- In a twist of digital fate, ETH has bloomed back to $120.5M tokens, like a weed after a scorching summer.

- Experts murmur that ETH might be playing catch-up in a race it never seemed to want to win against BTC.

In the vast digital orchard that is Ethereum, the fruits of [ETH] have ripened once more to pre-Merge abundance, stirring a tempest in the teacups of altcoin speculators.

Let us recall, The Merge, that grand pivot from Proof-of-Work to Proof-of-Stake back in September 2022, was meant to be a renaissance.

Goals were set like stars in the night: conservation of energy, a slower flow of ETH, and a stage for scalability’s grand theater.

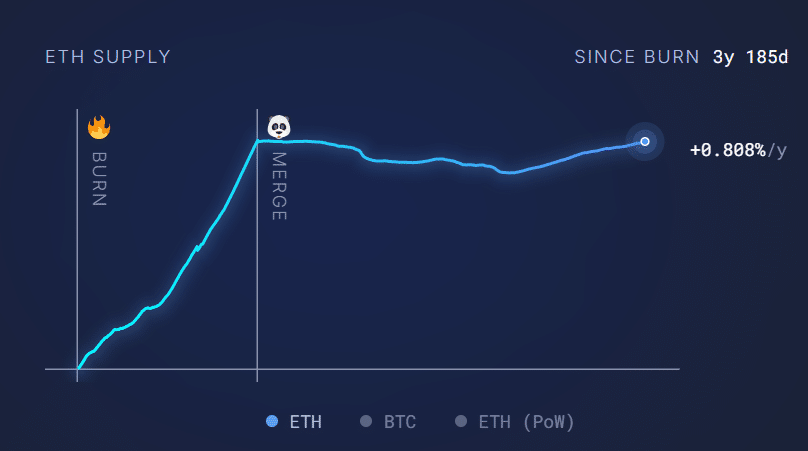

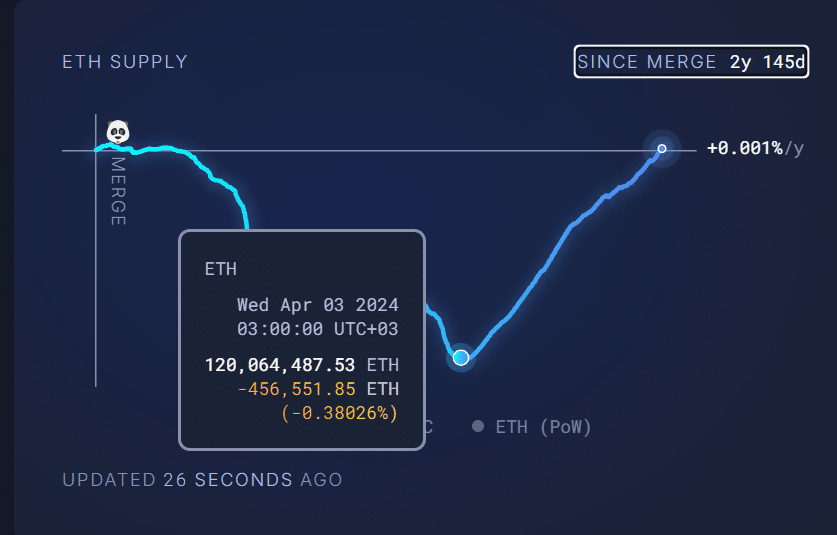

But lo and behold, the recent reversal in ETH’s supply, now over 120.5 million, suggests that perhaps the seeds of change were sown on rocky ground.

As UltraSound Money’s tune hums a somber note, over 46K ETH found their way into the supply basket in just a month’s time. Since the blob upgrade in Q1 2024, the supply’s growth has been as relentless as a weed in a garden.

The update, it seems, made Layer 2 transactions as cheap as a tin of beans, diverting demand from the base layer like water from a river. And just like that, the fire of burnt ETH was snuffed out.

So, in less time than it takes a child to grow a tooth, ETH’s deflationary dreams were but a fleeting mist, and the supply swelled back to its former Mergeless glory.

