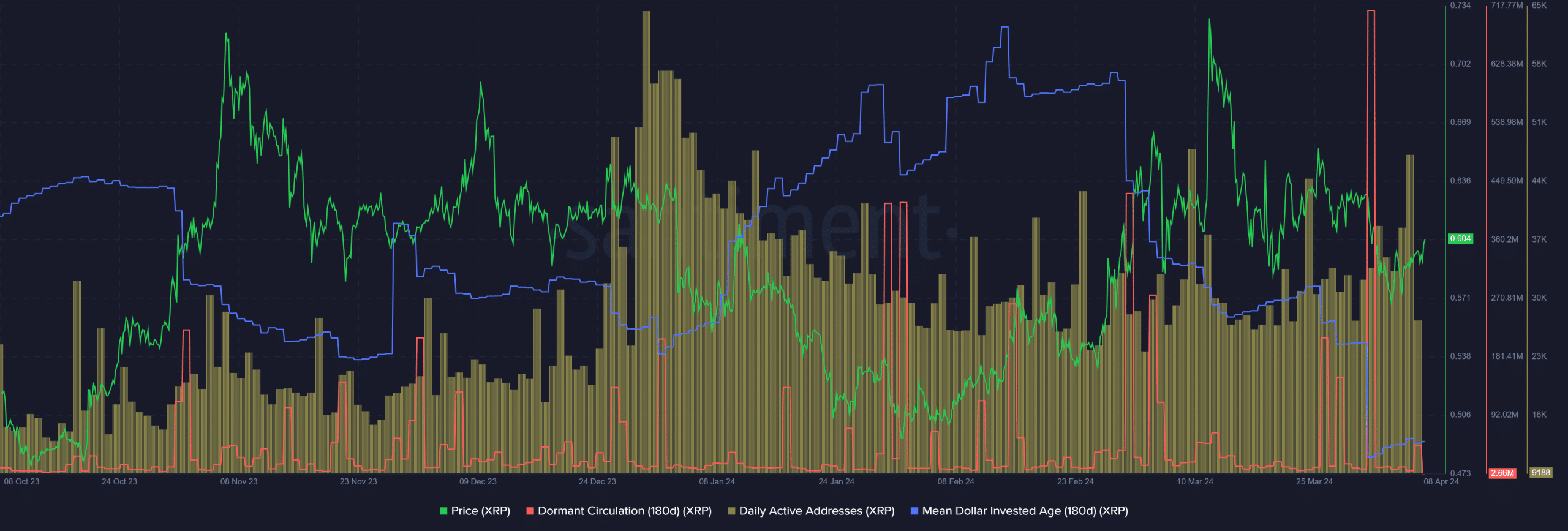

Despite the declines experienced over the past month, the number of daily active addresses has been gradually increasing since February.

It showed increased user engagement and a healthy network.

An alternate expression could be: Contrarily, the average dollar invested age (MDIA) experienced a significant drop over the past two months. As of now, it hasn’t bounced back or formed an upward trend. If it manages to do so, this would imply that investors are amassing more holdings.

On April 1st, there was a substantial increase in dormant circulating supplies, greater than any observed in the year 2024. This surge indicated strong demand to sell, signaling a diminished confidence among holders.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- How Potential Biden Replacements Feel About Crypto Regulation

- Why Shiba Inu’s 482% burn rate surge wasn’t enough for SHIB’s price

2024-04-09 04:07