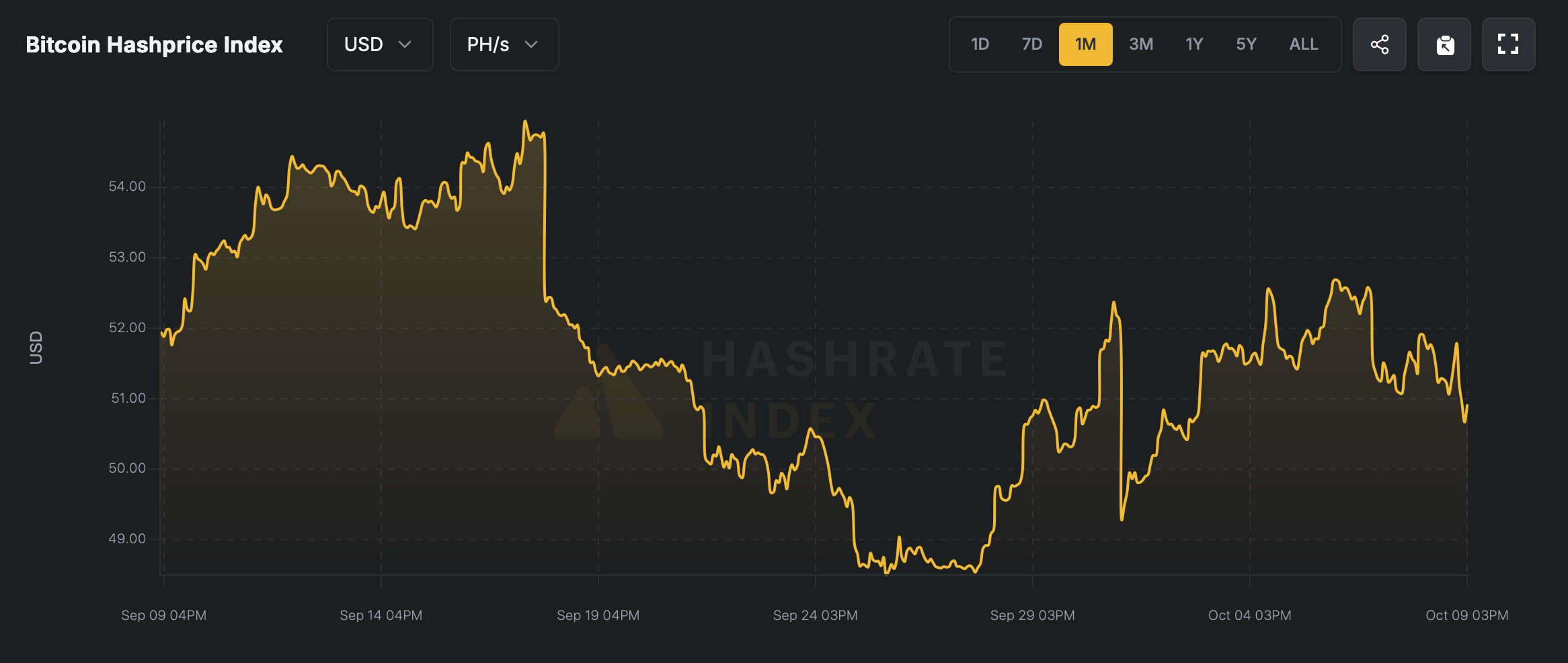

Well, well, well! It looks like Bitcoin’s hashrate took a little nap and dropped by a good 100 exahashes per second (EH/s) over the past two weeks. Who could’ve predicted it? This slowdown has got miners scratching their heads, as mining revenue per petahash (PH/s) took a dive by $2 since last month, showing us just how tight the profit margins are when the network conditions go on their usual roller-coaster ride. ⛷️

Global Bitcoin Hashrate Pulls Back From All-Time High, Signaling Network Rebalance

With the next difficulty adjustment right around the corner, estimates suggest we might get a little relief with a reduction in mining difficulty. It’s like when you finally get to take off that tight pair of shoes after a long day. But don’t get too comfortable, because this volatility is far from over. You know how it goes. Hold on to your hats! 🎩

