In what some might call a breathtaking act of digital gymnastics, Bitcoin (BTC) decided to wade into the shallow end of the price pool yesterday, nosediving to $114,386. This caused a ripple of nearly $300 million in liquidations-think of it as a financial firework display that nobody particularly asked for-and left investors clutching their digital pearls with all the confidence of a toddler in a fridge full of sweets.

Is Bitcoin Pearl Diving or Just Taking a Nap?

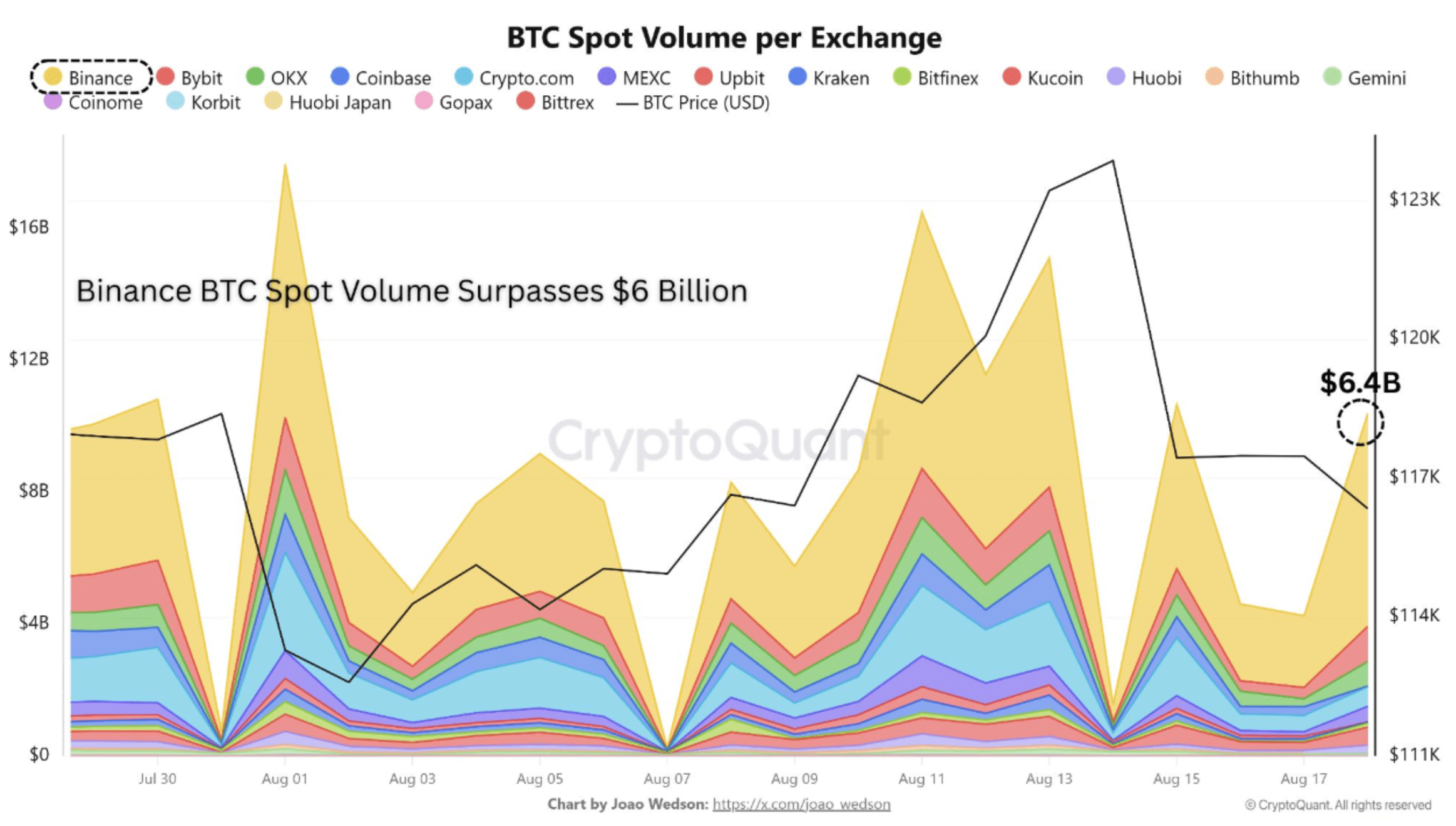

According to the ever-wise CryptoQuant Quicktake post by Amr Taha-who clearly has a more exciting life than most-Binance’s BTC spot trading volume exploded past $6 billion on August 18. That’s a lot of zeroes, even by crypto standards, and probably enough to make old-school traders drop their monocles.

Amr Taha points out that such sudden surges in activity usually mean institutional investors and the big fish are having their moment-probably planning their next digital empire-while retail traders nervously shuffle their feet in the volatility anticipation dance.

The timing of this impressive volume spike right after BTC’s dip below $115,000 seems less like coincidence and more like a prequel to some sort of market drama-think less soap opera, more financial circus. Historical data suggest that these dips often attract traders eager for a sweet, discounted Bitcoin stock-up, potentially softening the blow and setting the stage for a rebound worthy of a Hollywood soundtrack.

