-

ZK’s market capitalization dropped from $800 million to $648 million

Bearish sentiment around the token seemed to be rising too

As an experienced financial analyst, I have seen my fair share of market fluctuations and token airdrops. While zkSync Era’s [ZK] airdrop brought excitement and network activity growth, the subsequent price correction was not unexpected.

Recently, ZkSync Era (ZK) generated buzz with its latest token distribution event. Consequently, the transaction volume on this layer-2 network increased noticeably over the past week. Yet, following the airdrop, the token’s value underwent a significant price drop on cryptocurrency exchanges.

All about the zkSync Airdrop

Last year, zkSync made history by being the first Ethereum Virtual Machine (EVM) to support zero-knowledge proofs (zk-SNARKs). Now, they’ve introduced their new token named ZK, which was airdropped recently. Over 3.6 million tokens were distributed among approximately 695,000 eligible addresses that had engaged with either zkSync Era or its earlier version, zkSync Lite.

Over 225,000 unique wallets successfully claimed nearly half (45%) of the distributed ZK tokens during the airdrop event, which transpired within just two hours.

As an analyst, I’d rephrase it this way: Upon its debut, ZK‘s token value stood at $0.27, and its market capitalization amounted to $800 million. However, the token experienced a significant price drop shortly after launch. Specifically, in just the past 24 hours, ZK’s price decreased by over 9%. Presently, the token is being traded at approximately $0.1765, and its market capitalization has dipped below $648 million.

Investors need not be alarmed, as price declines following airdrops are typical occurrences in the crypto market. To provide some context, NOT, which underwent an airdrop just a few weeks prior, experienced a comparable price decrease.

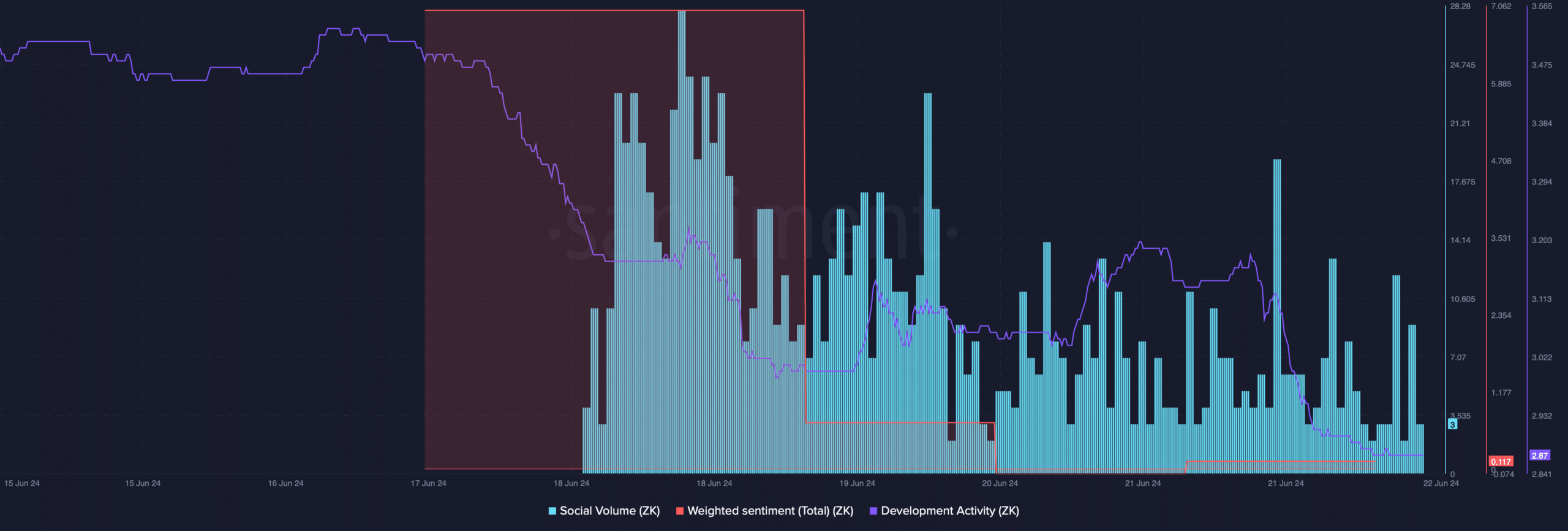

ZK faces additional concerns. According to AMBCrypto’s interpretation of Santiment’s statistics, there has been a decrease in social buzz surrounding the token, indicating a drop in its public interest. Moreover, the weighted sentiment towards ZK has turned bearish, suggesting an increase in negative sentiment among investors.

Additionally, its development activity fell, which can be interpreted as a bearish metric.

