- Bitcoin‘s crystal ball is more foggy than a London morning

- Bulls on vacation? Bitcoin teetering on the brink of an $80k cliff dive

Oh dear, Bitcoin [BTC] has lost its shiny luster, slipping below the $92,000 mark like a banana peel underfoot. Technical indicators, like the OBV, are pointing fingers at selling pressure. It’s like watching a domino effect, with more tiles ready to topple.

In a tale as old as time, analyst Darkfost from CryptoQuant spun a yarn about Bitcoin’s waning demand. It’s like comparing apples to oranges—figuring out if the new BTC is being gobbled up or left to rot on the vine.

And guess what? The demand ratio took a nose-dive below zero at the end of February, right when the $92k support level did a disappearing act. It’s been a sad story ever since. AMBCrypto decided to don their detective hats to snoop around holder behavior.

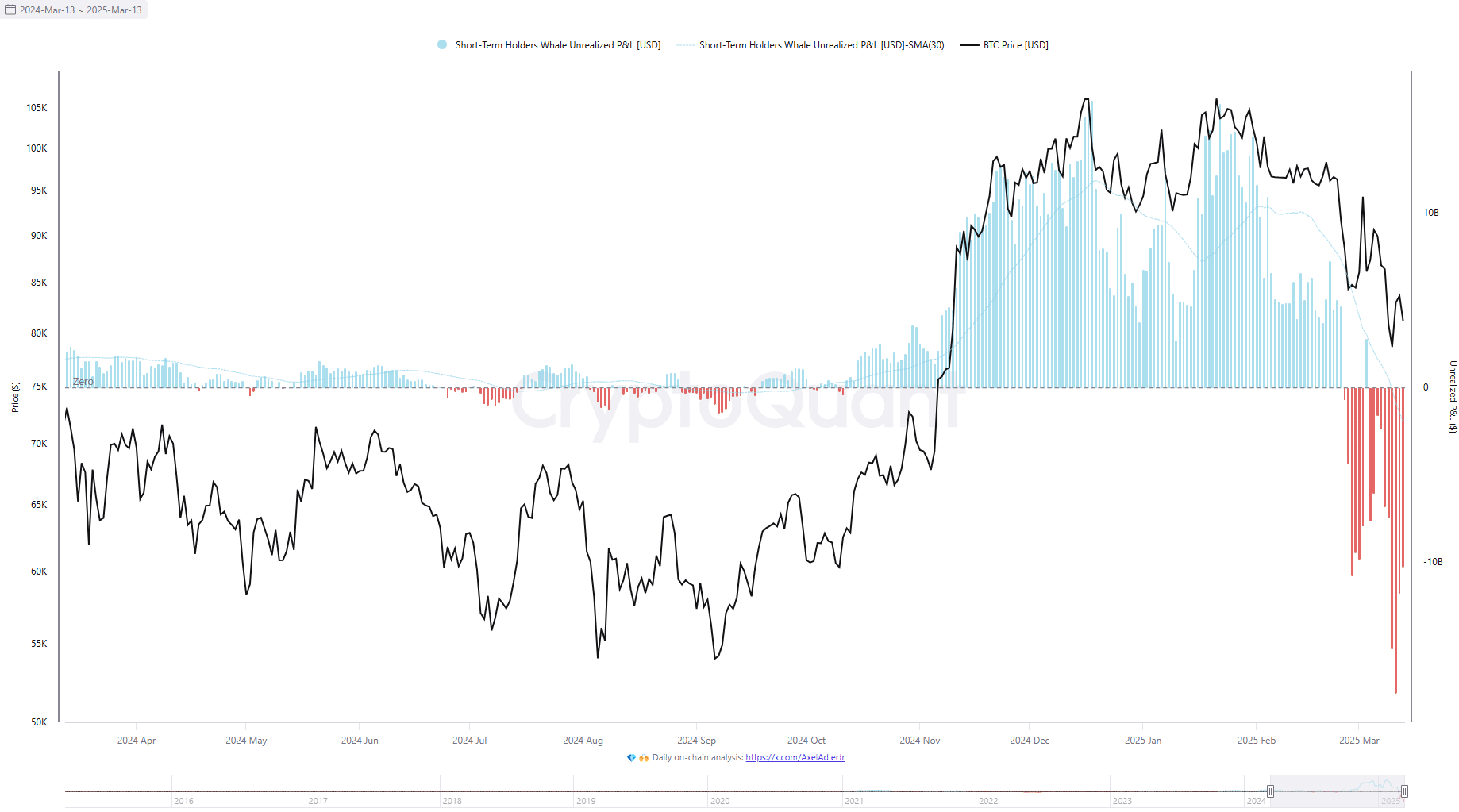

Short-term holders (STHs), the whales with the attention span of a goldfish, found themselves in a pickle. Unrealized losses piled up to a mountainous $17.52 billion on 11 March. It’s like watching a sinking ship, and everyone’s jumping overboard to save their skin.

