In the grand theater of Ethereum, where fortunes are made and lost with the flick of a digital switch, a curious spectacle unfolds. Validators, those noble guardians of the blockchain, find themselves in a peculiar predicament. As they hastily unstake their treasures, a throng of eager newcomers rushes to join the ranks of ETH validators, creating a delightful chaos that speaks volumes of the mixed sentiments swirling among the titans of the crypto realm.

Behold! $7 billion trapped in the Ethereum Validator Queue

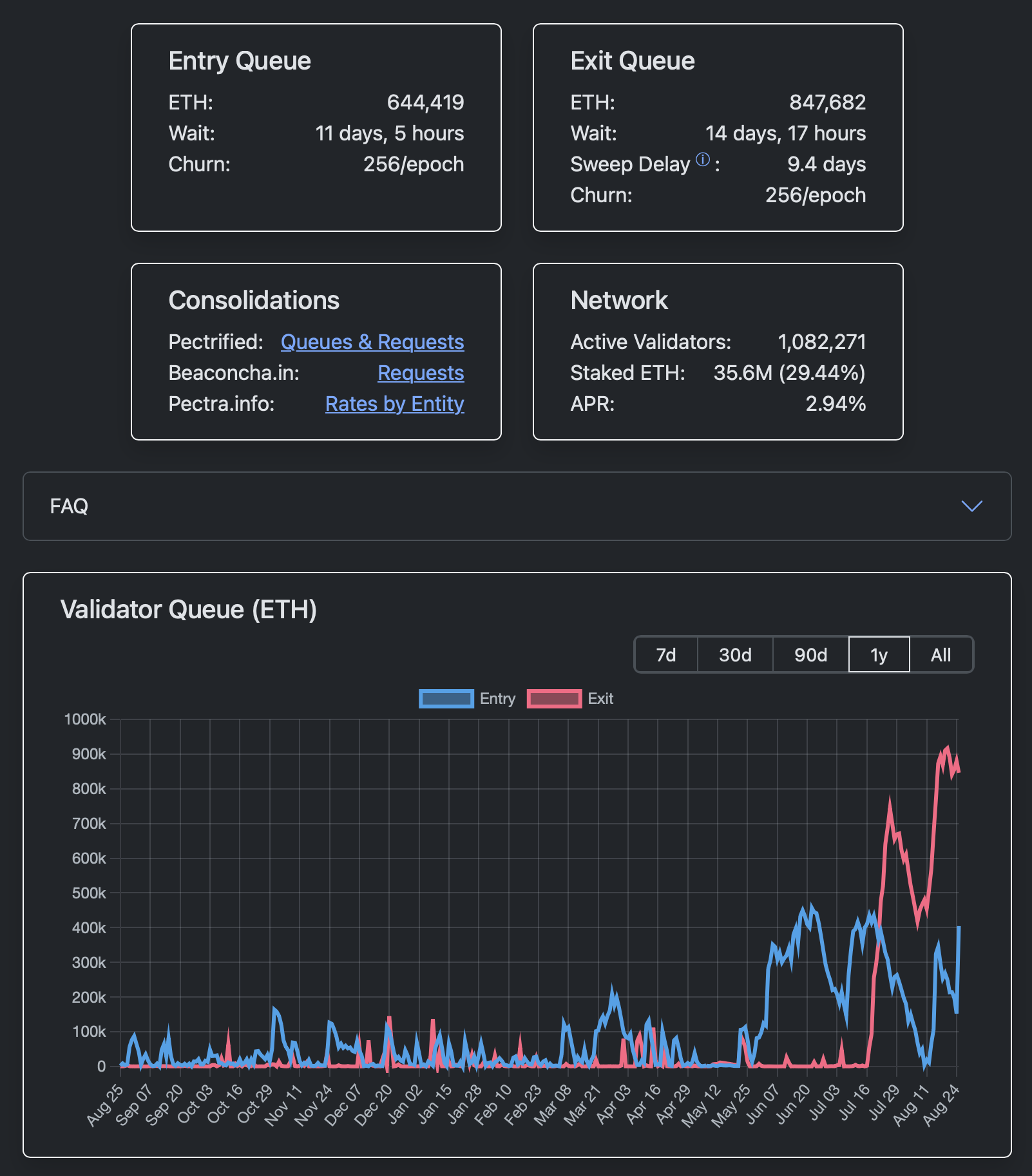

Ah, the Ethereum validation entry queue! A veritable line of hopefuls, each clutching their precious ETH, yearning for the sweet nectar of periodic rewards. In a mere span of two days, this queue swelled by over 400,000 ETH, reaching a staggering multi-month high of 644,000 Ethers. It seems that patience is indeed a virtue, as it now takes a staggering 11 days to withdraw one’s ETH from the clutches of staking. The last time such a prolonged wait was witnessed, one might have thought it was a line for a popular concert, not a financial endeavor.

Meanwhile, the once tumultuous unstaking queue has begun to settle, much like a calm after a storm, following its peak on the fateful day of August 20, 2025. After reaching an astonishing 970,000 ETH, it has now gracefully retreated below 850,000 ETH, as if to say, “Enough is enough!”

In total, a staggering $7 billion in liquidity now languishes, caught in the limbo of either joining the ETH staking mechanism or making a hasty exit. This curious state of affairs reflects the mixed expectations of the large ETH market participants, who seem to be playing a game of financial chess, albeit with a few pieces missing.

Ethereum Community: Optimism Amidst the Debates of All-Time Highs

The fervor for withdrawal appears to be driven by the desire to secure profits at the current price level, a sentiment that echoes through the halls of the Ethereum community. Conversely, the eagerness to lock ETH with validators signals a burgeoning optimism regarding its price performance, as if the community collectively decided to don rose-tinted glasses.

Yet, as the ecosystem becomes increasingly saturated, the annualized rewards for Ethereum staking have dipped below the once-coveted 3%, a far cry from the usual 4%. It seems that even in the world of crypto, one must sometimes settle for less.

As previously reported by U.Today, the price of Ethereum reached a new all-time high last Friday on certain cryptocurrency exchanges, igniting a flurry of excitement. However, the ever-reliable CoinGecko and CoinMarketCap have yet to confirm that the previous ATH from 2021 has indeed been shattered, leaving many to wonder if they are witnessing a grand illusion or a genuine breakthrough.

Read More

- Best Controller Settings for ARC Raiders

- How to Get the Bloodfeather Set in Enshrouded

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Gold Rate Forecast

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- Yakuza Kiwami 3 And Dark Ties Guide – How To Farm Training Points

- How to Build a Waterfall in Enshrouded

- Meet the cast of Mighty Nein: Every Critical Role character explained

- These Are the 10 Best Stephen King Movies of All Time

- Best Werewolf Movies (October 2025)

2025-08-25 20:06