Picture this: Bitcoin’s trying to break out like a teenager past curfew, altcoins are clinging to support like my mother-in-law clings to grudges, but stablecoins? Oh, these babies are multiplying faster than rabbits on aphrodisiacs. Strap in, folks—stablecoins are making DeFi look like a Catskills nightclub circa 1962—packed, energetic, and everyone’s fighting for a chair!

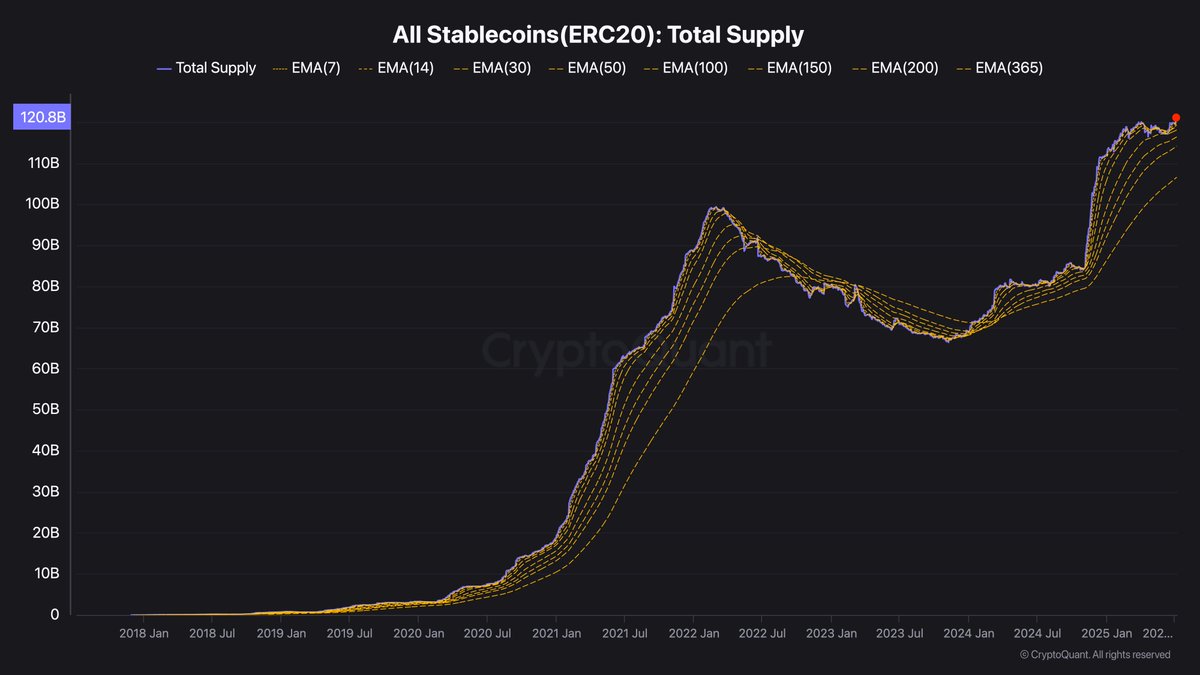

Recently, top analyst (and part-time magician) Darkfost revealed the kind of numbers that would make an accountant faint: ERC-20 stablecoin supply hit a jaw-dropping $121 billion. That’s a lot of stability! At this point, stablecoins are so “reliable,” even my ex trusts them. Take that, market volatility!

While the rest of crypto’s acting like it took a Valium, the stablecoin crew’s out here working 9-to-5 and cashing every paycheck. These coins might not promise Lambo money overnight, but utility is their middle name—hedging, trading, yield farming—they do it all! Forget drama, this is the Swiss Army Knife of digital cash. Of course, nobody’s putting this narrative to bed…it just got its second wind, honey.

Stablecoins: The Crypto Invention That Would Make My Bubbe Proud

Stablecoins have built a bridge between TradFi and DeFi wide enough to march the Rockettes across. Just look at Circle. This crew launched an IPO, priced at $31. By the bell? $82.84. Even Scorsese wouldn’t script a jump that wild—Circle’s now sitting on a market cap that would make Rockefeller jealous. People love this thing more than pastrami on rye.

Darkfost, our chart-wielding hero, brings receipts: ERC-20 stablecoins are at a fresh $121 billion supply. (“ERC-20,” by the way, isn’t a new Star Wars droid—it’s just the Ethereum standard. Try explaining that at Thanksgiving.) These are tokens with enough steady value you can almost hear them say, “Oy, calm down.” Dollars, euros, matzo balls—you name it, they’re pegged to it.

Why’s this supply boom a big deal? Because stablecoins get minted when people WANT them. Like menu specials during tourist season, demand means action, baby! More coins, more action, more liquidity swishing through exchanges and protocols like my uncle Irving in Vegas.

So, while the market’s more nervous than a priest at a family reunion, stablecoin supply doing sit-ups signals one thing: investors want in. Watch this space—these coins could be the canary in the crypto coalmine, or the matzo ball soup before the main event.

Dominance at 7.9%: Not Hot, Not Cold—It’s Just Right (for Now)

Let’s check the charts: stablecoin dominance is right below 8%. Not too high, not too low—just Goldilocks, minus the bears and forest break-ins. Back in 2020-2022, dominance shot up above 16% when everyone panicked. Nowadays? It’s chillin’ between 7% and 10%, like it owns the place but doesn’t want to brag.

Bouncing between the 50- and 100-week moving averages, stablecoins look steady enough to get a mortgage—7.76% and 8.02%, with a 9.3% “do not cross” sign from the 200-week mark. Interpret that how you want: the market’s not feeling wild, but it’s not hiding under the covers either.

If dominance rises, maybe everyone’s scared (again), or maybe crypto’s about to party like it’s 1929 (minus the stock market crash). Either way, one thing’s for sure—the ERC-20 stablecoin hustle isn’t slowing down. As my good friend always says, “In crypto and deli meats, freshness counts!”

🍞💰🎩

Read More

- Sony Removes Resident Evil Copy Ebola Village Trailer from YouTube

- Best Controller Settings for ARC Raiders

- Ashes of Creation Rogue Guide for Beginners

- So Long, Anthem: EA’s Biggest Flop Says Goodbye

- The Night Manager season 2 episode 3 first-look clip sees steamy tension between Jonathan Pine and a new love interest

- 10 Essential Marvel Horror Comics (That Aren’t Just Marvel Zombies)

- Elijah Wood Addresses Frodo’s Return in New Lord of the Rings Movie & Reveals More Films Are In The Works

- X-Men: Popular Professor X Fan Cast on if He’s Ever Joining the MCU

- DreamWorks’ Most Underrated Movie Just Found a New Streaming Home

- Robert De Niro’s Divisive Crime Comedy From The Fifth Element Director Finds Redemption on Free Streaming 13 Years Later

2025-07-09 04:36