As a seasoned trader who has navigated the treacherous waters of various trading platforms, I can confidently say that XS Trading Platform has truly stood out for me. The platform’s multilingual approach resonates deeply with my personal experience of hailing from a diverse linguistic background myself. It’s refreshing to see a platform that caters to the needs of traders from all corners of the globe, making it easier for us to connect and trade comfortably.

Navigating the current market to find a dependable Computational Fluid Dynamics (CFD) broker may seem tough due to the abundance of options available. It’s often difficult to distinguish between those who boast superior features and robust security, and those that actually provide what they promise.

XS.com is proving itself to be a serious competitor with its wide range of features, sophisticated trading instruments, and robust security measures. However, let’s find out if it truly delivers as promised.

In this analysis, we’ll delve deep into the services provided by XS.com, covering aspects such as their security features, client service, trading terms, and more.

Regardless of your trading background – be it novice or seasoned pro – this guide offers valuable information to help you determine if XS.com suits your needs as a platform.

Let’s dive in!

What is XS.com?

XS.com is a worldwide broker specializing in various assets, established in Australia back in 2010. The platform provides an extensive selection of financial tools such as forex trading, stocks, indices, precious metals, commodities, cryptocurrencies, futures contracts, and energy products.

Under the umbrella of the XS Group, a globally recognized fintech company offering financial services, XS.com has solidified its position as a pioneer in digital trading.

The XS Group boasts entities that are both regulated and authorized across numerous countries, thus providing assurance of compliance and security for its global clientele. Yet, it’s crucial to mention that this broker does not conduct operations within the United States, Iran, or North Korea.

From its very beginning, XS.com has consistently advanced and broadened its offerings to adapt to the evolving requirements of its clients. This unwavering commitment to superior service has garnered the company several prestigious industry accolades, including “Broker of the Year,” “Best Partnership Programs,” “Best Multi-Asset Broker,” and “Most Secure Broker.”

These acknowledgements underscore XS.com’s dedication to providing exceptional trading services and ensuring a secure trading atmosphere.