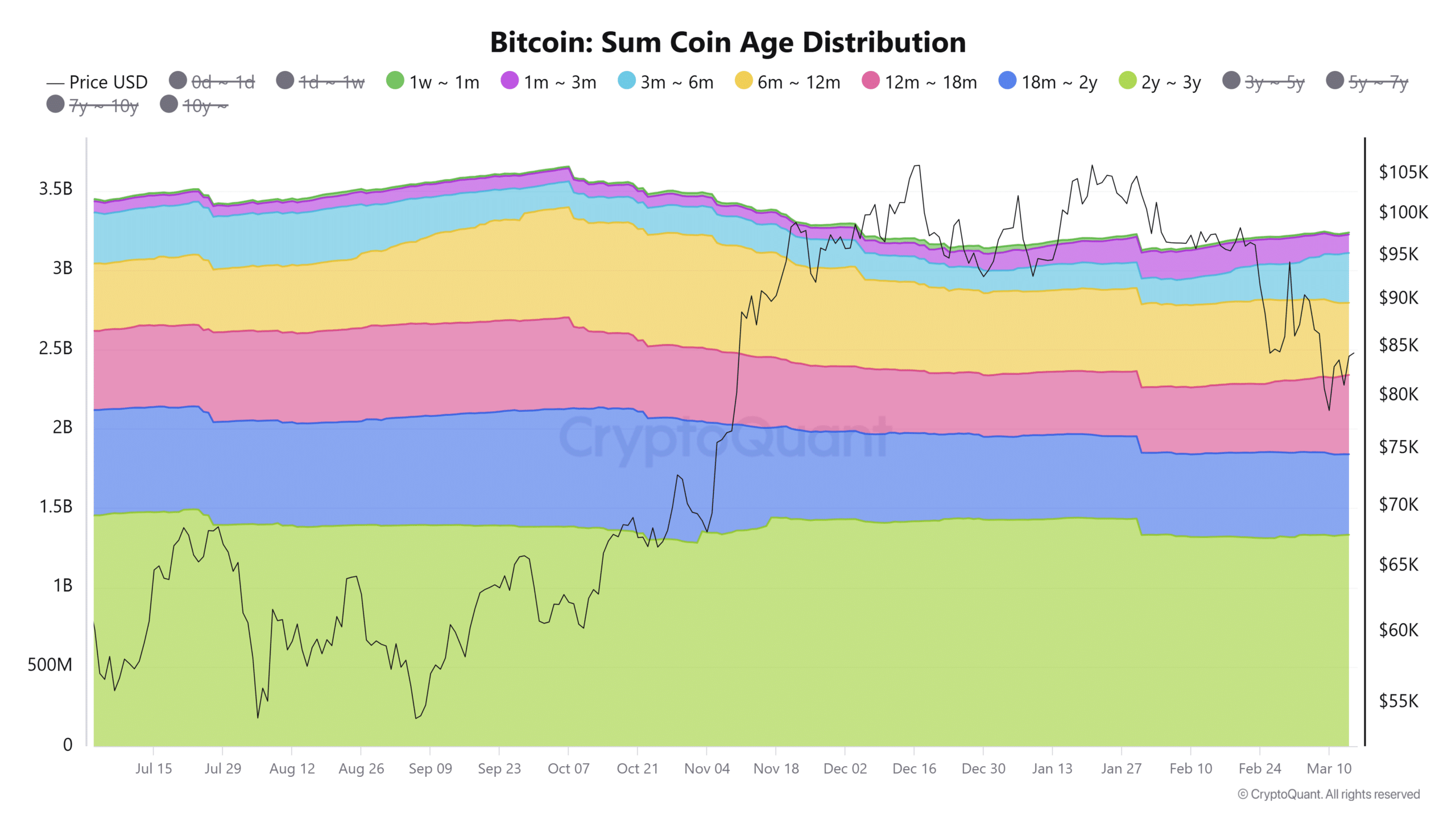

Now, let’s talk about the grandpa coins, the ones that have been around the block a few times. The sum coin age distribution is like a scale, and it’s currently tilting towards HODLing and accumulation. But wait! The 6-12 month coins are acting like they’ve got somewhere better to be.

It’s a mixed bag, really. The young whales are drowning, and the apparent demand is as weak as a kitten. But the old-timers seem to be holding on for dear life. Until the short-term squall passes, Bitcoin might just take another swan dive below $80k. 🤷♂️

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2025-03-16 02:17