Markets

What to know:

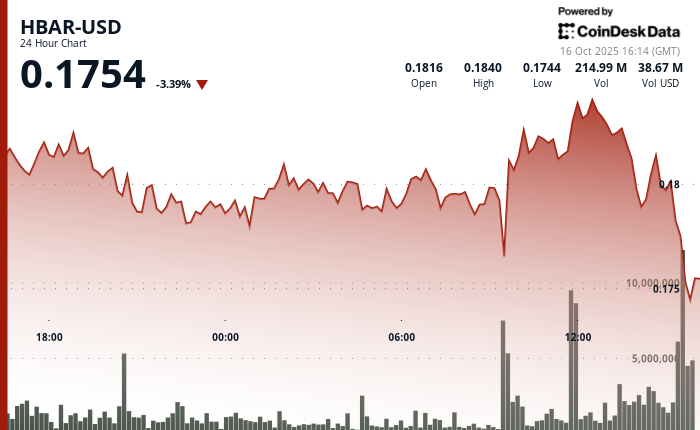

- 5% enterprise price range: HBAR flitted between $0.176 and $0.185 from Oct. 15-16, like a caffeine-fueled squirrel, as institutions scrambled for profits.

- Heavy corporate volume: Morning trades smashed through 129 million before the market had a mild existential crisis in the last 60 minutes.

- Support and resistance tested: Key support lurked around $0.176-$0.178, while resistance near $0.183-$0.185 kept the token from getting too ambitious.

HBAR endured a rollercoaster 24-hour saga, bouncing like a caffeinated kangaroo between $0.176 and $0.185. Morning optimism had it charging back up after some corporate profit nibbling, with enterprise trades leaping above 129 million on Oct. 16. 🐇💸

Alas, all good things must end. In the final hour, a dramatic reversal slammed the brakes, as corporate sell pressure obliterated earlier support. Between 14:02 and 14:04, volumes spiked past 3 million, and HBAR slid from $0.183 to $0.1805 like a snowboarder missing a jump. 🏂

Analysts, probably sipping strong coffee, noted that this dance of ups and downs shows a subtle shift in institutional affection for enterprise blockchain assets. HBAR’s corporate base held firm at $0.176-$0.178, but the $0.183-$0.185 ceiling made it clear that institutions are now tiptoeing cautiously. 🧐

In short, the market looked like it was juggling flaming torches while riding a unicycle-profit-taking on one hand, structural rebalancing on the other, with blockchain tokens precariously balanced in the middle.

Corporate Technical Indicators Highlight Enterprise Market Dynamics

- Institutional trading range of $0.01 representing a sprightly 5% spread between $0.18 enterprise low and $0.19 corporate high. Not exactly Wall Street drama, but close enough.

- Key corporate support zone at $0.18-$0.18 with repeated institutional buying-basically HBAR’s comfort blanket.

- Enterprise resistance levels around $0.18-$0.19 during the corporate comeback attempt. Spoiler: resistance won some rounds.

- Volume surge exceeding 129 million between 09:00-12:00-like a caffeine-fueled stampede of traders.

- Final hour corporate spike above 3 million, signaling that some institutions were saying “enough, we’re out!”

- Market exhaustion visible with zero institutional volume in the final minutes-like everyone collectively decided to take a nap. 💤

Read More

- How to Get the Bloodfeather Set in Enshrouded

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- Gold Rate Forecast

- Best Werewolf Movies (October 2025)

- Best Controller Settings for ARC Raiders

- 10 Movies That Were Secretly Sequels

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Goat 2 Release Date Estimate, News & Updates

2025-10-16 20:34