- In the rather droll spectacle of the 1-day chart, Compound has donned the bears’ motley.

- Yet, amidst this furor, the plucky bulls seem to whisper of an upward trajectory, hinting at accumulation in the wings.

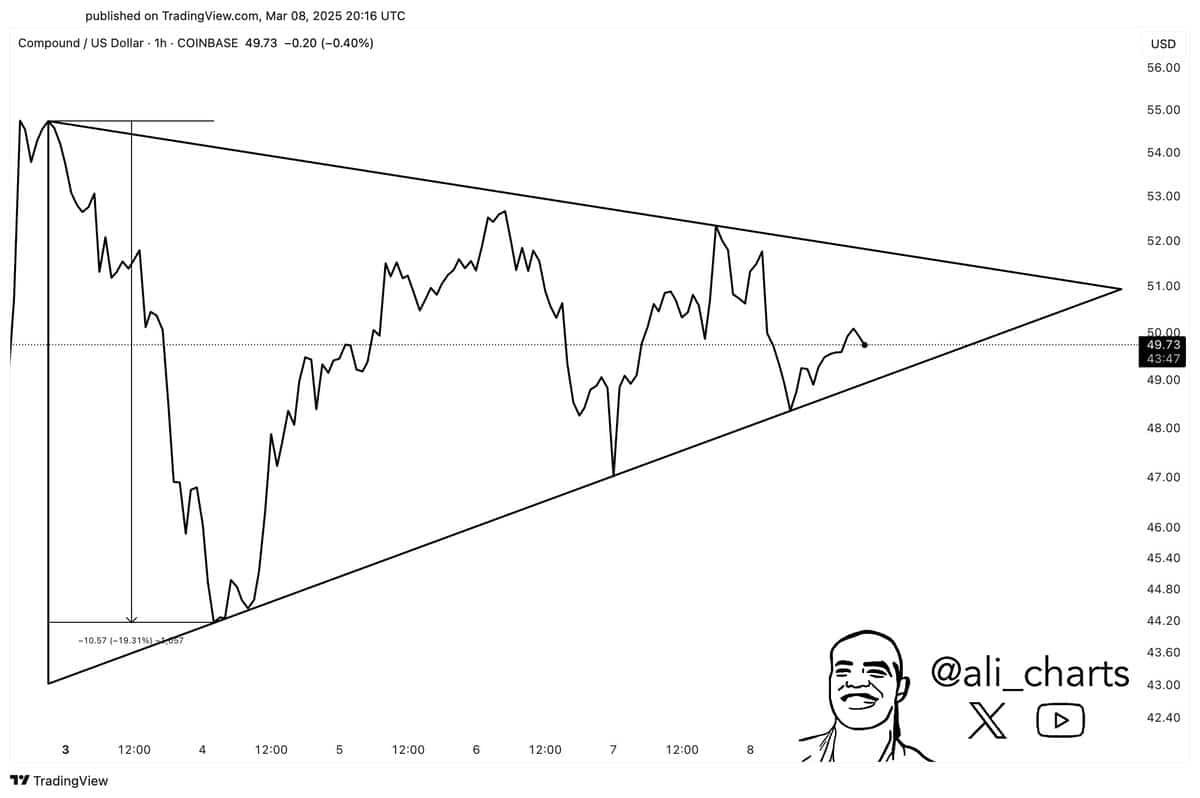

In a rather perspicacious observation, the crypto savant Ali Martinez discerned a symmetrical triangle pattern within Compound’s [COMP] serpentine dance, as chronicled on the newfangled X (formerly the bawdy Twitter).

Derived from the hourly chart, this cryptic formation portends a potential 20% surge in price, should it burst forth from its constraints.

While the promise of short-term gains titillates the senses, the more judicious investor would do well to ponder the longer-term on-chain tea leaves. Higher timeframe divination may yet yield some actionable alchemy for the intrepid investor.

