-

There was evidence for whale accumulation based on XRP supply distribution

The social metrics and network activity showed bulls likely don’t have the strength for a resurgence

As a researcher with several years of experience in cryptocurrency markets, I’ve closely observed XRP‘s recent market trends and analyzed various metrics. Based on my findings, I believe that XRP is facing some challenges in the short term.

XRP (Ripple) stayed confined to a price range it had been in for ten months, with prices hovering around the lower end of that range since mid-April. The Open Interest didn’t show much excitement due to this trend. However, despite the lackluster market conditions, large investors continued to amass XRP.

As an analyst, I’ve recently come across a fascinating insight from a report published by AMBCrypto. Based on their findings, there are indications that the market could experience a bullish trend reversal. This is primarily due to a noticeable decrease in the amount of cryptocurrency available for trading on exchanges. This reduction might suggest that investors are accumulating assets in anticipation of price increases. However, it’s essential to acknowledge that this accumulation alone may not be sufficient to trigger a full market recovery.

The social media engagement was in a decay

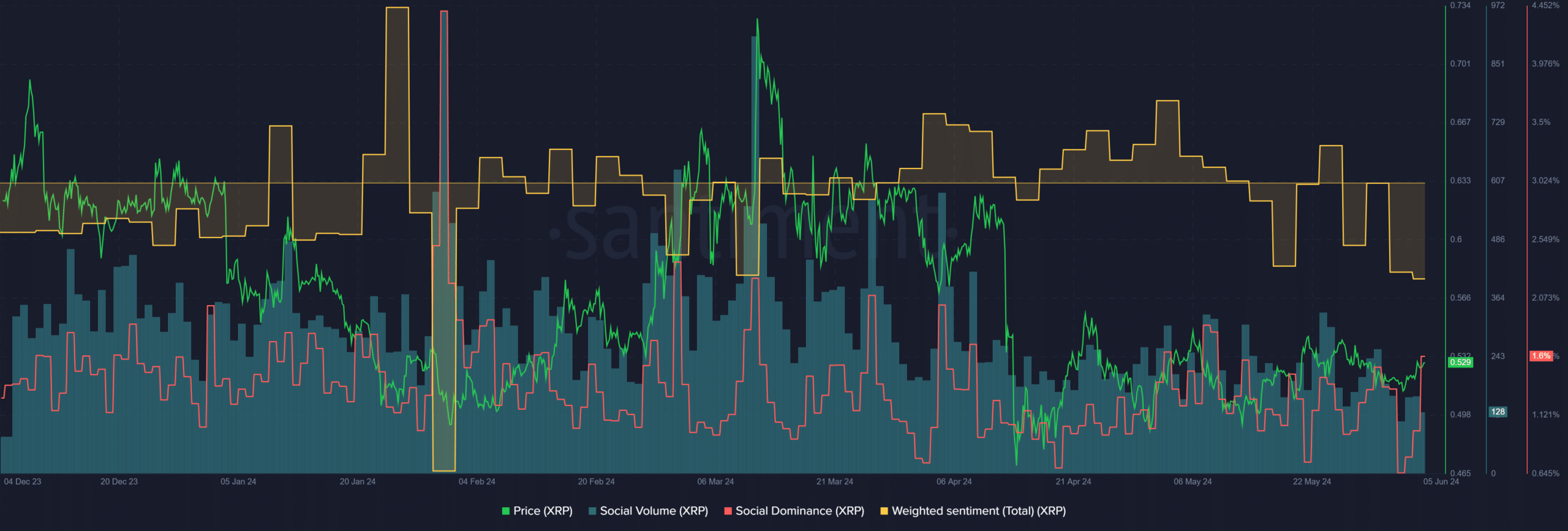

For the past month, the average sentiment based on daily data with a three-day window has mostly shown negativity. Surprisingly, there was a positive reading for this sentiment indicator in April, even though the price had dropped below the $0.58 mid-support level at that time.

This enthusiasm has waned since then. The bearish engagement has begun to dominate.

Since early April, the social buzz surrounding the volume of conversations hasn’t shifted. However, the volume during this period was less compared to March. This wasn’t surprising since the excitement around altcoins had dwindled and the market saw minimal price fluctuations.

