- Behold! Dogecoin Reserve, a quest to make DOGE swift as a Cossack’s horse and usable as a trusty ruble for global daily transactions 🐕🚀

- Alas! Active addresses plummeted by 75%, a cruel joke amidst the fanfare 🤦♂️

In the quaint town of Cryptoville, a most singular event transpired, courtesy of the enigmatic House of Doge, the newly minted corporate arm of the Dogecoin Foundation 🏠👥. On the 24th of March, they unveiled the Official Dogecoin Reserve, a behemoth of 10 million DOGE, purchased at market value, no less! 🤑

This Reserve, a self-proclaimed “liquidity buffer” for merchants and users, aims to vanquish the scourge of lag times, those pesky obstacles to crypto payment adoption ⏱️. But, dear reader, did it succeed in captivating the hearts of the market? 🤔

The Market’s Mercurial Reaction 🌡️

Why, yes! The markets, those fickle creatures, responded with alacrity 🐴! Between the 24th and 25th of March, DOGE soared from a humble $0.176 to a dizzying $0.19158, a gain of more than 8.8% 🚀!

This daring breakout, as astutely observed by the venerable analyst Ali Martinez, shattered key resistance levels, birthing an ascending triangle pattern, oft harbinger of continued bullish fervor 📈.

And now, dear reader, let us delve into the numbers, those cold, unforgiving arbiters of truth 📊.

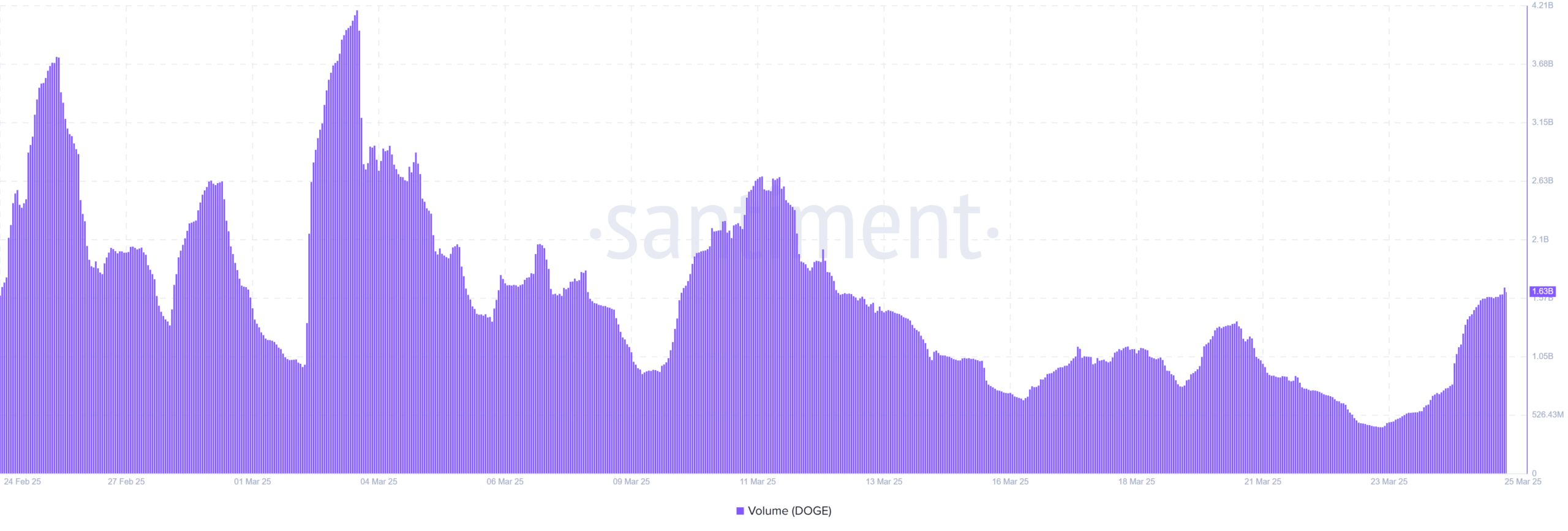

On-chain data, that most reliable of narrators, revealed a surge in trading activity, a veritable tsunami of transactions 🌊! Dogecoin’s trading volume skyrocketed from $1.07 billion on the 24th of March to $1.63 billion on the 25th, a whopping 52.34% jump within a mere 24 hours 🕰️.

This dramatic upswing reversed a three-week downtrend in trading activity, which had seen volume plummet by over 74% since the dawn of March 📉.

