So, markets may have finally survived the worst of the U.S. tariff drama. But just when you think you’ve reached a safe place, hold on tight – the ride ahead is still pretty darn bumpy, according to the sharp minds at Nansen.

Nansen Spotlights the ‘Bessent Put’ as U.S. Finally Tries to Chill on Trade Wars

In a dazzlingly insightful report shared with TopMob, Aurelie Barthere, Principal Research Analyst at Nansen, presents a picture of U.S. tariff negotiations turning more pragmatic, which has somehow managed to calm some investor panic. In this world of endless trade tension, Bessent (whoever that is) is now calling the shots over trade policy, leaving the likes of Navarro and Commerce Secretary Lutnick sulking in the corner. 😒

With temporary tariff exemptions for semiconductors and tech products, it looks like the U.S. might just be backing off from the brink of full-blown economic chaos. But don’t get too comfy. Barthere still points out that risks are like that one sock you can never find – lurking around in the background. Sectoral tariffs and China still have unresolved issues, meaning uncertainty might hang around like an unwelcome house guest. 🏚️

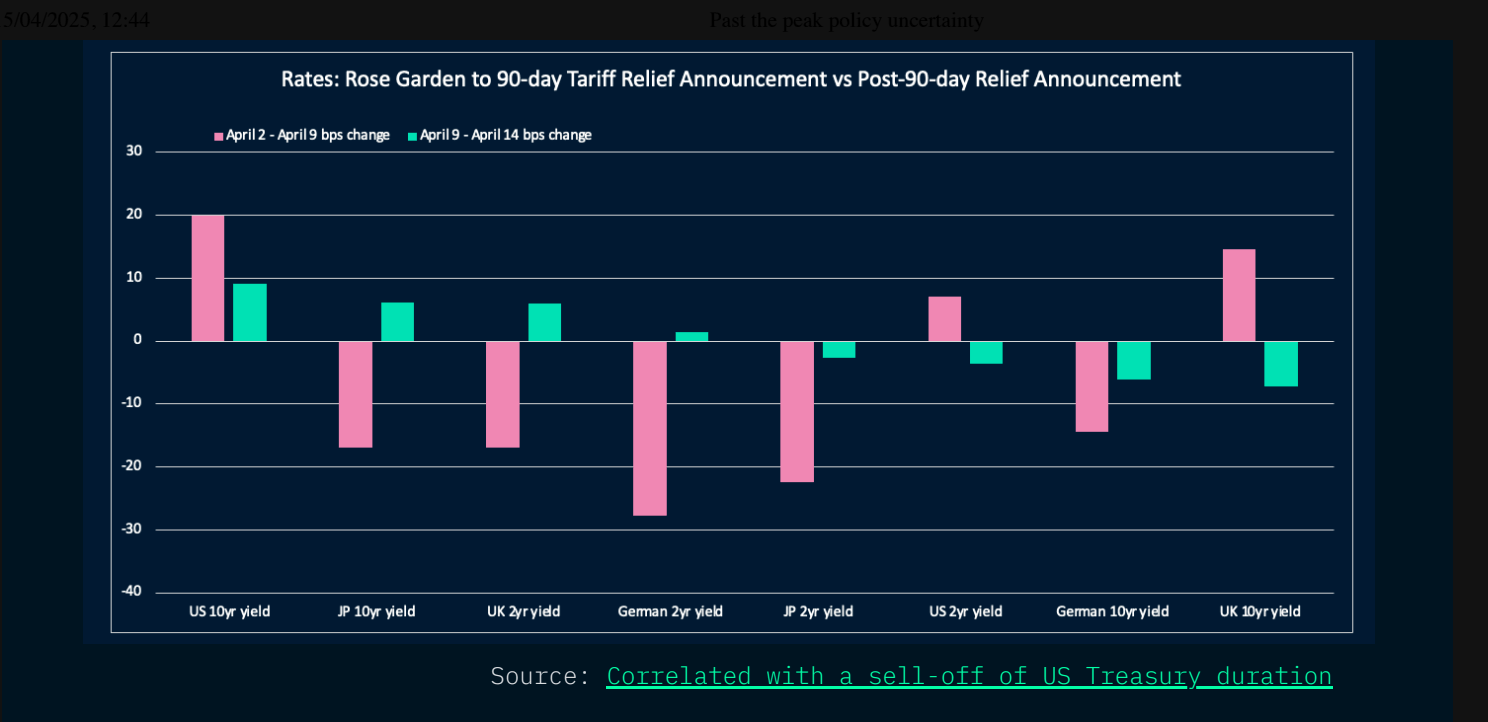

The report also mentions that U.S. Treasury demand is weakening and the dollar is stumbling like a drunk uncle at a family reunion. Apparently, foreign investors are trying to hedge against future chaos, which is why equities outside the U.S. (sorry Europe and China) didn’t exactly shine during the peak of tariff madness. But don’t get too excited, global investors may still be stuck with U.S. markets because – well, there are no better options. Sorry, everyone else. 🙄

Barthere suggests a *very* cautious approach. Maybe think about things like bitcoin (because, why not? 😎), cheap tech stocks like Nvidia, and European pharma companies making a killing in high-margin products. Oh, and gold. Because gold always gets invited to the party, even when the theme is ‘complete global financial mayhem’. Nansen’s Risk Barometer (fancy, huh?) just went “risk-on” late last week, meaning there’s a tiny glimmer of optimism. But don’t pop the champagne just yet – it’s still going to be a bumpy climb ahead:

We have likely passed the peak tariff uncertainty, with risk assets now climbing a bumpy wall of worry. 😬

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2025-04-16 06:57