- Crowd and smart money sentiment both highlighted market optimism

- Higher transaction counts and active addresses, combined with declining exchange reserves, supported XRP’s bullish chances

As a seasoned crypto investor with a knack for spotting trends, I find myself intrigued by XRP’s current market position. The bullish sentiment from both retail and institutional investors has my risk-taking antennae twitching. Having been through multiple market cycles, I can tell you that when the crowd and smart money align, it often signals a significant move.

Currently, the general feeling towards XRP appears to be quite optimistic, as indicated by a crowd sentiment score of 1.77 and a smart money sentiment of 0.76. The fact that both retail and institutional investors seem to share this positive outlook could suggest a growing sense of confidence within the XRP community.

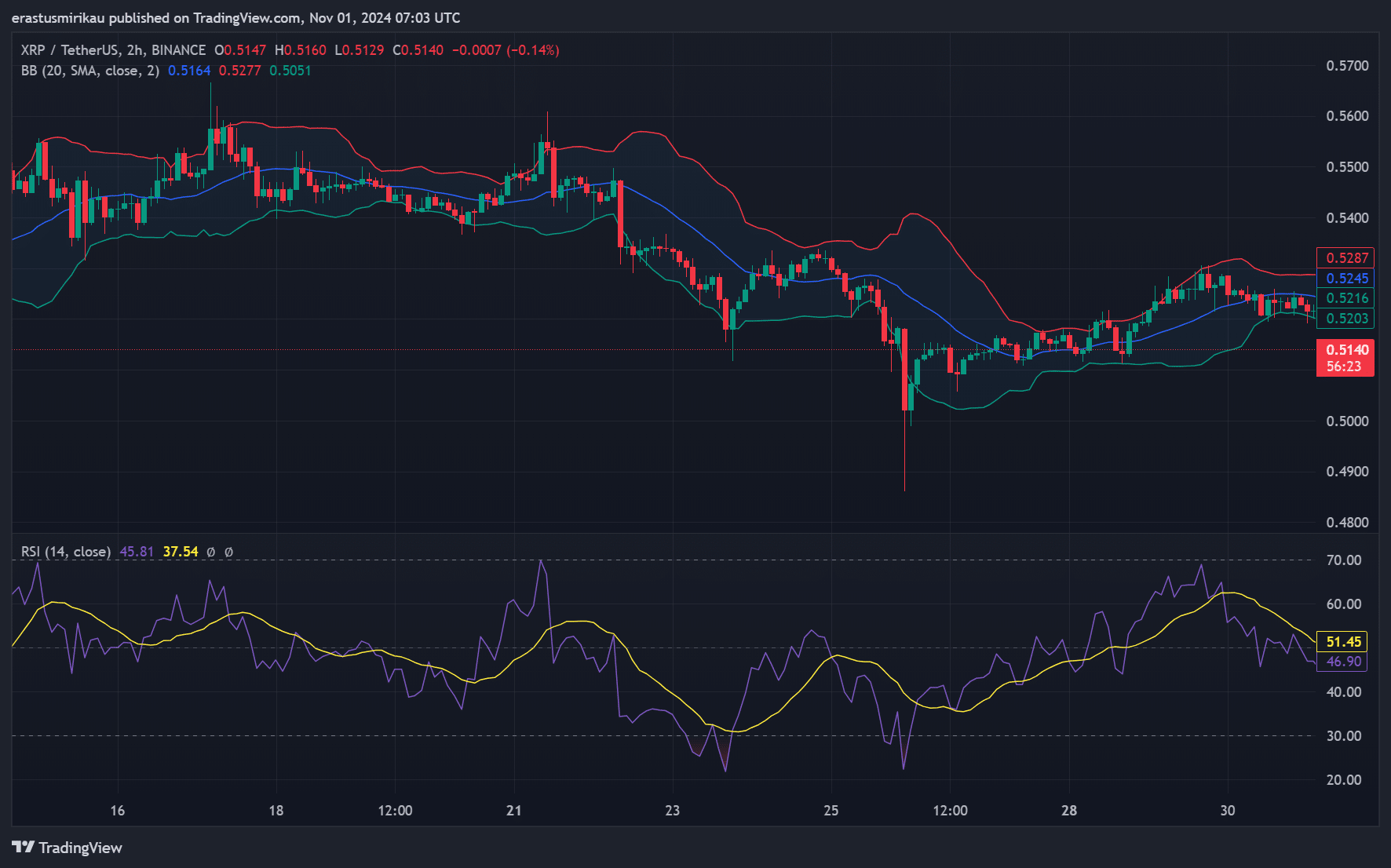

Currently, at the point of composition, XRP was being exchanged for approximately $0.514, showing a small decrease of 0.14% in the previous 24 hours. Nevertheless, the broader market outlook hinted at a possible increase in momentum. Consequently, the query arises – Might this combined bullish feeling ignite XRP’s next surge?