The Waning Siren Call of Selling Pressure on Compound

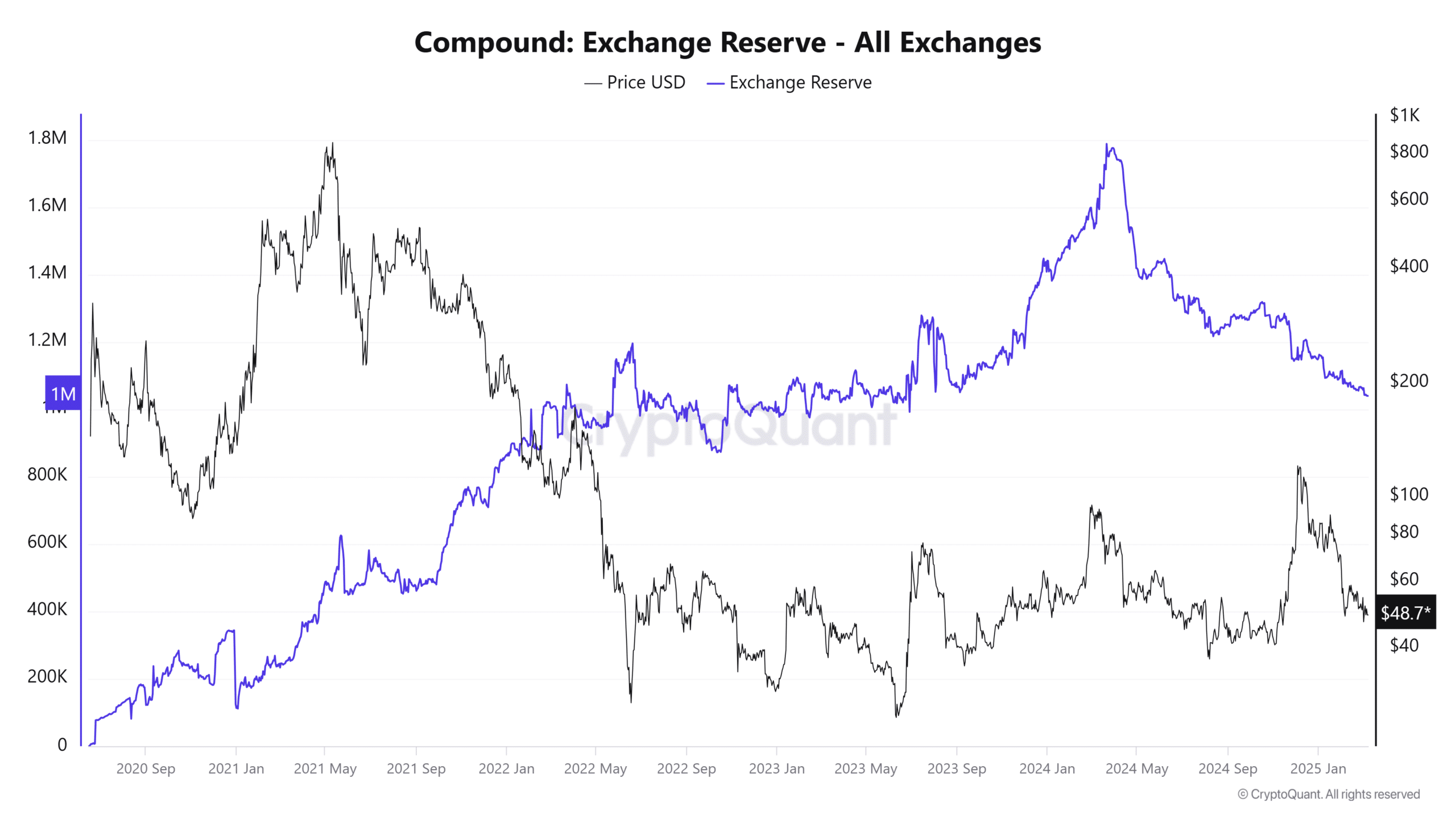

The exchange reserve, that fickle barometer of accumulation and distribution, has much to say in hushed tones.

During the bleak miasma of the 2022 and early 2023 bear markets, the reserve exhibited a slow, methodical uptrend—interrupted by the occasional exodus of COMP from the exchanges.

These withdrawals, a veritable flight from the coop, suggest a long-term bullish tendency as tokens presumably find refuge in the icy embrace of cold wallets.

In 2024, the reserve’s descent was most auspicious. Even during November’s brisk rally, the reserves maintained their downward trajectory, a veritable lemming march that continued apace over the past three months—surely a harbinger of accumulation.

