In the vast universe of financial gyrations, Bitcoin is currently doing the cosmic equivalent of a spacewalk without a tether, struggling mightily to hang onto the mythical $100K level. The market, cloaked in a nebula of anxiety and uncertainty, has the bulls doing gymnastics they’re absolutely no good at. Despite the strong, yet invisible, on-chain infrastructure (much like the actual infrastructure on the streets of Vondom on any Orangutan Bong Day), the sentiment is as fragile as a Balrog’s ego.

According to a top analyst who goes by the enigmatic moniker of Darkfost, the market is mutating faster than a Proteus on quaaludes. The traditional on-chain indicators have started to look about as reliable as Female Androids’ fake wrists. “With time, we can clearly see that the structure and dynamics of the market are evolving,” Darkfost comments, in what might well be Charles Darwin’s most puzzling observation ever.

Yes, the days of retail behavior and exchange flows dictating the markets are as dead as yesterday’s fish and chips. Institutions, ETFs, and long-term investors have stepped into the void, rewriting the rules faster than you can say “So long and thanks for all the fish.”

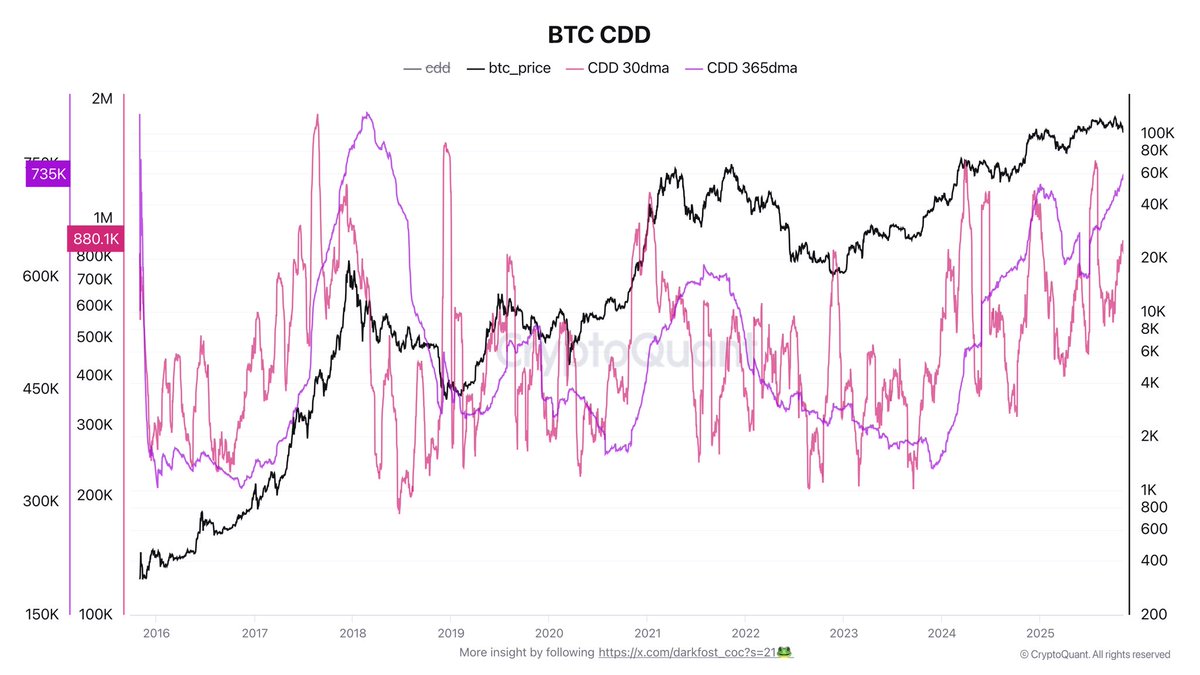

Now, some metrics, like stragglers at a Vogon auction, refuse to die. Chief among them, as our mysterious Darkfost would tell you, is Coin Days Destroyed (CDD) – a measure of long-term holder activity. “It’s one of the indicators I follow the most because long-term holders are still driving this market,” he claims. Much like hitchhikers in a Grab-and-Go Taxi, these long-term holders are holding steady amidst the chaos.

Currently, somewhere between 75% and 80% of the Bitcoin supply is safeguarded by long-term holders, stubbornly clutching their digital cargo in the face of market squalls. This stubborn consolidation amongst the patient ones might just set the stage for the next quantum leap, once the short-term fear and hysteria resembling a Vogon poetry recital has faded.

Long-Term Holders: The True Space Heroes Driving Bitcoin’s Galactic Adventures

Coin Days Destroyed (CDD), or as Darkfost refers to it, the ‘Pie Chart of Hope’, is absolutely the must-have metric for those trying to decipher Bitcoin’s perplexing market structure. It provides a kind of map, not unlike the one used by HG at the Intergalactic Hyperspace Barge Company, to visualize long-term holder activity and the potential selling pressure they might unleash. CDD essentially measures the cosmic age of coins before they budge – when these ancient coins start circulating again, it could be a sign of an impending trading storm.

The 30-day moving average of CDD, having curiously doubled since a sunny summer day (when might that have been?), signals a rise in long-term holder activity. Curiously, this metric took a dip before Bitcoin’s last all-time high, thus possibly helping fuel the hurtling rocket up again, before it just continued climbing back on its pedestal – much like an action hero in a cheesy 80s flick.

On an interstellar timescale, CDD levels are zooming past their 2021 heights and are zooming toward those of 2017 – we are possibly witnessing a galactic event in Bitcoin’s epic saga. This cosmic trend hints at the frantic transfer of digital dough between market space cadets. Despite this, Bitcoin is still swimming in the deep end above $100,000, suggesting today’s market is far more liquid (and institutional) than any prior proto-eras. The LTHs can now distribute colossal amounts of Bitcoin without everything crashing like a spaceship landing in a swamp, demonstrating just how mature and deep Bitcoin’s market has become.

Battling to Maintain the $100K Fort

Currently, Bitcoin is hanging on by its digital fingernails near $100,767. Cast against a sky full of financial angst, BTC has once more put the $100K psychological barrier to the test – a critical line in the galactic sand that must be defended to keep malevolent price movements at bay.

Tech-wise, Bitcoin is below its 50-day (blue) and 100-day (green) moving averages, indicating that short- and mid-term market forces continue to side with the sharks. The 200-day moving average (red), hovering somewhere slightly above $106K, acts as a dynamic wall of resistance, supporting a broader descent that began in the autumn of 2025’s October.

If Bitcoin manages to carve a path above $103K-$104K, it might signal a brief resurgence in the direction of $108K-$110K. Conversely, a precipitous fall below $100K could trigger a more dramatic excursion toward $95K, probing the resilience of market-goers as sentiment wavers like lights winking in and out of a distant rain shower.

Read More

- Best Controller Settings for ARC Raiders

- Gold Rate Forecast

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- How to Build a Waterfall in Enshrouded

- Meet the cast of Mighty Nein: Every Critical Role character explained

- How to Get the Bloodfeather Set in Enshrouded

- Ratchet & Clank Mobile May Be Okay Actually, First Gameplay Revealed

- How to Build Water Elevators and Fountains in Enshrouded

- Forza Horizon 6’s Tokyo City is One of Playground’s “Most Detailed and Layered Environments” Yet

2025-11-08 05:17