Price action overview – Can XRP break free from its range?

Analyzing its latest price fluctuations, the digital coin appeared to be holding steady within a tight band, fluctuating between roughly $0.51 and $0.52. Interestingly, Bollinger Bands’ analysis indicated a narrowing trend, implying a decrease in near-term volatility.

Even though the Relative Strength Index (RSI) was around 45.81, suggesting that XRP might be approaching oversold territory, such a situation could lead to a potential breakout if purchasing momentum increases in accordance with the ongoing optimistic market sentiments.

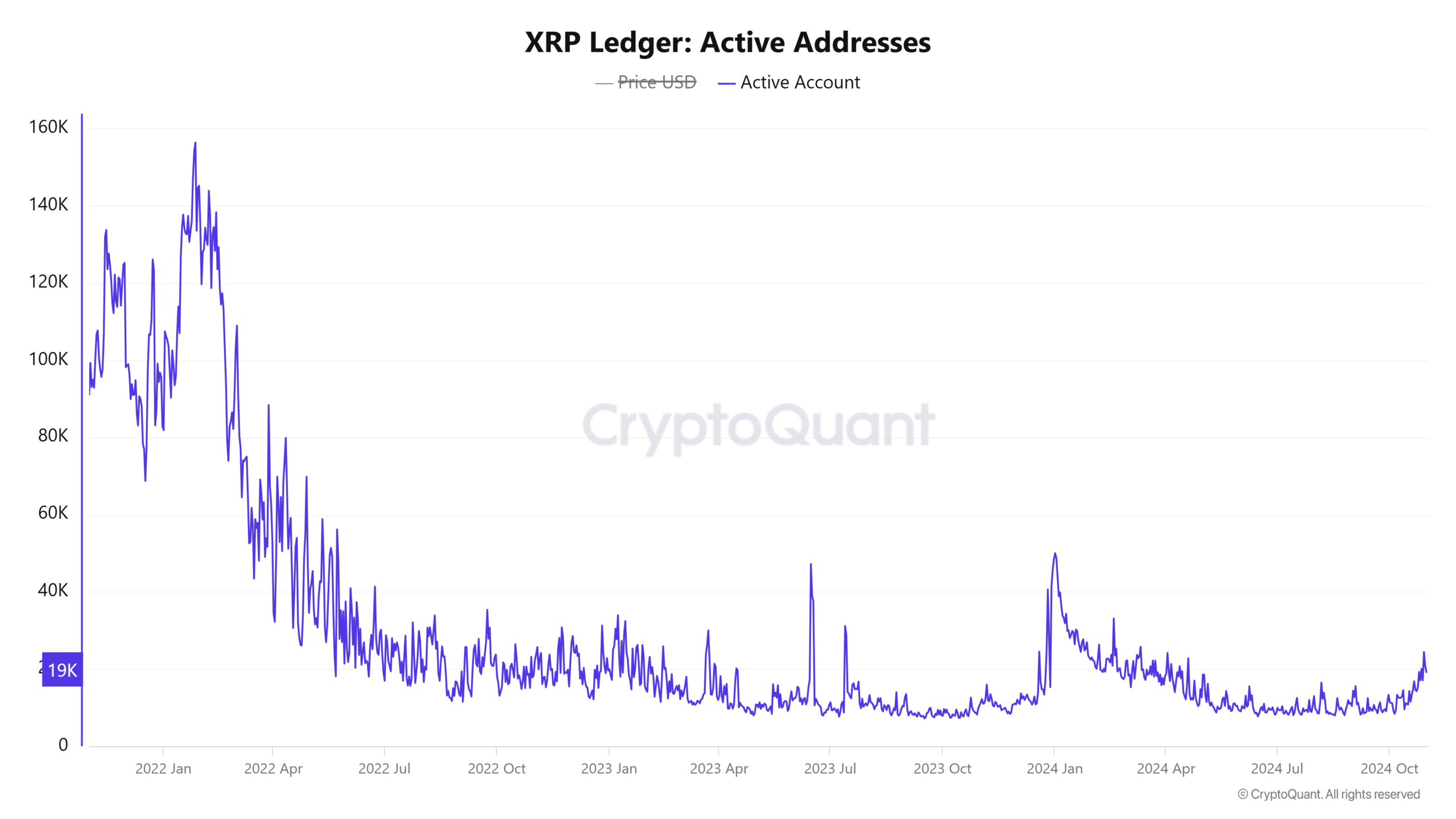

XRP active addresses surge – Bullish network signal?

