Bitcoin, that shimmering mirage of modern finance, has been flirting with disaster below the $90,000 mark since last week. It now clings to stability like a drunkard to a lamppost, while selling pressure molds market sentiment into something resembling a Greek tragedy. The recent nosedive from the cycle’s zenith has left bullish traders clutching their pearls, their confidence evaporating faster than champagne at a debutante ball. Analysts, who mere weeks ago were heralding new all-time highs, now whisper of bear markets like villagers foreseeing a plague.

The broader market, ever the magnifying glass, has amplified these woes. Momentum has turned tail, liquidity has withered, and buyers are as scarce as a sober guest at a Wildean soirée. Bitcoin, in its search for support, now hovers precariously around the high-$80K region. Investors, ever the eternal optimists, watch with bated breath to determine whether this decline is a harbinger of doom or merely a temporary hiccup in the grander scheme of things.

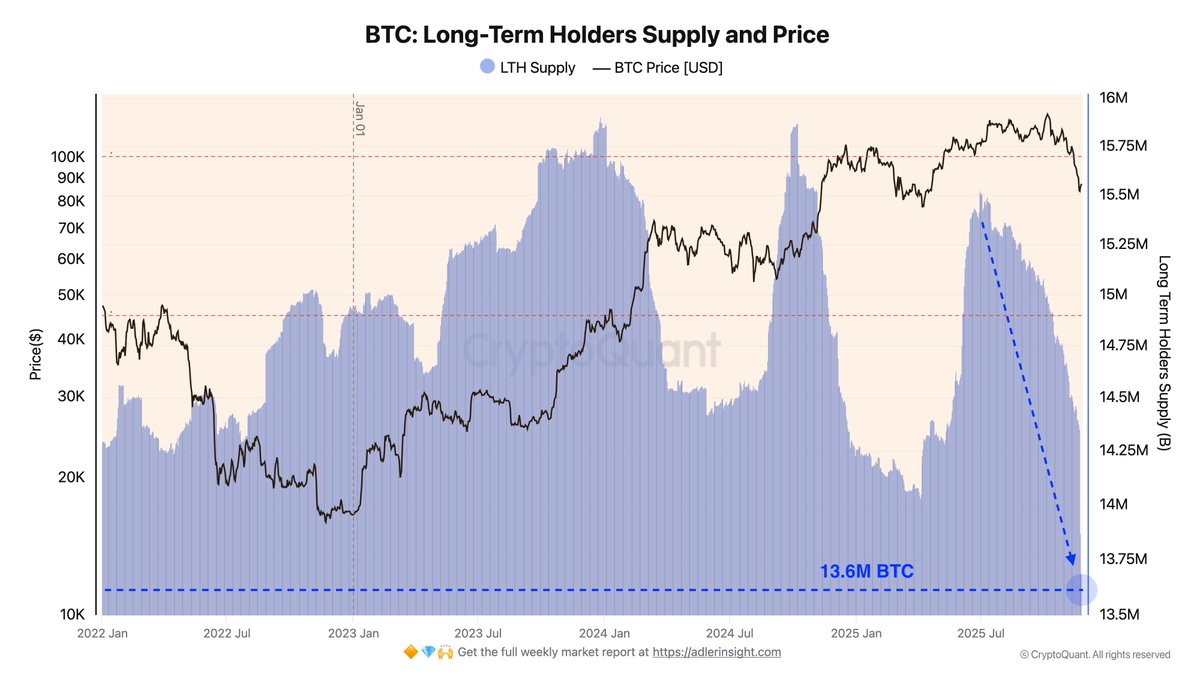

Enter Axel Adler, the soothsayer of the hour, who declares that Long-Term Holders (LTH) have been the architects of this downturn. With the precision of a seasoned auctioneer, he reveals that this cohort has conducted the largest profit-taking event of the cycle, shedding 1.57 million BTC as prices tumbled toward $80,000. Such a massive exodus, Adler warns, has historically signaled exhaustion phases and late-cycle tops-essentially the death knell for Bitcoin’s bull run.

Long-Term Holders: Masters of the Great Escape

Adler, ever the bearer of grim tidings, highlights that LTHs are engaging in a frenzy of profit-taking unseen since early 2023. His data paints a bleak picture: the 30-day Net Position Change reflects one of the deepest sell-offs of the entire bull cycle. LTH supply has plummeted from 15.75 million BTC to a measly 13.6 million BTC-the lowest since the cycle began. Adler, with the gravitas of a man who has seen too much, notes that this behavior mirrors the smart-money distribution phase typical of major market tops.

In just two weeks (November 11-25), LTHs offloaded 803,399 BTC, a staggering 5.54% drop averaging 53,560 BTC per day. Such aggressive coin dumping has historically only occurred during major inflection periods, leaving the market gasping for air.

Adler draws comparisons to previous extremes-March 2024, following the $73,000 all-time high sell-off, and October 2024, when Bitcoin corrected from the ATH toward $85,000. The current phase, however, is marked by a level of ruthlessness that suggests the cycle is teetering on the edge of collapse. Unless new demand emerges to absorb the sell-side volume, Bitcoin’s fate seems as sealed as a coffin.

Bitcoin: A Fallen Titan Struggles to Rise

Bitcoin’s daily chart tells a story of desperation. After a precipitous fall from the $120K region to a recent low near $80K, it now hovers around $86,800-a feeble attempt at a relief bounce. Yet, the broader trend remains as bearish as a sailor’s hangover. Price languishes below the 50-day, 100-day, and 200-day moving averages, all of which slope downward like a ski run after a fresh snowfall.

Volume spikes during the selloff suggest forced liquidation and capitulation-driven selling, while the recent bounce occurs on lighter volume, hinting at buyer apathy. For bulls, the key question is whether Bitcoin can muster the strength to build a base above $85K. Failure to do so could unleash another wave of selling, dragging prices toward $78K or even $72K-a prospect as cheerful as a tax audit.

Read More

- Sony Removes Resident Evil Copy Ebola Village Trailer from YouTube

- Best Controller Settings for ARC Raiders

- Ashes of Creation Rogue Guide for Beginners

- Can You Visit Casino Sites While Using a VPN?

- AKIBA LOST launches September 17

- New Look at Sam Raimi’s Return to Horror After 17 Years Drops Ahead of Release: Watch The Trailer

- One Piece Just Confirmed Elbaph’s Next King, And He Will Be Even Better Than Harald

- The Night Manager season 2 episode 3 first-look clip sees steamy tension between Jonathan Pine and a new love interest

- Michael B. Jordan Almost Changed His Name Due to NBA’s Michael Jordan

- Lies of P 2 Team is “Fully Focused” on Development, But NEOWIZ Isn’t Sharing Specifics

2025-11-27 05:12