In an potentially seismic shift for Hollywood, it’s rumored that Paramount Skydance is gearing up to make a significant offer, backed by cash, to take over Warner Bros. Discovery. If this deal goes through, it would unite two of the industry’s biggest players in film, TV, and streaming, creating an entertainment powerhouse unlike any other in recent times-a colossus that could shake up the entertainment landscape for years to come.

I’m excited to share that I’ve learned some exciting news about the media industry! According to reliable sources, as reported by The Wall Street Journal and later confirmed by Reuters, shares of Warner Bros. Discovery have seen a significant increase of nearly 30%. This surge comes following reports about the deal, which, if finalized, could potentially be one of the most groundbreaking media mergers of the decade. Additionally, Paramount Skydance stock has also risen in response to this news, indicating that investors are enthusiastic about the potential transformative effects this deal may have on our industry.

What We Know So Far

Here’s the information currently circulating on this Paramount Warner Bros. deal.

- The Offer: Paramount Skydance’s bid would be majority cash, targeting the entire Warner Bros. Discovery portfolio. That means Warner Bros. Pictures, HBO, CNN, Discovery’s cable networks, Cartoon Network, and more could all be absorbed.

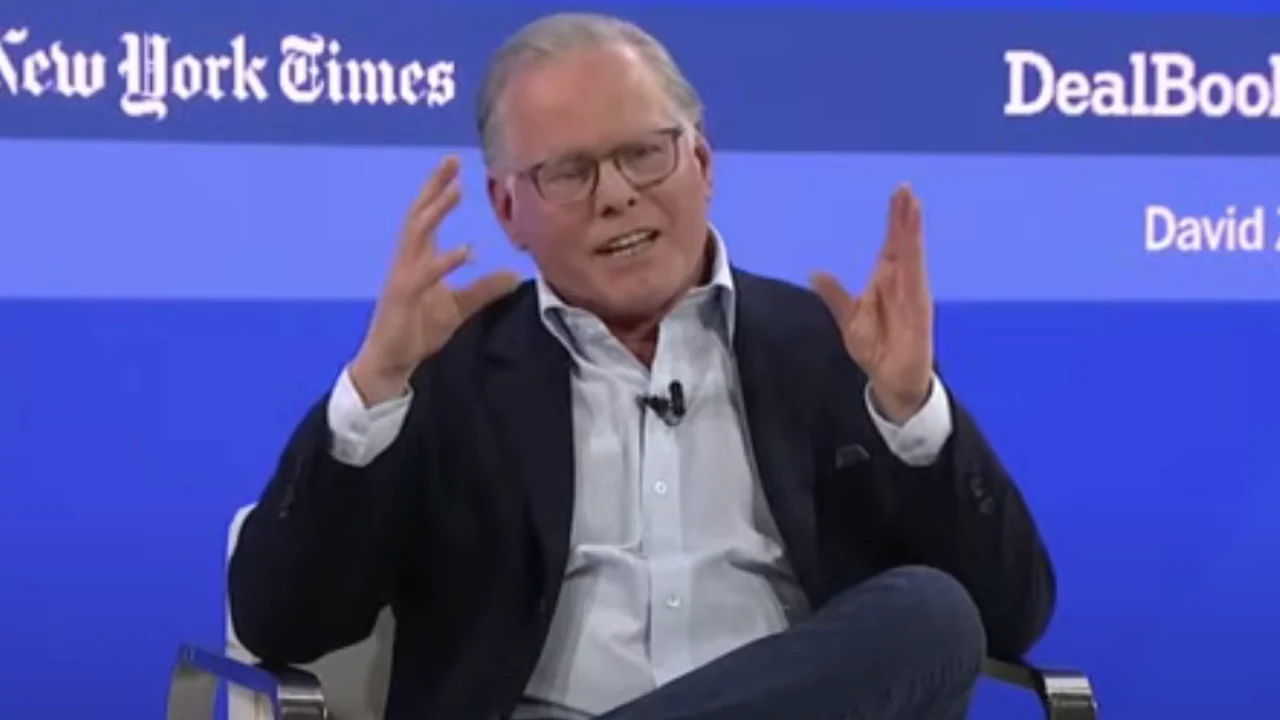

- The Backing: David Ellison of Skydance Media—newly merged with Paramount earlier this year—is spearheading the effort. His father, Oracle founder Larry Ellison, is believed to be financially supporting the deal.

- The Market Reaction: WBD’s stock popped nearly 20% on the news, an unmistakable sign that investors view a buyout as credible and potentially lucrative. Paramount Skydance itself saw a smaller but meaningful 2% rise.

- The Silence: Both Paramount and Warner Bros. Discovery declined to comment on the reports.

Why This Deal Matters

Should this merger between Paramount Warner Bros. be finalized, the resulting content collection could potentially surpass those of Disney, Netflix, and Amazon jointly. The combined entity, Warner Bros. Discovery, encompasses HBO, Warner Bros. Pictures, Discovery’s reality powerhouses like CNN, TNT, Cartoon Network, and DC Studios. Meanwhile, Paramount Skydance offers Nickelodeon, CBS, MTV, Comedy Central, Paramount Pictures, and the expanding streaming service Paramount+ boasting popular series such as Tulsa King.

