The House, in its infinite wisdom, has passed President Trump’s sweeping budget bill on July 3, locking in tax cuts, $5 trillion in new debt capacity, and deep reductions to Medicaid and food assistance. As the bill awaits Trump’s signature on July 4, market watchers are shifting attention from politics to liquidity and Bitcoin may be an early beneficiary.

VICTORY: The One Big Beautiful Bill Passes U.S. Congress, Heads to President Trump’s Desk 🇺🇸🎉

— The White House (@WhiteHouse) July 3, 2025

The combination of deficit spending and ongoing monetary tightening is expected to put pressure on the US dollar. With federal debt set to rise sharply and the Federal Reserve continuing to reduce its balance sheet, liquidity mismatches could emerge. In similar past cycles, these conditions have favored non-sovereign assets like Bitcoin.

Bitcoin has historically responded faster than equities to shifts in global liquidity conditions. If the Treasury initiates informal liquidity support to stabilize bond markets, Bitcoin could attract early capital inflows, particularly as investors seek hedges against rising inflation.

Ethereum, Altcoin Outlook Remain Divided: 😕📈📉

While Bitcoin stands to benefit from macro pressures, the altcoin market remains mixed. Infrastructure tokens like Ethereum may attract institutional interest amid a potential “risk-on” sentiment shift, especially if Treasury yields climb. However, speculative meme assets may lag, with volatility weighing on short-term confidence.

One key provision that could have supported retail altcoin trading is a de minimis tax exemption for small crypto transactions which failed to make it into the final bill, reducing near-term incentives for US-based trading volume.

Clean Energy Cuts May Benefit Bitcoin Miners: ⚡️💸

An overlooked byproduct of the bill is its rollback of clean energy subsidies. This could unintentionally boost profit margins for Bitcoin miners in energy-rich states like Texas and Wyoming, where surplus electricity is cheap and underutilized. Without government-subsidized competition, miners may gain access to lower-cost power, increasing mining efficiency and margins.

With growing fiscal uncertainty and signs of liquidity imbalance, Bitcoin could stand to gain. This would not be due to any direct policy change, but rather because the US economy may be approaching another phase of quiet monetary loosening.

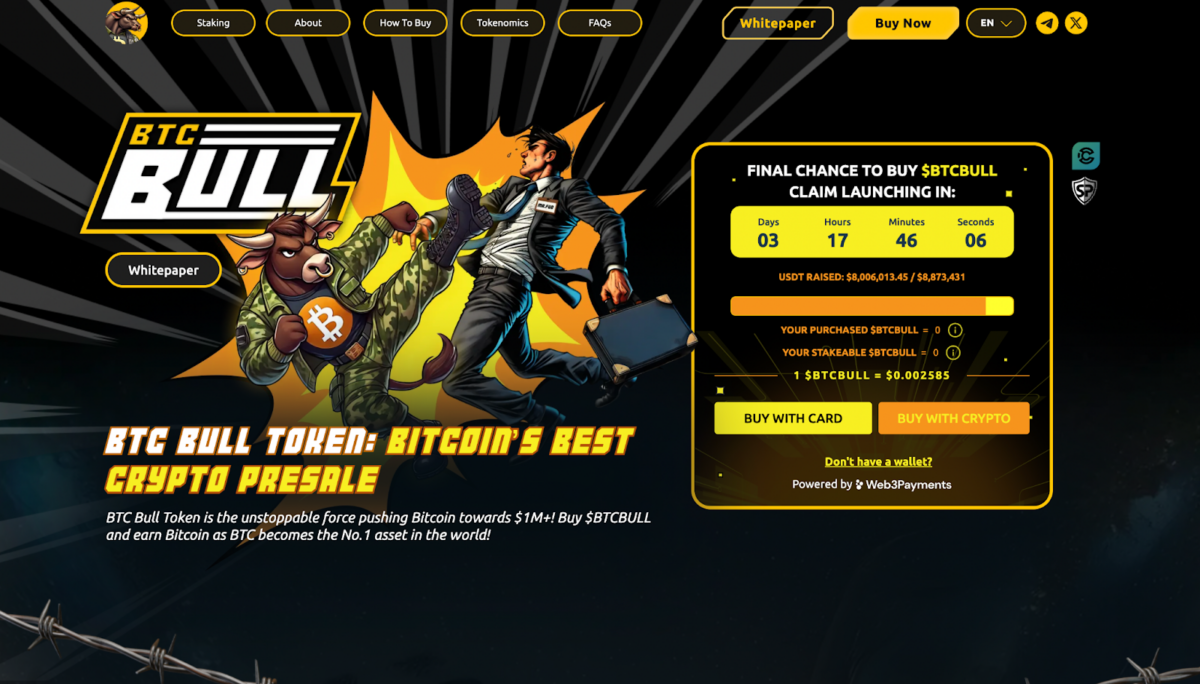

BTC Bull Token Presale: Final Countdown Begins: 🚀💰

BTC Bull Token is in its final presale phase with just over three days left before launch. Priced at $0.002585, the token has already raised more than $8 million out of its $8.87 million goal.

Buyers can participate using either crypto or card, with the platform powered by Web3Payments. Positioned as a high-energy meme coin inspired by Bitcoin’s long-term potential, BTC Bull aims to ride the wave of fiscal uncertainty and crypto optimism. Early participants also gain access to staking benefits once the token goes live.

Read More

- Best Controller Settings for ARC Raiders

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- Battlefield 6 Season 2 Update Is Live, Here Are the Full Patch Notes

- The Best Members of the Flash Family

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- Duffer Brothers Discuss ‘Stranger Things’ Season 1 Vecna Theory

- Dan Da Dan Chapter 226 Release Date & Where to Read

- GBP USD PREDICTION

2025-07-04 07:46