It is a truth universally acknowledged—by those, that is, who prowl the souks of digital assets clutching their smartphones like prayer-beads—that even amidst chaos there will be, inevitably, the unlikely hero: an altcoin launching from ordinariness into notoriety. This week’s ingénue, Ardor, has performed no less than a triple-pirouette, leaping a sprightly 127% while the rest of the market wallows in a sort of post-Edwardian gloom. One can almost hear polite gasps circulating through Telegram groups worldwide 🌍, as hopeful dealers add ARDR to their watchlists with the trembling fingers usually reserved for telegrams from disapproving aunts.

Now, this meteorological event in what would otherwise be a cloudless crypto backwater has left the bon ton searching for an explanation, grasping at questions like “Why on earth is Ardor up today?” as if seeking a misplaced monocle after a particularly riotous fox hunt. To illuminate these shadowy corners, one must peer into the heart of the matter: South Korea 🇰🇷, land of chaebol, K-pop—and now, apparent epicenter of Ardor-mania.

Ardor: Doing Dramatic Things on South Korean Exchanges 😎

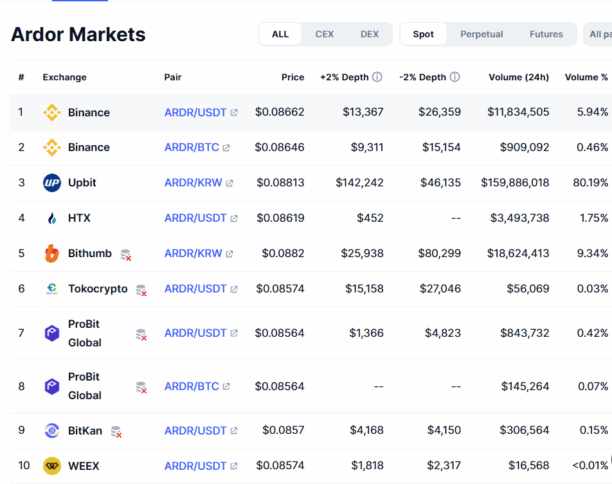

It is, in fact, almost indecent: some 89.46% (no, do not adjust your spectacles) of ARDR’s daily inflow—amounting to a not inconsiderable $177.5 million—finds itself sashaying through the KRW pair. One imagines hordes of Seoul’s brightest, bespectacled traders gathered in cafes, speculating on news as yet unannounced, or perhaps merely enchanted by the siren call of a new token. Quite why so many have fallen under Ardor’s spell remains shrouded, but that has never stopped anyone from speculating wildly.

127% Gains! And Other Ways to Turn Heads at Your Crypto Soirée 👀

One must genuflect before the numbers. With an intraday volume leap of no less than 1,284% (yes, there’s no decimal misplaced), Ardor’s price has executed a jump that would leave any aspiring acrobat green with envy—and benefitted rather handsomely, too. The South Asian enthusiasm continues to fan the flames, pushing Ardor’s fortunes up 120.93% this week and 53% over a mere month. It’s Deauville, but with fewer champagne bottles and considerably more volatility.

As it stands—with a supply nudging just under a billion and a suspiciously precise 333rd rank by market capitalization—Ardor has crashed the party in dazzling form, sporting a wardrobe of $91.43 million in capes and sequins. As for whether this mad parade continues? Well, one would need the vision of a Venetian oracle (or at least a better fortune-teller than the last one consulted by Lord Copper) to predict tomorrow in crypto-land.

Speculators and Anaïs-Nin-quoting romantics alike should, as ever, proceed with the wariness of a debutante at her first ball—volatility being what it is, and Ardor’s sudden encore likely to generate both tales of triumph and unprintable lamentations in equal measure. DYOR, as the young people say, and keep one’s wits (and gin supply) about you. 🍸

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2025-04-15 23:34