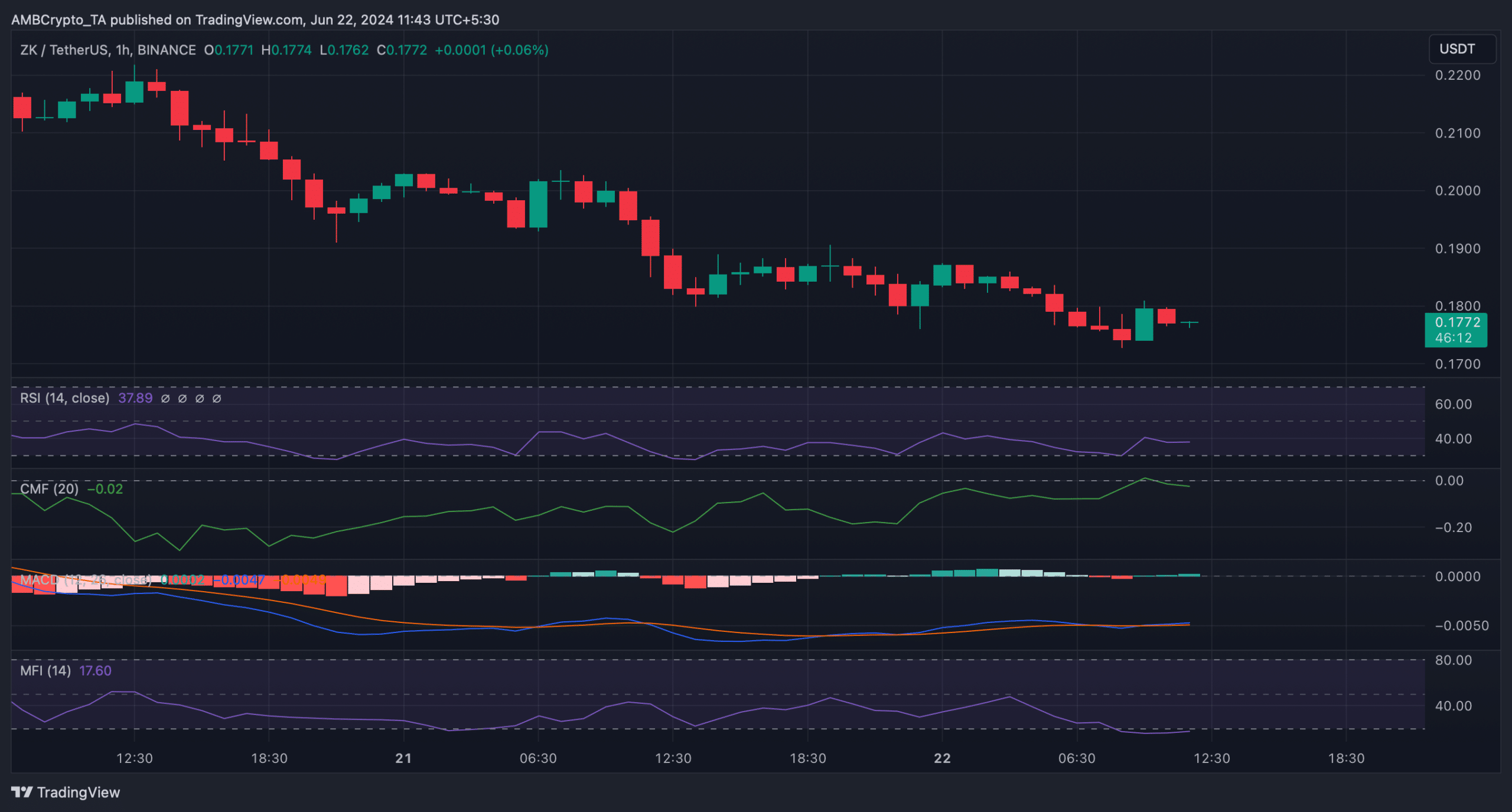

To gain more insight into ZK‘s potential short-term price increase, AMBCrypto decided to examine its hourly chart in detail. However, we noticed that the Relative Strength Index (RSI) and Chaikin Money Flow (CMF) indicators showed significant decreases, suggesting a prolonged price decline.

Despite the Money Flow Index (MFI) indicating an oversold condition for the token, potentially leading to purchasing activity and price increases, the Moving Average Convergence Divergence (MACD) displayed a bullish signal on the graphs as well.

Is zkSync’s activity rising?

As an analyst, I have examined the data from Artemis and observed an increase in network activity for zkSync around the time of their ZK token airdrop. Notably, their daily transaction volume surged last week and peaked at approximately 1.7 million transactions.

As a researcher observing the data, I noticed an unexpected surge in daily active addresses on June 17th, which later declined. Nevertheless, fees and revenue experienced a downturn during the previous week.

Read More

2024-06-23 01:11