Amidst the chaotic and ever-shifting tides of the cryptocurrency market, the once-mighty memecoins have found themselves in a peculiar predicament. These tokens, which not long ago were the darlings of the retail crowd, driven by nothing more substantial than whims and tweets, now find themselves on the fringes, overshadowed by the steady march of Ethereum and its ilk. The speculative fervor that once propelled these digital jesters to dizzying heights has waned, leaving behind a market that seems to have grown up, or at least, grown tired of the antics.

Indeed, a few stubborn memecoins continue to dance to their own tune, offering glimmers of hope to those who still believe in the power of meme and meme alone. Yet, these are but fleeting moments of defiance in a world where deeper pockets and stronger fundamentals now dictate the rules of engagement. The current altcoin rally, much like a grand ball in a gilded hall, has reserved its finest dances for those with the most elegant steps-sectors with robust liquidity and the favor of institutional investors. The memecoins, it seems, have been relegated to the shadows, their invitations to the main floor conspicuously absent.

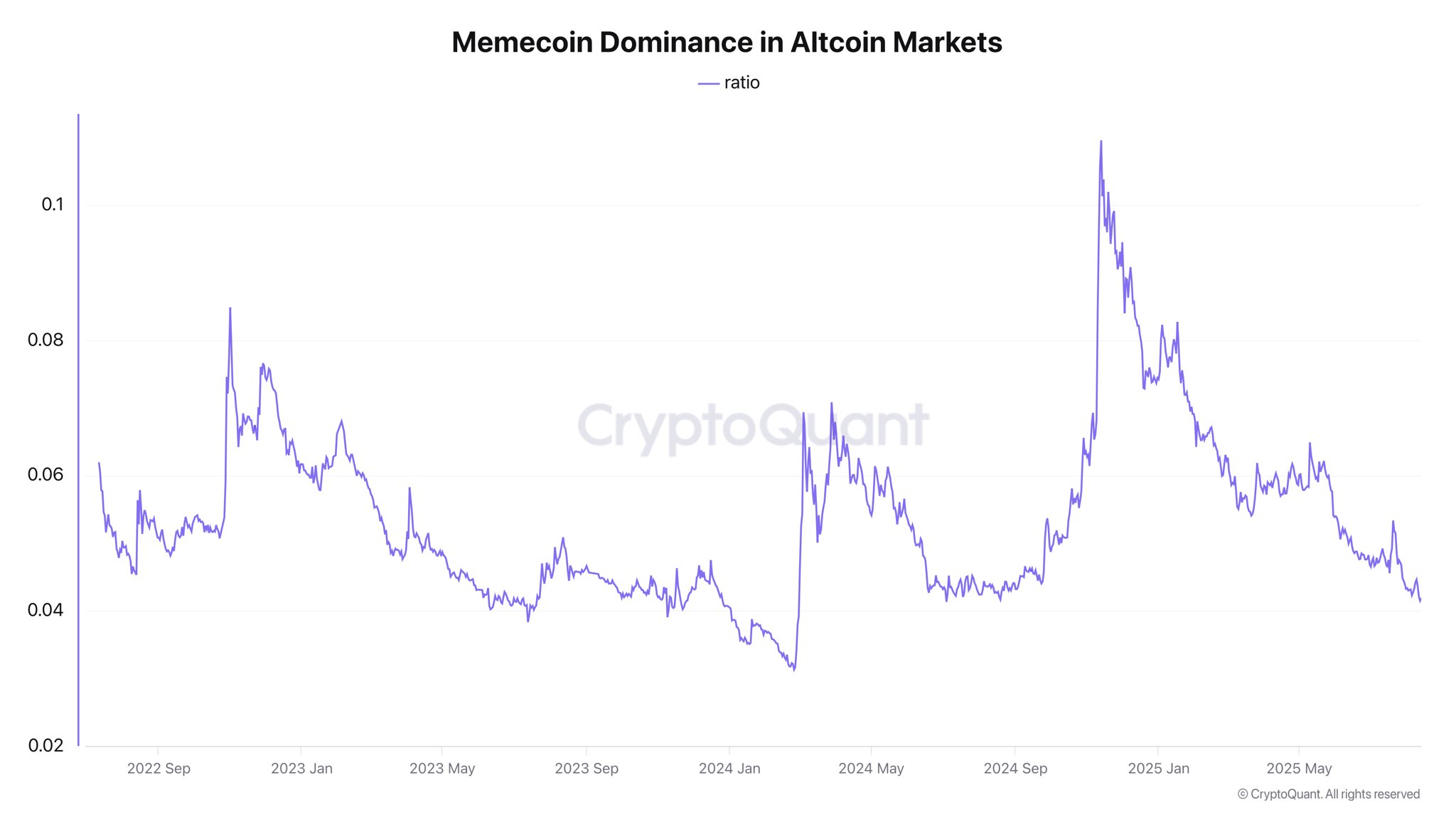

Darkfost, a name whispered with a mix of reverence and dread in the halls of crypto analysis, has observed this shift with a keen eye. “The memecoins,” he intones with a dramatic flourish, “are but shadows of their former selves, lagging behind the broader altcoin market in both performance and investor attention.” He warns, with a touch of dark humor, that without a sudden influx of hype-driven buying, these tokens may well find themselves trapped in a perpetual autumn, forever waiting for the spring that may never come. The path to reclaiming their former glory, he suggests, is steep and fraught with challenges, as the market’s gaze remains firmly fixed on assets that offer more than just a good laugh and a catchy slogan.

As Ethereum continues its relentless ascent, absorbing liquidity like a sponge soaks up water, the plight of the memecoins becomes all the more poignant. Darkfost notes that while a few stragglers still manage to post gains, these are mere blips on the radar, anomalies in a market that has moved on. “This is clearly not memecoin season,” he declares, his voice tinged with a hint of melancholy. “Traders would do well to exercise caution, lest they find themselves caught in a whirlpool of speculative decline.”

