In those gray, interminable corridors — not of a prison, but of a London banking house — a strange fate befalls the coins of cyberspace. Standard Chartered, a bank that once prowled the sunlit colonies hunting real gold, now peeks sullenly at Binance Coin (BNB). “Hyper-growth!” they mutter. “Fourfold returns!” Imagine, comrades, what could drive such optimism. Have they gone mad, or have they read too much modern finance?

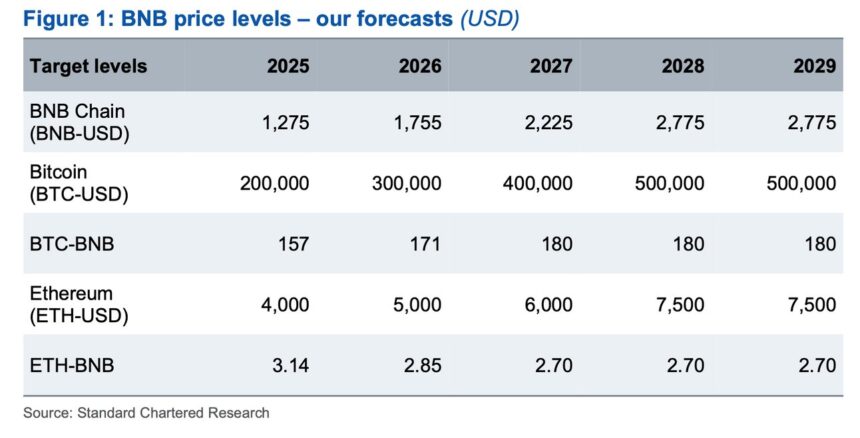

According to their prophets (called “chief digital asset analysts” in the modern tongue, though in the old regime they’d be suspiciously eyed statisticians), BNB will soar to $2,775 by 2028. Yes — four times as much as its puny $600, just now shivering in the cold rain of speculative markets. If only our daily bread grew like that! 🍞

BNB, for those not attending the blockchain catechism, began its life as another Initial Coin Offering in 2017. Now — such are the miracles of the digital world — it sits, bloated and proud, as the fourth-largest cryptocurrency, worth $84 billion. Though the crowd whispers about its many flaws: the stubborn centralization, wallet-emptying fees, uncertain usefulness in the infernal “real world,” and the curious lack of developers (who, perhaps, have heard of Siberia). Yet BNB clings tightly to Binance — not so much a mother as a raven perched atop the crypto tree, watching for market signals.

Geoffrey Kendrick — perhaps not a Party functionary, but speaking with equal self-assurance — observes that since May 2021, BNB marches eerily in step with both Bitcoin and Ethereum. In the time of the great market purges, such similarity would earn a coin a one-way ticket to the Gulag. In this case, they claim it makes BNB a “benchmark,” a kind of thermometer stuck into the crypto fever dream. The wisdom of the bank suggests Binance’s continued rule of this strange jungle bodes well for the little coin’s “stability.” Shall we laugh, or quietly weep?

Meanwhile, the bureaucrats at VanEck have filed papers with the dreaded SEC, hoping at last to list a BNB ETF (imagine, in America! Where the paradox of regulation and freedom dances nightly). Should they succeed, the ETF might own BNB tokens themselves and bring a whiff of legitimacy to collections of digital digits. You can almost picture the grandmothers opening ETFs filled, not with wheat, but coin: “For my retirement, Boris!”

Bitcoin hogs the headlines, yes, but the shadow of institutional longing creeps slowly, inevitably, toward other altcoins — and BNB awaits its turn. With the ETF machinery possibly grinding into action, the floodgates may open for “intense demand,” or perhaps just mild bureaucratic chaos. Whatever the outcome, Standard Chartered’s vision of a sparkling $2,775 BNB by 2028 will either become a legend whispered in soup lines, or the punchline to another cosmic joke. 🙃

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- You Won’t Believe Today’s Tricky NYT Wordle Answer and Tips for April 30th!

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2025-05-07 21:37