In the dim light of market uncertainty, where every tick and tock seems a whisper of fate, traders cling to the price of XLM near $0.36 – like prisoners hoping for a reprieve in their ceaseless cycle of despair. Could this be the genesis of a grander, merciless game, played by the unseen hand of market forces?

The W Pattern: A Mirage of Hope in the Bleak Wilderness

Our modern-day soothsayer, CryptoCharged on X, proclaims a token’s struggle to rise from the abyss, forging a higher low in the shape of a W – a sign familiar to those who have stared too long at charts in cold rooms, waiting for redemption. Daily and weekly scrolls paint this “reversal” as a beacon of bullish zeal, though the shadows of history, written in Fibonacci’s cryptic script, caution us otherwise.

For even in past bears’ savage grip, XLM has plunged deep, only to crawl back – not to freedom, but to another stage in the cruel cycle of folly and hope. Traders now are invited to dance this dance, chasing cycles rather than embracing eternal holding – the latter being the true tormentor’s path.

Our analyst warns – should the asset climb to the ominous 1.618 Fibonacci extension, a 90% correction lurks in the wings, leaving the patient souls with losses of 58% from the current vantage. Ah, but should the price reach loftier summits – 4.236 or even 8.0 – then the cruel cycle might mock us by breaking even or, as if mocking fate itself, presenting a 2x return. This peculiar dance of asymmetric risk and reward would amuse even the sternest bureaucrat in the Kremlin’s shadow.

The Market’s Whisper: Liquidity Amidst the Ruins

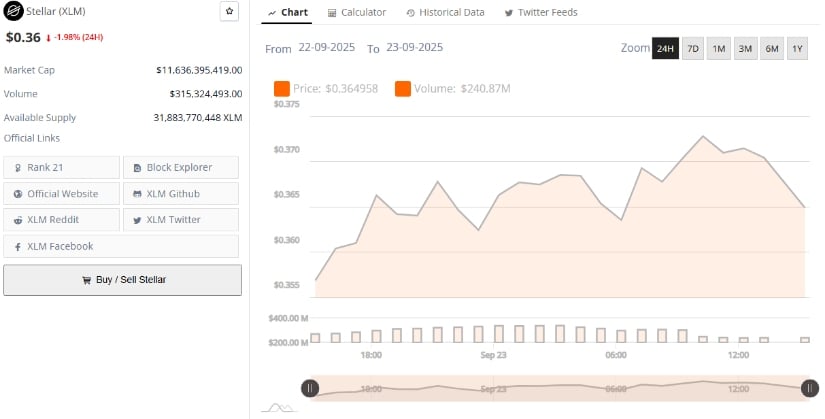

Data from BraveNewCoin, that cold chronicler of markets, shows XLM trading at $0.36, down by a mere 1.98% in 24 hours – a modest tremor in the vast machinery grinding billions of dollars and hopes. The market capital, a hefty $11.63 billion, and daily volume of $315 million, with 31.8 billion tokens marching in endless procession, paint a picture of vibrant life beneath the brittle shell of price decline.

Though prices waver, the liquidity remains a fortress, a grim testament to the stubborn persistence of human folly and faith in this top-25 digital colossus.

The broader market landscape is no kinder. XLM wavers, struggling to maintain its ephemeral momentum. Yet, beneath lies a stalwart ecosystem, resilient as a Siberian winter, suggesting these trials might only pave the way for greater upheavals – or perhaps just more waiting for those condemned to this market’s labyrinthine cycle.

Technical Indicators: The Grim Prognosis of Modest Gains

As we pen these words, XLM/USDT clings to $0.3688, boasting a tiny 0.14% gain – hardly cause for celebration. The MACD, that cryptic oracle, lingers just below its signal line, echoing weak breath; the histogram mutters faintly in negative numbers, and the Relative Vigor Index, like a weary worker, fails to muster the strength above 50.

These are the signs of a market at a crossroads; buyers and sellers locked in a grim duel. Should XLM manage to stand guard above $0.35 and climb toward $0.40-$0.42, the W’s promise may bloom into a genuine surge – or, if crushed below $0.35, the cruel gears of time will grind down hopes even further, extending a winter from which none may quickly escape.

So here we stand – in the cold light of charts and cryptic numbers, with hope shackled to skepticism, waiting to see whether this digital gladiator will rise, falter, or simply amuse the gods of the market with its persistent struggle. 🥶📉

Read More

- How to Get the Bloodfeather Set in Enshrouded

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Goat 2 Release Date Estimate, News & Updates

- Felicia Day reveals The Guild movie update, as musical version lands in London

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- 10 Movies That Were Secretly Sequels

- Best Thanos Comics (September 2025)

2025-09-24 01:23