- XRP is in a high-stakes tug-of-war, setting up a potential short squeeze

- If it materializes, FOMO could fuel a surge of new investors flocking to XRP as BTC consolidates

As a seasoned crypto researcher with years of experience navigating the tumultuous waters of the digital asset market, I’ve seen my fair share of bull runs and bear markets. The latest developments surrounding XRP have left me both intrigued and cautious.

The recent drop in price, coupled with the surge in network activity, paints a complex picture for this token. On one hand, the rise in on-chain activity suggests growing interest and potential use cases. However, the sharp decline in value raises concerns about its short-term prospects.

The volatility in the derivatives market has been particularly noteworthy. The “Trump pump” and subsequent long squeeze serve as a stark reminder of the power of speculation and market sentiment in driving price action. As I’ve learned from past experiences, it’s essential to remain vigilant when dealing with such high-stakes tug-of-war situations.

That being said, there is a silver lining for XRP. Its ability to retain a solid base of investors in profit and the potential for a short squeeze if it can hold key support levels offers an interesting opportunity for those looking to diversify their crypto portfolio. However, as I’ve also learned from past experiences, the market can be unpredictable, so caution is always advised.

One thing that has never changed throughout my journey in the crypto world is the need for a sense of humor to maintain sanity amidst all the chaos. So, let’s keep an eye on XRP and hope that it doesn’t go from “XRP” to “X-tra Rough Period.” 😜

It appears that XRP is experiencing a significant downturn, despite having practical applications, speculative surges due to fear of missing out (FOMO), and large investors purchasing during dips. Over the last seven days, the token has dropped by 8%, showing a steeper decrease on its price charts.

As a seasoned cryptocurrency investor with over a decade of experience in this dynamic market, I have seen many ups and downs. On the positive front, the increased activity on the XRP ledger is quite encouraging, as network velocity suggests a significant surge. However, it’s important to note that history has taught us that upticks alone do not guarantee a comeback. In fact, they could potentially signal the beginning of a deeper pullback. Given the current strained state of the broader market, I believe caution is essential. It would be wise to tread carefully and keep a close eye on further developments before making any rash decisions. After all, the key to success in this industry lies in patience and strategic planning.

Disclosing the volatility in the derivatives market

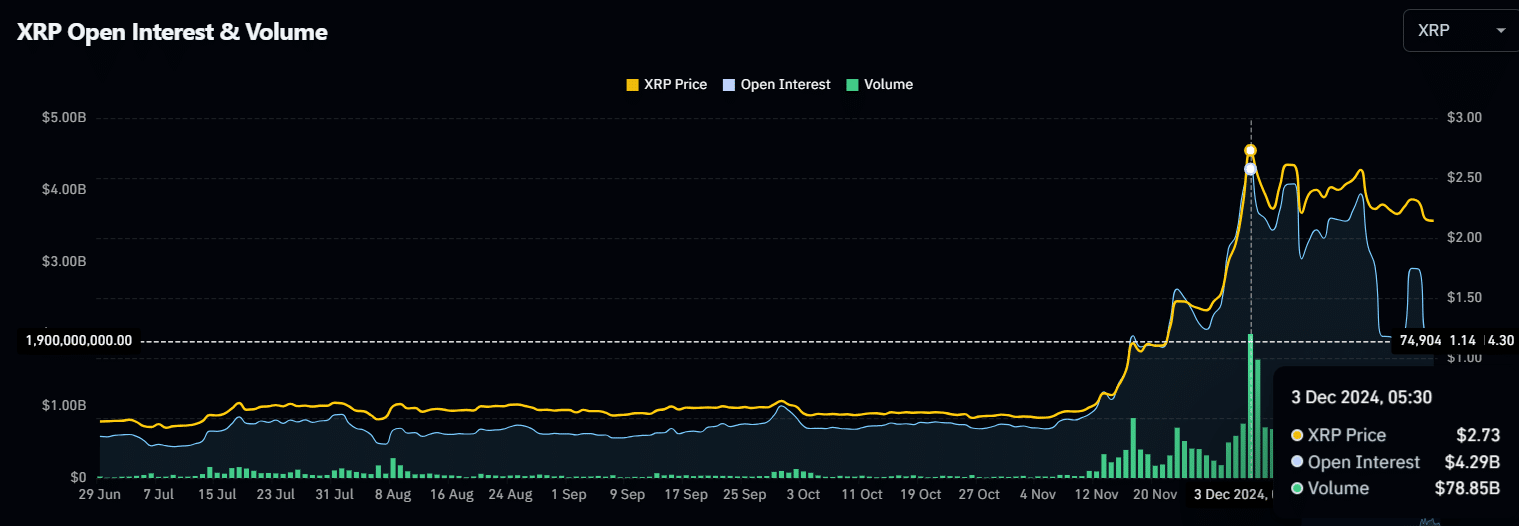

The “Trump effect” boosted XRP almost to $3 – its highest level in three years – causing a flurry among Futures traders. Notably, the Open Interest (OI) soared to an unprecedented $4.29 billion as investors eagerly invested, predicting additional price increases.

Source : Coinglass

Initially, the market experienced a sudden reversal, causing trouble for its bullish investors. Rapidly, long positions were eliminated in a severe squeeze, resulting in an Open Interest (OI) plummeting to $1.97 billion – a significant 54% decrease over just one month. In a mere day, about $2.66 million worth of long positions were liquidated out of a total $2.93 million.

The market suddenly changed direction, causing problems for its optimistic investors. Long positions were quickly eliminated in a tough situation, leading to a massive drop in the number of open contracts (OI). In just 24 hours, around $2.66 million worth of these long positions were closed out of a total $2.93 million.

