It seems our friend Ethereum has decided to throw a second act party, and boy, is it a doozy! Just when you thought it was left gasping for breath in bearish waters, it’s suddenly the life of the crypto soirée, breaking key resistance levels like they’re just fuzzy little piñatas. Analysts are practically salivating at the prospect of ETH reaching a tidy $10,000 within mere months. If only they could predict where I left my keys. 🗝️

ETH Price Today: Bulls About to Stampede

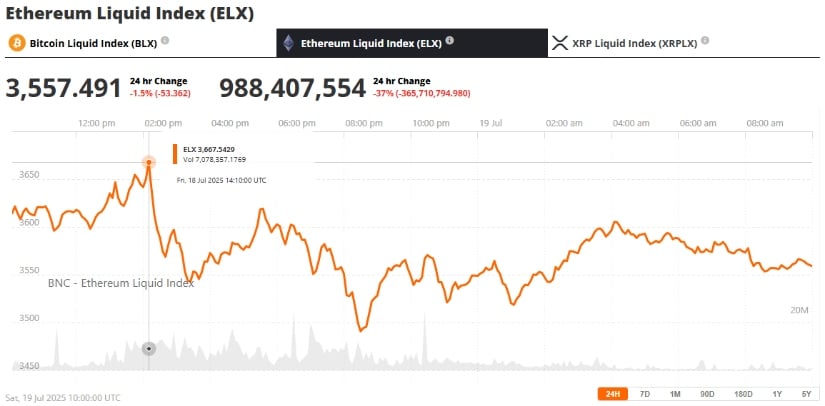

Ethereum (ETH) is currently cruising along at $3,660 and boasts a dazzling 45% gain in the past month. It’s like a high school reunion where everyone shows up hotter than they looked in the yearbook. After a period of nail-biting tension, ETH has decided to stop playing coy and burst through all those pesky resistance levels, giving the crypto space reason to nod sagely and discuss “institutional demand” in hushed tones.

Enhanced inflows have been a part of this bullish buffet. On July 16, ETH ETFs snagged $726 million in net inflows—a historic slap on the back for Ethereum. A day later, another $602 million joined the party. According to CoinShares, in the past week alone, Ethereum funds have gobbled up nearly $1 billion. Clearly, it’s a bottomless pit of enthusiasm! 💸

Market Overview: Technical Analysis In Its Finest Trousers

If you keep one eye on the charts, Ethereum is engaging in what might be described as an *aggressive tango*. It’s reached a short-term goal of $3,675, but watch out—$3,980 to $4,100 is looming like an ex at a wedding, ready to stir up all sorts of drama. Clear that range, and we might just retest its snug all-time high (ATH) of $4,868. Someone, bring the popcorn! 🍿

Ali Martinez, our oracle of on-chain analysis, weighed in with a cryptic message: “Should Ethereum close above $3,980, brace yourselves for a thrilling ride towards $4,500, followed potentially by the fabled $10,000 milestone.” On smaller charts, ETH seems to be a well-mannered pet respecting Overbalance patterns, ensuring a continuation of this exhilarating uptrend. Should the price hiccup temporarily, you’ll find a long-lost $3,400 waiting to catch the fall. 👀

Ethereum ETF News: Institutional Crush Alert

The secret ingredient to Ethereum’s current bullish cocktail? ETF developments! BlackRock and Fidelity both filed to sprinkle some staking magic into their Ethereum ETFs, indicating a long-term commitment. This isn’t just a summer fling—they’re in it for the yields! Talk about commitment! 🥂

iShares, rocking a BlackRock t-shirt, has joined the parade with a similar proposal. These moves are whispering sweet nothings about Ethereum becoming an essential asset in institutional portfolios. It’s like Ethereum is suddenly way more popular than bitcoin at a banking convention!

Ethereum Layer 2 and Its Understated Brilliance

Digging below the price action reveals a bustling ecosystem of Layer 2 scaling networks like Arbitrum, Optimism, and zkSync processing transactions like caffeinated squirrels on a quest for nuts. These beauties are making gas fees more palatable and expanding Ethereum’s use case across DeFi, NFTs, and gaming. Someone tell my collection of digital cats! 🐱

Total value locked (TVL) on Ethereum Layer 2 platforms has surpassed more than $40 billion, leading developers to pat themselves on the back and whisper sweet nothings to their screens about “growing utility.”

Ethereum validators are cashing in on staking rewards like they’ve found coupons for endless coffee. With higher transaction volumes, long-term holding is the new black—easing the panic of potential sell-offs.

So, Will Ethereum Actually Hit $10K?

The chatter around Ethereum hitting the coveted $10,000 mark is becoming less like idle gossip and more like everyone putting their money where their mouth is. Technically, a breakthrough above $4,100 could open floodgates to $5,000 and beyond, and yes, maybe even that tantalizing $10K. 💥

But hold your horses! With Ethereum’s RSI cozying up near 80—hello, overbought territory—it’s likely traders will be eyeing their profits closely. However, the momentum is so strong, it’s like watching a dog chase its own tail—dips are likely to be gobbled up by institutions longing for long-term staking rewards.

Ethereum Prediction: The Journey Ahead

With Ethereum solidifying its status as the reigning champ of altcoins, the wave of daily ETF inflows and institutional interest are no longer just plot twists in a soap opera. Instead, it’s a serious sit-down, and the road to $10K by 2025 is being paved with cold, hard data and steadily increasing infrastructure.

In the short term, prepare for a skirmish at the $4,000 resistance level. But if it crumbles, we’re all set for a thrilling rollercoaster of higher highs—and I didn’t even pack for that! 🎢

Final Thoughts

Ethereum’s recent uptick isn’t just another overhyped crypto tango; it’s a sign of deeper structural changes reshaping its role from a smart contract platform to an institutional yield-generating powerhouse. Now that’s some character development worthy of an award! 🏆

Whether you’re looking for long-term gains or daydreaming of short-term profits, Ethereum stands out as one of the most vibrant and lively prospects in the crypto circus today.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Felicia Day reveals The Guild movie update, as musical version lands in London

- Best Controller Settings for ARC Raiders

- 10 Movies That Were Secretly Sequels

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Goat 2 Release Date Estimate, News & Updates

- Best Thanos Comics (September 2025)

2025-07-20 00:57