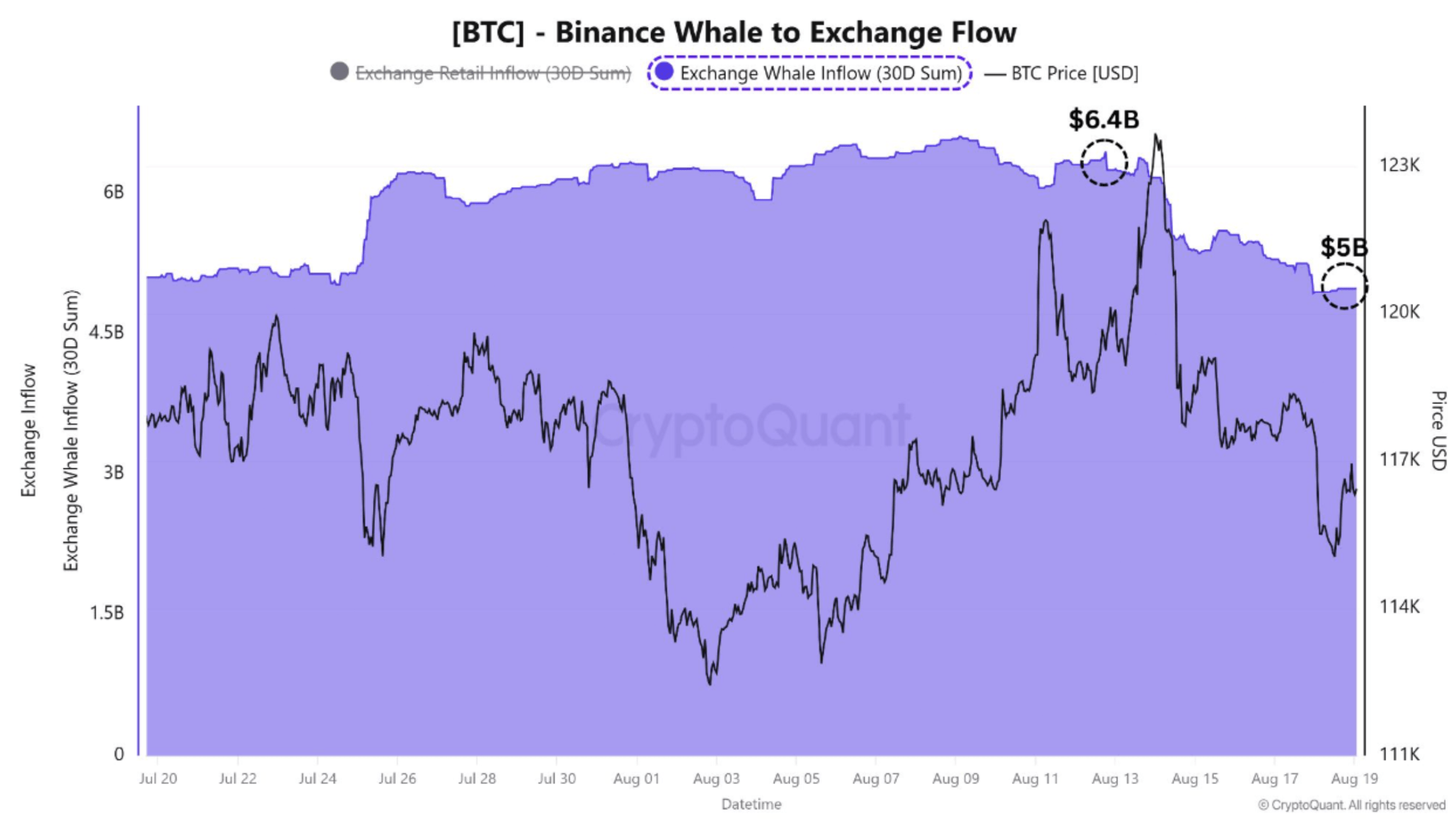

Taha also reveals that as Binance’s spot volume surged, the whale-to-exchange flow shrank from a hefty $6.4 billion to a mere $5 billion-a sign that the large holders, or whales, are perhaps taking their profits and heading for the digital hills, leaving fewer big deposits to get in the way of a bullish rally.

This restraint from the whales might mean fewer large-scale sell-offs-good news for the hopeful bulls among us. As Taha neatly sums it up: with rising demand on the dips, a decrease in whale deposits, and a healthy dose of volume, we might just be witnessing the early inklings of Crypto’s equivalent of

a calm before the storm-or perhaps just a really convincing lull in the chaos.

Meanwhile, titan of Crypto, who probably has a magic 8-ball, suggests BTC might still be following a weekly trendline, hinting at a potential target of $130,000 if the stars align-probably after a few more rollercoaster dips and maybe a few more sleepless nights.

Side of Caution, Please!

While the crypto gods may be whispering sweet nothings of hope about being in an accumulation phase, doom prophets warn us that September could be the financial equivalent of a thunderstorm-brutal, relentless, and full of surprises. Crypto analyst Josh Olszewics warns that Bitcoin might have to endure a “brutal September,” which sounds like the kind of phrase that makes investors reach for their lucky charms.

CryptoQuant’s BorisVest chips in with a cheerful warning: the next couple of weeks could see some selling fireworks, so hold onto your digital hats. Currently, Bitcoin dances at $115,489, down a tiny 0.1%-probably just testing the waters before a great leap or another nose dive into the abyss.

Read More

- Best Controller Settings for ARC Raiders

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Ashes of Creation Rogue Guide for Beginners

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- Cult Horror With 92% On Rotten Tomatoes Quietly Added To Netflix (& I Guarantee You’ve Seen Nothing Like It)

- 2 Marvel Villain Actors Shortlisted for Brainiac in Man of Tomorrow

- Pokemon Legends: Z-A Mega Reveals Leave Me Worried the DLC Has Nothing Else to Offer

2025-08-20 02:22