Oh, my dear reader, prepare thyself for a tale of intrigue and suspense, as we delve into the world of Hyperliquid (HYPE) and its current state of affairs. Market watchers, take heed, for several key signals are converging at once, and the fate of HYPE hangs in the balance.

$40M Hyperliquid Unstaking Event Set for 15th July

Over $40 million worth of Hyperliquid is set to be unstaked on the 15th of July, just ahead of the much-anticipated Kinetiq launch. Three whale wallets alone account for $33.5 million of that figure, signaling serious capital repositioning. Rather than a typical unlock event leading to sell pressure, this looks more like whales preparing to reallocate toward Kinetiq’s staking protocol.

The seven-day unstaking window comes at a moment when HYPE’s price is consolidating near its highs and supply is already tight. If this $40M shift moves into Kinetiq’s ecosystem instead of exchanges, it could reduce available liquidity further and strengthen the case for a post-launch squeeze. For participants watching HYPE’s price structure, this development adds a key layer to track: the effect of rotation, not rejection.

Surge in Trading Volume Signals HYPE May Be Gearing Up

Following the $40 million unstaking event set for July 15, HYPE is now making noise on the volume front. In the last 24 hours, it recorded a 62.94% jump in trading volume, as highlighted by Crypto Raven. That spike put HYPE among the top movers across all tracked assets, second only to XRP in volume growth. For a token sitting in a tight consolidation zone, this kind of activity could be an early sign of upcoming directional movement.

Volume spikes like this, especially ahead of a major ecosystem shift like the Kinetiq launch, shouldn’t be ignored. It suggests that eyes are already positioning ahead of what could be a low liquidity environment. Combined with the recent whale unstaking activity and price holding near $38–$40, this burst in trading volume may be setting the stage for the next leg.

HYPE Open to Two-Path Scenario

The 12-hour chart of HYPE shared by analyst iamcfw lays out a clear two-path scenario just as the $40M unstaking event looms. Structurally, price is hovering above the previous all-time high zone, now retested as support, and dancing along the 50 EMA. The chart outlines a potential local 5-wave completion, which could kick off a new impulsive leg if HYPE Hyperliquid price reclaims the $40 to $42 region with strength.

On the flip side, the setup also leaves room for a short-term correction. If price loses momentum and breaks under the prior ATH zone near $36, a retest of the bullish order block around $30 to $32 becomes likely. However, in the broader context of increasing volume and the incoming Kinetiq-driven supply shift, that dip could be short-lived.

Downside Risk Remains as HYPE Tests Mid-Range

While bullish scenarios for HYPE remain in play, Dieguito Charts brings a more cautious perspective, noting a possible short setup targeting the $30 to $28 zone. The structure shown suggests lower highs forming into a mid-range squeeze, with no strong breakout confirmation yet. The highlighted region also aligns with a prior demand zone that hasn’t been revisited since the rally in early June, making it a logical spot for liquidity grabs if support at $36 cracks.

This potential short view doesn’t necessarily counter the broader narrative from previous H2s, but it reinforces the importance of short-term positioning. Until HYPE decisively flips $40 to $42 into support, price could remain vulnerable to deeper pullbacks, especially with the Kinetiq unstaking still unfolding.

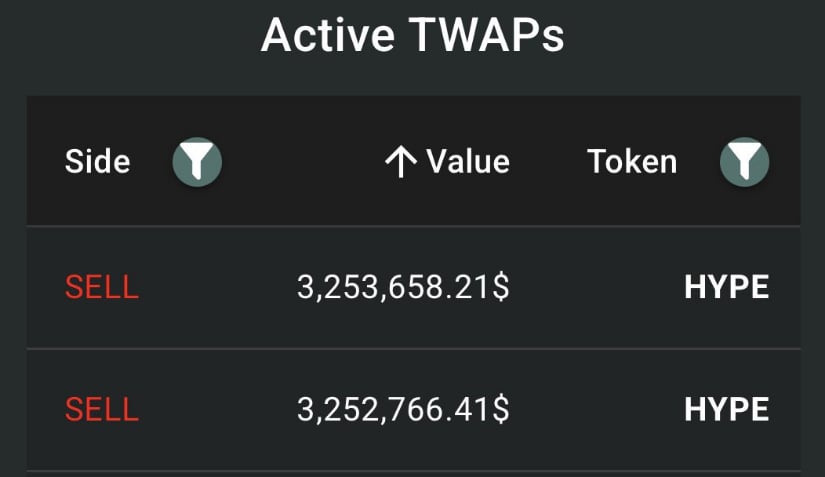

$6.5M TWAP Sell Order Tests HYPE’s Short-Term Strength

A $6.5 million Time-Weighted Average Price (TWAP) sell order just hit the HYPE market, split into two symmetrical $3.25M chunks over a 2-hour window. While not a full-blown panic signal, it’s a tactical move that usually points to someone offloading size without disrupting price too aggressively.

Contextually, this comes as HYPE sits on the edge of two narratives, rotation-driven accumulation and short-term downside risk. Following the $40M unstaking heading into Kinetiq and the recent volume explosion, this TWAP could be a hedge or a preemptive exit. If the price can chew through this kind of sell pressure and still reclaim $40+, it would add serious weight to the bullish structure. Until then, eyes remain on how Hyperliquid manages these large, controlled exits.

Final Thoughts: Correction Due For HYPE?

Hype Hyperliquid price is at a crossroads as on one side, there is a major whale unstaking and volume exploding, while on the other hand, the chart still leaves room for a dip if $36 breaks, and the recent TWAP sell order confirms a potential sign of pressure.

A short-term correction wouldn’t necessarily break the bigger picture. With HYPE holding deflationary tokenomics and positioning for a fresh ecosystem shift, even a pullback toward $30 to $32 could be seen as an opportunity rather than weakness.

Read More

- Sony Removes Resident Evil Copy Ebola Village Trailer from YouTube

- Can You Visit Casino Sites While Using a VPN?

- Best Controller Settings for ARC Raiders

- Ashes of Creation Rogue Guide for Beginners

- The Night Manager season 2 episode 3 first-look clip sees steamy tension between Jonathan Pine and a new love interest

- Holy Hammer Fist, Paramount+’s Updated UFC Archive Is Absolutely Perfect For A Lapsed Fan Like Me

- Jujutsu Kaisen Season 3 Explains Yuta Is More Terrifying Than Fans Remember

- 84% RT Movie With Two of the Decade’s Best Actors Is a Netflix Hit, 3 Years After Box Office Disappointment

- Who is Charlie Frederick? Love Island: All Stars 2026 contestant

- All 3 New Avengers: Doomsday Characters Confirmed by The Trailers

2025-07-09 00:44