- XRP liquidations at $2.2 highlighted a profit-taking phase as bullish momentum built on the charts

- A breakout past $3.3 could push XRP towards its 2017 highs, with key metrics supporting this rally

As a seasoned crypto investor with a knack for reading between the lines of price action and on-chain metrics, I find myself increasingly intrigued by XRP’s current performance. The recent liquidations at $2.2 highlighted a profit-taking phase, but it was short-lived as bullish momentum quickly resumed.

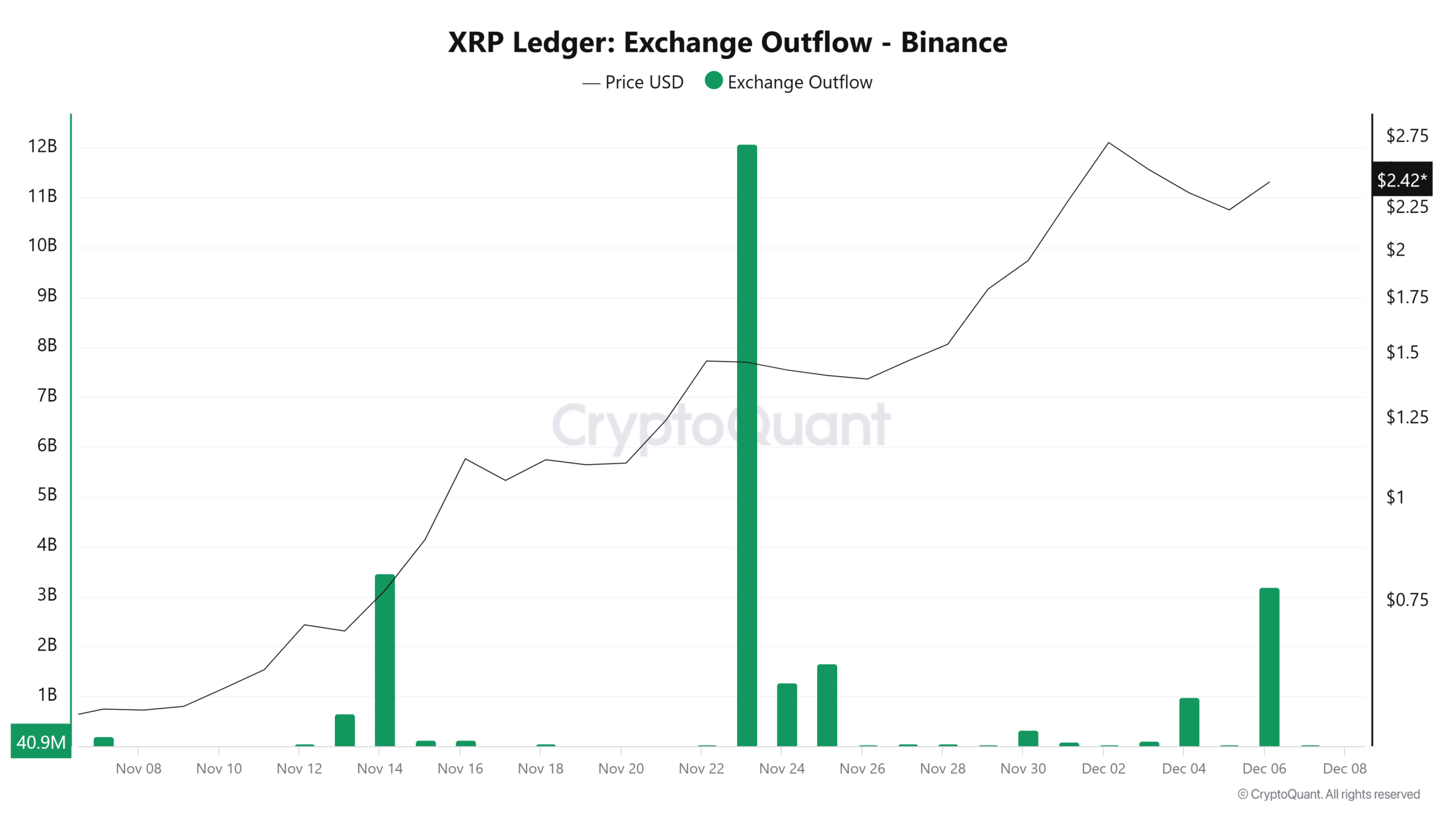

As a crypto investor, I’ve noticed an increased focus on the price movements of XRP lately, especially after its recent dip to around $2.2. Notably, CryptoQuant reported a significant event – the liquidation of over $4 million in XRP short positions during this period.

