Who knew Ethereum could be so quiet? While the price flutters like a caffeinated hummingbird, the real drama is happening in the shadows-Spot Ethereum ETFs stacking ETH like I stack old sweaters in my closet. “This is a crucial shift,” they say. Sure, if by “crucial” you mean “meh but with spreadsheets.”

Smart Money Moves Quietly Via Ethereum Spot ETFs

The crypto market is back to its bullish routine, and Ethereum is playing the part of the overachieving cousin at a family reunion. Yes, the price isn’t screaming, but the on-chain data? It’s whispering secrets while ETFs hoard ETH like squirrels in a blockchain forest. “Subtle,” they said. “Consistent,” they said. I’m not convinced either of them owns a mirror.

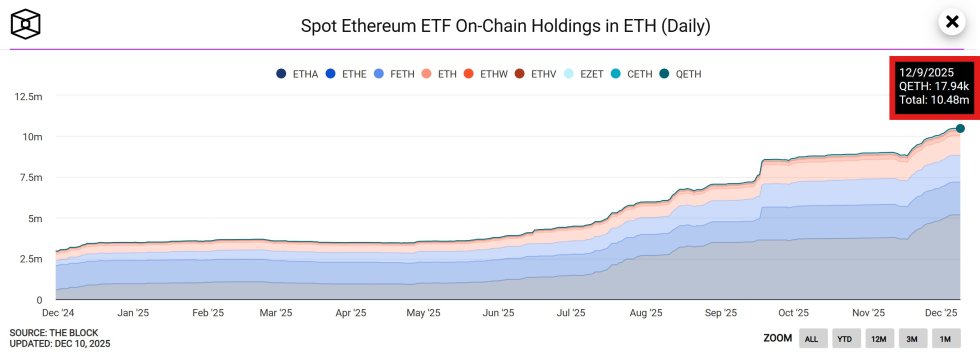

Everstake.eth, the Ethereum guru who probably knows more about gas fees than his own tax bracket, claims ETFs are amassing ETH at “unprecedented levels.” Translation: someone finally stopped buying Bitcoin and remembered Ethereum exists. With 10.48 million ETH hoarded so far, it’s less “buy the dip” and more “bury it in a vault and forget about it.”

“The future is bullish, and the future is Ethereum,” Everstake declared. If the future looks like a 10-figure ETH hoard and a CEO in a puffer vest, count me in. But let’s not confuse accumulation with a party invitation-this is more of a “we’re all going to die” vibe with better math.

Meanwhile, the Funding Rates are cooling down like lukewarm soup. Is this a bad sign? Not necessarily. It’s just the crypto version of “I’m not mad, I’m just disappointed.” According to Sina Estavi, CEO of Bridge Capital, this is the calm before the next rally. Or, as I call it, “the phase where we all panic and sell.”

When funding resets without aggressive shorting, it’s like saying, “Hey, maybe we’re not all irrational lunatics after all.” But let’s not get ahead of ourselves-until ETH gets a second date, we’ll just keep pretending this is a bull market.

Institutional Demand For ETH Is Returning

Ethereum’s sideways price isn’t stopping institutions from playing “let’s make this look like we care.” Bitmine Immersion, led by Tom Lee (who I’m sure has a LinkedIn profile that reads “Blockchain Whisperer”), is buying ETH like it’s the last bagel at Zabar’s. Over 138,452 ETH? That’s not a purchase-it’s a hostile takeover in loafers.

With $12.05 billion in ETH and $1 billion still to spend, Bitmine’s crypto hoard now rivals the budget of a small country. Or, as my mom would say, “Why not buy a house?” But hey, at least their vaults won’t flood.

Read More

- Best Controller Settings for ARC Raiders

- Gwen Stefani Details “Blessing” of Her Holidays With Blake Shelton

- Bitcoin’s Mysterious Millionaire Overtakes Bill Gates: A Tale of Digital Riches 🤑💰

- Binance & Trump’s Crypto Ventures: A Tale of Stablecoins & Paradoxes 😏💎

- How to Froggy Grind in Tony Hawk Pro Skater 3+4 | Foundry Pro Goals Guide

- Embracer Group is Divesting Ownership of Arc Games, Cryptic Studios to Project Golden Arc

- How to Get to Heaven from Belfast soundtrack: All songs featured

- The $35 Million Crypto Crime: Ex-CFO’s Greed Backfires Spectacularly

- 5 Reasons Naoya Zenin Just Became Jujutsu Kaisen’s Most Hated Character

- Primal Season 3 Is the Best Season of the Adult Swim Show Yet (Review)

2025-12-11 21:35