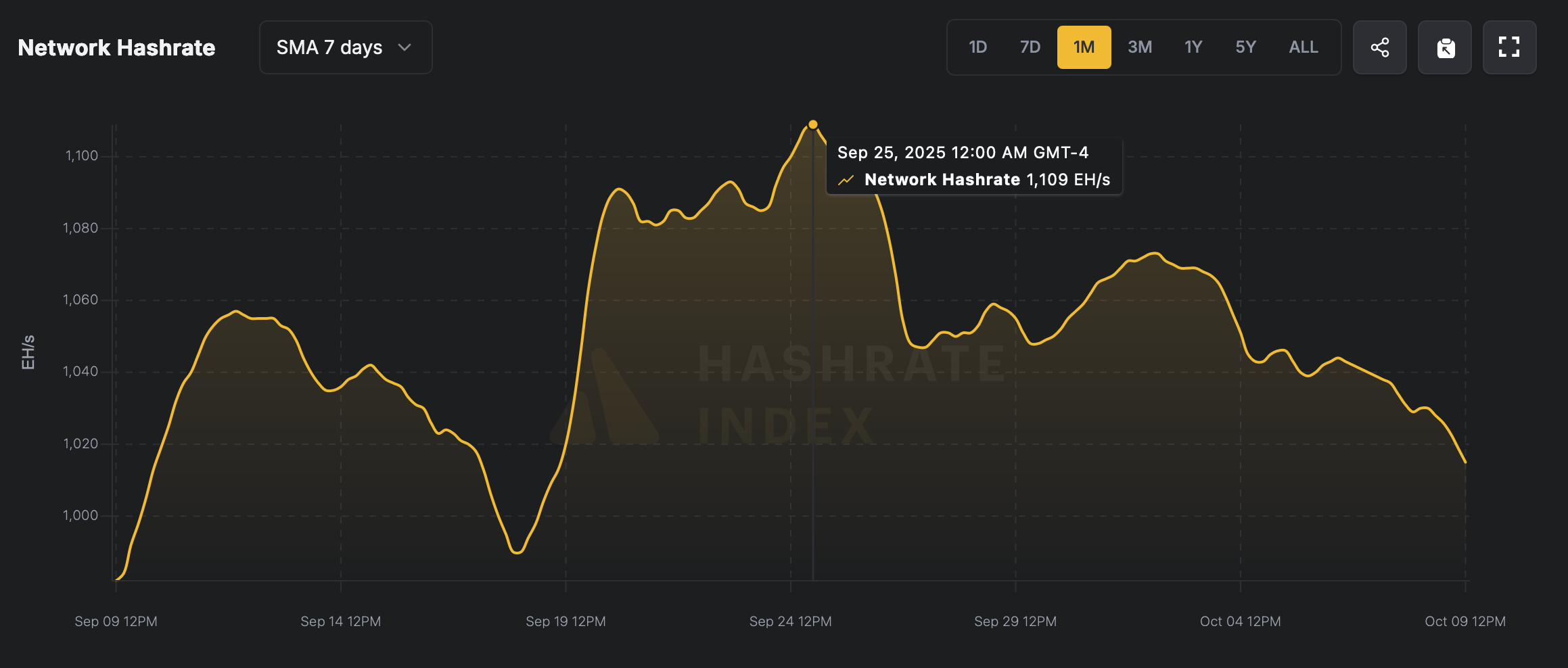

Let’s rewind to about two weeks ago, when Bitcoin’s total network hashrate shot up to a jaw-dropping record-breaking peak of 1,109 EH/s. That’s right, the network reached its highest-ever computational power. But since then, the excitement has cooled off, and we’re now hanging around 1,011 EH/s. I guess even Bitcoin gets tired sometimes. 😴

So, what’s behind this sudden slump? It’s mainly due to Bitcoin’s mining difficulty hitting an all-time high of 150.84 trillion, after seven consecutive increases. Yep, it’s like trying to climb Mount Everest with a backpack full of bricks-miners are struggling to stay profitable with all that added competition. 🏔️

As of Oct. 10, there’s a glimmer of hope! Projections indicate a 7.57% drop in mining difficulty, which could provide miners with a much-needed break from the grind. A little breathing room never hurt anyone, right? 😌

Mining revenue did see a brief spark of life when Bitcoin’s price surged earlier this week, sending the hashprice (the value of one PH/s) up to nearly $53. But just like your favorite snack, the excitement was short-lived. At the time of writing, the hashprice is sitting pretty at $51.20. It’s not bad, but it’s not the fireworks show we were hoping for. 💥

In the coming weeks, the Bitcoin mining world will be watching closely to see how miners adjust to the difficulty drop and whether Bitcoin’s price will hold steady. Fingers crossed! 🤞 A 7.57% decrease in difficulty could give miners a little break, but long-term stability? Well, that depends on Bitcoin’s price, energy costs, and whether the rest of the world wants to join the mining party. 🌍

Historically, these cycles of hashrate dips and rebounds have served as a natural recalibration, filtering out the less efficient operations while rewarding those who can innovate and scale. It’s like the wild west out there, and only the sharpest survive. 🔫 Right now, the drop in hashrate and easing of mining difficulty might signal a stabilization phase, giving miners a chance to optimize before the next major shift. Hang tight, folks, it’s gonna be a bumpy ride! 🚗💨

💡 FAQ: Bitcoin Hashrate & Mining Difficulty

- What caused Bitcoin’s hashrate to drop recently?

Well, rising mining difficulty and shrinking profit margins had a lot to do with it. Miners are feeling the squeeze. 😬 - How much is the Bitcoin mining difficulty expected to change?

Looks like it’s set to drop by about 7.57%. A nice little relief, but don’t go buying that new yacht just yet. 🚢 - What is Bitcoin’s current hashprice per PH/s?

It’s floating around $51.20, just below its recent peak of $52. Not terrible, but let’s see what happens next. 💰 - How will this difficulty drop affect miners?

The reduction in difficulty could give miners a temporary boost and help steady their operations during this wild ride. 🎢

Read More

- Sony Removes Resident Evil Copy Ebola Village Trailer from YouTube

- Ashes of Creation Rogue Guide for Beginners

- Best Controller Settings for ARC Raiders

- Can You Visit Casino Sites While Using a VPN?

- One Piece Just Confirmed Elbaph’s Next King, And He Will Be Even Better Than Harald

- The Night Manager season 2 episode 3 first-look clip sees steamy tension between Jonathan Pine and a new love interest

- Michael B. Jordan Almost Changed His Name Due to NBA’s Michael Jordan

- Lies of P 2 Team is “Fully Focused” on Development, But NEOWIZ Isn’t Sharing Specifics

- Crunchyroll Confirms Packed Dub Lineup for January 2026

- AKIBA LOST launches September 17

2025-10-10 13:19