Combining their resources, the new entity would boast one of the biggest collections of intellectual properties globally, encompassing classic content as well as modern brands. This advantage positions them strongly in negotiations for licensing deals, advertising space, and in the ongoing battle for profitability in streaming services – a challenge many other companies are currently grappling with.

The Roadblocks Ahead

Of course, it won’t be smooth sailing. Several major challenges stand in the way:

- Regulatory Hurdles: Combining two giants of this size will draw heavy scrutiny from antitrust regulators. The FTC, FCC, and DOJ would all weigh in, and international regulators could demand divestitures.

- Integration Chaos: Warner Bros. Discovery itself was only recently created by the Warner–Discovery merger, a deal still plagued by debt and operational struggles. Merging another massive studio into that mix risks more turbulence.

- Debt Pressure: Any cash-heavy offer will require financing, and both companies already carry significant debt loads. Investors will be watching closely to see how much new borrowing is required.

- Cultural Clash: Warner Bros.’ Hollywood legacy meets Paramount’s Ellison-backed reboot. Studio leadership, greenlighting authority, and corporate strategy will all be up for grabs.

Streaming at the Center

In simpler terms, the main arena for competition is the streaming platform market. Warner Bros. Discovery owns HBO Max, while Paramount Skydance operates Paramount+. These two platforms are engaging in a tough struggle against heavyweights like Netflix, Disney+, and Amazon Prime Video.

Combining libraries could offer the unified company an opportunity to streamline their services, reduce expenses, and establish a robust platform capable of competing effectively on a large scale. However, this merger could potentially lead to discontent among subscribers if costs increase or certain services are discontinued. Consumers might come to expect packages that include multiple offerings or advertising-supported tiers as the new standard.

What Happens to Cable?

Traditional cable networks such as CNN, TNT, TBS, Discovery, Food Network, Nickelodeon, MTV, are rapidly diminishing due to the increasing trend of cord-cutting. For a long time, these channels played a significant role in financing Hollywood’s grand studio ambitions. However, currently, they serve as more of a burden than a benefit. They’re causing a drop in stock prices and forcing studios to compensate by relying on advertising revenue to keep them afloat.

Due to certain changes in their operations, Warner Bros. Discovery is planning a significant transformation of its business. This transformation involves splitting the company into two distinct entities. One part will be dedicated to managing the cable networks that are experiencing a decline. The other part will encompass the prestigious studio and streaming assets, including Warner Bros. Pictures, HBO, and Max.

The proposal by Paramount complicates the existing plan significantly. If the Ellison-supported offer is accepted, Paramount Skydance aims to acquire the cable properties too. This might lead to CNN, TNT, Food Network, Nickelodeon, and MTV being managed under a single umbrella. Paramount Skydance’s bid encompasses Warner Bros. Discovery in its entirety, including its dwindling cable networks. However, whether the Ellison-backed company plans to retain these assets permanently or divest them at some point in the future is yet undecided.

Should Paramount Skydance aim to retain full control over linear distribution, regulators like the FTC or FCC might require them to sell off some channels as part of the agreement. Essentially, they could be forced to relinquish a portion of their holdings if they want to avoid possible interference from Washington.

From a dedicated viewer’s perspective, it seems that cable could be the point of vulnerability in this colossal merger. It might be the area facing harsh restructuring measures such as downsizing, splitting off into separate entities, or even potential sale.

A Shifting Competitive Landscape

It’s quite possible that if Paramount Skydance manages to achieve what is being planned, they could significantly elevate their position in the entertainment industry, potentially matching or even surpassing Disney, Netflix, Amazon, and Apple in influence and impact on discussions about the future of entertainment.

Furthermore, these repercussions are likely to continue. Several other studios might consider merging or forming alliances to stay competitive. Potentially, companies such as Lionsgate, Sony, and AMC could become acquisition targets amidst an industry-wide consolidation trend.

Stepping into the theater of Hollywood’s latest blockbuster, it’s hard not to feel a mix of anticipation and trepidation as we consider the potential implications of Paramount’s proposed acquisition of Warner Bros. Discovery. Will this union birth an era of groundbreaking cinema or merely add another layer to the pile of industry missteps? Time will tell, but one thing is indisputable: if this deal goes through, Hollywood as we know it could very well undergo a seismic shift.

Read More

- Sony Removes Resident Evil Copy Ebola Village Trailer from YouTube

- Ashes of Creation Rogue Guide for Beginners

- Best Controller Settings for ARC Raiders

- Can You Visit Casino Sites While Using a VPN?

- One Piece Just Confirmed Elbaph’s Next King, And He Will Be Even Better Than Harald

- Michael B. Jordan Almost Changed His Name Due to NBA’s Michael Jordan

- The Night Manager season 2 episode 3 first-look clip sees steamy tension between Jonathan Pine and a new love interest

- Lies of P 2 Team is “Fully Focused” on Development, But NEOWIZ Isn’t Sharing Specifics

- Crunchyroll Confirms Packed Dub Lineup for January 2026

- AKIBA LOST launches September 17

2025-09-11 21:58