- Zcash has rallied by 12% in 24 hours, amid a surge in buying activity.

- Zcash could hit a $1 billion market cap by year-end as bullish signals align.

As a seasoned crypto investor with a knack for spotting trends and reading charts, I find myself rather optimistic about Zcash [ZEC] at this juncture. The 12% surge in 24 hours and the approach of the $1 billion market cap milestone are certainly bullish signs that cannot be ignored.

At the present moment, Zcash (ZEC) was among the coins experiencing significant growth, having increased by 12% over the past 24 hours to a trading price of $54.40. Moreover, its market capitalization had surged to $886 million, moving ever closer to the substantial $1 billion threshold.

Over the past month, the value of ZEC has increased by 48%, much like how Bitcoin [BTC] and many other altcoins grew in November. Yet, with the overall market indicating a pullback, could Zcash continue its upward trend or get swept up by the bearish wave?

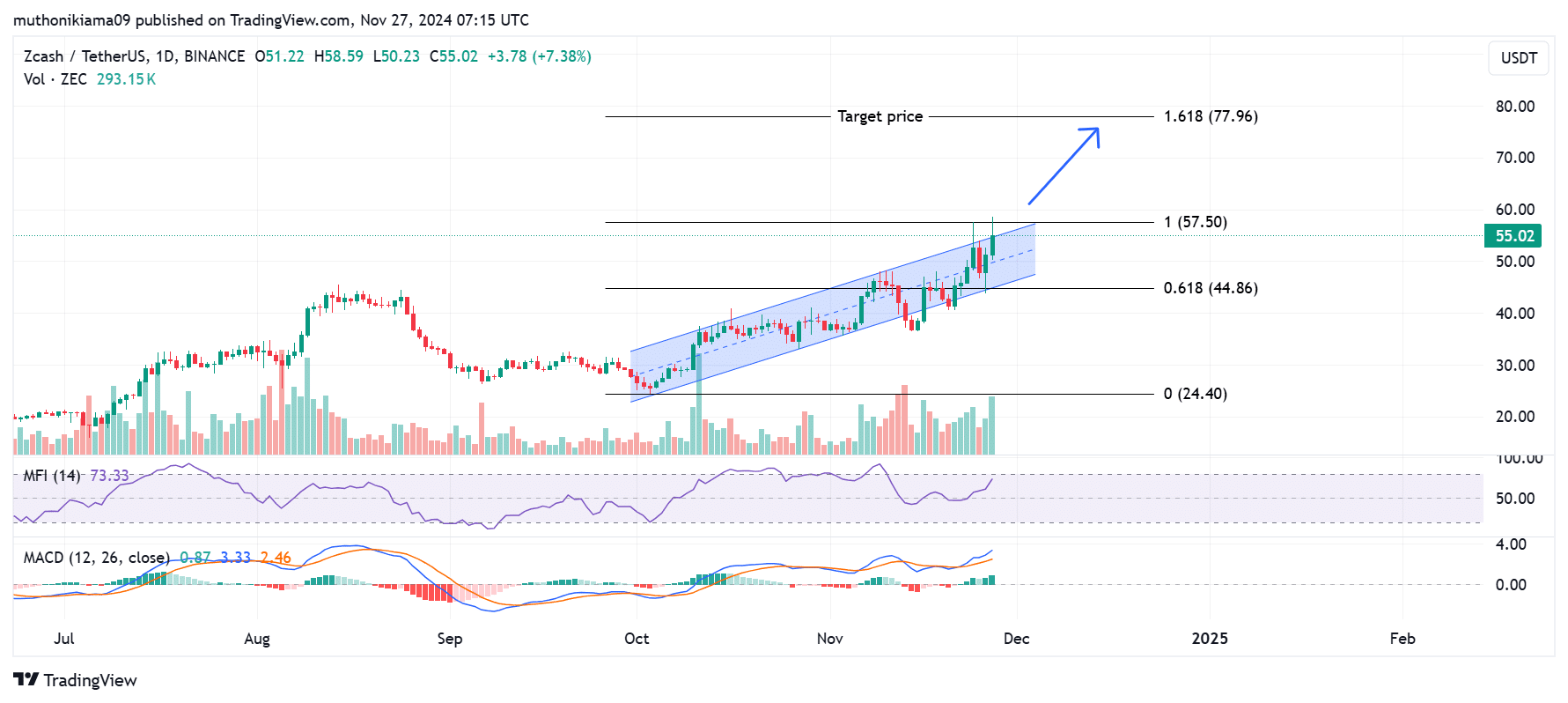

Analyzing ZEC’s parallel ascending channel

On a daily basis, Zcash is trying to push past an upward sloping parallel channel it’s been confined within. However, the token is encountering significant resistance at the top of this channel. An increase in trading activity, as suggested by the volume bars on the histogram, might maintain the upward trend.