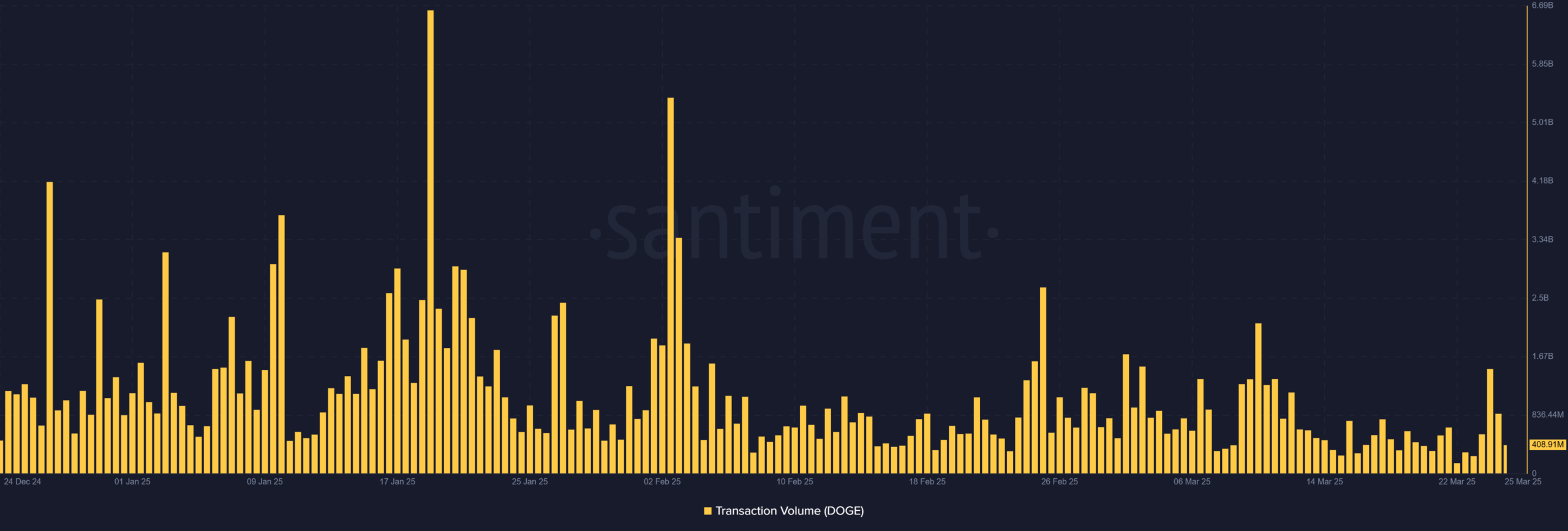

An Assessment of Transaction Volumes 📊

On the 25th of March, total on-chain transaction volumes swelled to 858.59 million DOGE, up from a paltry 354 million DOGE the preceding day 🚀. This marked a staggering 142.8% hike, underscoring an uptick in blockchain activity as traders, speculators, and perhaps new users, responded to the initiative 🤝.

And yet, dear reader, amidst this fanfare, active address data whispered a different tale, a tale of woe and impermanence 🗣️.

The Sustainability Conundrum 🤔

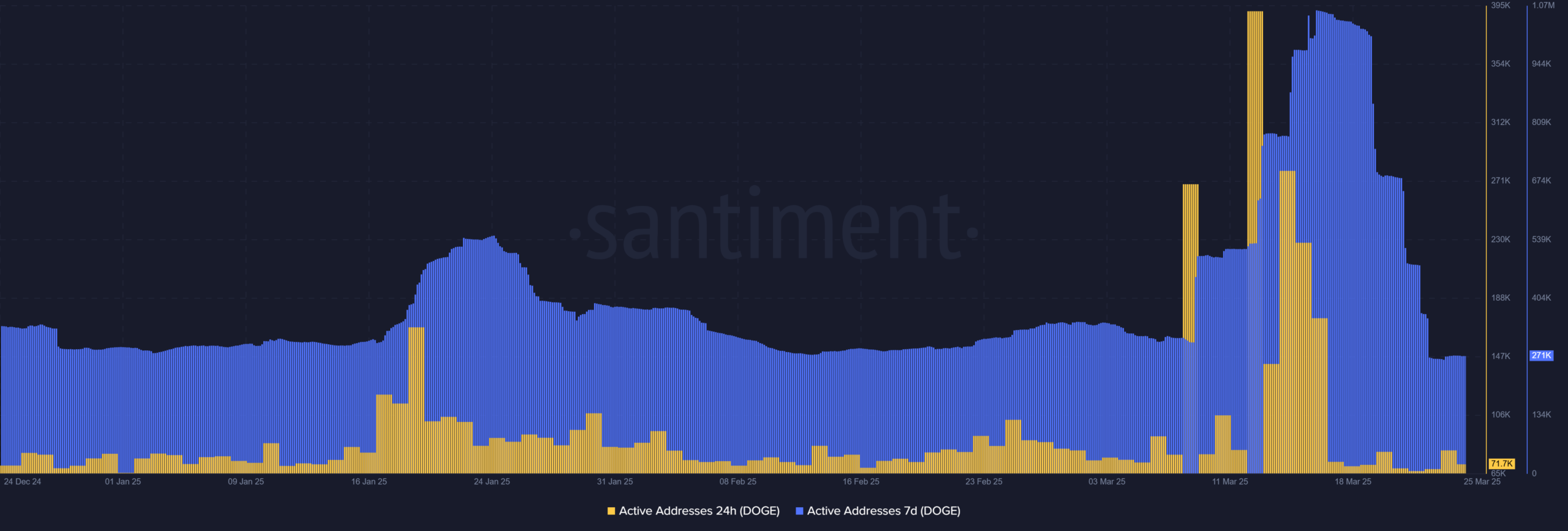

A week prior to the announcement, 24-hour active addresses peaked at 291,220, and 7-day active users reached 1.06 million, hinting at a build-up of interest 📈. Alas, by the 25th of March, both figures had tumbled precipitously 📉.

Daily active addresses plummeted to 73,130, a heart-wrenching 75% decline from peak levels 😔. Weekly active addresses also slid to 271,520, down roughly 74% from their lofty heights 📊.

This fall, dear reader, highlighted a most vexing theme across Dogecoin’s network – the propensity for event-driven bursts of activity, followed by an inevitable fade into obscurity 🌫️. While DOGE may scale during attention spikes, sustaining user engagement beyond the fanfare of major announcements remains an open challenge 🤷♂️.

In conclusion, though traders responded with gusto to the Reserve news, the day-to-day momentum remains as elusive as a will-o’-the-wisp 🌟. The rapid drop in active users post-spike served as a poignant reminder: sustained adoption, much like the fleeting nature of life itself, remains an enigma 🙏.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2025-03-26 11:08