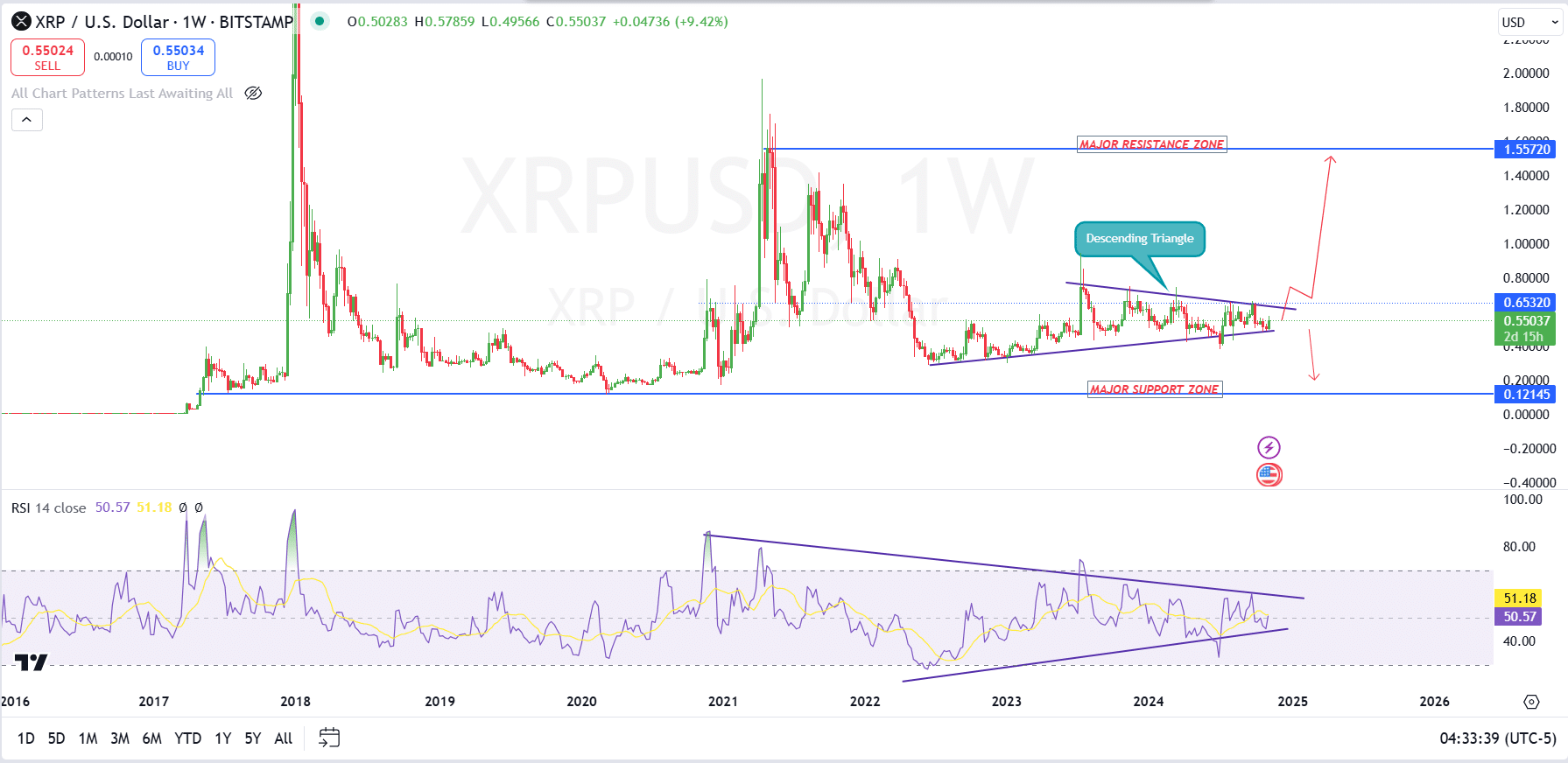

- XRP has been forming a symmetrical triangle, which is ready for breakout anytime.

- The RSI is in a similar consolidation, supporting the breakout.

As a seasoned crypto investor with years of market navigation under my belt, I can confidently say that the current XRP situation is shaping up to be quite intriguing. The symmetrical triangle pattern on the weekly chart hints at an imminent breakout, which could potentially lock in 130% gains if the $0.65 breakout level is breached and retested. My eyes are firmly set on the next resistance zone at $1.55.

2022 saw XRP confined within a certain range, gradually gaining steam for a potential breakthrough. If successful, this breakout could potentially yield a 130% profit if it surpasses and revisits the $0.65 threshold. A subsequent area of attention would be the $1.55 resistance level.

XRP primed for action: Triangle pattern hints at breakout!

