- ZEC’s long/short ratio indicates a strong bearish sentiment among the traders.

- Currently, 52% of top traders hold short positions, while 48% hold long positions.

As an experienced crypto investor with a keen eye for market trends, I must admit that the current situation with ZEC has me a bit concerned. The inflow of $7.8M into exchanges and the bearish sentiment among top traders as indicated by the long/short ratio are not exactly green flags.

The digital currency known as ZEC, which is associated with the platform Zcash, is creating a stir in the cryptocurrency market due to its strong performance during the past week. This positive trend seems to be influencing the attitudes of big investors and traders, according to data provided by on-chain analytics firm Coinglass.

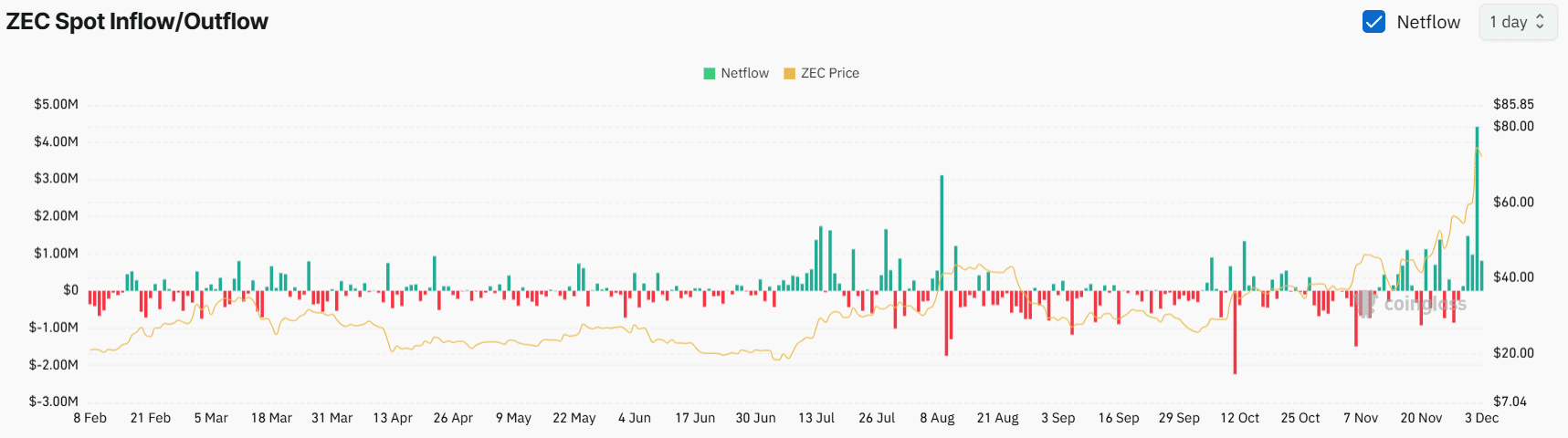

Zcash’s $7.8M inflow

Based on data from Coinglass regarding Zcash inflows and outflows, it appears that there was a substantial deposit of approximately $7.85 million into exchanges over the last four days, suggesting that the asset has been moved to these platforms.

In the world of cryptocurrencies, an inflow indicates a possible sign of selling and suggests that there might be a drop in price over the upcoming period.

The surge into trading platforms might be attributed to the strong upward trend (115%) in ZEC’s price and the bearish price pattern, which hints at possible selling off or profit-taking of assets.

In addition to long-term investors, it seems that traders are aligning their strategies based on recent data from Coinglass. The current long/short ratio for ZEC is 0.89, suggesting a dominant bearish outlook among traders, implying they believe the price will decrease more than increase.

Currently, 52% of top traders hold short positions, while 48% hold long positions.

Based on the patterns observed in on-chain data, it seems like bears might be taking over, suggesting a possible decrease or correction in price within the next few days.