As an analyst, I’m observing a robust bullish trend in ZEC, backed by the Money Flow Index (MFI) reading of 73. This strong buying pressure is propelling the upward momentum of ZEC. Remarkably, even with this positive slope, the MFI hasn’t yet signaled overbought conditions, indicating that there’s potential for further price increases.

A rising Money Flow Index (MFI) and a breach beyond the rising parallel trendline might encourage traders to maintain or boost their investments.

A stronger upward trend is noticeable in the Moving Average Convergence Divergence (MACD) chart, as the MACD line persists above the signal line. Additionally, the rising MACD bars add credence to this bullish pattern.

If the optimistic indicators line up, the projected price for Zcash could reach approximately $77, which is the 1.618 Fibonacci extension level. Moreover, there’s a robust support level at around $44. Should ZEC not manage to surpass the resistance at the top of the ascending channel, the price may dip to retest this support level.

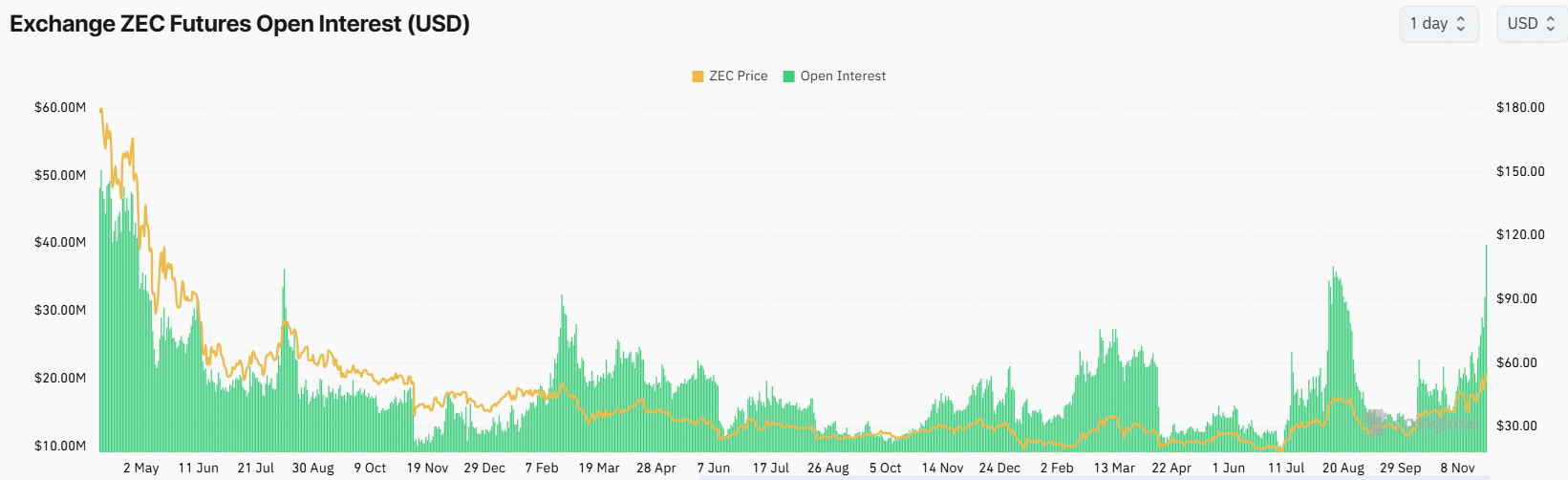

Zcash open interest hits record highs

Zcash’s recent gains have spurred interest in the token from derivative traders as seen in the rising open interest. In 24 hours, ZEC’s open interest has risen by 47% to $39 million at press time, its highest level since April 2022.

An increase in the number of new positions being opened on Zcash indicates that more traders are becoming involved. This trend, which coincides with a rise in price, suggests a positive outlook, or “bullishness.