Over the past week, the XRP price chart exhibited a symmetrical triangle formation. This pattern suggests that the price is building up pressure for an imminent breakout in either direction due to the compression of prices within this geometric structure. The upper boundary of the triangle has been steadily descending since mid-2021, while the lower boundary has served as a gradually rising support level.

if it breaks out upward, the crucial level is roughly $1.56; if it moves downward, significant support can be found around $0.12.

The Relative Strength Index (RSI), displaying a triangle formation similar to the market’s movement, mirrored the period of price stability, indicating that although prices were consolidating, there was a gradual increase in buying pressure as suggested by the RSI’s long-term uptrend line.

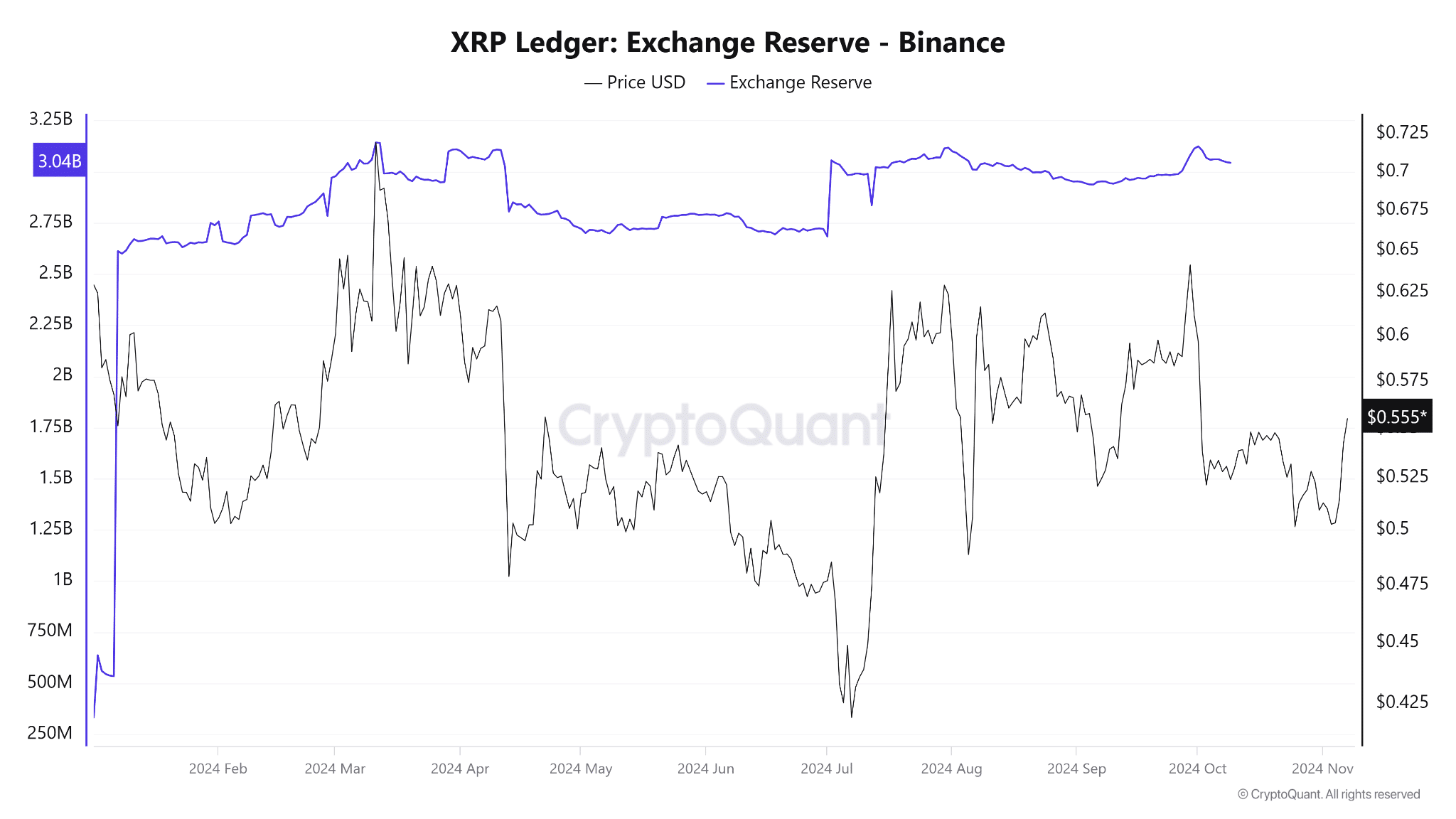

Stable XRP reserves suggest holders expect future gains

Over the given timeframe, the XRP reserves held in exchanges have generally stayed between 2.9 and 3.1 billion, showing a steady state with some small variations. On the other hand, the value of each XRP (represented by the black line) has shown significant price swings during this period.

