Prediction markets are placing their bets on a modest rate cut at the Federal Reserve’s December pow-wow, even as the Fed folks seem to be engaged in a toddler-like battle of wills, grappling with conflicting numbers and internal squabbles.

Rate-Cut Odds Dance As Bettors React to Fed’s Sibling Rivalry and Spotty Data

Prediction markets have been laying out the welcome mat for the Federal Reserve’s Dec. 9-10 meeting. It appears the brainiacs are tipping their hats toward a modest 25-basis-point haircut, even though Fed officials seem to be playing soccer in different stadiums. Polymarket, Kalshi, and CME’s Fedwatch tool have all teetered toward expecting a tiny trim, though each platform seems to have its own style of market nerves.

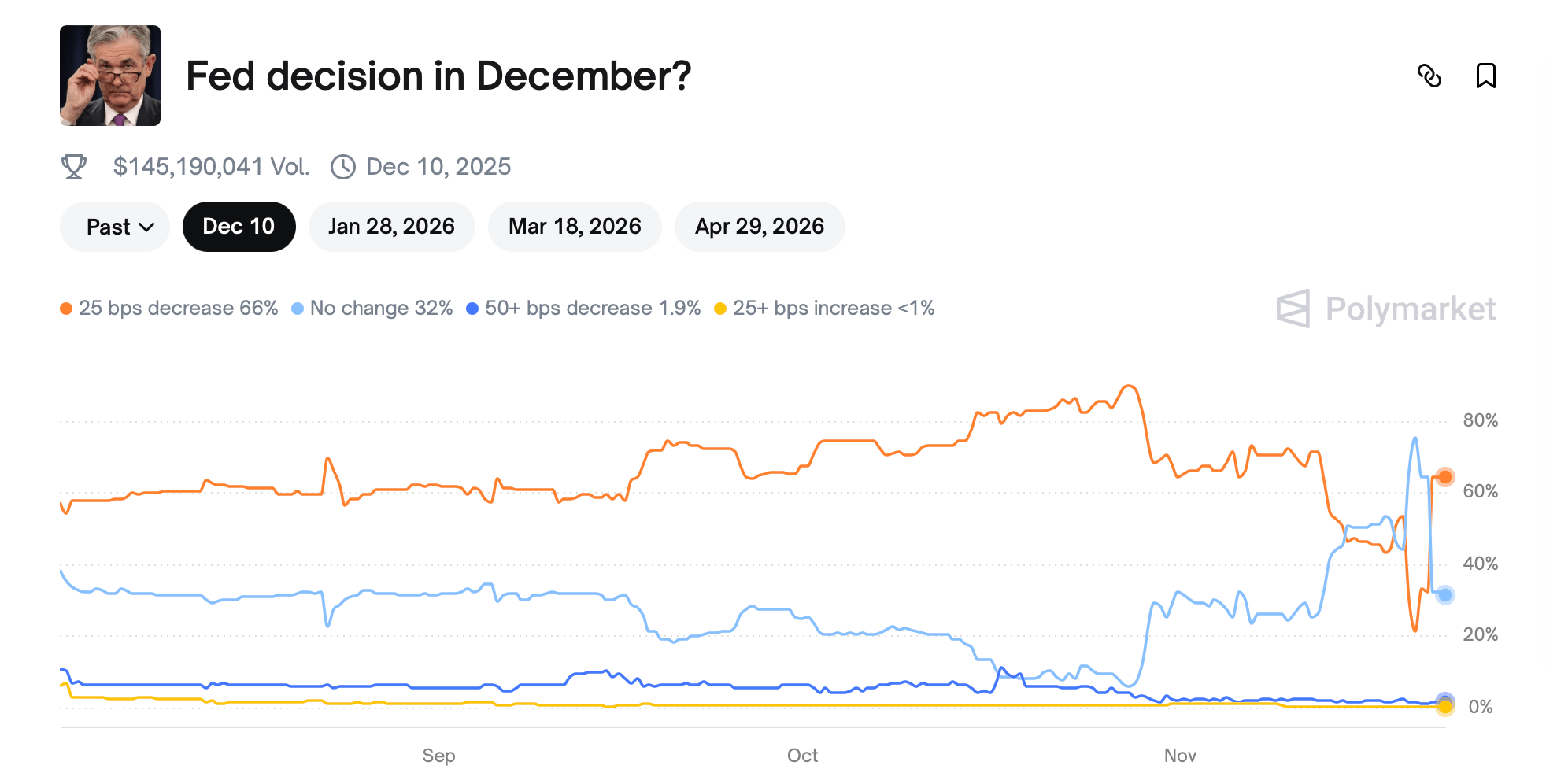

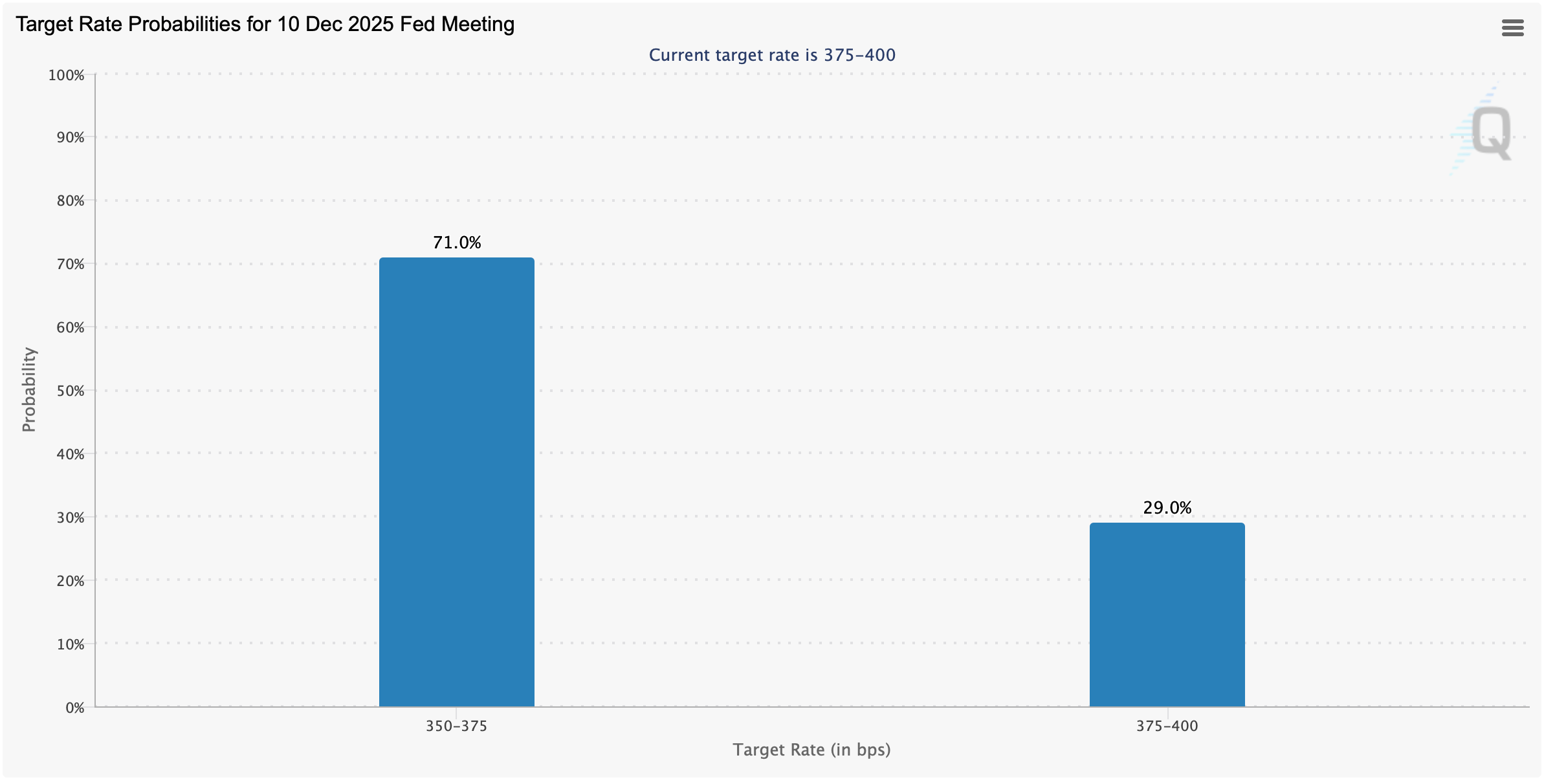

According to Polymarket data, bettors currently assign a whopping 66% odds to a 25 bps cut, compared with a 32% chance of no change and a paltry 2% for a larger-than-usual 50 bps reduction. The “25+ bps increase” market is practically comatose at under 1%, reflecting the Groupthink view that the Fed is done being mean for now. Kalshi’s market echoes that sentiment, pricing the 25 bps cut at 64%, a staunch hold at 36%, and anything larger at 3%. CME’s Fedwatch tool rounds out the porridge, showing a 71% probability that the target range will drop to 350-375 bps – a clean 25 bps snip from the current 375-400 bps band.