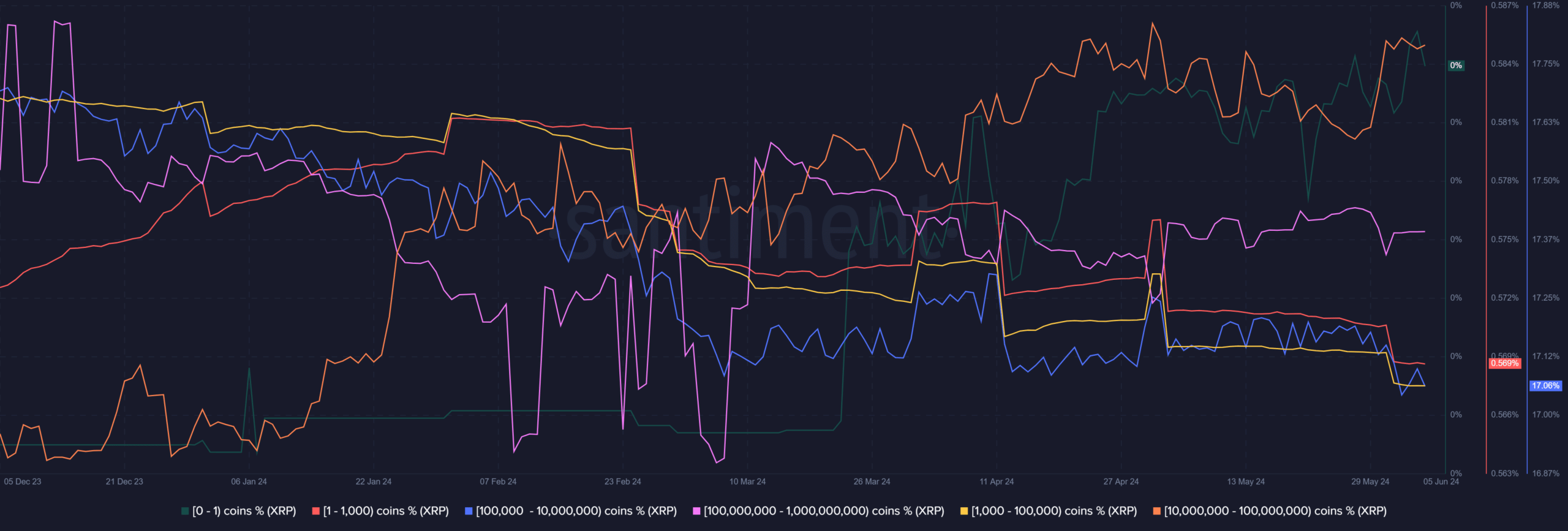

As an analyst examining the XRP supply distribution, I observed a notable trend: the majority of XRP holders across various brackets were selling their tokens, with only those possessing 10 million or more remaining as net buyers. Conversely, XRP holders with a quantity of 1 token or less showed an upward trend in their activity.

The discovery aligns with previous indications of whales hoarding XRP and decreased exchange supplies available for trading. This development was encouraging, yet the absence of strong commitment from smaller wallet holders over the last two months could potentially raise concerns.

The mean coin age dip could be bad news in the short-term

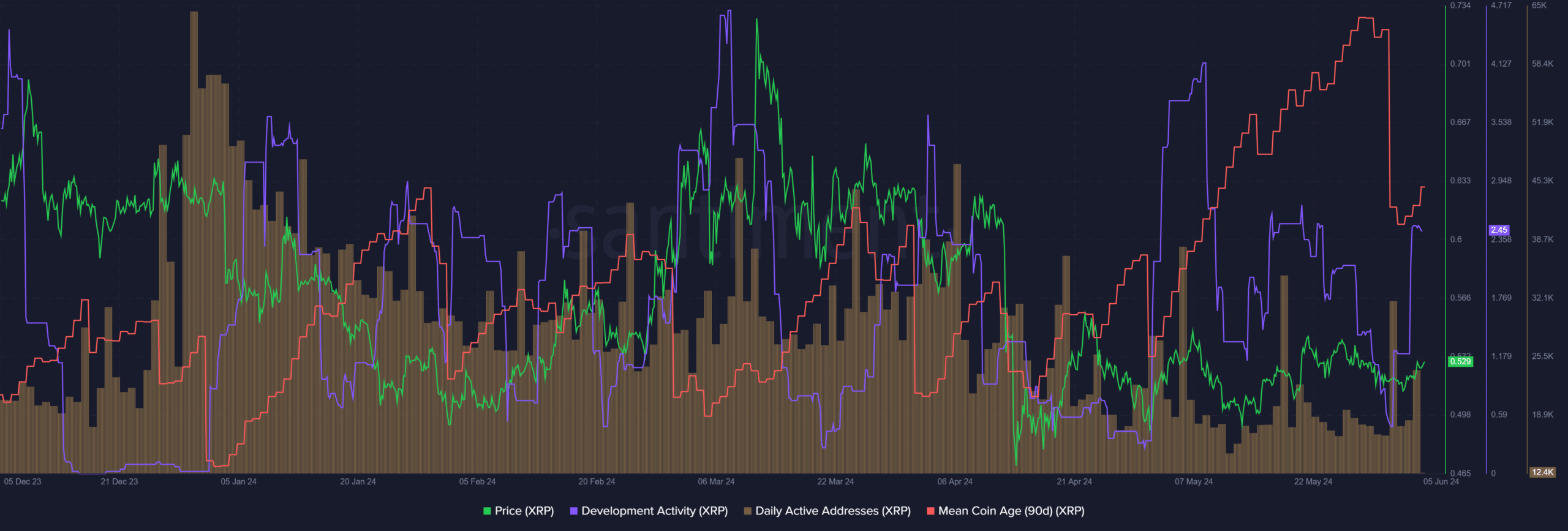

The trend of new development projects has remained consistent. Nevertheless, the number of ongoing activities was surprisingly low, with a count of just 2.5 at the time of reporting and peaking at 4.67 in March. In contrast, Ethereum [ETH] currently hosts 48.7 projects, while Cardano [ADA] boasts 62.9.

The daily active addresses have trended downward with occasional bouts of increased activity.

Realistic or not, here’s XRP’s market cap in BTC’s terms

As a crypto investor, I’ve noticed an intriguing pattern with Mean Coin over the past six weeks. Its age distribution had been steadily climbing higher, suggesting that a substantial number of previously dormant tokens were being activated. However, in just a few days, we’ve seen a sudden and significant reversal of this trend. This abrupt change might be an indication of a large-scale shift within the Mean Coin community, possibly signaling a major transaction or movement. Keep an eye on this development for potential investment opportunities.

In the current market situation, supporters of XRP face a challenging climb. Similar to past trends, it’s likely that the token will remain relatively quiet during much of the bullish phase and then surge with significant triple-digit growth in the last few months.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-06-06 09:11