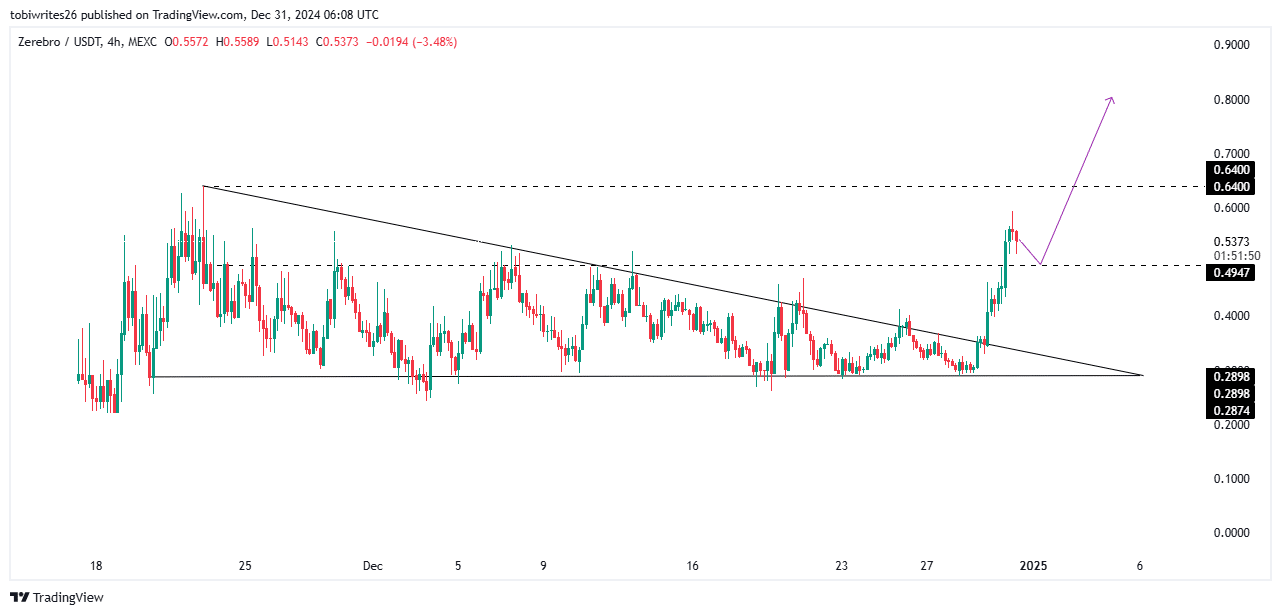

- The rally followed the asset breaking out of a consolidation channel, where it had traded for several days.

- Currently, a strong support level on the chart suggests ZEREBRO could climb even higher, potentially reaching $0.80 or more.

As a seasoned analyst with over a decade of experience navigating the cryptocurrency market, I have seen my fair share of rallies and pullbacks. However, ZEREBRO’s current trajectory has caught my attention, particularly given its impressive gains in the last month and 24 hours.

Having closely monitored the asset’s movements, I believe that ZEREBRO is poised for further gains, possibly reaching $0.80 or even surpassing $1 if it follows the bullish path suggested by our analysis.

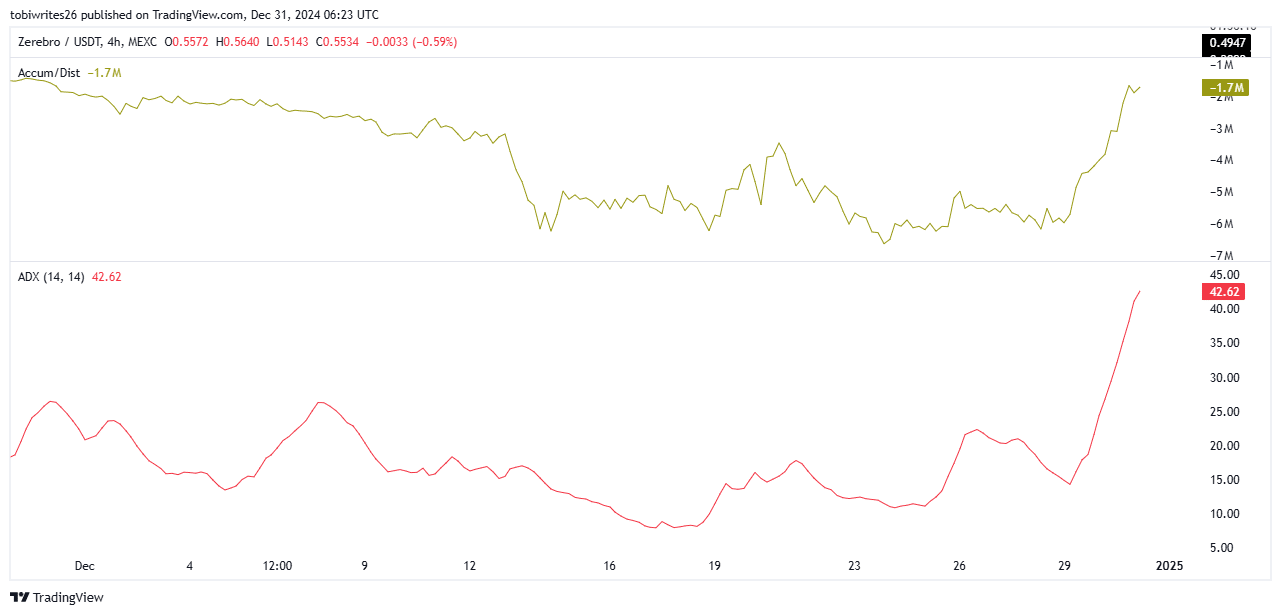

The breakout from a consolidation channel and the strong support level at $0.497 are clear indicators of the asset’s potential for growth. The rising accumulation, strengthened by an upward-trending A/D indicator, and the ADX reading of 42.62 further bolster this bullish outlook.

