Oh, poor WLD! Stranded at $0.90 like a tramp on a trampoline, it clings to its dignity while the market capitalization sneezes beneath $1.8B. The numbers whisper sweet nothings to the bears, who cackle like hyenas at every wobble. Open interest? Technical indicators? Oh, they’re just the grown-ups arguing over cake crumbs while the token flounders. A *masterpiece* of indecision!

Open Interest Shows Persistent Speculative Activity

Derivatives markets are throwing a party-open interest dances between $190M and $210M like a nervous penguin on roller skates. Traders? They’re still here, dear reader, clinging to positions like monkeys to coconuts, even as the price hums the saddest lullaby near $0.90.

When WLD tumbled from $0.96 to $0.90, open interest didn’t bat an eye. Traders are either brave, foolish, or both-hedging like it’s their job. And let’s face it, it *is*.

This peculiar dance of “more open interest, less hope” smells of bearish plots. Liquidity hoarders are brewing a storm, and if prices keep slumping while open interest balloons, watch out! The market might throw a tantrum so fierce, WLD could crash through $0.88 like a house of cards in a hurricane. Or-gasp-a short squeeze could rocket it upward! The drama! The suspense! 🎭🚀

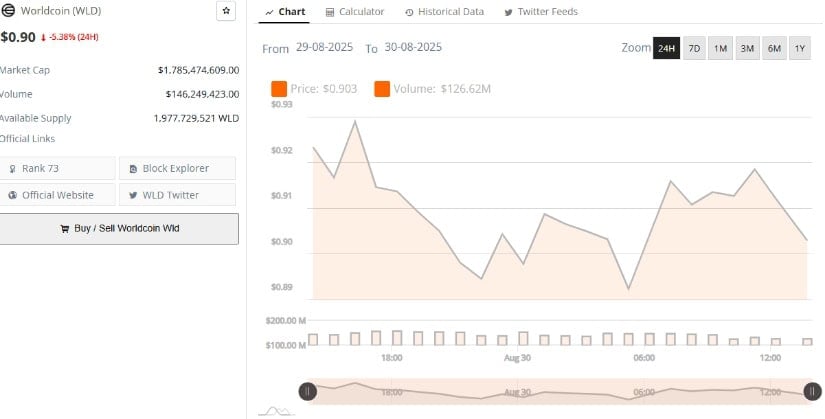

Market Data Reflects Selling Pressure Despite Active Volume

BraveNewCoin reports WLD’s 24-hour slump from $0.92 to $0.90-a 5% dip that makes you question your life choices. Trading volume? A robust $146M, because why not? Buyers and sellers are having a chaotic fling, and the market cap now tiptoes near $1.78B, ranking 73rd like it’s playing hide-and-seek with relevance.

High volumes and sinking prices? It’s like a buffet where everyone’s eating but no one’s gaining weight. Buyers keep trying to push WLD past $0.92, but the bears just laugh and slap them down. Selling pressure? Dominant. Unless someone invents a magic wand for $0.92, this bearish ballad isn’t ending anytime soon.

Technical Indicators Highlight Continuing Weak Momentum

The daily charts paint a picture of despair. WLD hovers at $0.90, far from its glorious $1.64 peak. The MACD? A grumpy old man muttering, “I told you so,” with its -0.030 line sulking below -0.026. The histogram? Negative and sassy. Chaikin Money Flow? At -0.12, it’s like a grumpy uncle draining the piggy bank.

Since July, no one’s been buying in bulk. If $0.88 breaks, WLD might plummet faster than a greedy squirrel in a thunderstorm. But hey! A MACD crossover and a CMF grin could spark a comeback. The resistance at $1.00? A fortress. Support at $0.57? A moat. This is the financial jungle, darling-only the clever survive. 🦁💰

In conclusion, WLD’s story is a tragicomedy of errors, open interest parties, and technical indicators throwing shade. Investors, proceed with caution-or bring popcorn. 🍿

Read More

- Best Controller Settings for ARC Raiders

- How to Get to Heaven from Belfast soundtrack: All songs featured

- 10 Most Memorable Batman Covers

- 10 Best Anime to Watch if You Miss Dragon Ball Super

- Star Wars: Galactic Racer May Be 2026’s Best Substitute for WipEout on PS5

- Best X-Men Movies (September 2025)

- How to Froggy Grind in Tony Hawk Pro Skater 3+4 | Foundry Pro Goals Guide

- Netflix’s Stranger Things Replacement Reveals First Trailer (It’s Scarier Than Anything in the Upside Down)

- PlayStation Plus Game Catalog and Classics Catalog lineup for July 2025 announced

- Avatar: Fire and Ash May Have a Big Problem (But Here’s Why Fans Shouldn’t Worry)

2025-08-30 23:31