As the sun flirtatiously embraces Sunday, July 13, 2025, Bitcoin’s price tantalizingly lingers around a sumptuous $118,077—a veritable ball where the market capital waltzes in at a princely $2.34 trillion and the trading volume pirouettes at a plush $20.09 billion. Such an exquisite affair, marked by a mere $1,086 stretch between $117,103 and $118,189, suggests that our Bitcoin is currently engaged in an intimate, albeit high-stakes, consolidation with resistance looming like an over-dramatic character in a Shakespearean comedy!

Bitcoin: The Dapper Rogue

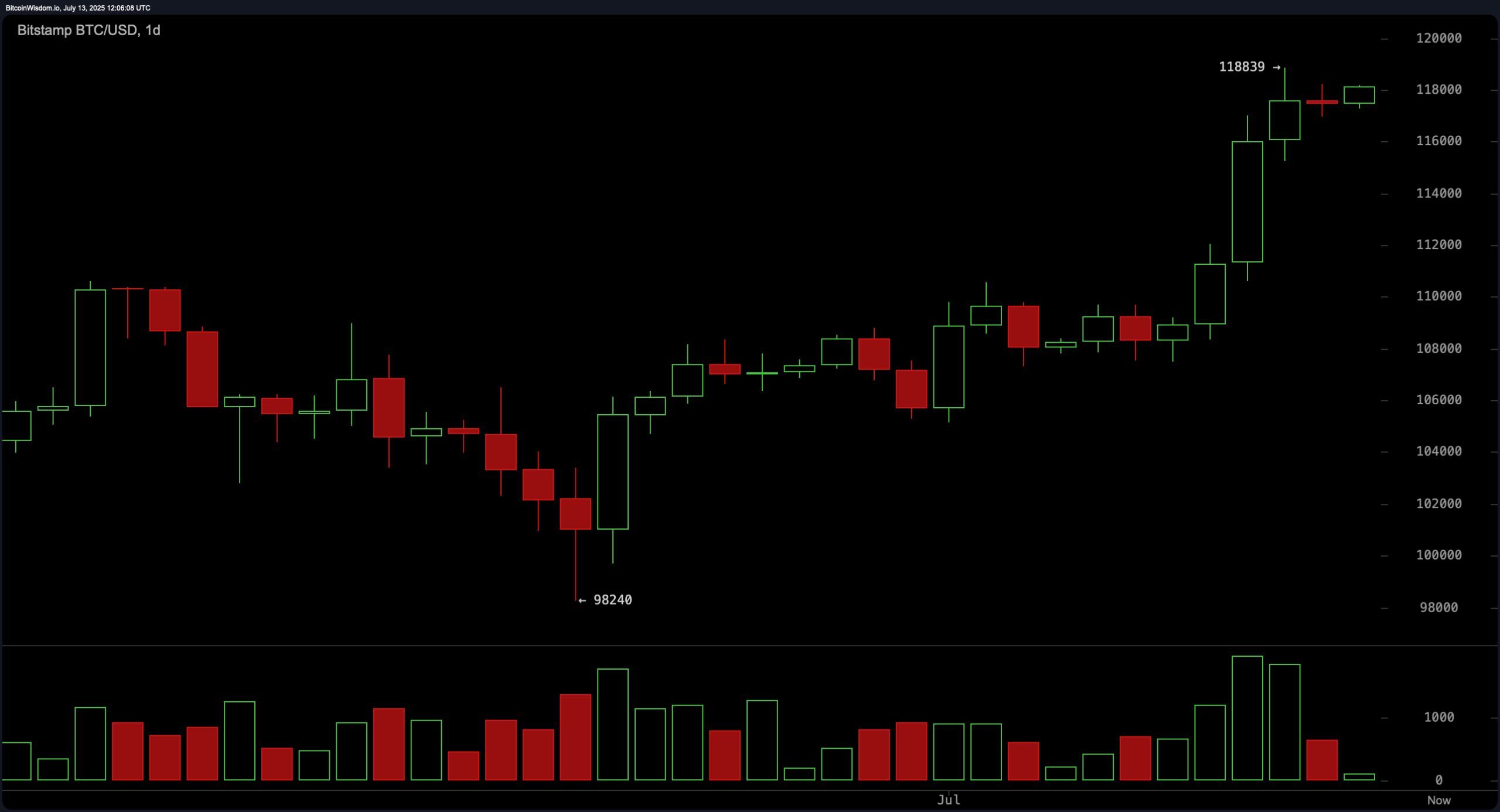

Gazing upon the splendid daily BTC/USD chart, one can witness a magnificent bullish breakout from a rather dismal $98,240 low, a raucous rise reaching an extravagant $118,839 before hitting the proverbial brakes. This upward gaiety finds its foundation in the bountiful volume of yesteryear, but alas! Recent movements whisper tales of waning momentum, perhaps signaling a distribution phase even as our gallant price action settles comfortably near the peaks. Support has reestablished itself most genteelly between $110,000 and $106,000. Fancy a ‘buy-the-dip’ opportunity at the $110,000 to $112,000 range? It may just require a romantic bullish reversal candle and a voluminous swoon to seal the deal! Profit-seeking creatures, take heed! Near the $118,500 to $119,000 soiree, particularly if bearish reversal patterns decide to crash the party.

Meanwhile, the 4-hour escapade reveals Bitcoin gallantly strutting its stuff from a lowly $107,500 to a majestic high of $118,839, thereafter indulging in a languorous lateral consolidation. The formation is reminiscent of a bullish flag or perhaps a gallivanting ascending triangle, both teasing the notion of upward continuation. Should it soar beyond $118,839 with the vigor of a caffeinated courtier, we may be galloping towards $120,000 or more! Should it fall below $117,000, however, we might prefer to retreat to a cozy $115,000, casting aside our bullish dreams. Breakout traders, sharpen those wits and ready your quills for swift decisions!

Our charming 1-hour tableau discovers a minor double top near $118,200, and a reactive low at $116,971—ah, the drama of market dynamics! Momentum appears to be faltering; the price feels tender, and volume is skipping away. Key resistance cavalierly saunters between $118,200 and $118,800, while immediate support valiantly stands at $117,000. Should we break above $118,200 with a sprightly rise in volume, the stage may be set for short-term merry-making. A bullish bounce at $117,000 could invite scalpers to the dance floor. Traders, keep your wits about you, with stop-loss levels snugly positioned around $116,500—as a prudent gambler never forgets their marbles!