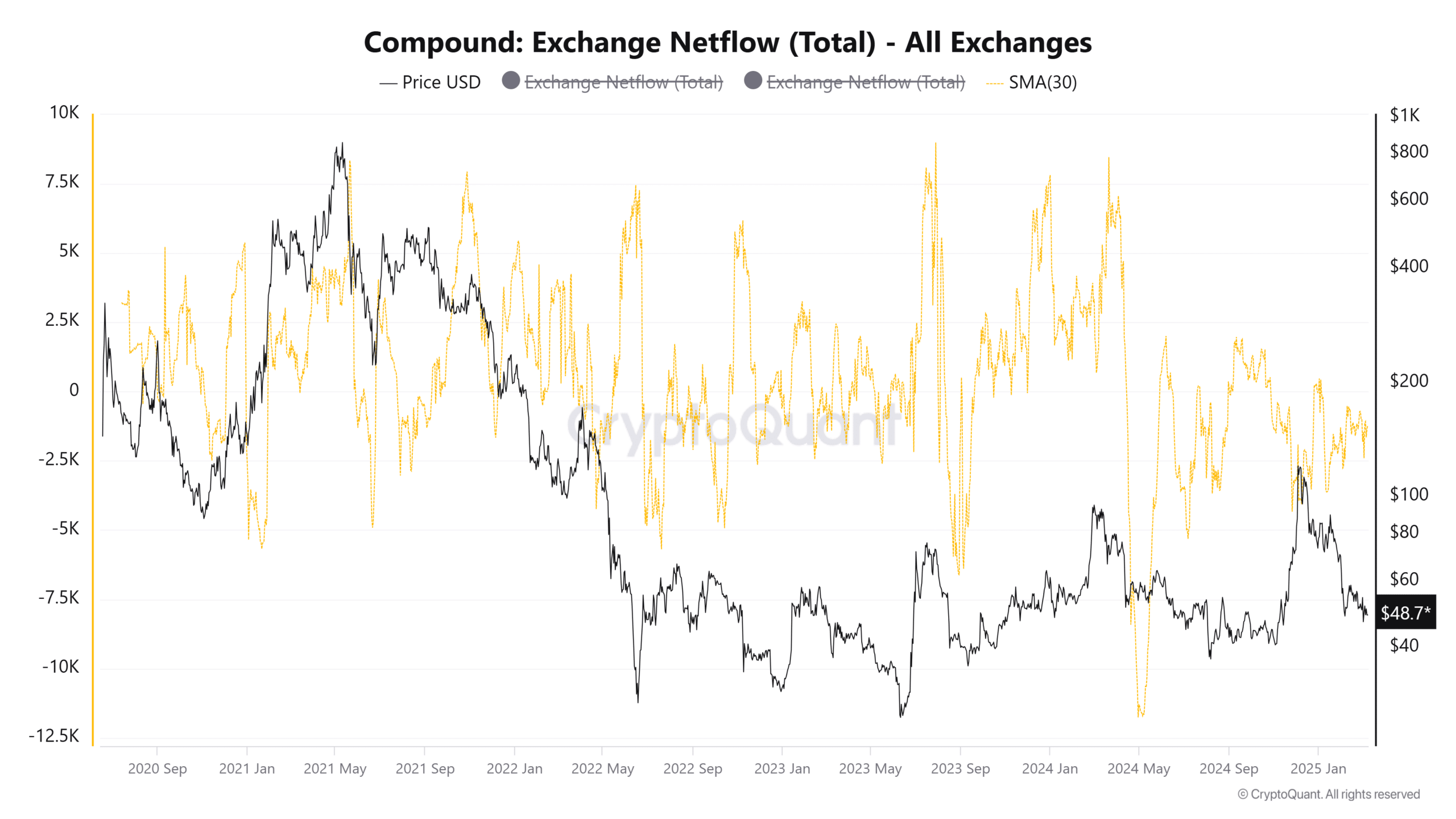

The 30-day SMA of exchange netflows—a most diverting graph—revealed a period of robust inflows from September to early November 2024, as if Compound were a fashionable destination for the discerning seller.

This trend, however, has reversed its course, with outflows now the order of the day. Since the second week of January, the netflows have donned the negative cloak, with a consistent departure of at least 1k COMP from the exchanges.

This only serves to confirm the earlier reserve findings, as if the two were in cahoots.