XS Trading Platform: Features

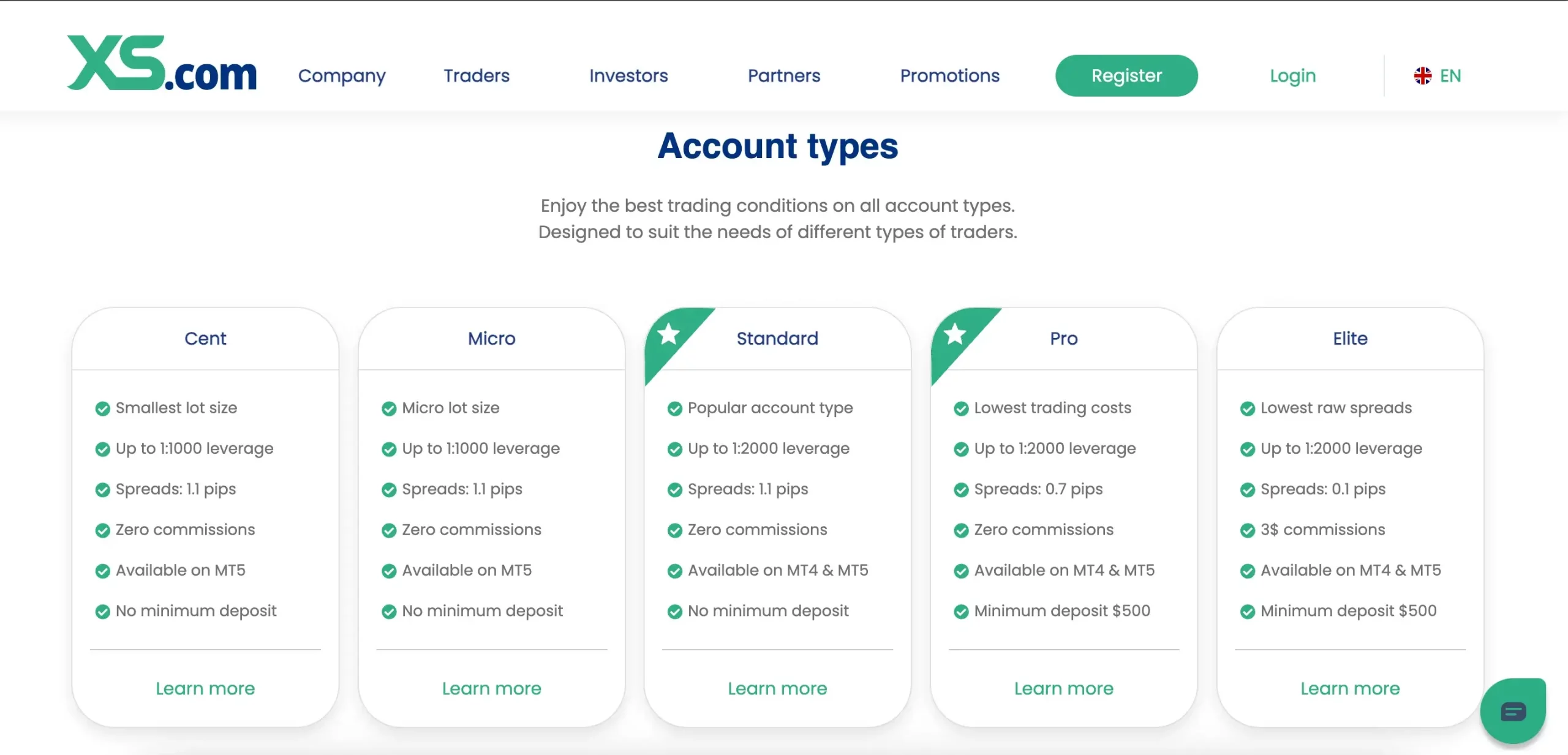

Multiple Account Types

XS offers a variety of account types to meet different trading needs and preferences.

- Preferred Accounts – These accounts are great for beginners and smaller traders. They offer low spreads and no commissions. The Cent Account is ideal for those just starting out, while the Standard and Micro Accounts provide more flexibility and varied trading sizes.

- Professional Accounts – Aimed at experienced traders and high-net-worth individuals, these accounts come with tighter spreads and extra benefits. The Elite Account features low commissions, the Pro Account offers a balanced approach, and the VIP Account is tailored for exclusive trading needs with commission-based pricing.

XS Mastercard and Mobile App

With XS, you’ll enjoy a seamless financial journey through their prepaid Mastercard and mobile app. You can effortlessly move funds between your XS wallet and the card, allowing for hassle-free management of both online and traditional transactions.

The mobile app allows you to track your transactions conveniently and integrates seamlessly with the XS client portal for effortless fund management.

Multiple Asset Classes

XS offers a wide variety of investment options, allowing traders to spread their investments wisely. The platform grants access to multiple asset categories, such as equities, where users can delve into Contracts for Differences (CFDs) on international shares from prominent corporations like Amazon, Alibaba, and Apple.

Additionally, it includes options for tracking various global indices, enabling traders to explore significant indexes like the Dow Jones, NASDAQ, S&P 500, and FTSE 100.

On the market scene, XS.com provides an opportunity for trading various commodities, including precious metals such as gold, silver, platinum, and palladium, in addition to energy commodities like Brent Crude Oil, West Texas Intermediate (WTI) Crude Oil, and Natural Gas.

As someone who has navigated the ever-evolving world of digital finance for years, I can confidently say that the platform’s offerings cater beautifully to those fascinated by the realm of cryptocurrencies. With options to trade established heavyweights such as Bitcoin, Ethereum, and Litecoin, this platform provides a secure and user-friendly space for investors to dive into the digital asset market. Having personally dabbled in these currencies, I can attest to their potential for growth and the opportunities they present for savvy investors like myself.

Forex traders have the opportunity to trade various currency combinations, including not only major currencies but also minor ones and exotic pairs as well. Furthermore, they can engage in trading a range of commodities like cocoa, coffee, copper, corn, cotton, soybeans, sugar, and wheat. The platform additionally facilitates Futures trading by providing Contracts for Differences (CFDs) on Futures across numerous markets.

Insurance Program

At XS.com, your security as a client is paramount. They offer a robust Civil Liability Insurance Program, which is underwritten by Lloyd’s of London. This program serves as an additional shield, safeguarding you against losses surpassing $10,000, all the way up to a substantial $5,000,000. It covers risks such as fraud, negligence, and others. What’s more, this extensive insurance coverage comes at no extra cost to you, offering reassurance and confidence during your trading experience.