Ah, the oscillator readings parade forth with a delightfully mixed technical bias! The relative strength index (RSI) courts a suave 74, Stochastic flaunts its 92, and the average directional index (ADX) dons a most neutral 20. Yet, the commodity channel index (CCI) at 186 and momentum (10) at 8,512 offer bearish whispers of impending overextension. Still, the moving average convergence divergence (MACD) at 2,832 winks with a bullish salutation. Such are the mixed signals of our market—a delightful tapestry where the broader trend remains entwined, yet caution serves as a watchful companion.

Onward to moving averages (MAs) which staunchly uphold the bullish trend across all timeframes. The exponential moving average (EMA) and simple moving average (SMA) are as ever diligently positioned below the current price, valiantly supporting the upward thesis. The EMA (10) at $113,545 and SMA (10) at $112,323 perform their duties of strong near-term support with aplomb. Long-term trend strength is reaffirmed with the EMA (200) at $96,660 and SMA (200) at $96,999, suggesting that even a fall to the $110,000 region could present tantalizing reentry moments for the more daring traders.

Bull Verdict:

Bitcoin, that resilient darling, sways elegantly through the market, buoyed by robust support from its moving averages. A confirmed breakout above $118,839, empowered by volume, would set forth a delightful romp toward $120,000 and beyond, a veritable playground for momentum-seeking consorts!

Bear Verdict:

Yet, despite its dominion in the uptrend, the wisps of caution flutter near resistance, served by the commodity channel index (CCI) and momentum indicators that chide us about buyer fatigue. Should Bitcoin falter in its conquest of $118,839 and retreat below $117,000, the scene may shift dramatically towards a corrective descent in the realm of $115,000 to $110,000—clever strategists might seize upon such conditions to craft short-term bearish trades.

Read More

- Best Controller Settings for ARC Raiders

- Gold Rate Forecast

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- How to Build a Waterfall in Enshrouded

- How to Get the Bloodfeather Set in Enshrouded

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Meet the cast of Mighty Nein: Every Critical Role character explained

- Assassin’s Creed Black Flag Resynced, The Worst-Kept Secret in Gaming, Rated by PEGI

- 10 Manga With the Best Art, Ranked

- Jamie Chung Reveals Why She & Bryan Greenberg Love Thanksgiving

2025-07-13 15:58