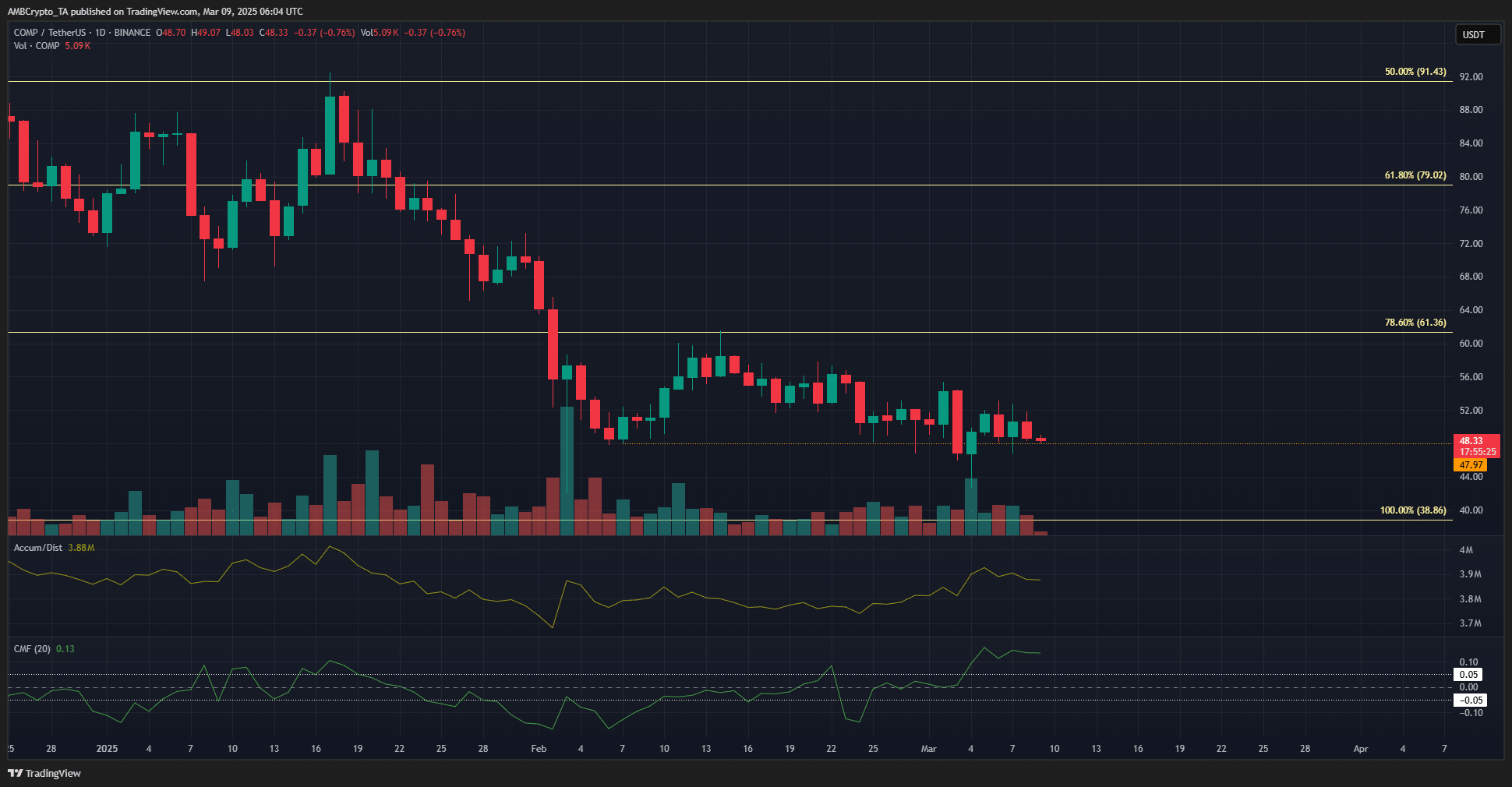

The daily chart’s COMP price action has painted a rather bearish tableau. The DeFi token has not mustered the strength for a new high since mid-January. At the moment of this missive, it teeters precariously just above the $48 support level.

A descent below $46 would surely herald the bears’ triumphant return.

Yet, the A/D indicator has been on a stealthy ascent over the past five weeks, and the CMF has burst forth above +0.05, indicating a veritable deluge of capital inflows.

In this grand game of push and pull, the bulls may yet seize the day and propel Compound to loftier heights.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2025-03-09 16:13