- Bonk, Pepe, and Hedera had the biggest gains in the past week.

- Ethena, Nervos Network, and Ronin were the biggest losers for the week.

As a crypto investor, I’ve noticed some intriguing movements at the summit of the gainers’ chart. Two memecoins have particularly impressed me with their substantial price increases. On the other hand, an asset that saw a sudden surge due to misunderstandings has held on to a portion of its profits.

On the other hand, an asset that appeared on the losing chart experienced a “jittery” downturn during the previous week.

Biggest winners

Bonk

As a researcher studying the cryptocurrency market, I found that upon examining Bonk [BONK] closely, its start to the week was less than ideal. Analyzing its price trend revealed an initial drop in value, with the coin trading at approximately $0.000020 to begin the week.

I analyzed the price trend of the asset throughout the past week and noticed a substantial upward movement. The peak price reached an impressive $0.00029 during the trading session on 25th April. Concluding the week, the asset was trading around $0.00025.

Based on information from CoinMarketCap, Bonk experienced the greatest percentage increase during the past week, amounting to more than 28.4%.

At the point of composition, the asset was priced approximately at $0.000027, while its market value exceeded $1.7 billion. Over the past week, there was a significant rise of more than 10% in its market capitalization.

Pepe

Over the last week, PEPE, yet another popular meme token, observed a substantial surge in worth. Based on CoinMarketCap’s data, this digital asset registered the second most notable price rise, boasting an impressive advancement of more than 26.5%.

I noticed that AMBCrypto’s price behavior this week bore a resemblance to BONK‘s. At the start of the week, its value hovered around $0.0000059, which was not an auspicious sign.

By the end of the week, the price had picked up steam, reaching approximately $0.0000070.

The market analysis shows that the company’s value grew by more than 8% as a result of the price rise, amounting to around $3.2 billion when last checked.

As a market analyst, I’ve observed that Pepe, at the moment of penning this analysis, was exhibiting a rise in price. This upward trend suggests that the positive momentum for Pepe is persisting.

Hedera

Hedera (HBAR) recorded a significant surge over the last week, registering a nearly 19% growth based on available data.

The price hike during that week was quite remarkable and primarily caused by uncertainty regarding its relationship to Blackrock.

According to AMBCrypto’s assessment of the daily chart, HBAR kicked off the week by climbing approximately 3%, reaching roughly $0.089 in value.

On April 23rd, there was a significant price jump for HBAR, with over a 73% increase, peaking at around $0.15. The cause of this rise can be linked to the latest news about tokenization efforts by Blackrock.

Despite a significant drop, the price fell by more than 20% on the 24th of April, reaching a new low of $0.12. By the close of that week, it had further decreased to approximately $0.10.

As a crypto investor, I’ve noticed that despite taking a hit this past week and ranking third from the bottom, HBAR has managed to bounce back slightly. At present, its price hovers around $0.10 in the market.

The company’s market capitalization exceeded $3.8 billion, but it had dropped by more than 1.7% when this was penned down.

Biggest losers

Ethena

As a researcher studying the cryptocurrency market, I discovered that Ethena (ENA) started the week with a trading price approximately equal to 1.05 US dollars. However, my analysis unfortunate reveals that its value took a downturn following this initial point.

Based on information from CoinMarketCap, this cryptocurrency experienced a significant drop of approximately 22% during the last seven days. Consequently, it held the position of the greatest weekly loss and was priced at roughly $0.82 by the end of the week.

As I pen this down, Enara Technologies (ENA) was hovering around $0.86 in trading, signaling a promising start to the fresh week. Additionally, its market value surpassed $1.2 billion, marking a substantial rise of more than 4%.

Nervos Network

As a researcher, I’ve noticed that for the second week in a row, Nervos Network [CKB] has emerged as one of the top contenders for the title of “biggest weekly loser.”

As a crypto investor, I’ve noticed that according to CoinMarketCap, I suffered one of the greatest weekly setbacks with my investment in CKB. The token experienced a nearly 19% drop in value.

