-

XRP’s daily and weekly charts flashed red, at press time

While a few metrics seemed bullish, the rest suggested otherwise

As an experienced analyst, I believe that XRP‘s current market situation is intriguing. While the daily and weekly charts indicate red, there are bullish signs that could lead to a trend reversal. The appearance of a bullish falling wedge pattern on XRP’s chart is noteworthy as it suggests the potential for a significant price rally in the coming days or weeks.

XRP, like many other cryptocurrencies, experienced several price corrections in the past week. Yet, there are signs of an impending trend reversal for XRP. A bullish pattern has emerged on its chart, hinting at a potential breakout for the token.

To gain a clearer perspective on what may transpire in the near future, it’s essential to examine the present situation of XRP.

A bullish pattern on XRP’s chart

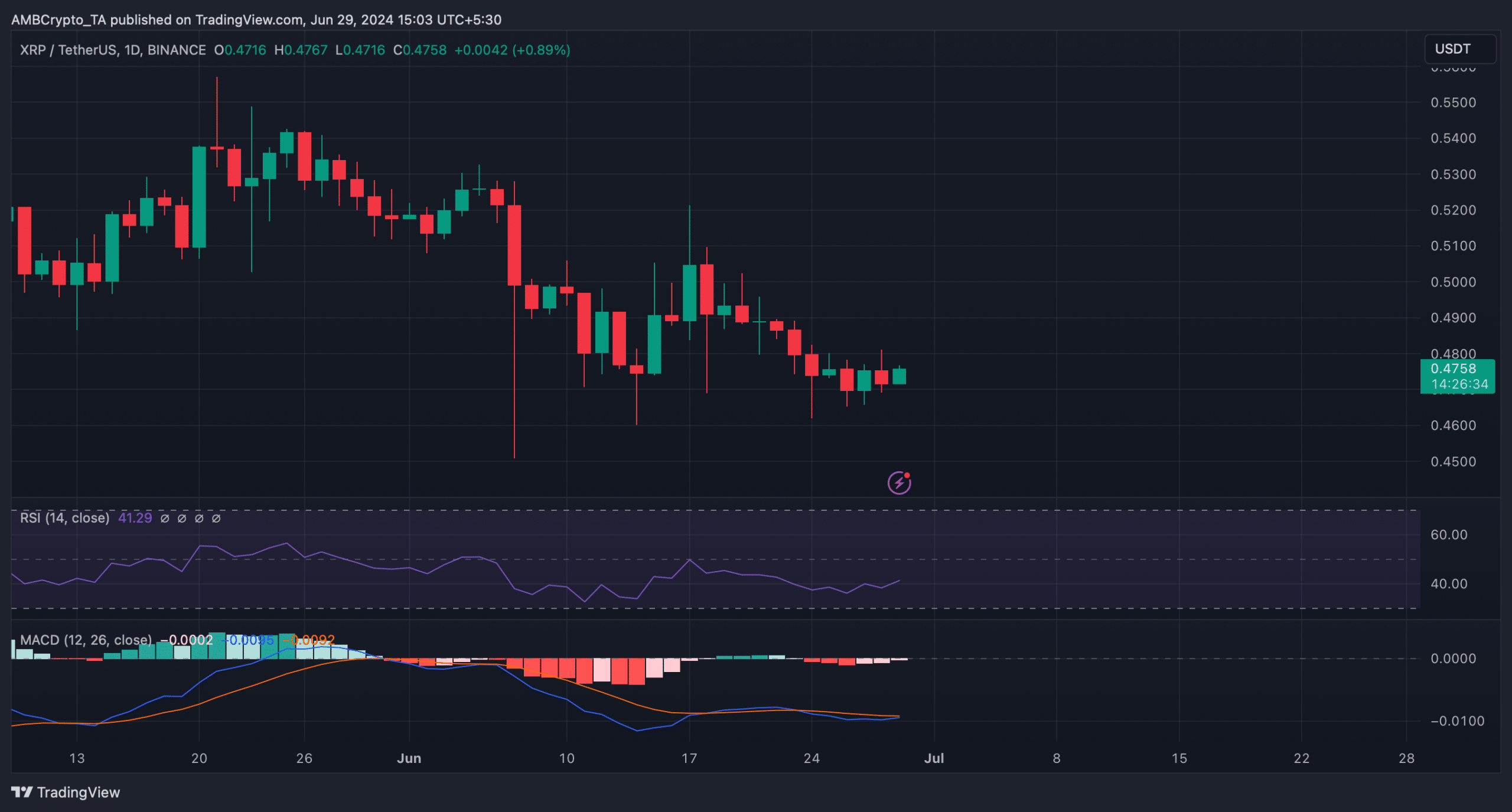

As a crypto investor, I’ve observed that XRP‘s price has taken a hit, decreasing by almost 2% in just the last week, based on data from CoinMarketCap. This downward trend persisted over the past 24 hours as well, with the altcoin currently valued at $0.4755 and boasting a market capitalization above $26.4 billion as of now.