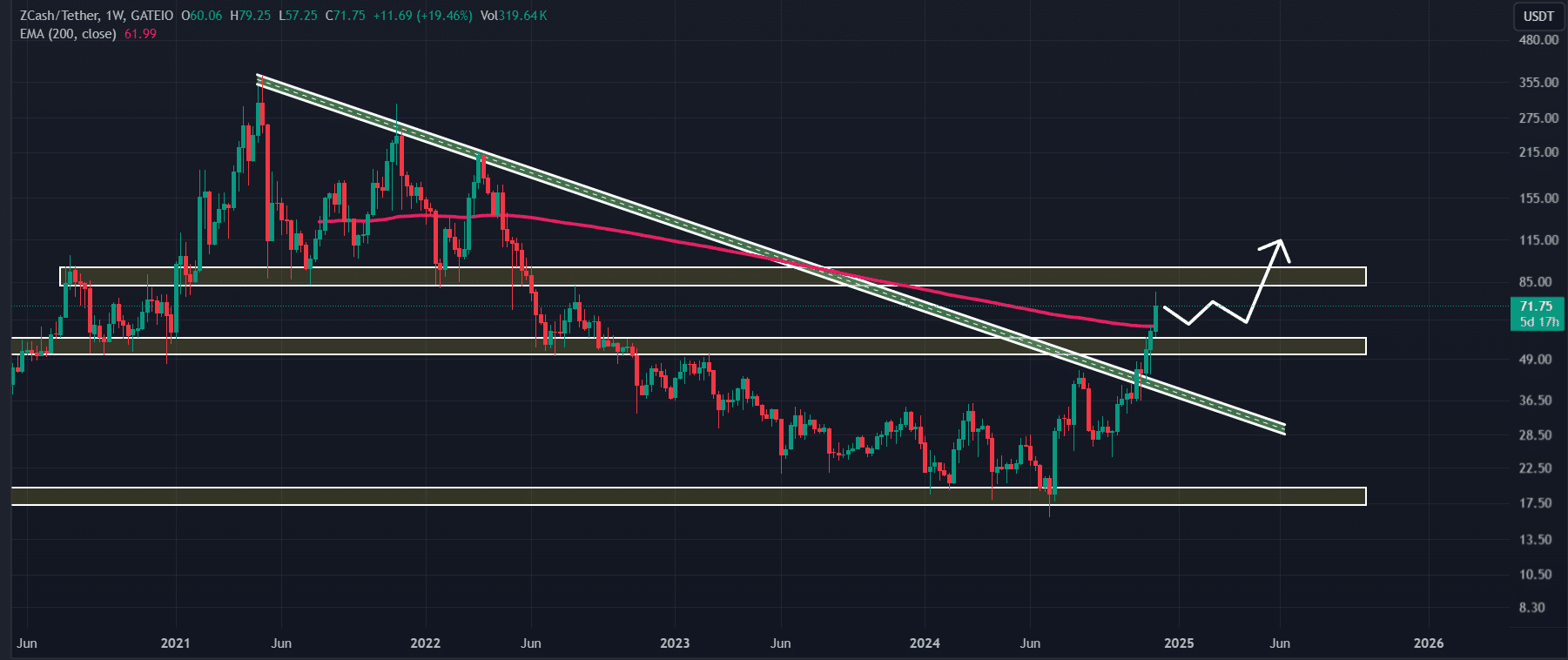

ZEC technical analysis and key levels

Based on the technical assessment by AMBCrypto, ZEC is now encountering a robust resistance point around $80, which appears to be causing price reversals.

Previously, at this same price point, there was a noticeable surge of selling activity that led to a price drop. Yet, large investors (whales) and traders who monitor on-chain data are anticipating a similar outcome this time around.

Considering the latest market trends, it seems highly likely that the price of ZEC might dip or correct within the near future.

On the other hand, the RSI for this altcoin stands at 78, suggesting it’s currently overbought, which might signal a possible price correction or reversal within the next few days.

Currently, ZEC is close to $72.70 per unit and has seen an increase of more than 21% in its value during the last 24 hours.

Simultaneously, over that timeframe, its trading activity significantly increased by 120%, suggesting greater involvement from both traders and investors, as opposed to the preceding day.

Read More

2024-12-03 19:04