The fact that the reserves for exchanging XRP remained constant while its price was volatile implies that traders weren’t significantly taking out or putting in XRP on Binance. Rather, it seems like the trading activity was primarily speculative.

The consistency in reserve funds may suggest trust from owners, perhaps anticipating a price rise ahead, or merely indicating a lack of motivation to sell off. Furthermore, the recent surge in price back to approximately $0.555 might indicate revived enthusiasm among investors.

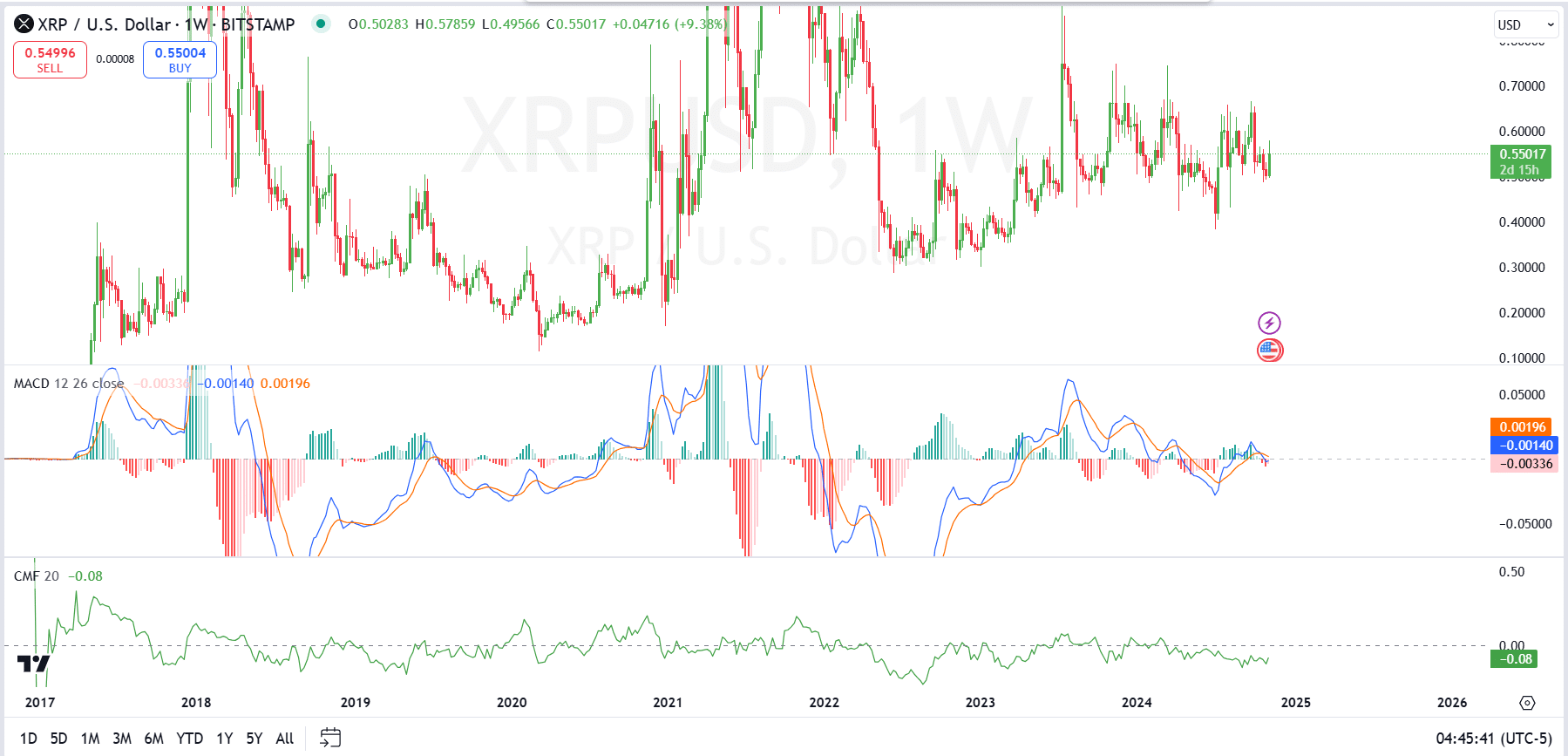

XRP holding steady: Are the indicators about to spark a breakout?

In simpler terms, the Middle Moving Average Convergence Divergence (MACD) hinted at a combined picture since the signal line (orange) slightly surpassed the MACD line (blue), suggesting only a slight bullish energy.

Despite the histogram being close to zero, indicating little to no dominant directional tendency, it seemed like XRP might be gathering strength before making a decisive move. Notably, there was no evident trend yet as the MACD lines didn’t show a significant momentum shift.

The Money Flow Volume Indicator (CMF) below displayed a value of -0.08, suggesting a moderate tendency for sellers to offload XRP over buyers. Essentially, this means a higher amount of funds are being withdrawn from XRP compared to invested.