As a crypto analyst, I’ve been keeping a close eye on XRP‘s price movements. Recently, I came across an encouraging sign: ZAYK Charts, a reputable analysis account, identified a bullish falling wedge pattern for XRP. This pattern emerged in March, and since then, XRP has been consolidating within it. At the moment, it appears that XRP is on the brink of breaking out from this bullish formation.

As a researcher, I’ve observed that a potential market breakout could lead to a significant price surge of around 30% to 40%.

Is a breakout possible?

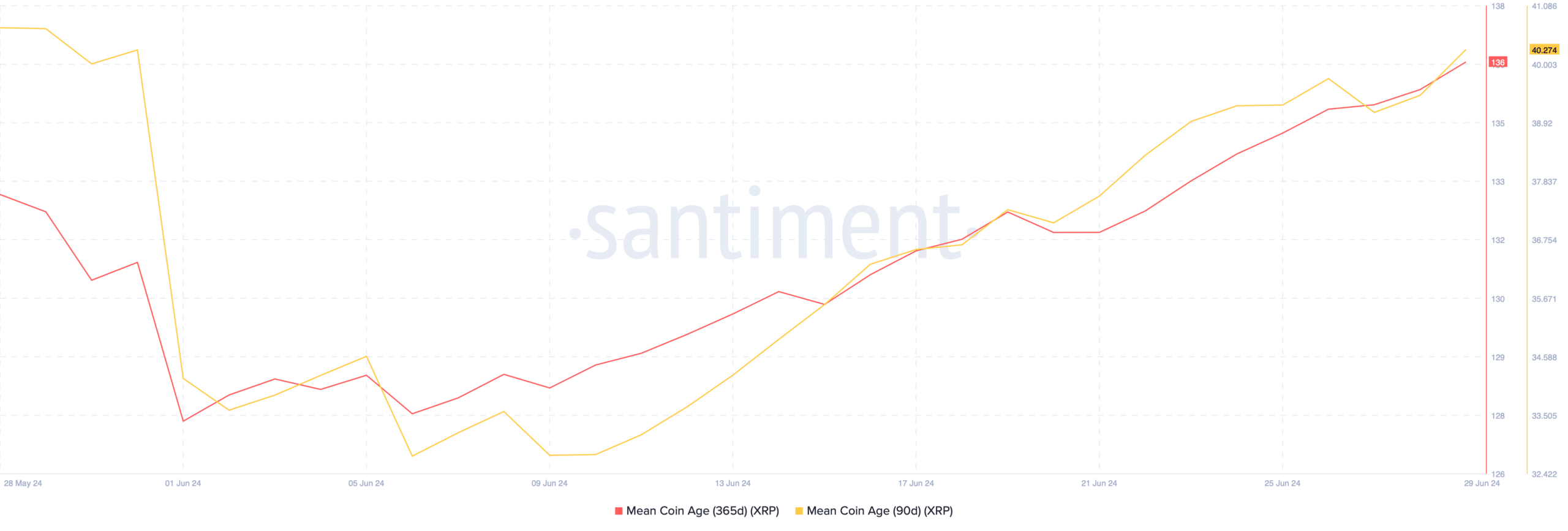

As a researcher studying the cryptocurrency market, I recently examined the potential bullish trend for XRP. To support this theory, I delved into its on-chain data using tools like Santiment’s platform. Notably, my findings indicated that investor confidence in XRP has been robust as of late.

The one-year-old and 90-day-old coin tokens saw significant increases in activity over the past month. This data implied a noticeable rise in the quantity of cryptocurrency coins that hadn’t been moved on the blockchain within the last year and 90 days.

AMBCrypto’s analysis of Hyblock Capital’s data also revealed an interesting relationship between XRP’s price and its cumulative liquidation delta.

When the token’s cumulative liquidation delta becomes green, its price movement tends to decelerate or drop. On the other hand, when this indicator turns red, it often signals an upcoming price surge.

At press time, this metric had a value of -785, hinting at a price uptick on the charts soon.

Several metrics indicated a bearish trend for the token. For example, according to Coinglass’s data, the token’s long/short ratio decreased – A clear indication of increasing bearishness among investors.

At the current moment, the Fear and Greed Index was showing “greedy” conditions. Historically, when this index reaches such levels, there is a significant possibility for price adjustments.

Despite this, the Relative Strength Index (RSI) showed an increase, while the Moving Average Convergence Divergence (MACD) hinted at a bullish crossover event. This adds to the confidence that XRP may manage to break free from its falling wedge pattern.

Read More

2024-06-29 22:15