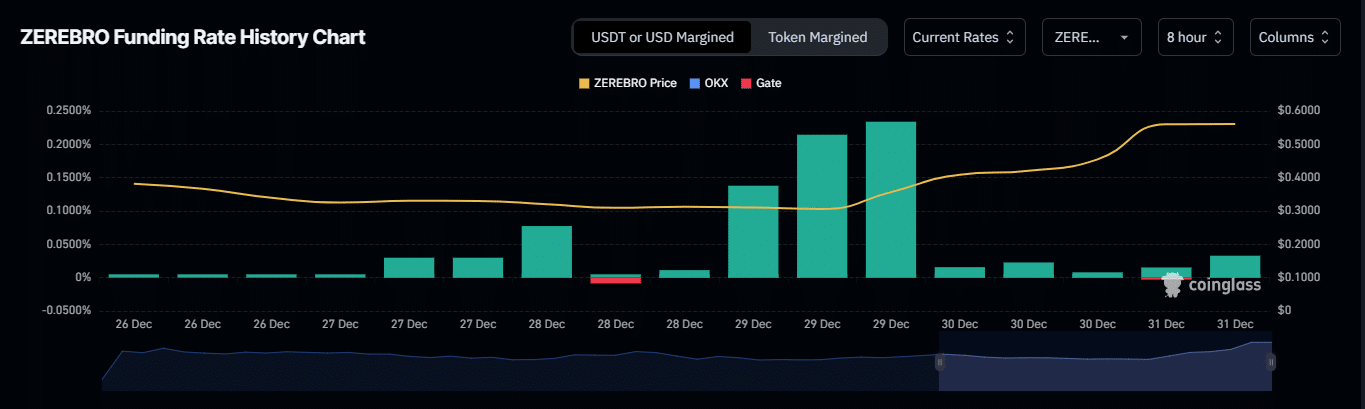

Moreover, the surge in long contracts within the derivatives market and the rising funding rate are positive signs that traders have faith in ZEREBRO’s upward momentum.

Now, I am not one to make predictions without a touch of humor. So let me say this: If you thought ZEREBRO couldn’t get any hotter, just wait until it reaches its next milestone – then we might need to call it “Z-Hot!”

Over the past month, ZEREBRO has experienced a significant surge, rising by 67.92%. In just the last day, it has seen an additional boost of 35.90%. Currently, its total market value is estimated to be approximately $541.6 million.

Although these profits may imply that ZEREBRO is approaching its maximum and could potentially fall back, AMBCrypto’s examination suggests that the asset continues to be optimistic, offering potential for additional upward movement.

Is ZEREBRO ready for further gains?

The surge in ZEREBRO’s value is primarily due to its asset moving beyond a significant confinement pattern that lasted from November, which has been pushing it upward on the price graphs.

Usually, this breakout trend suggests a potential rise towards approximately $0.64, however, the asset is currently experiencing a slowdown around $0.55. The analysis for ZEREBRO indicates two possible scenarios: either reaching the projected $0.64 peak or escalating further to the $0.80-$1 price range.

Based on my extensive experience in trading and analyzing cryptocurrencies, I believe that if we consider the chart provided, ZEREBRO would likely have to return to a support level around $0.497 in the next scenario. If the asset bounces back from this point, it could potentially surge towards $1. Such a move could significantly increase its market capitalization and propel it beyond $1 billion. I’ve seen similar patterns play out many times before, so I wouldn’t be surprised if this unfolded in a similar manner. However, as with any investment, there are always risks involved, and it’s essential to do thorough research and consider your own risk tolerance before making any decisions.

To determine if a strong upward trend is likely to continue, AMBCrypto examined crucial technical signals, finding evidence that the bulls are still in control.

Rising accumulation could lead ZEREBRO higher

Currently, when I’m typing this, ZEREBRO’s Accumulation/Distribution (A/D) indicator is indicating an accumulation phase, as evidenced by a rising trendline.

In simpler terms, the A/D indicator blends price and trading volume to determine market trends. An upward trend in this indicator, in conjunction with rising prices, typically indicates strong interest or high demand for the asset in question.

To verify the trend’s directional inclination, we examined the Average Directional Movement Index (ADX). This index gauges the force behind a market’s price movement.

If a financial asset’s cost continues to increase in tandem with a growing Average Directional Movement Index (ADX), it suggests robust bullish energy. For ZEREBRO, an ADX value of 42.62 underscores this optimistic trend, hinting that the asset may experience additional growth from its current position.

The on-chain data lines up with this pattern, indicating a rise in trading activity among derivatives traders within the market.

Derivative traders go long

It’s been observed that ZEREBRO is experiencing an uptick in lengthy agreements related to the derivatives sector. Currently, the Funding Rate is set at 0.0320%, which suggests a rise in optimistic feelings among traders about the market.

An increasing financing cost generally signals a bullish trend, since investors who anticipate the market will grow are prepared to pay extra to preserve their holdings.

This demonstrates faith in ZEREBRO’s rising trend, as traders are closing the gap between the current market prices and future contracts.

If the current pattern persists, it’s possible that ZEREBRO might momentarily drop but then surge strongly, or else it could be on track to reach an unprecedented peak.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-01-01 05:12