Regardless of this recent adjustment, XRP swiftly continued its ascent. As suggested by CryptoQuant’s analysis, the decrease in exchange outflows after the selling spree suggested a brief halt in purchasing activity.

Meanwhile, as I’m composing this, it seems that the market is preparing for its next step, as XRP’s Open Interest (OI) has reached its peak just now.

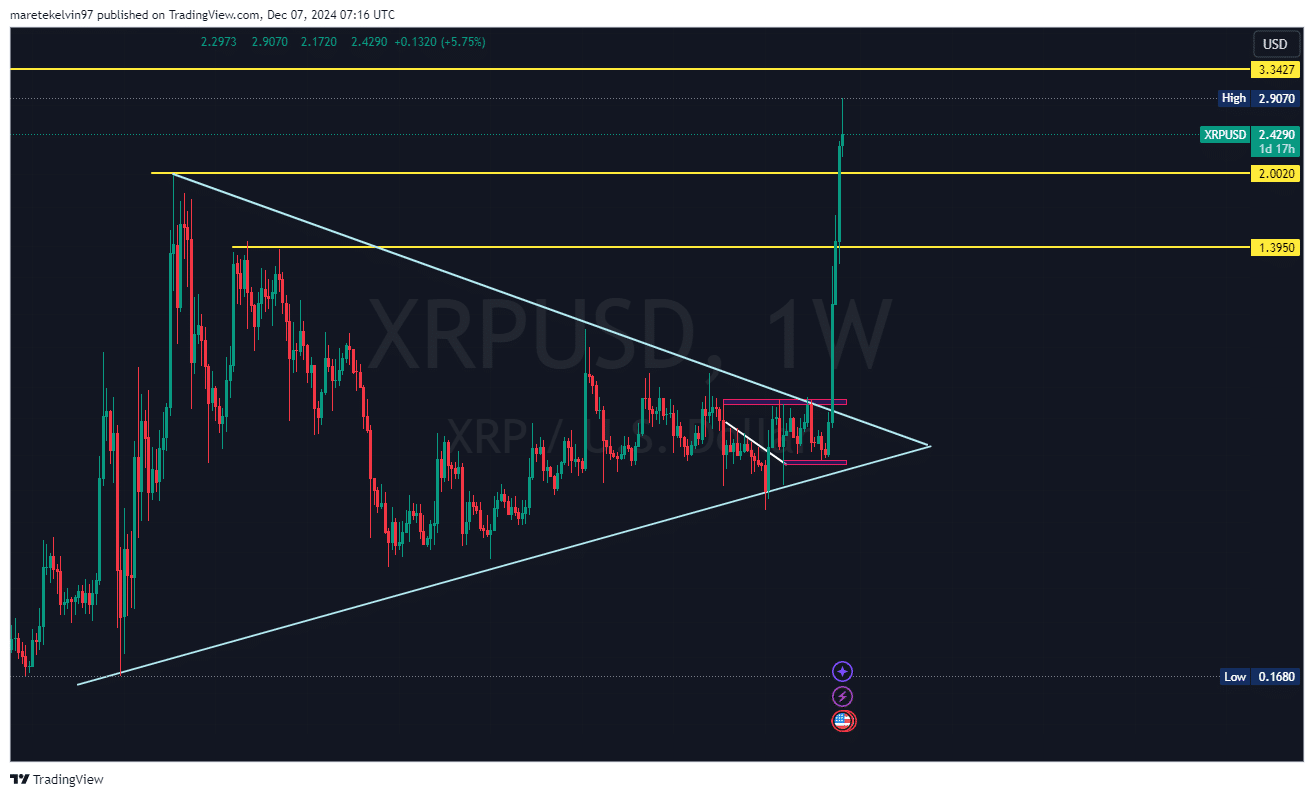

Consolidation and breakout on weekly charts

Looking at its weekly trend, XRP appeared to be gathering strength inside a symmetrical triangle formation. This triangle was eventually broken in late November, triggering an astounding 300% price increase.

Although impressive, this surge is still far from the 1000% rally witnessed during the 2021 bull run.

Should XRP recapture its past bullish energy, it may well approach the $7.7 mark. Yet, traders are keeping a close eye on the $3.3 barrier – a substantial challenge that could shape the subsequent phase of this surge.