Despite the modest volume of the outflow, the location of the CMF close to the neutral point implies a generally even, but slightly bearish stance, possibly indicating market uncertainty.

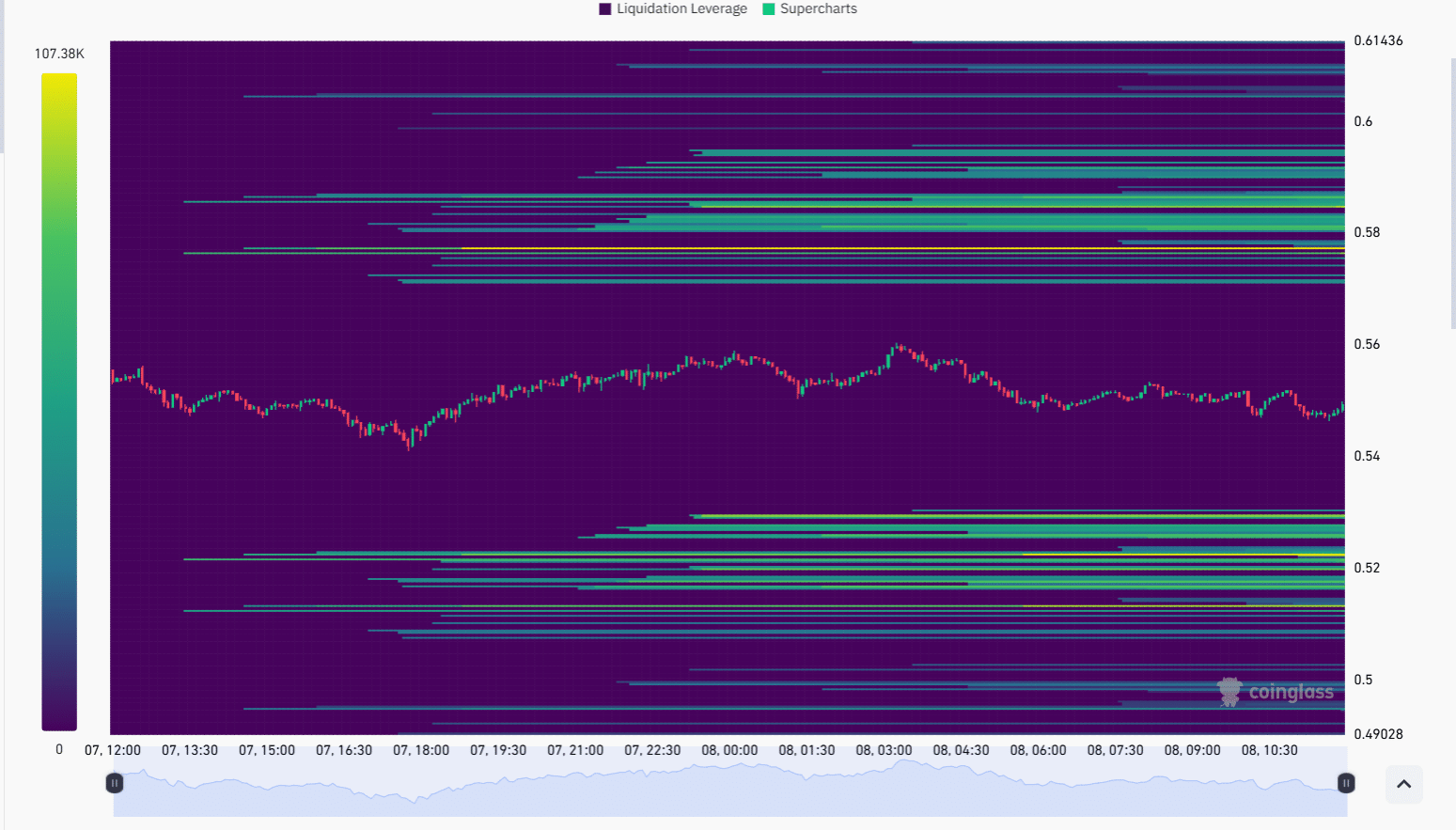

Liquidation zones at $0.54-$0.58 set stage for XRP volatility

The graphic display revealed groups of liquidity distributed across different price points. Notably, these tended to cluster around the prices between $0.54 and $0.58, with substantial regions both above and below this price range.

The arrangement of areas for liquidation demonstrates locations where traders have established leveraged positions, which could potentially be subjected to compulsory liquidation if market prices shift quickly, whether upwards or downwards.

These concentration spots suggest high-risk regions where price fluctuations might cause substantial volatility. As XRP’s price gets closer to these congested regions, it may initiate a chain reaction of liquidations.

This can amplify price swings due to the forced closure of positions.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2024-11-09 09:11