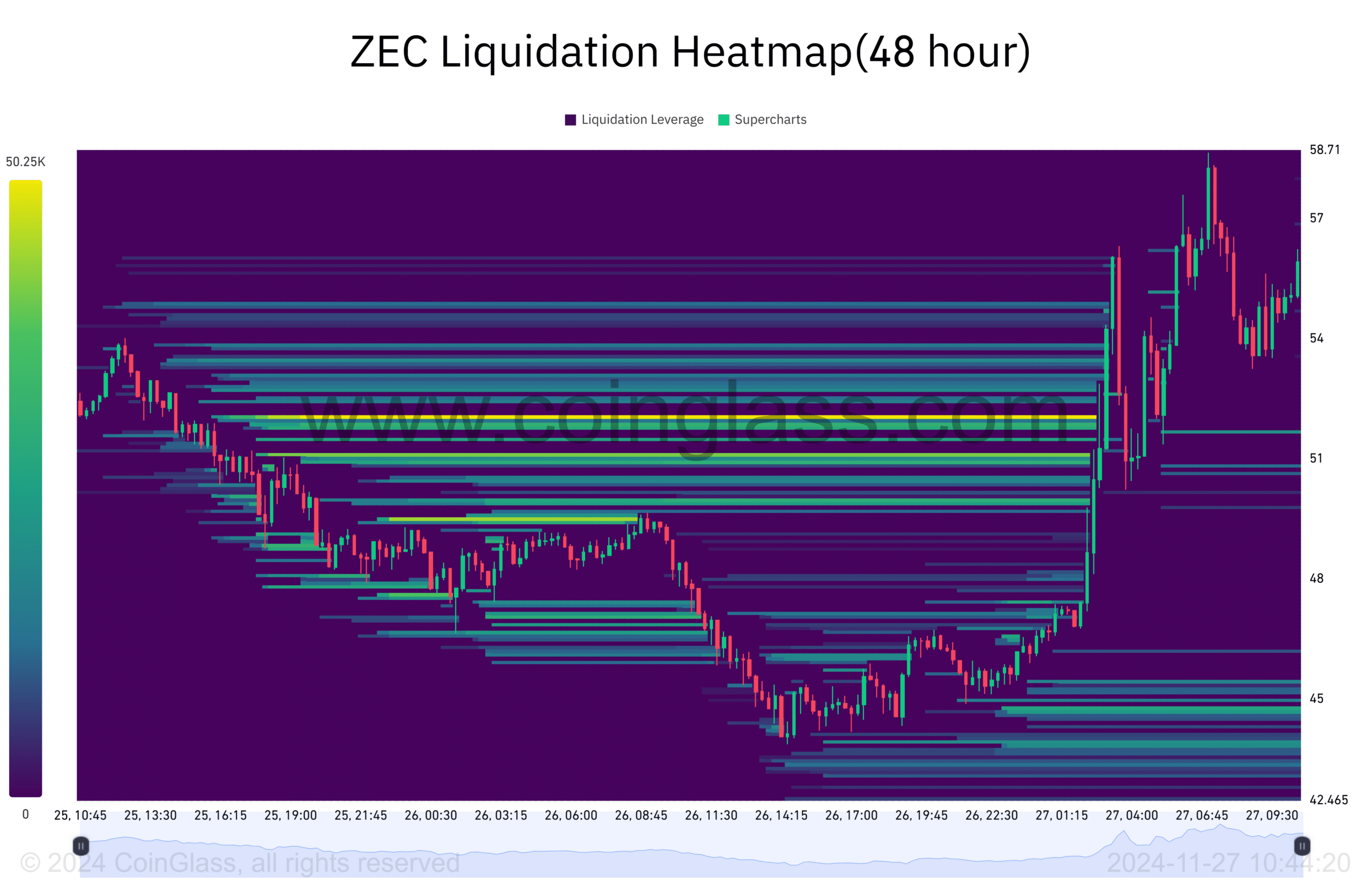

Liquidation heatmap shows THIS

In simpler terms, Zcash’s liquidation map demonstrates an accumulation of closures as the price rose. This rapid closing of short positions due to high leverage boosted purchasing actions, thereby driving the upward trend.

Following the elimination of those temporary high positions, the nearest point for liquidation has shifted downwards, below the present $51 price level. Should ZEC descend to this area, it might instigate additional drops as a result of compulsory selling from long position holders who are being forced out.

Should additional investors jump in prior to ZEC reaching this price point and fortify this resistance area, it may trigger a prolonged bullish momentum.

Read More

2024-11-27 18:15