Somewhere between a midlife crisis and winning the lottery, Ether ETFs just raked in $729.14 million in a single day. Bitcoin ETFs, ever the overachievers, managed six straight days of “look at me” gains with $86.91 million. Markets were busier than a toddler on espresso, and net assets reached eye-watering highs.

Ether ETFs Go Full Rockstar While Bitcoin Plays Its Safe Six-Day Streak

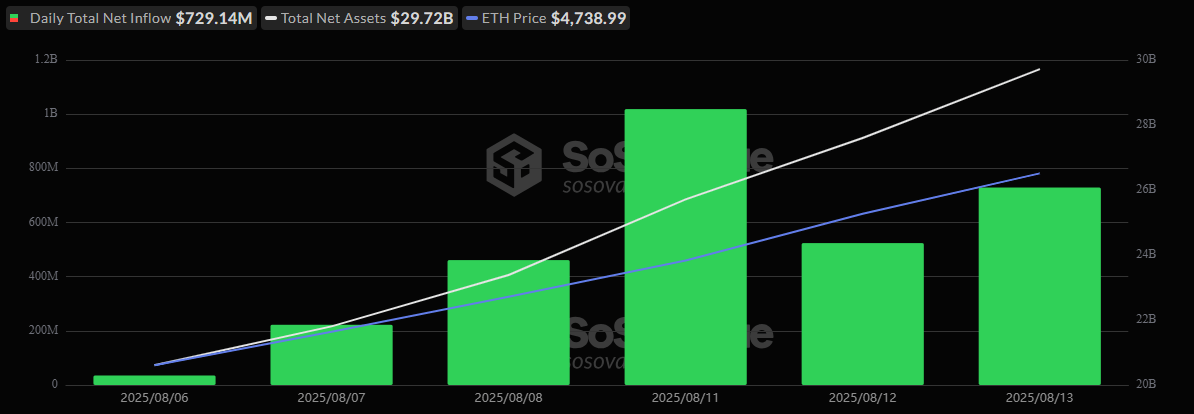

Wednesday, Aug. 13, was basically a crypto-themed episode of “Extreme Makeover: ETF Edition.” Ether ETFs strutted into the spotlight with a $729.14 million inflow-the second-biggest in history-while Bitcoin ETFs quietly flexed their six-day streak of gains, because subtlety is apparently still a thing in crypto.

For Ether ETFs, it was a day of VIP treatment. Blackrock’s ETHA swaggered in with $500.85 million, Fidelity’s FETH followed with $154.69 million like a slightly overdressed sidekick. Grayscale’s Ether Mini Trust tossed in $51.34 million, ETHE casually added $7.38 million, and Bitwise’s ETHW plus Franklin’s EZET contributed $10.85 million and $3.59 million, respectively. No one left early-trading volume hit a jaw-dropping $4.47 billion, and net assets climbed to a new peak of $29.72 billion. 🚀

Meanwhile, Bitcoin’s parade happened without its usual celebrity, Blackrock’s IBIT, who apparently decided to nap on the sidelines. Ark 21shares’ ARKB took the spotlight with $36.58 million, Fidelity’s FBTC followed with $26.70 million. Grayscale’s Bitcoin Mini Trust added $11.42 million, and Bitwise’s BITB plus Invesco’s BTCO chipped in $7.32 million and $4.90 million, respectively. Not a single Bitcoin ETF ran for the exits. Total traded value soared to $4.97 billion, pushing net assets to an all-time high of $158.64 billion. 🎉

Two days of historic inflows and record volumes suggest one thing: institutional crypto is in full-on overdrive, and ETH is driving the limo, champagne in hand. 🍾

Read More

- Best Controller Settings for ARC Raiders

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- Ashes of Creation Rogue Guide for Beginners

- DC K.O.: Superman vs Captain Atom #1 Uses a Fight as Character Study (Review)

- Final Fantasy 7 Remake Developers Discussed Making Cloud’s Buster Sword a Smaller, Regular Sword

- Mila Kunis Reveals One Parenting Rule With Ashton Kutcher

2025-08-14 16:22