Hyperscale Data just revealed that their Bitcoin stash is so big, it’s basically their entire company’s life insurance policy. 🎯💸

Not your grandma.)

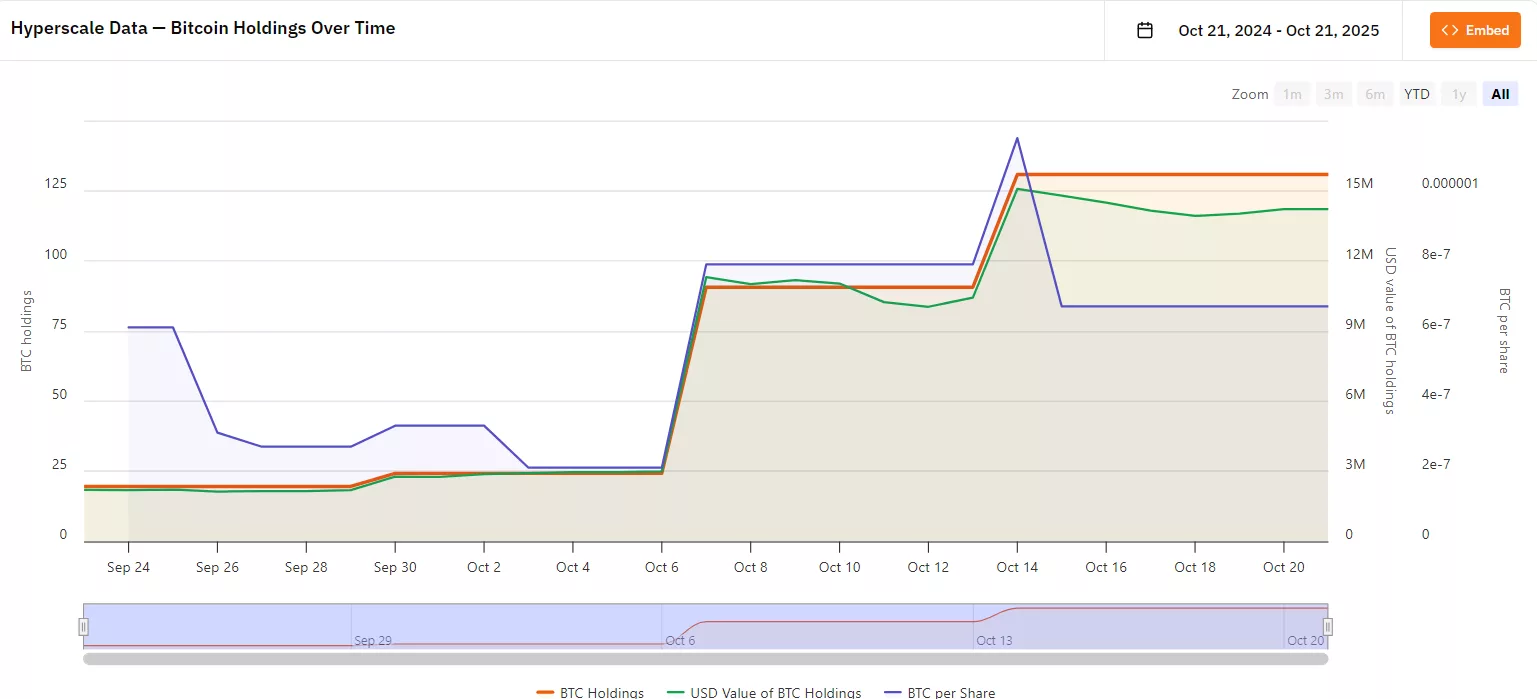

As of Oct. 19, the company’s Bitcoin (BTC) treasury subsidiary Sentinum reportedly held about 150.21 Bitcoin ($16.2 million). This amount consists of Bitcoin acquired from mining operations, which is 32.632 BTC or equal to $3.52 million, as well as Bitcoin purchased from the open-market. Because nothing says “spy agency” like a Bitcoin subsidiary. 🔍

So far, the company has purchased as much as 117.58 BTC. Its latest purchase took place during the week of Oct. 19, when the firm bought 15.88 BTC. Based on the Bitcoin closing price of $108,666 on October 19, 2025, these holdings were valued at approximately $16.3 million. Because nothing says “I’m a big shot” like buying 15.88 BTC in a week. 🚀

Moreover, the company claims to have allocated around $43.7 million in corporate funds for Sentinum to buy more Bitcoin on the open-market. The company stated that it plans to keep investing funds using what it calls a “measured dollar-cost averaging approach” that aims to limit the impact of market fluctuations while also increasing the value of its long-term reserve holdings. Because nothing says “measured” like buying during a crash. 🚨

“Volatility in Bitcoin’s price has provided meaningful opportunities to build our position methodically and at favorable long-term averages,” said Executive Chairman of Hyperscale Data Milton “Todd” Ault III in his statement. Because nothing says “long-term” like buying during a crash. 🚨

Hyperscale Data’s plan to hold 100% of its market cap in BTC

Hyperscale Data stated that it will continue acquiring more Bitcoin to fulfill its long-term goal of building up a Bitcoin treasury with a value that matches 100% of its market capitalization. As part of its broader digital asset treasury strategy, it aims to stockpile as much as $100 million worth of Bitcoin from open-market purchases and self-mined BTC. Because who needs a business when you can just hold BTC? 🏦

“Hyperscale will continue to issue weekly reports every Tuesday morning detailing its Bitcoin holdings as it advances toward its $100 million DAT target,” said the firm in its official statement. Because nothing says “transparency” like a weekly report. 🗓️

According to data from Bitcoin Treasuries, Hyperscale Data has only been acquiring BTC for less than a month. It started holding BTC in September 23 of this year. So far, its Bitcoin holdings have reached 130.8 BTC or equal to $14.18 million. With an average cost of $115,460, the company has accumulated a loss of about 6.02% after the value of Bitcoin plummeted below $110,000. Because starting in September is totally on time. 🗓️

Compared to larger and more established Bitcoin treasury companies like Strategy, Metaplanet, Tesla and Galaxy Digital, it still has a long way to go. However, it has managed to make it into the top 100 public companies that hold Bitcoin despite its late start. Bitcoin Treasuries has ranked Hyperscale Data in 98th place with 131 BTC, beating Mac House and Bitcoin Depot. Because nothing says “I’m a big player” like being behind Tesla. 🚗

At press time, Bitcoin has dropped 2.5% in the past 24 hours, continuing its downward trend of 2.75% within the past week. The largest cryptocurrency by market cap is currently trading hands at $108,153 as it attempts to climb back up to the $110,000 threshold. Because Bitcoin is just trying to find its footing. 🧘♂️

Read More

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Gold Rate Forecast

- Best Controller Settings for ARC Raiders

- How to Build a Waterfall in Enshrouded

- Yakuza Kiwami 3 And Dark Ties Guide – How To Farm Training Points

- Best Shazam Comics (Updated: September 2025)

- 10 Best Sci-fi Movie Sequels Ranked

- Monster Hunter Stories 3’s character creator is officially revealed — and it features a cosmetic that’s normally paywalled in the mainline games

- Ratchet & Clank Mobile May Be Okay Actually, First Gameplay Revealed

2025-10-21 15:33