- Zcash achieved impressive gains underpinned by robust demand, but short-term profit-taking intensified.

- We explored the possibility of discounted short-term prices and more potential upside in the long-term.

As a seasoned crypto investor with battle scars from more than a few market cycles, I must admit that Zcash’s [ZEC] recent bull run has been nothing short of exhilarating. With a 175% gain in just six weeks, it’s safe to say that those who held on have reaped the rewards. However, as they say, what goes up must come down, and I believe Zcash is due for a retracement.

In the past two months, the privacy-focused cryptocurrency, Zcash (ZEC), has shown remarkable strength, posting significant gains. Investors who got on board with Zcash over the past six weeks and held their positions have reaped rewards, experiencing a surge of approximately 175% in value.

However, a Zcash is due for a retracement.

Over the past six weeks, Zcash’s performance has been truly remarkable, demonstrating resilience by recovering strongly following the market dip in late July and early August.

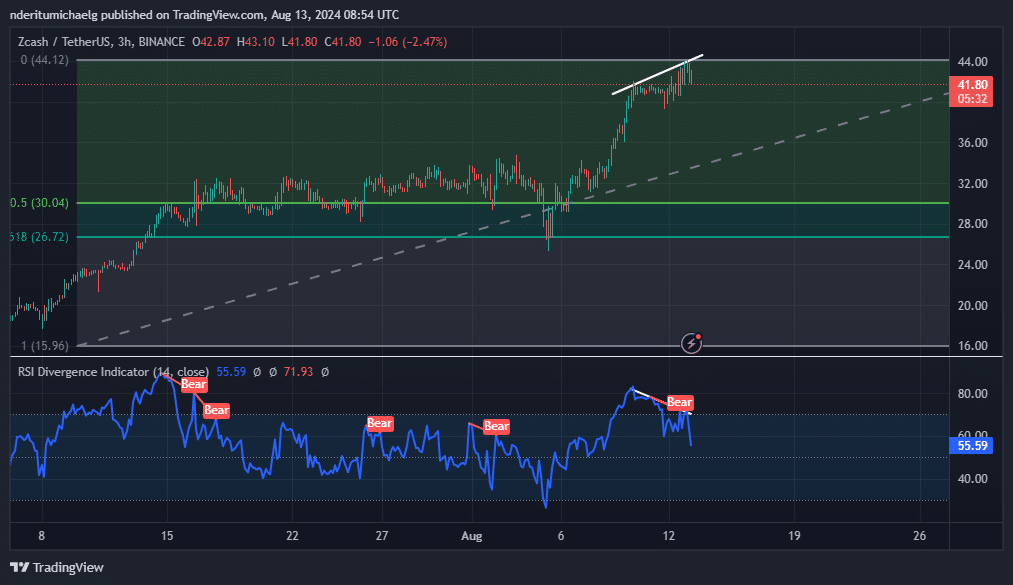

To give you some context, the value of this privacy-focused coin dipped down to $15.78 on July 5th, but then soared up to $43.44 during the trading day on August 12th. Now, let’s delve into the Zcash price forecast.

Zcash price prediction

After showing strong upward movement, it seems likely that Zcash may experience a temporary dip as a normal market correction. Several indicators suggest a potential shift in trend direction.

In simpler terms, the Relative Strength Index (RSI) showed a divergence with the price on the 3-hour chart, suggesting that the upward trend’s strength might be decreasing, potentially signaling a shift in market direction towards bearishness.

Moreover, the Relative Strength Index (RSI) had retreated from the overbought region, indicating an accelerated accumulation of sell orders. At the current moment, ZEC was being traded at $41.52, representing a 5.67% decrease from its peak value.

This could be the start of a broader pullback, given the extent of the asset’s recent rally.

A substantial reversal could potentially drive the price between approximately $26.71 and $30.10, after which it might continue moving upward again. This range is derived by applying the Fibonacci retracement tool from the current month’s lowest point to its most recent highs.

The range is within the 0.5 and 0.618 Fibonacci levels.