Dynamic Leverage Model

In addition to XS, it offers a flexible leverage system that can be customized according to your preferences. This ranges from leverage levels as high as 1:2000. The system intelligently adjusts the leverage based on your trading activity, thus ensuring a well-balanced approach to risk management. As your trading volume escalates, the leverage is progressively decreased, making it suitable for both cautious and bold traders by allowing them to fine-tune their trading tactics optimally.

Swap-Free Accounts

XS promotes inclusivity by providing Swap-Free (Islamic) accounts that align with Shariah law. This means these accounts eliminate swap or rollover fees, enabling traders who practice Islamic principles to actively trade in the market without violating their religious beliefs.

XS Trading Platform: Security

At XS.com, we prioritize creating a

As a crypto investor, I appreciate the robust security measures this platform employs to safeguard my data. They leverage sophisticated encryption methods to bar unauthorized access, ensuring that both my personal and financial details stay secure. This encryption is applied extensively across their websites and applications, forming the foundation of their comprehensive data protection strategy.

To boost security even more, XS.com implements a security measure known as two-step verification. This additional protection ensures that even with a password, an extra step is needed for login approval. Furthermore, XS.com insists on stringent password rules, making sure passwords adhere to specific complexity and character count standards, thus minimizing the chances of unauthorized account access.

At XS.com, regular external security evaluations play an integral role in our overall security approach. These reviews help us strengthen our security infrastructure, maintain conformity with sector standards, and stay vigilant against emerging security risks.

Additionally, XS prioritizes client security by storing their funds in distinct accounts with trusted financial entities. This separation guarantees that client’s resources remain secure, even during challenging financial times for the company.

XS Trading Platform: Regulatory Compliance

It has been found that XS Group places great importance on adhering to regulations throughout all their activities, thereby safeguarding their clients and maintaining business conduct of the utmost integrity.

Because the XS Group is subject to regulation by multiple financial authorities across the globe, they can maintain stringent industry standards and offer their clients an extra layer of protection and trust. In essence, each XS Group entity carries authorization and oversight from a prominent financial regulator in its local area.

Here’s an overview of their key regulatory bodies:

- Seychelles – Financial Services Authority (FSA): XS Ltd, with license number SD089, operates under Seychelles’ FSA. The FSA is responsible for licensing, monitoring, and enforcing regulations within the non-bank financial sector.

- Australia – Australian Securities and Investments Commission (ASIC): XS Prime Ltd, holding license number 374409, is regulated by ASIC, the primary authority in Australia overseeing registered companies, financial markets, and financial service providers.

- Cyprus – Cyprus Securities and Exchange Commission (CySEC): XS Markets Ltd, under license number 412/22, falls under the regulatory supervision of CySEC, which oversees investment services in Cyprus.

- Labuan, Malaysia – Financial Services Authority of Labuan (LFSA): XS Finance Ltd, with license number MB/21/0081, is authorized by the LFSA, the governing body that oversees the Labuan International Business and Financial Centre (Labuan IBFC).

- South Africa – Financial Sector Conduct Authority (FSCA): XS ZA (Pty) Ltd, with FSP number 53199, is regulated by the FSCA, which ensures market conduct, efficiency, and integrity within South Africa’s financial markets.

XS Group openly discloses their regulatory standing, offering comprehensive details on each of their entities’ registration particulars, license numbers, and direct connections to the respective regulatory bodies’ official websites.

Furthermore, these regulations also provide investor protection through compensation plans, but the particulars can vary depending on the specific XS entity that a user is interacting with.

XS Trading Platform: Deposits and Withdrawals

Deposits

At XS.com, you’ll find a range of funding methods that cater to your convenience. The platform accepts options such as bank transfers, Visa/MasterCard, Skrill, and Neteller. These methods typically require minimal initial deposits and process transactions quickly.

Minimum deposits and processing times:

- Bank Transfer: $300 minimum deposit, unlimited maximum, 1–7 working days processing, EUR, USD, GBP accepted.

- Visa/MasterCard: $20 minimum deposit, $25,000 maximum, instant processing, EUR, USD, GBP accepted.

- Skrill: $15 minimum deposit, $15,000 maximum, instant processing, EUR, USD, GBP accepted.

- Neteller: $15 minimum deposit, $15,000 maximum, instant processing, EUR, USD, GBP accepted.

