- Bitcoin‘s Short-Term Holders (STHs) are sweating bullets—macro uncertainty does wonders for market jitters!

- Is it game over if BTC slips below $72k? Time for the STHs to grab their fainting couches!

Ah, the 9th of April. A date etched in the chronicles of cryptocurrency history, as the U.S. President (let’s not mention names—*cough* Donald *cough*) declared a 90-day tariff holiday. This delightful announcement sent Bitcoin soaring ☁️, a staggering 8.27% leap in a single day! Yes, folks, its longest green candlestick in almost a month—a veritable fiesta of hope and excitement! 🎉

But the fun didn’t stop there! Just a day later, the core CPI inflation number nosedived below 3% for the first time since March 2021. Cue another applause for our dear Bitcoin, which promptly jumped another 3.36% to reach the dizzying heights of $82,532 at press time. 🎈 Such joy!

With these macro nudges, one could imagine the market taking a deep breath, ready to plunge forward. But wait, there’s a twist in our tale!

Our friends, the Short-Term Holders (STHs), are clutching their wallets tightly as their realized price per BTC hangs awkwardly at $93k. Remember kids, when the going gets tough, the tough get going… or do they?

Bitcoin’s STH supply—where capitulation risks run wild!

We find ourselves at a critical crossroads in Bitcoin’s saga. The STH supply has been jostled awake—on the 10th of February, it peaked at a luscious 400k BTC, but lo and behold, it has sunk to 360k. A sign of mass exodus? The dramatic irony is delicious, isn’t it?

On-chain intel from our ever-reliable Glassnode whispered that most of these holdings were acquired around—hold onto your seats—$93k. But alas, trading below this price means approximately 360k BTC are drowning in unrealized losses, and the risk of capitulation dangles ominously like a piñata at a birthday party.

Furthermore, the reality of the STH realized price looms large at $131k and $72k. If Bitcoin takes a tumble to the lower band at $72k, it would mean our short-term comrades would suffer a 22% erosion of their much-coveted profit margins. Such delightful chaos—historically, when the lower band is breached, it’s like watching dominos fall in slow motion!

Should Bitcoin slip beneath the fated $72k, wave goodbye to calm waters—cascading sell pressure would arrive like an uninvited guest at dinner! 🍷

On the bright side, if Bitcoin manages to reclaim $93k, it could flip the STHs back into profit territory, a miracle worthy of the front page of the Daily Celebrator.

Macro volatility: The party crasher!

Observing from a macro lens, Bitcoin is languishing below the all-important $85k resistance level. Every rejection acts as a reminder that this zone teeters on the brink, and a breach could unleash a veritable cataclysm of short liquidations. What a scene that would be! 🥳

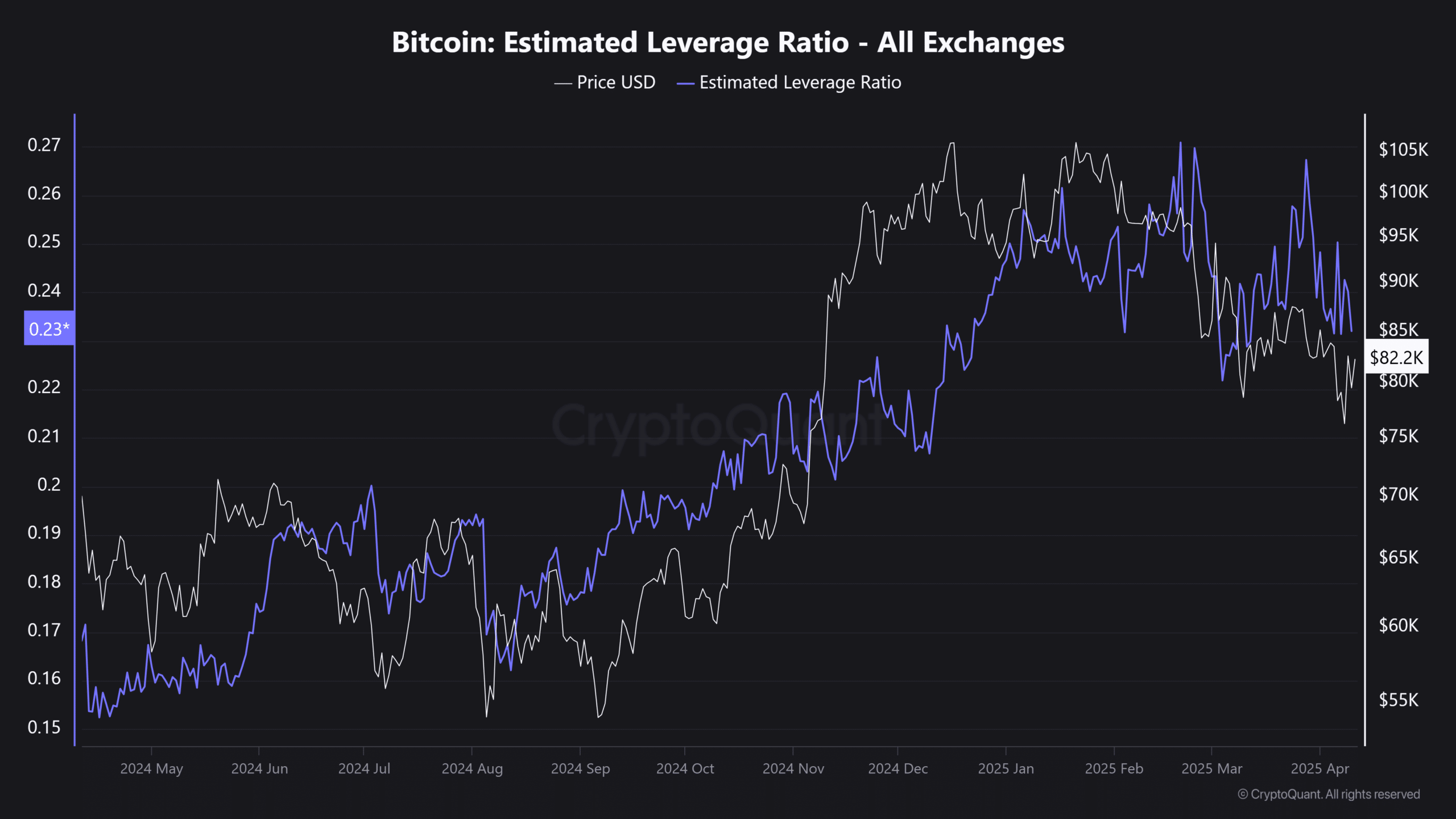

As if on cue, Bitcoin’s Estimated Leverage Ratio (ELR) has slipped below its early March benchmark—observe the traders, tiptoeing cautiously away from high-leverage positions, like kids escaping an awkward conversation.

Despite these trials, Bitcoin has shown some grit. Post-tariff fiasco, the BTC market cap only bled a modest $90 billion—nothing compared to other, more dramatic risk assets. By comparison, that’s like losing a dollar in the couch versus your entire wallet. 😅

However, with the Federal Reserve doing its best impression of a stubborn mule, short-term holders may soon feel the urge to cut their losses. Many joined the party around that oh-so-lovely $93k mark. If prices don’t sing a sweet recovery song soon, the desperate may opt for a swift exit left.

So here we stand, still in a climate of fear, with educational levels low, and significant resistance looming overhead. A dip to $72k isn’t just a wild rumor; it’s a real possibility before Bitcoin dares to throw itself into the breakout dance.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2025-04-12 03:07