Oh, the thrill of watching Circle stock shoot up like a rocket in pre-market trading, as if it’s on a mission to prove that IPOs can actually perform well for a change. It’s officially one of the best performers of the year, just like that kid in class who shows up late but still manages to get an A. 😎

On its debut, CRCL surged an eye-popping 170%, followed by another 16% increase in the pre-market session. Someone, please, give this stock a cape. With this rally, its market capitalization is now over $20 billion, which, if you’re keeping score at home, is roughly one-third of USD Coin’s (USDC) market cap. Who knew stablecoins could be so glamorous? 💸

And why the sudden surge? Well, strong retail and institutional demand for shares in the second-largest stablecoin issuer is the magic ingredient. BlackRock, that investment giant we all pretend to understand, snatched up a 10% stake, and Ark Invest came in with a cool $150 million. Clearly, the big players think Circle is the next big thing, and who are we to argue? 🤷♂️

Now, here’s the thing: stablecoins are apparently going to revolutionize finance, and Citi seems pretty sure about it. According to them, the stablecoin industry could be worth $1.6 trillion by 2030—up from a modest $250 billion. That’s… quite the leap. If they’re right, Circle will be riding high on the back of a rapidly growing sector. Not bad for a company that doesn’t even have a real mascot. 🐢

Unlike its less-compliant cousin Tether, Circle is the responsible adult in the room. It plays by the rules, like the Markets in Crypto-Assets (MiCA) regulations, while Tether is… well, let’s just say Tether doesn’t even know what MiCA stands for. Circle’s got its legal ducks in a row, and it even has its eyes set on disrupting the mighty Swift payment system that processes over $150 trillion annually. Watch out, Swift—here comes the Circle Payments Network, ready to process your funds in seconds. 🏃♂️💨

But that’s not all—Circle also wants to take over the world of real-world asset tokenization with its USYC solution. You know, just casually tokenizing a $378 million money market fund. No big deal. 💼

Investors love Circle’s business model because it’s “asset-light” and “high-margin,” which translates to making money off customer deposits and sticking those funds into liquid assets like Treasuries. And don’t forget the Circle Reserve Fund, which BlackRock manages, because if anyone knows how to manage your money, it’s the people who made billions off other people’s money. 💰

So, Should You Buy Circle Stock Today?

Well, Circle is clearly strong, sitting pretty in a growing industry. Long-term, it might just keep soaring. But hold your horses—there are a few potential bumps on the road. For one, if the Federal Reserve starts cutting interest rates this year, Circle’s returns could take a hit. And then there’s the little matter of competition. Companies like Ripple, PayPal, and even U.S. banks are jumping on the stablecoin bandwagon. It’s a crowded space, folks. 🚗💨

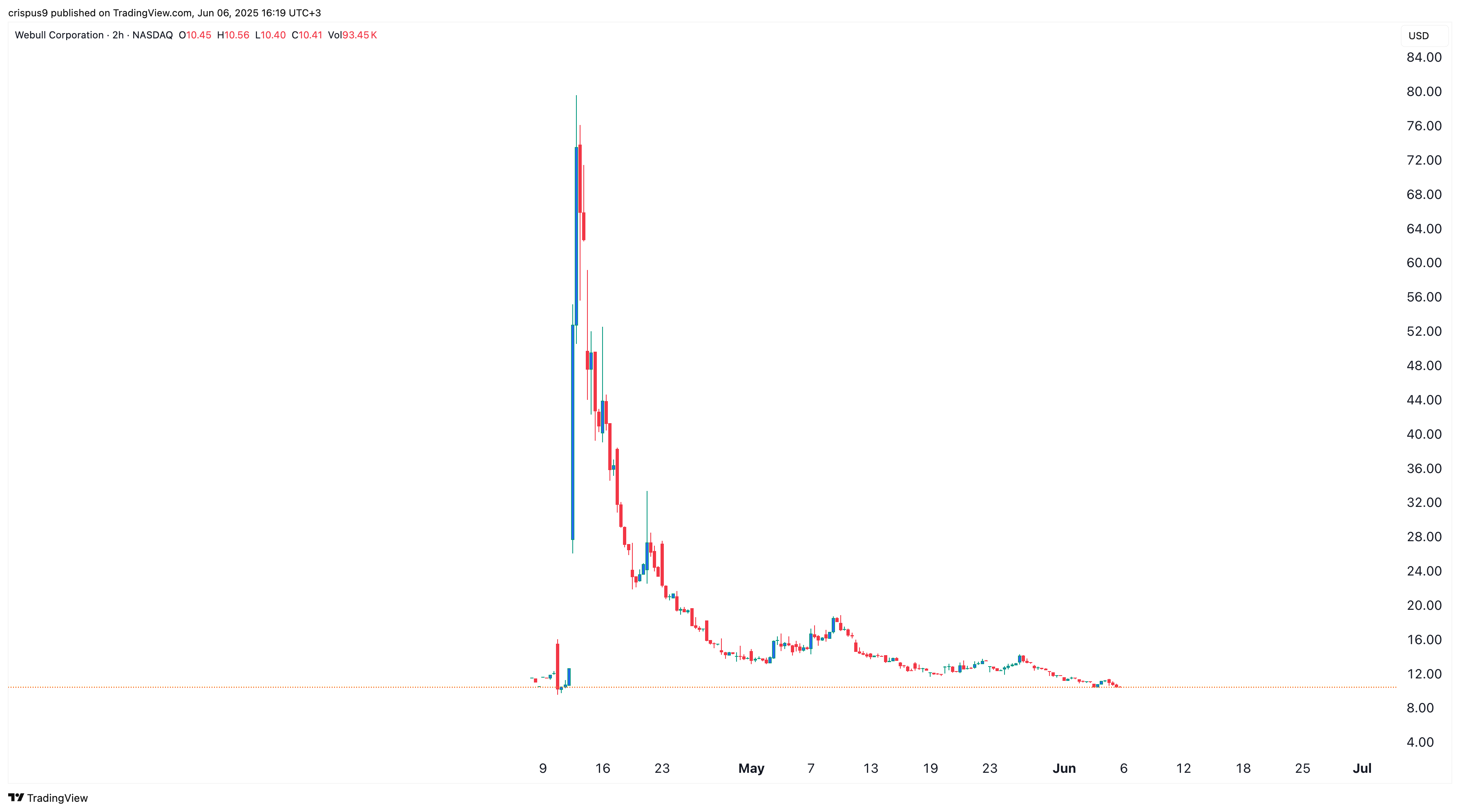

In the short term, don’t be surprised if Circle stock does a little rollercoaster act. We’ve seen this before. Take Webull stock, which went from $25 to $80, only to plummet to $10. Or CoreWeave, which shot up from $35 to $64 and then nosedived to $34. And now, it’s at $135. It’s safe to say that Circle’s stock might take a little dip before it finds its real groove. But hey, that’s the IPO game, right? 🎢

So, expect a little pullback, a little drama, and then—just maybe—another run-up. Because, when you’re a company with a billion-dollar market cap, a high-flying stock is basically a rite of passage. 🚀

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2025-06-06 16:44