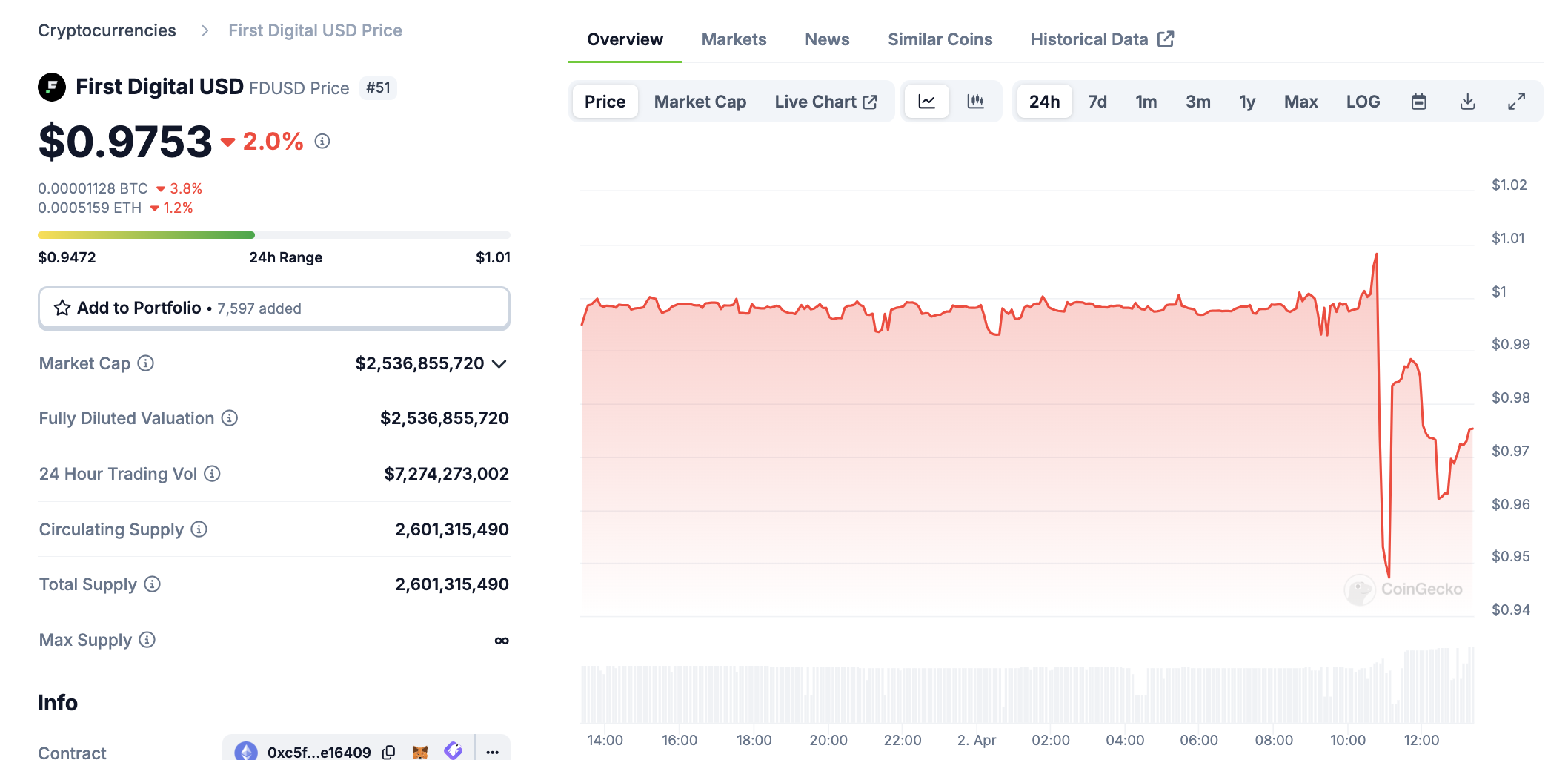

In a theatrical turn of events, the flamboyant founder of TRON, Justin Sun, has levelled accusations of insolvency at the esteemed First Digital Trust, causing the lesser-known FDUSD to take a rather undignified dive to $0.87.

As if the spectacle wasn’t grand enough, the lawsuit, primarily concerning TUSD, prompted the rather hasty withdrawal of over $30 million from FDUSD by Wintermute. And in a twist that would make Shakespeare proud, Binance‘s own Yi He waded into the fray, suggesting her company play auditor to FDUSD’s embattled reserves.

Justin Sun, a man who never shies from the limelight, finds himself at the epicentre of a new stablecoin saga. Having previously expressed his ‘grave concerns’ about First Digital’s TUSD token (and yet, allegedly, purchasing it in 2023), he has now filed a lawsuit claiming the firm is as bankrupt as a spendthrift at a casino:

“First Digital Trust (FDT) is effectively insolvent and unable to fulfill client fund redemptions. I strongly recommend that users take immediate action to secure their assets. I urge regulators and law enforcement to take swift action to address these issues and prevent further major losses. Hong Kong’s reputation as a global financial center is at stake,” Sun proclaimed, with all the gravitas of a soap opera villain.

Oddly enough, the TUSD stablecoin at the heart of Sun’s lawsuit remained relatively unscathed. First Digital had previously settled with the SEC over allegations that TUSD reserves were riskier than a tightrope walk over a volcano, suggesting Sun’s claims might carry more weight than a sumo wrestler. Yet, it was FDUSD, an innocent bystander in this drama, that took the fall, depegging to a laughable $.087.

FDUSD may have been collateral damage in Sun’s legal barrage, but its price plunge could send ripples across the market. As one of the more substantial stablecoins, and with Binance’s backing, its sudden swoon has caused quite the stir. Wintermute’s $30 million exodus from Binance accounts only added to the chaos, like a bull in a china shop.

Yi He, the ever-so-diplomatic cofounder of Binance, stepped in to address the confusion. She reminded all and sundry that FDUSD is as related to Sun’s lawsuit as a kangaroo is to a penguin, claiming no insider knowledge of the kerfuffle. She also proposed a Binance audit, because why not add another layer to this intrigue?

“The recent allegations by Justin Sun against First Digital Trust are as false as a politician’s promise. This dispute is with TUSD and not with FDUSD. First Digital is as solvent as the Rock of Gibraltar. This is a typical Justin Sun smear campaign to try to attack a competitor to his business. FDT will pursue legal action to protect its rights and reputation,” the firm retorted, with a sniff of disdain.

As both parties prepare for a legal showdown that promises to be as entertaining as a reality TV series, we can only hope for some clarity amidst the chaos. Sun remains resolute in his allegations, as unwavering as a toddler in a tantrum. The outcome of this legal fracas could indeed shape the stablecoin market for years to come. Or it might just be another chapter in the never-ending saga of crypto drama. 🎭🤑

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- PI PREDICTION. PI cryptocurrency

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2025-04-03 10:59