Furthermore, it seems that the network’s influence is growing steadily. In the past 24 hours, the number of active addresses has increased by 0.92%, reaching a total of approximately 19,191 unique addresses. This rise in active addresses could suggest an increase in user interaction with the XRP ledger.

Typically, an increase in the number of active addresses suggests growing user engagement, which is usually followed by higher transaction volumes.

Consequently, the increase in active addresses indicates growing interest in XRP, which fits with the overall optimistic outlook towards it in the market.

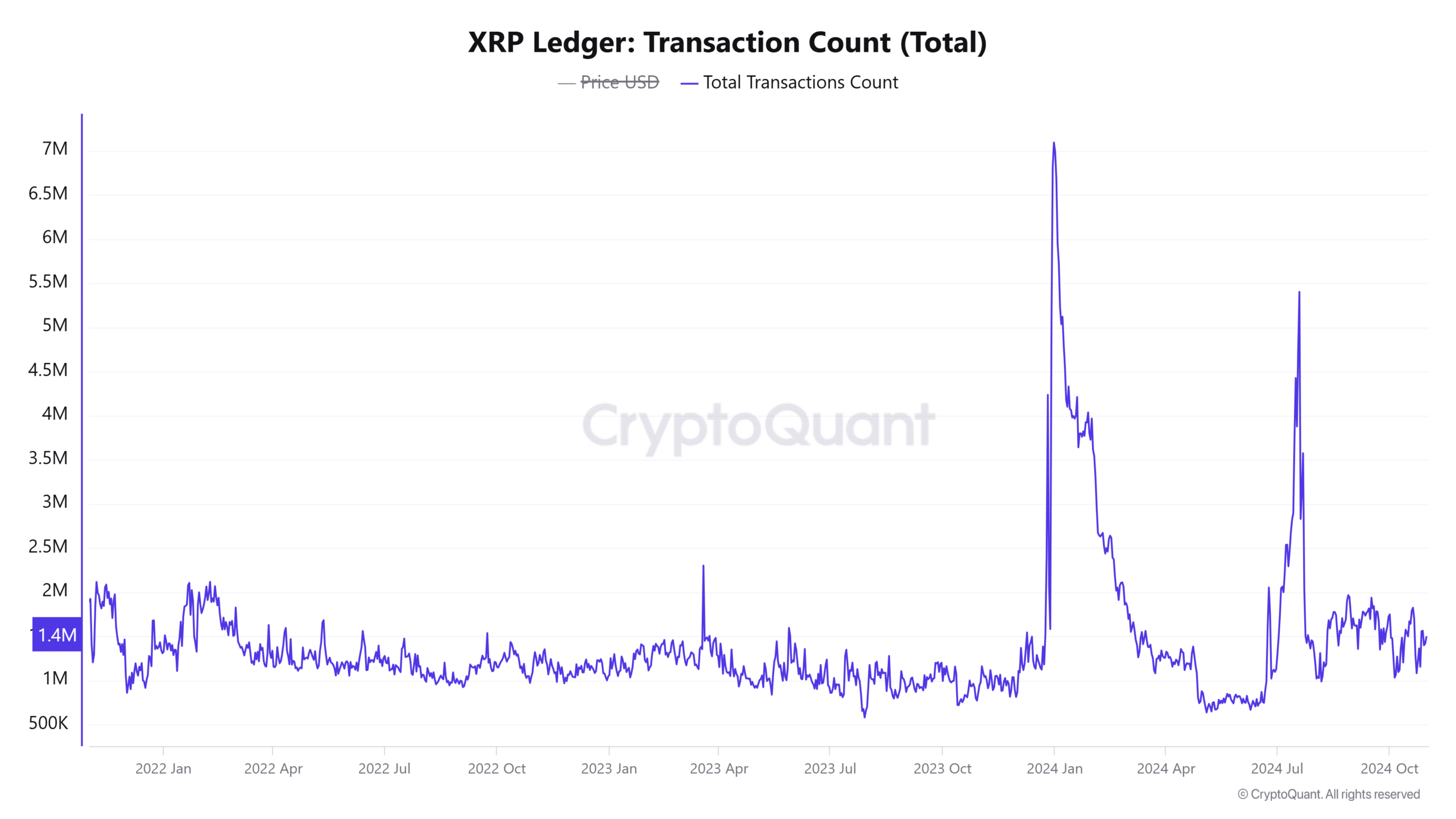

XRP transaction count growth – Higher network utility

The surge in transaction count further highlighted XRP’s expanding utility.

Over the past day, the number of transactions increased by approximately 0.98%, reaching a total of 1,408,900. An uptick in transaction activity within the network typically boosts the desire for the token, suggesting it could be a promising indicator for both price consistency and potential growth.