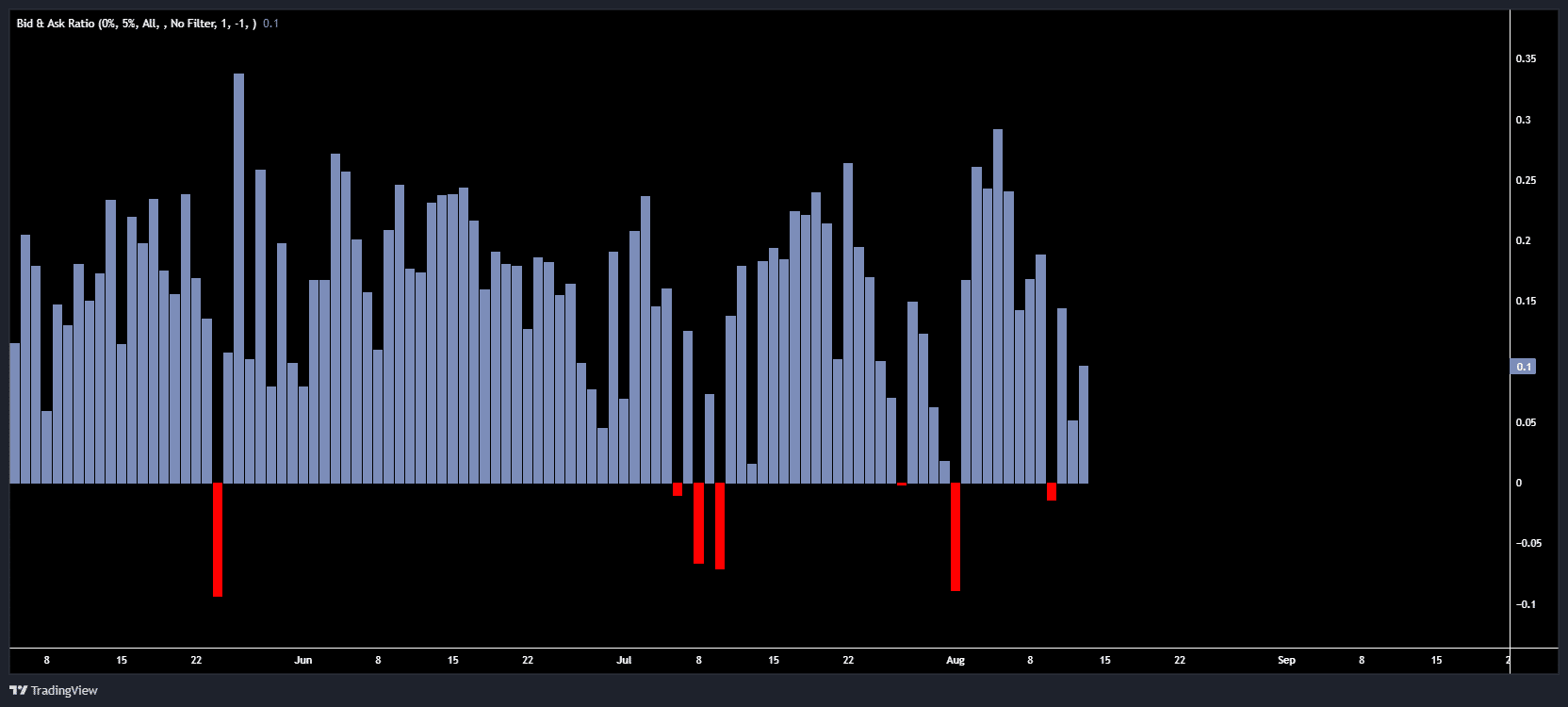

As a researcher, I’ve noticed an intriguing trend in ZEC‘s bid-ask ratio: it underscores the robustness of the bullish sentiment. Even during recent market downturns, demand remained palpable, suggesting strong investor interest. However, over the past few days, bids seem to be gradually waning, which could indicate a potential shift in market dynamics.

Will Zcash remain bullish long term?

Zcash’s impressive surge outperformed many leading cryptocurrencies, implying a potential for further growth in the future as long as it maintains its appeal to investors.

This could be the case, especially now that ZEC was receiving support from key figures.

As a seasoned investor with a background in cryptocurrency and a deep understanding of its intricacies, I have always been interested in exploring new and innovative projects in the space. Recently, I came across Zcash, a privacy-focused cryptocurrency that caught my attention due to its unique features.

“Important and underrated.”

In the grand scheme of things, Zcash may still be considered underestimated, even after its recent surge. Notably, at this moment, there are only approximately 15 million Zcash coins in circulation, making it less common compared to Bitcoin‘s current supply.

If this cryptocurrency becomes popular and stays in high demand, its investors may have the opportunity for substantial growth as there isn’t much of it circulating now.)

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-08-13 22:16