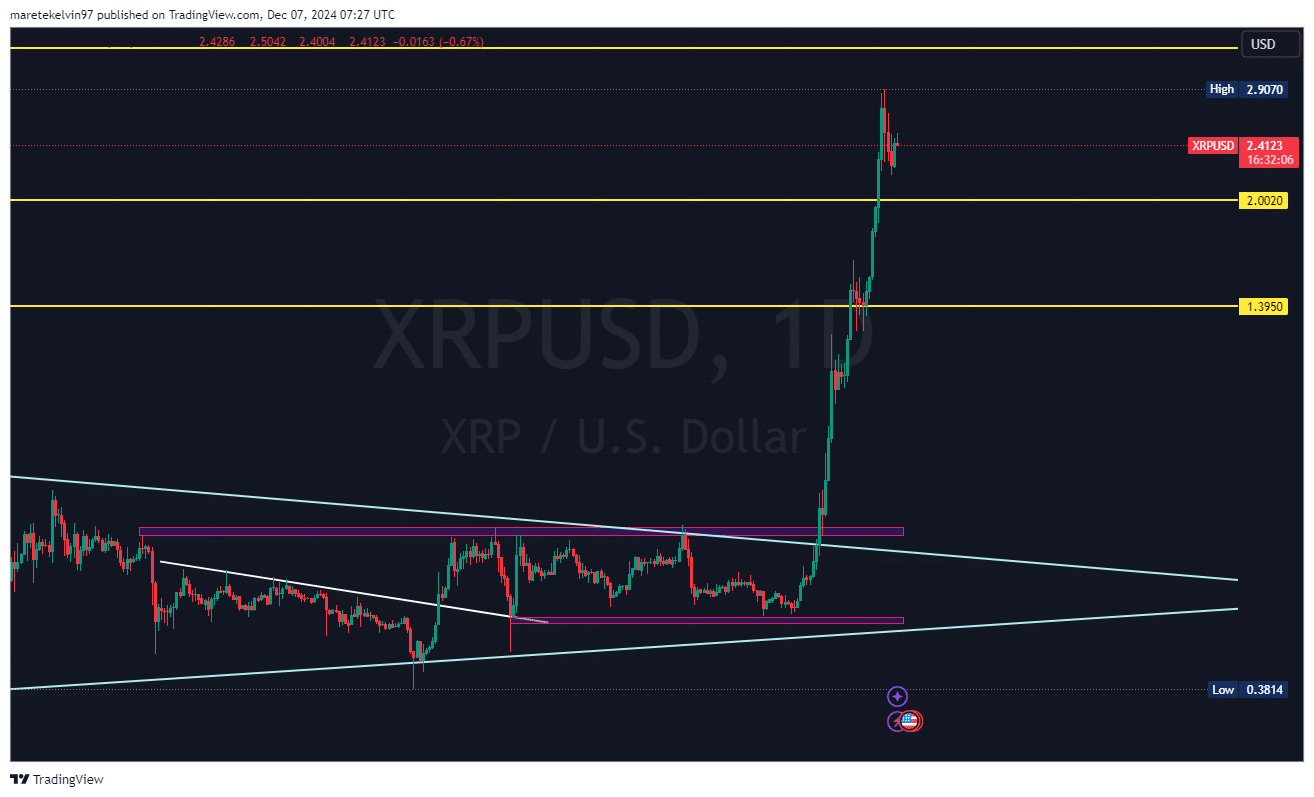

Signs of strength on daily chart

Each day’s graph presented a hopeful scenario. Following the recent dip to $2.2, XRP swiftly recovered its bullish drive. This upward price shift suggested robust demand from buyers, even amid price chart consolidation periods.

Data points like increasing Open Interest (OI) and decreasing outflow from exchanges could hint at potential future profits. Taken together, these signs point towards a possibility that traders might be preparing for a possible market breakthrough.

Can XRP rally beyond $3.3?

Overcoming the $3.3 barrier is significant for the coin’s continued upward momentum. Should it manage this, the cryptocurrency may aim higher, possibly climbing to around $7.7 if market circumstances mirror those of the 2021 surge.

Read Ripple’s [XRP] Price Prediction 2024–2025

Currently, as I write, there are some encouraging signs regarding XRP’s price movement and internal network data. For it to continue thriving, it’s crucial to surpass significant resistance points and secure long-term market backing.

Read More

2024-12-07 22:15