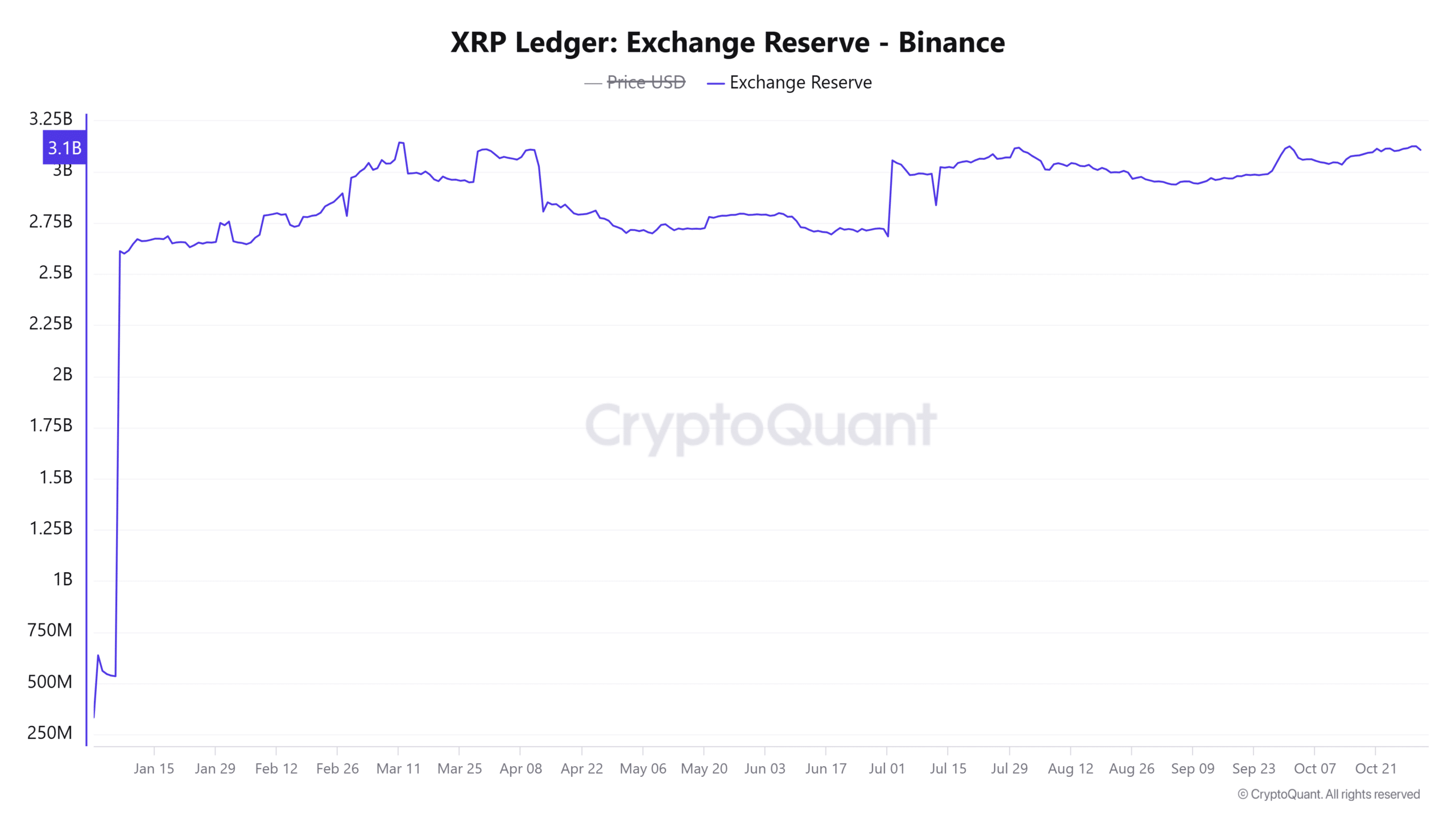

Exchange reserves fall – Lower selling pressure ahead?

Great news! Over the last day, the reserve levels at exchanges fell by approximately 0.59%. This reduction typically means less pressure to sell immediately, since there are now fewer coins available on the exchanges for quick transactions.

As investors are taking out their XRP holdings from exchanges, it might indicate a positive outlook on the coin’s future value. This decrease in the exchange-held XRP supports the optimistic market feeling and hints at potential reduced selling pressure for a while.

Read Ripple’s [XRP] Price Prediction 2024-25

In summary, the combined data points point towards a robust base for possible price increases. The general public and sophisticated investors are optimistic, while on-chain indicators such as active users and transaction frequency appear to be growing positively.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-11-02 03:04