Hold onto your eggnog, folks-traders are practically singing carols about a December rate cut, with odds skyrocketing faster than holiday shopping stress. Who knew that financial forecasts could be as predictable as Santa’s naughty or nice list? 🎅📉

December 25bps Cut Now the Market’s Undeniable Favorite (Sorry, No Contest)

Prediction platforms are now basically shouting from the rooftops that a 25-basis-point cut is happening, turning what was once cautious whispering into the financial world’s equivalent of a holiday blockbuster. Move over, Christmas movies, there’s a new blockbuster in town: Fed rate cuts! 🎬💰

Polymarket’s main contract sees a jaw-dropping 84% chance of the Fed trimming rates, up from 66% just five days ago. The dissent tracker shows a 63% chance of a 25-bps cut with more than two dissidents-definitely not your average family dinner table debate. Meanwhile, the “no change” camp is now out in the cold with 12-16%, like that awkward relative you avoid at parties. 🎄🤷♂️

Kalshi is waving the same flag, also pegging the odds at 84%. They’re basically saying, “Hey, U.S. traders, go ahead, carve that turkey-because we’re all about that rate cut life.” Only an 18% chance of keeping things as-is. Who needs dinner when you’ve got a rate cut to celebrate? 🦃📉

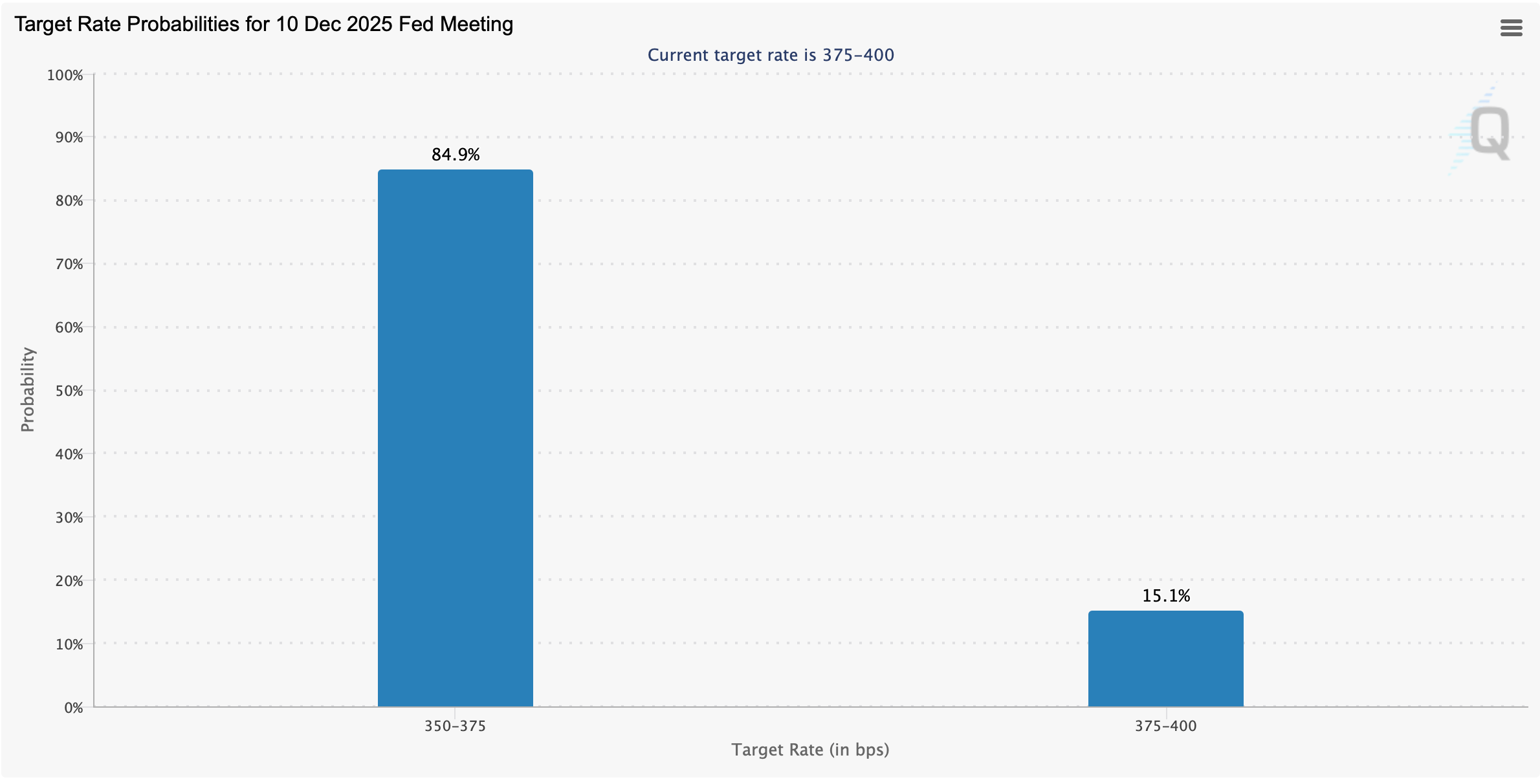

Meanwhile, the CME’s Fedwatch Tool is practically shouting from the rooftops that there’s an 84.9% chance of shifting the target down to 350-375 basis points-fancy talk for “Yes, we’re cutting.” Only 15.1% are still clinging to the hope of no change, as if they’re stuck at the bottom of a clearance sale. Last week’s 71% prediction has now doubled down-it’s all about that cut, baby! 🛍️📉

Across the board, the message is loud and clear: despite the months of mixed signals (and the occasional policy tantrum), the markets are now confidently marching towards a modest rate trim-probably with some pie and perhaps a splash of sarcastic optimism. With liquidity, holiday cheer, and macro uncertainty simmering like grandma’s secret sauce, a standard quarter-point cut feels as unavoidable as Uncle Bob asking for a second serving. 🎅🤷

Will the Fed play Santa and give us what we expect? Only time will tell-but today, markets are rubbing their hands together in anticipation, betting early and often, with plenty of stuffing and confidence on the side. 🦃📉

FAQ ❓

- What are traders expecting for the December Fed meeting? Most prediction markets are betting an 84% chance of a 25-basis-point cut-because who wouldn’t want to cut rates before the holiday feasting? 🎁

- How does CME FedWatch compare? FedWatch sees the odds at about 85%, so they’re basically saying, “Yeah, it’s happening.”

- Are rate-hold odds still in the running? Sure, but they’re slipping into single digits, like that leftover fruitcake nobody wants. 🧁

- Which platforms are fuelling this enthusiasm? Polymarket, Kalshi, and CME FedWatch-think of them as the holiday chorus singing “Rate Cut!” in perfect harmony.

Read More

- Sony Removes Resident Evil Copy Ebola Village Trailer from YouTube

- Best Controller Settings for ARC Raiders

- Ashes of Creation Rogue Guide for Beginners

- Can You Visit Casino Sites While Using a VPN?

- The Night Manager season 2 episode 3 first-look clip sees steamy tension between Jonathan Pine and a new love interest

- Holy Hammer Fist, Paramount+’s Updated UFC Archive Is Absolutely Perfect For A Lapsed Fan Like Me

- 10 Essential Marvel Horror Comics (That Aren’t Just Marvel Zombies)

- 40 Inspiring Optimus Prime Quotes

- Gandalf’s Most Quotable Lord of the Rings Line Hits Harder 25 Years Later

- 9 years after it aired, fans discover a Dr Who episode absolutely copy-pasted a Skyrim dragon PNG from a wiki for some background VFX

2025-11-27 19:58