-

XRP’s price dropped by 1.74% in the last 24 hours

Metrics indicated potential shifts in market sentiment

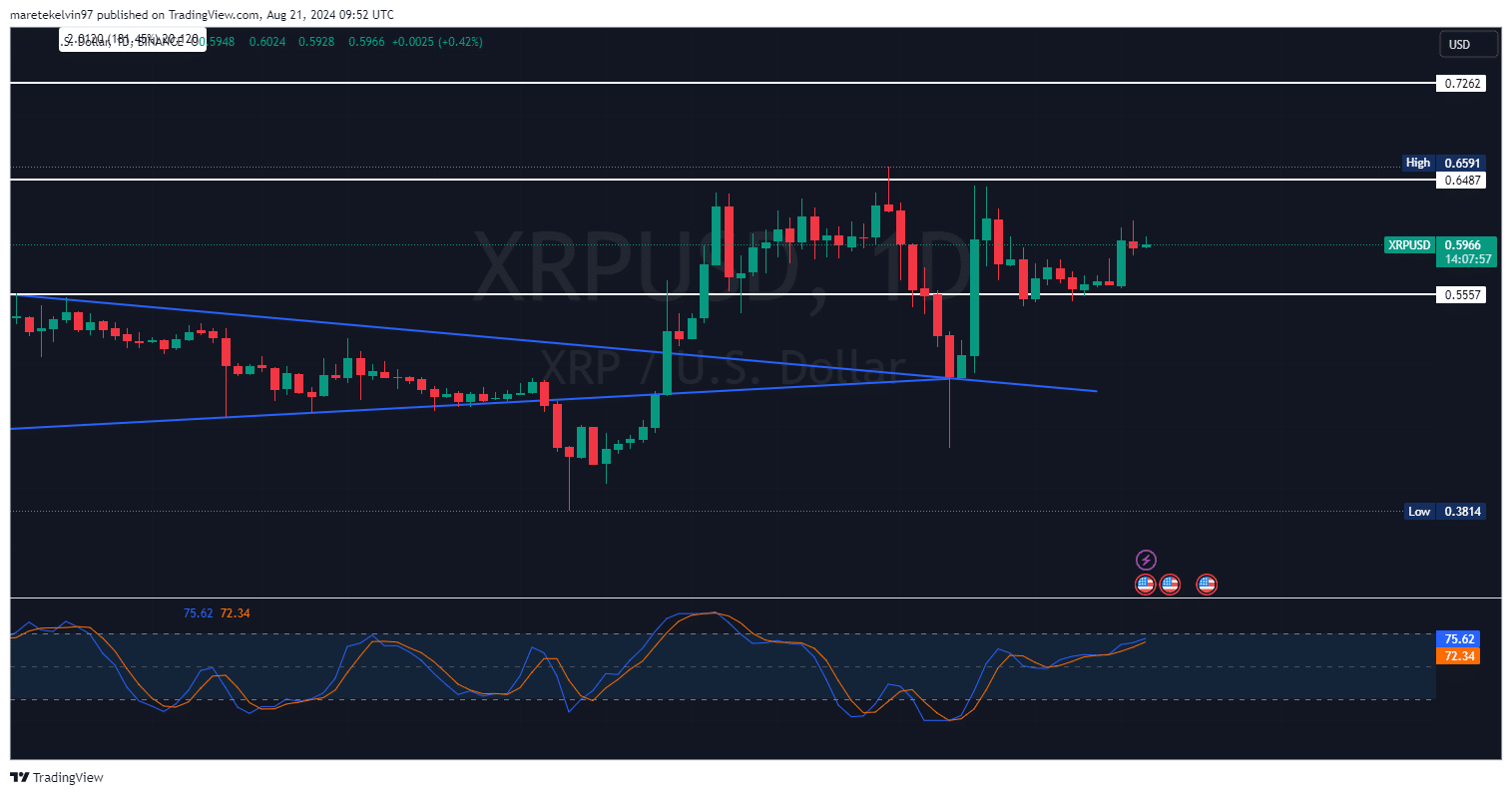

As a seasoned analyst with years of experience navigating the cryptocurrency markets, I can’t help but feel a sense of deja vu looking at XRP‘s current situation. The 1.74% drop within the last 24 hours and the potential breach of the critical support level at $0.595 is a familiar dance we’ve seen before.

Over the last day, the value of XRP dropped by approximately 1.74%, reaching a crucial support point at around $0.595 on price graphs.

Nevertheless, the level that was earlier shattered in the course of a rally is now in danger of collapsing again. If XRP can’t maintain its position above this level, the positive momentum this recent rally has generated could potentially weaken.

Market outlook

The XRP price trend suggested an important examination at the $0.595 resistance-turned-support point. This significant spot, where the last breakout occurred, might become a contest area for both the bearish and bullish groups.

Crossing beneath this point could lead to an unexpected drop to the subsequent support level at $0.555, potentially undoing the progress made over the past few weeks.

Examining the graph, it appears that XRP is accumulating within a tightening band. The resistance level can be found around $0.6487, while support lies at approximately $0.5557. The shrinking price fluctuations, coupled with a potential stochastic crossover, indicate that a substantial shift might occur soon.

XRP strain or gain?

As reported by Coinglass, there’s been a growing trend of liquidations, predominantly in long positions. Notably, significant changes have been observed near a particular price point, affecting both long and short investment pools. This suggests an uptick in market volatility.

Open interest flashed a mixed signal!

To sum up, an analysis of the open interest (OI)-based funding rate suggests that the market for XRP has displayed volatility since around early July. High positive funding rates indicate that long-term investors have been predominant, willing to incur additional costs for maintaining their investment positions.

On the other hand, the financing costs for XRP have dropped, implying that bullish enthusiasm might be waning. If this trend persists, it could potentially increase the bearish influence on its prices.

What next for XRP?

In simpler terms, whether XRP will head upwards or downwards in the near term greatly depends on its performance around the $0.595 mark. If it falls below this point, there’s a chance we might see it testing lower support levels again. But if the bulls manage to keep it afloat, it could lead to more upward momentum for XRP.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- The Battle Royale That Started It All Has Never Been More Profitable

- Everything Jax Taylor & Brittany Cartwright Said About Their Breakup

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- ANKR PREDICTION. ANKR cryptocurrency

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- Taylor Swift and Travis Kelce: A Love Story Unfolds at Chiefs’ AFC Celebration!

- Tainted Grail: The Fall of Avalon Review

- What the Venom 3 Box Office Means for the Future of Sony’s Spider-Man Universe

2024-08-22 08:39