Underneath the shiny surface, however, the central bank is contending with what internal minutes describe as “strongly differing views,” a rare storm in a Fed teacup that makes December’s meeting a genuine coin flip. October FOMC minutes revealed a “two-sided dissent,” with one official craving a deeper cut and others opposing any pampering at all. Analysts quoted in a smattering of reports note that Chair Jerome Powell is struggling with what they call a “consensus problem,” and that bickering has spilled over into public whispers.

This friction is one reason prediction markets remain as wobbly as a newborn giraffe. Traders saw cut odds dip as low as 22% after the minutes were published – only to rebound after soothing comments from New York Fed President John Williams, who noted there is “room for rates to fall in the near term.” Conversely, Boston and Cleveland officials have argued that there is “no urgency” to cut, citing still-elevated inflation and the risk of easing too soon. With those kinds of cross-currents, it’s no wonder bettors scrutinize every speech like it’s an episode of The Bachelor.

Economic data hasn’t exactly clarified matters. Reports outline the fallout from a 44-day governmental nap, which delayed key labor and inflation updates, leaving policymakers peering in the dark on their tiptoes. September’s long-delayed jobs report revealed 119,000 jobs added but also a rise in unemployment to 4.4%, the highest since our new friend, 2021. Wage growth held at 3.8%, and private-sector trackers point to softer hiring in October. With only snippets of data available before the meeting, traders are effectively pricing a decision without much of a map.

Inflation also remains stubborn enough to embolden the hawks. September CPI registered 3%, with core at 3.1%, and core PCE is still hovering around the 2.8-2.9% zone. Officials warn “progress has stalled,” reinforcing the argument that maybe a wait-and-see stance is the saner path. All of this sets up the December meeting like a knife-edge balancing act between weakening labor signals and inflation that defies politeness.

Even so, betting markets seem to be wagering that the doves are grabbing the pole position. Both Polymarket and Kalshi show a pronounced lean toward a 25 bps cut, and CME futures traders seem to have climbed aboard. The notable divergence is in the “no change” category: while Polymarket prices it at 32%, Kalshi’s number has flown to 36%, perhaps reflecting subtle differences in how retail bettors and event-contract traders interpret the Fed’s coded messages. The small but persistent premium on “no change” likely reflects the Fed’s recent reminders that future cuts are “not a guaranteed performance.”

Market volatility has ridden every twist and turn. Stocks, bonds, gold, and bitcoin have all flinched sharply to Fed-related headlines, with rate-sensitive sectors taking the brunt of each odds swing. Traders seem keenly aware that another cut could jazz up risk assets while a hold would fortify the dollar and lay on more pressure cooker vibes for the economy. In other words: the December meeting is primed to deliver market fireworks, rain or shine.

Ultimately, the question isn’t just what the Fed will do – it’s how Powell will sell it. With data gaps lurking, inflation still toasty, and officials bickering like fraternal twins under a microscope, prediction markets may be the only consistent signals chime at the moment. And hey, at least for right now, those markets whisper that December is shaping up to be another quaint 25-point shave.

FAQ ❓

- What are markets expecting the Fed to do in December?

Most prediction platforms show higher odds for a 25-basis-point rate cut. 📉 - Why are traders favoring a cut over a hold?

Soft labor data and recent dovish comments from key Fed officials have boosted expectations for a modest easing. 🧥 - How does CME FedWatch compare to betting markets?

CME futures show similar probabilities, with more than 70% predicting a 25 bps cut. 🎲 - Why is the December decision unusually uncertain?

Conflicting data, internal Fed disagreements, and delayed government reports have made visibility especially limited. 🔮

Read More

- Sony Removes Resident Evil Copy Ebola Village Trailer from YouTube

- Ashes of Creation Rogue Guide for Beginners

- Best Controller Settings for ARC Raiders

- Can You Visit Casino Sites While Using a VPN?

- New Look at Sam Raimi’s Return to Horror After 17 Years Drops Ahead of Release: Watch The Trailer

- Marvel Wants You to Believe Wolverine Is the Greatest Anti-Hero (But Actually He’s the Worst)

- Michael B. Jordan Almost Changed His Name Due to NBA’s Michael Jordan

- The Night Manager season 2 episode 3 first-look clip sees steamy tension between Jonathan Pine and a new love interest

- Lies of P 2 Team is “Fully Focused” on Development, But NEOWIZ Isn’t Sharing Specifics

- Crunchyroll Confirms Packed Dub Lineup for January 2026

2025-11-23 04:00