Without the cyclical waves of hype and speculative inflows that once buoyed their prices, the memecoins have settled into a state of subdued price action. Meanwhile, capital has gravitated toward Ethereum and other projects with stronger technical and fundamental underpinnings, drawn by the promise of stability and growth. Darkfost advises investors to tread carefully in the memecoin sector, emphasizing that the conditions for a robust recovery are far from ideal. With Ethereum inching closer to new highs and siphoning liquidity from the broader altcoin market, the odds of a memecoin resurgence seem slim.

The coming weeks will be crucial. If Ethereum breaches new frontiers and the altcoin market rallies toward its previous highs, there might be a trickle-down effect that breathes new life into the memecoin sector. But without a significant shift in market sentiment and liquidity distribution, the future looks decidedly bleak for these digital jesters. Traders, it seems, would be wise to focus on assets with more solid foundations, lest they find themselves laughing all the way to the poorhouse.

Memecoin Market Cap Analysis

The total memecoin market cap, a figure that once promised the world, now stands at a modest $70.74 billion, marking a slight +2.64% gain in the last session. This uptick, however, does little to mask the underlying volatility that has characterized the market since the heady days of July, when the cap peaked near the $80 billion mark. Since then, the market has struggled to maintain its momentum, repeatedly rebuffed at higher levels and settling into a pattern of consolidation.

The 50-day simple moving average (SMA), currently hovering around $66.57 billion, serves as a dynamic support level, with recent dips finding a semblance of buying interest around this zone. This suggests that while bullish sentiment has waned, there are still those willing to step in and defend key support areas. Trading volume has also seen an uptick in recent sessions, a sign that market participants are actively positioning themselves, despite the broader slowdown.

Yet, the failure to decisively break above the $75 billion threshold is a clear indication that sellers remain in control of the upper range. For a meaningful recovery, the memecoin market cap would need to reclaim and hold above the $75-$76 billion area. Conversely, a breakdown below the 50-day SMA could signal a deeper correction, potentially testing the $64-$65 billion range. In this game of numbers and charts, the memecoins must either adapt or face the prospect of being left behind, a fate that seems increasingly likely in a market that has moved on to greener pastures.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Best Thanos Comics (September 2025)

- Goat 2 Release Date Estimate, News & Updates

- Felicia Day reveals The Guild movie update, as musical version lands in London

- 10 Movies That Were Secretly Sequels

2025-08-15 20:25