At XS.com, the deposit choices are quite attractive, and the $15 minimum deposit on Skrill and Neteller is especially beneficial for traders aiming to begin with a more modest financial commitment.

Withdrawals

At XS.com, you have multiple options for cashing out your earnings, such as bank transfers, credit cards (Visa or MasterCard), Skrill, and Neteller. Each of these methods comes with specific minimum withdrawal thresholds and varying processing durations.

Minimum withdrawals and processing times:

- Bank Transfer: $250 minimum withdrawal, unlimited maximum, 1–7 working days processing, EUR, USD, GBP accepted

- Visa/MasterCard: $5 minimum withdrawal, $25,000 maximum, 7–10 working days processing, EUR, USD, GBP accepted

- Skrill: $50 minimum withdrawal, $15,000 maximum, 1 business day processing, EUR, USD, GBP accepted

- Neteller: $15 minimum withdrawal, $2,500 maximum, instant processing, EUR, USD, GBP accepted

At XS.com, you won’t find any withdrawal fees, making it a budget-friendly choice for traders. But keep in mind that the processing times may vary, particularly for withdrawals using Visa or MasterCard, which could take as long as 7 to 10 business days.

XS Trading Platform: Accessibility

XS firmly prioritizes inclusiveness and accessibility by providing their services in more than a dozen languages.

Adopting a multi-language system significantly broadens the platform’s attractiveness to people worldwide, as it simplifies navigation and usage for traders who speak various languages.

As a researcher, I can’t help but appreciate the commitment shown by the platform with its multilingual support. This feature allows for customer support in various languages, enabling me to receive assistance and address queries comfortably in my native tongue. This not only streamlines communication but also significantly improves my overall trading experience.

XS Trading Platform: Customer Support

It is worth noting that the website XS.com provides customer support services in various languages such as English, French, Spanish, Arabic, Portuguese, Traditional Chinese, Korean, Thai, Japanese, and several others.

As an analyst, I’d like to highlight that XS offers outstanding customer support through multiple avenues such as live chat, emails, and phone calls. They are dedicated to helping their traders by addressing their queries and fostering a supportive trading environment, ultimately creating a thriving community of satisfied users.

To assess the responsiveness of their customer service, we put their live chat function to the test. Remarkably, we were swiftly connected with a representative within 30 seconds, who effectively addressed our concern promptly.

So, we can consider that XS truly excels in this aspect.

XS Trading Platforms: Pros and Cons

XS Pros

- XS.com offers many tradable assets, including forex, stocks, indices, metals, commodities, and cryptocurrencies.

- Operates under multiple regulatory bodies like ASIC and CySEC, ensuring client protection and compliance.

- Implements high-level encryption, two-factor authentication, and regular security audits to protect user data and funds.

- Offers dynamic leverage up to 1:2000, allowing traders to adjust based on their trading style.

- Provides swap-free (Islamic) accounts that adhere to Shariah law.

- Available in over 11 languages, making it accessible to a global audience.

- Additional protection with insurance coverage up to USD 5,000,000 through Lloyd’s of London.

- Provides quick and effective live chat, email, and phone support, ensuring traders receive timely assistance.

XS Cons

- A $300 minimum deposit for bank transfers might be too high for some traders.

- Visa/MasterCard withdrawals can take 7–10 working days, which is longer than other methods.

- Withdrawal fees may apply from time to time depending on the account type.

- Some methods have lower withdrawal limits, which might not suit traders needing to withdraw large amounts.

Final Verdict: Is XS.com a Good and Legit Platform or It’s a Scam?

Currently, when I’m typing this, XS.com is recognized as a reliable and authentic platform, overseen by numerous regulatory bodies who prioritize client safety and adherence to industry norms.

On this platform, equipped with stringent regulations, cutting-edge safety features, and an array of investable resources, traders of all skill levels – from beginners to experts – can confidently participate.

Beyond showcasing XS.com’s dedication to inclusivity with multilingual assistance and a focus on putting clients first by waiving fees for deposits and withdrawals, it also boosts its attractiveness. Yet, the higher minimum deposit requirement for bank transfers and slower withdrawal speeds for specific methods could potentially deter certain users.

Just like usual, make sure you personally examine the facts prior to taking any investment actions.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-08-20 14:38