You Won’t Believe How Much Bitcoin Billionaires Are Hoarding Now! 🚀

What you need to know:

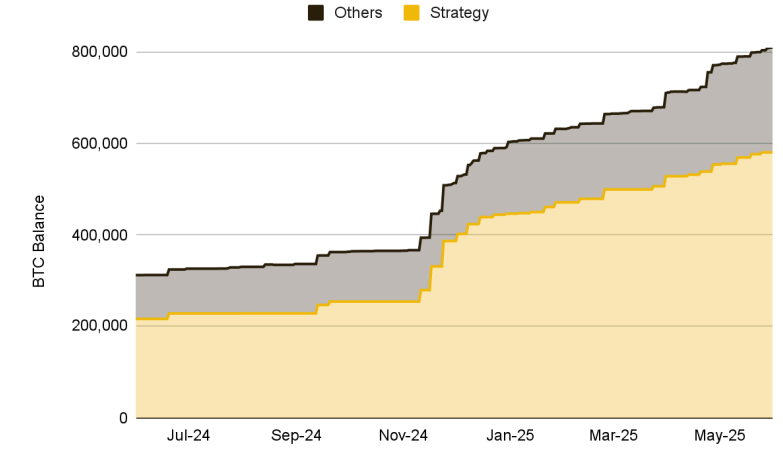

- So apparently, now 116 public companies are playing “HODL” with a total of 809,100 BTC — enough to buy a small country or a really expensive yacht. 🌊

- This is a *stunning* increase from just 312,200 BTC a year ago — because who doesn’t love a good growth story? Nearly 100,000 BTC have been added since early April alone. We see you, crypto whales. 🐋

- And if you thought that was wild, tokenized real-world assets (RWAs) just grew over 260%, hitting a shiny $23 billion this year. Because nothing says “trust me on this” like a bunch of digital tokens tied to real stuff.

Bitcoin isn’t just a buzzword anymore — it’s practically the corporate currency of choice. As of the end of May, 116 big companies are playing with around $85 billion worth of BTC, according to Binance Research. That’s more zeros than a Taylor Swift fan’s phone number. 📱

This meteoric rise from 312,200 BTC a year ago is fueled by rising prices and, apparently, a desire to look like they’re riding the crypto wave. Since early April, 100,000 BTC have slipped into corporate vaults — probably to impress investors or just because “YOLO,” right? 🤷♀️

Meanwhile, Trump’s pro-crypto stance – because who doesn’t want a president who loves digital gold? – has sparked rumors of a “Crypto Capital of the Planet” and a US Bitcoin Reserve. Presidential tweet confirmations still pending. 🗳️

In fact, since Trump won the 2020 election, bitcoin treasury holdings exploded in November. Coincidence? Or maybe a secret government plan to corner the pizza delivery market? 🍕

Thanks to new accounting rules from FASB, companies can now recognize gains on their BTC holdings without guilt — because nothing says “we’re responsible” like bragging about your massive crypto gains. 💼

Nifty new players like GameStop (GME) and PSG are now dabbling in Bitcoin — because why not? But Strategy still owns over 70% of the crypto pie, because they’re the OGs in the corporate “HODL” game. 🍰

And if you thought that was all, some companies are experimenting with other assets — like Ethereum (a cool $425 million), Solana, and even talking about a $300 million reserve in China. Because diversification is key when you’re trying to sound fancy at board meetings. 💸

But let’s be real — most of these altcoins are just trying to rebrand as “token-forward” disruptors. It’s like putting a fancy hat on a pig, but hey — it’s the effort that counts. 🐷🎩

Oh, and RWAs — tokenized real-world assets — have skyrocketed more than 260%, jumping from $8.6 billion to $23 billion this year. Because nothing says “trust me” like digital assets pretending to be actual stuff. 🏦

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2025-06-05 17:02