Ah, September 2025! The leaves turn, the winds chill, and the economy? Why, it teeters like a drunken courtier at Versailles! 🍷🤪 Mounting evidence suggests the US economy is closer to a recession than a noble’s nose to his own arrogance. Several key indicators have economists and market observers clutching their wigs in alarm.

The fallout, my dear reader, shall not be confined to the stuffy halls of traditional markets. Crypto assets, those high-risk darlings of the digital age, shall likely face the guillotine of investor fear. As the masses flee to safer holdings, volatility shall reign supreme, and sell-offs shall dance like courtiers at a masquerade ball. 🎭💰

Is the US in a Recession? Pray Tell!

The most amusing indicator, you ask? Why, the job market, of course! According to the jesters at BeInCrypto, nonfarm payrolls slowed in August, adding a mere 22,000 jobs-a far cry from the projected 75,000. A tragedy, or a farce? You decide! 😂

Of the ~598,000 jobs added in President Donald Trump’s second term (may the heavens help us), 86% were in healthcare and social assistance. Outside of these, job creation has stalled like a broken carriage wheel. Fragility, thou art the economy! 🛠️🚨

The US economy has entered a jobs recession.

– Mark Zandi (@Markzandi) September 5, 2025

And lo, on the platform of X, Global Markets Investor proclaimed that the US has shed 142,200 jobs in four months-the largest drop since the 2020 crisis. “A recession’s herald,” they cried, with all the drama of a Shakespearean actor. 🎭📉

“In the past, such a drop has usually happened at the onset of a recession,” the post read, with a wink and a nod.

In another post, the analyst pointed to the rise in long-term unemployment-a tale as old as time itself. The number of Americans jobless for 27 weeks or more has doubled since December 2022, reaching 1.9 million in August. The highest in four years! A comedy of errors, indeed. 🤡📈

“The share of Americans unemployed for over 27 weeks hit 25.7%, in line with DEEP recession levels,” Global Markets Investor added, with a flourish of their quill.

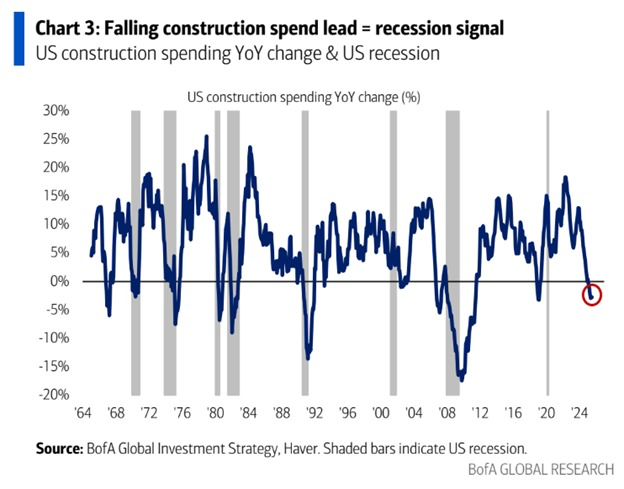

A second act in this economic tragedy? The steep decline in construction spending. The Kobeissi Letter revealed a 2.8% drop year-over-year in July 2025-a plunge not seen since the 2008 crisis. Spending has fallen in 10 of the past 11 months, the longest slide in 15 years. A slow-motion collapse, if ever there was one! 🏗️💥

“Over the last 50 years, such a sustained decrease has occurred only during recessions, except in 2018. Meanwhile, construction employment has fallen for 3 consecutive months, the longest streak since 2012,” The Kobeissi Letter declared, with all the gravitas of a royal decree.

Construction, that key driver of economic activity, serves as an early barometer of financial health. When it slows, it signals weaker demand for housing, commercial projects, and infrastructure. A ripple effect, my friends, that touches all! 🌊🏠

But what of public perception, that fickle mistress? A Wall Street Journal-NORC poll reveals a sharp decline in economic optimism. Only 25% believe they have a ‘good chance’ of improving their living standards-the lowest since 1987. A nation in despair, or a comedy of misplaced hopes? 😢🤡

More than three-quarters doubt future generations will fare better, while nearly 70% say the American dream is but a myth. The most pessimistic outlook in 15 years! Yet, Republicans remain rosier than Democrats-a partisan divide as old as time itself. 🌹🌪️

“Republicans in the survey were less pessimistic than Democrats, reflecting the longstanding trend that the party holding the White House has a rosier view of the economy,” WSJ reported, with a sly grin.

A Financial Times report highlights regional disparities-a patchwork of economic woe. States like Illinois, Washington, New Jersey, and Virginia may already be in recession, while New York, Texas, Florida, and California hold steady. A nation divided, indeed! 🗺️💔

Why a US Recession Could Trigger Crypto Sell-Offs: A Tragic Farce

The data paints a bleak picture, but where does crypto fit into this grand drama? Financial trader Matthew Dixon explains that a recession weighs on assets like Bitcoin (BTC). As growth slows, profits decline, and consumer demand weakens. A tragic farce, if ever there was one! 😭📉

“Risk assets (stocks, crypto) price in future growth. If growth expectations shrink, valuations contract,” he remarked, with the wisdom of a philosopher.

Investors, ever fickle, flee to safe-haven assets like Treasuries, gold, or stable currencies, draining liquidity from crypto markets. Lending tightens, borrowing costs rise, and speculative activity withers. Even before fundamentals deteriorate, negative sentiment drives investors to cut risk, creating a selling frenzy. A comedy of panic! 🏃💨

For months everybody counted on bitcoin shooting up because of the expanding money supply. But the money supply has flatlined.

With employment cooling and delinquencies rising, the growing gap between M2 and TMS suggests the US is entering a period of serious economic weakness.…

– Dr Martin Hiesboeck (@MHiesboeck) September 3, 2025

Thus, a US recession would weigh heavily on crypto. In the short term, risk aversion and tighter liquidity drain capital, pressuring prices. Yet, over time, monetary easing or growing distrust in fiat could reignite Bitcoin’s appeal as a hedge, while altcoins remain vulnerable. A tale of two fates, my friends! ⚖️🤑

Read More

- Best Controller Settings for ARC Raiders

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Ashes of Creation Rogue Guide for Beginners

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- Fantastic Four’s Cast Brings 12 New Marvel Characters To The MCU

- 10 Most Brutal Acts Of Revenge In Marvel Comics History

- DC K.O.: Superman vs Captain Atom #1 Uses a Fight as Character Study (Review)

2025-09-08 14:23