It’s evident that the momentum is leaning towards shorts – those who sell assets they don’t own, anticipating a decrease in value. As the delta moves into negative territory, these short sellers are aggressively betting on additional drops, causing XRP to plunge further. Given this bearish control, it seems that the near-future outlook for XRP is becoming increasingly dim.

There is a silver lining for XRP

Unlike many other top alternative cryptocurrencies whose gains following the election seem to have dissipated, XRP maintains a substantial number of investors who are currently in profit. The recent breach of two significant levels has kept enthusiasm for potential future growth (FOMO) strong. Nevertheless, if the downward trend persists and XRP falls below the crucial $2 mark, fear could set in. This fear of additional losses might lead to a chain reaction of sell-offs, potentially causing XRP to experience a more intense downturn.

As an analyst, I observed on the daily chart that XRP exhibited distinct indications of a heated market following the elections, as its price soared to $2.80. For several weeks prior, a series of long green candlesticks dominated the chart, which suggested that a pullback was imminent due to profit-taking becoming inevitable.

Currently, XRP is caught in an intense struggle – Large investors (whales) are working hard to maintain a steady price, but sellers are eager to make profits. Remarkably, this conflict could potentially pave the way for a rise in value in the future.

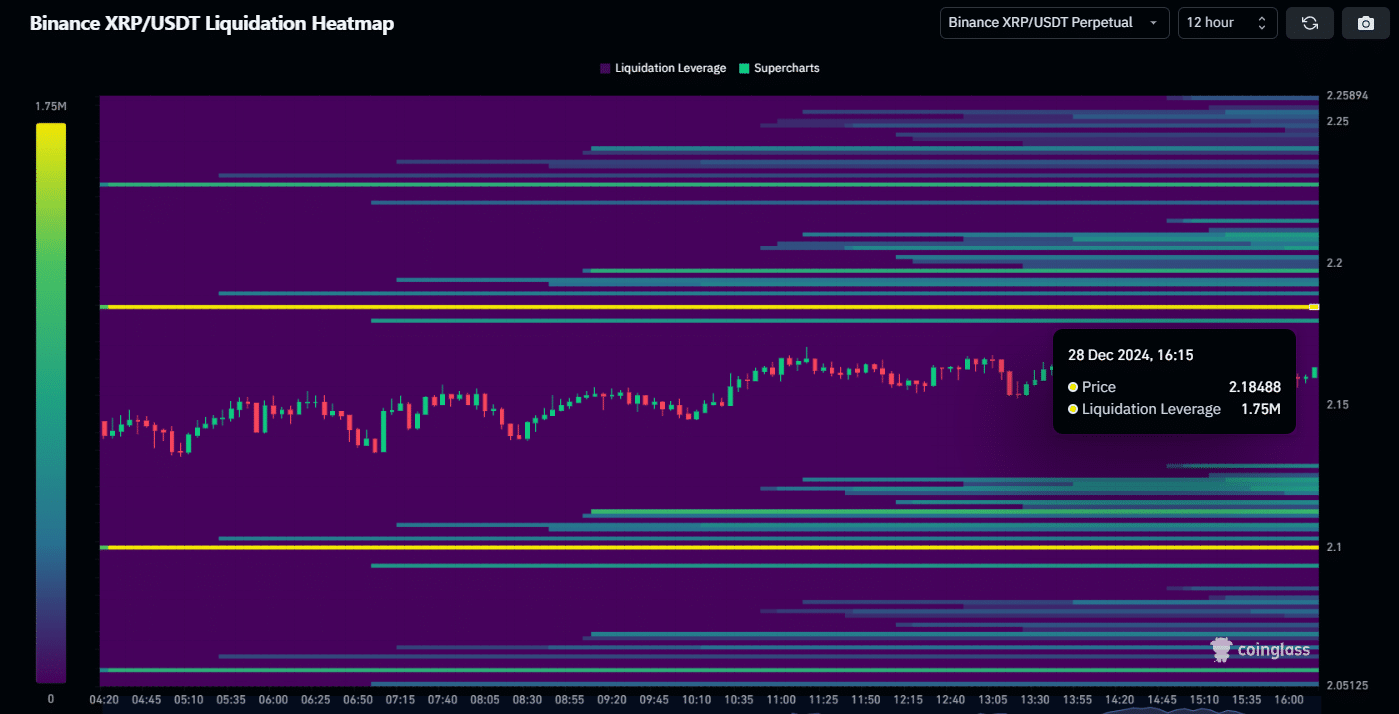

Source : Coinglass

Examining the 12-hour chart from my research perspective, I’ve noticed a substantial liquidity cluster around the price point of $2.18. It appears that approximately 1.75 million leveraged positions were active in this area. If XRP manages to sustain this level, it could potentially instigate a recovery, setting up conditions ripe for a short squeeze – a situation where heavy short-selling could lead to a rapid price increase due to a lack of available shares to borrow and sell.

Read XRP’s Price Prediction 2025–2026

As a seasoned investor with over two decades of experience, I believe this moment offers a unique chance for astute investors seeking to buy ‘dips’. Having witnessed several market cycles, I can confidently say that consolidation periods often precede significant rallies, particularly in the cryptocurrency market.

If XRP maintains its current strength, it could potentially take the lead and propel us towards a strong upward trend. My advice would be to keep a close eye on this asset and be ready to seize the opportunity when it arises. The potential gains could be substantial for those who are quick to act during these critical moments in the market.

In other words, this might just be the right time for individuals considering investing in altcoins as the market continues to show volatility.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-12-29 02:16