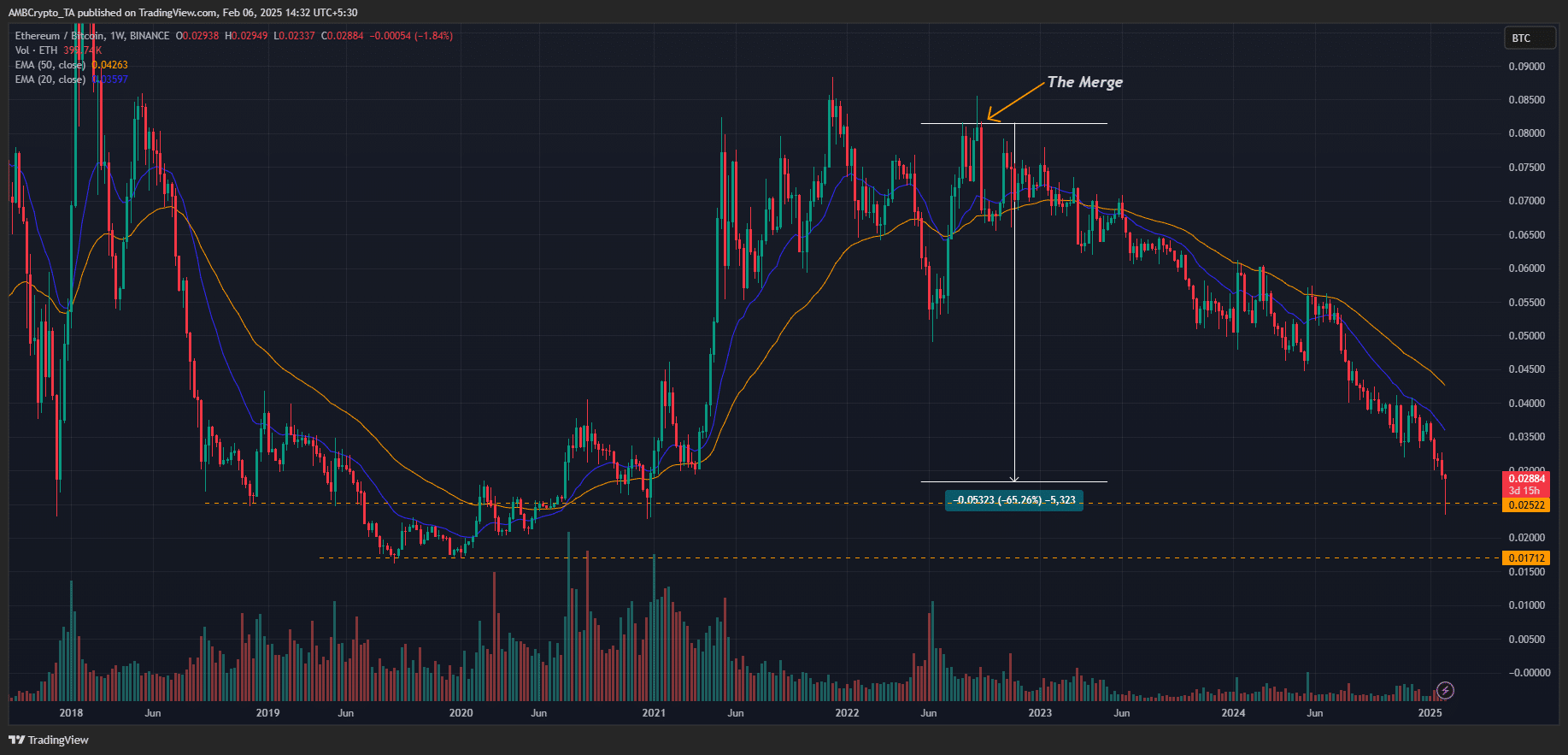

Now, for the juicy bit: ETH has tumbled over 65% in the shadow of BTC since the Merge. It’s like watching a race where one runner trips over their own shoelaces while the other sprints ahead with a jetpack.

The ETH/BTC pair, a sad little duet, sings a song of ETH’s lagging dance to BTC’s tune. The decline is a chorus of investors choosing the golden coin over the promised land of ETH.

Crypto seer Benjamin Cowen had foretold that such a supply surge might yank the ETH/BTC pair down like a kite in a storm.

While there are whispers of grand plans to further embrace the blob and scale L1, potentially reigniting the burn, the current supply dance might just be a raincheck on ETH’s short-term party plans.

And let’s not forget, the broader market’s macro uncertainty is like a dark cloud over ETH’s sunny skies.

Crypto sage Cryp Nuevo predicts ETH could slide down like a sled on a snowy hill, aiming to fill the price gap left by a recent candlestick’s wick.

If his crystal ball holds true, ETH might be digging a foxhole below $3K for a spell.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Despite Bitcoin’s $64K surprise, some major concerns persist

2025-02-06 22:19