On April 21st, the price of CKB opened at approximately $0.02. However, as the day progressed, its value dipped and ended around $0.019 by the close of trading.

It further declined to around $0.017 by the end of the week.

When I penned this down, the company’s market value stood at roughly $784 million, while its share price began the fresh week at around $0.018.

Ronin

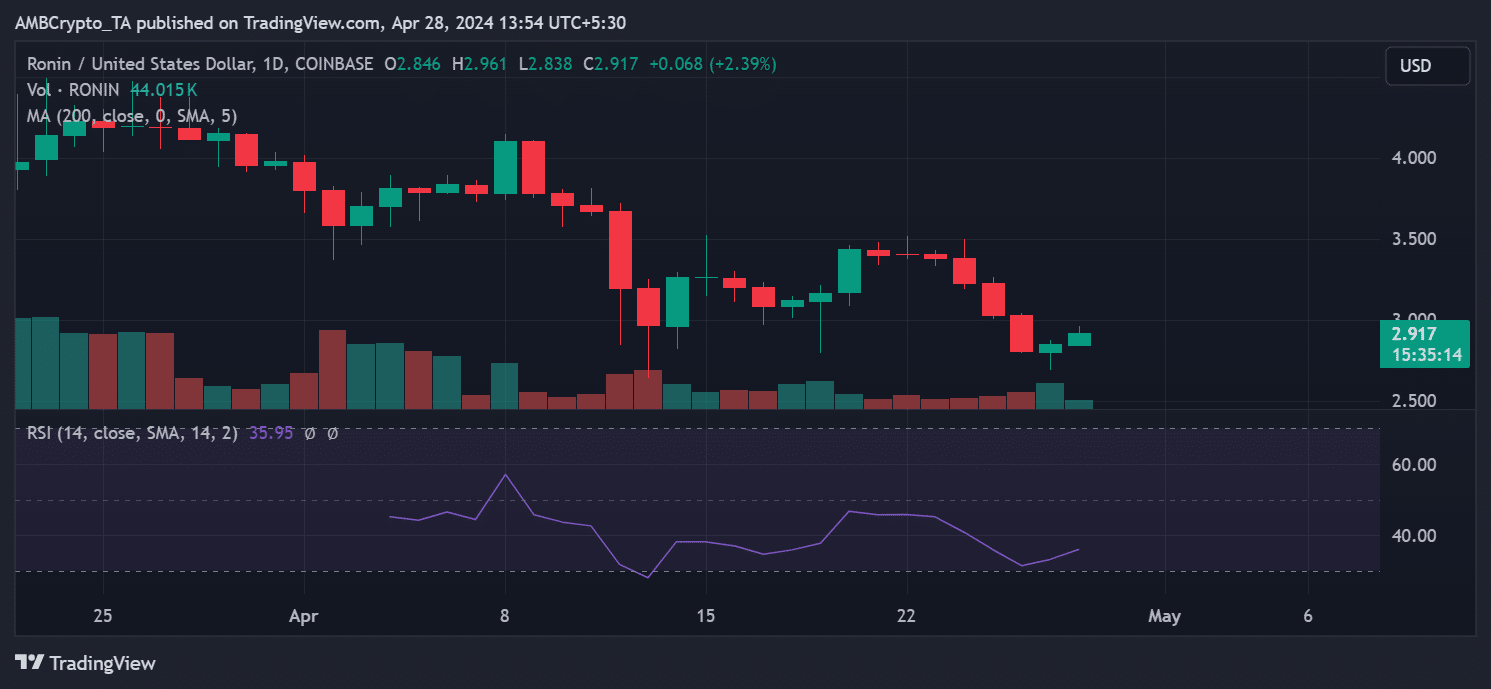

The analysis conducted by AMBCrypto on Ronin’s (RON) daily timeframe chart indicated a succession of losses during the last seven days, leading to a significant decrease of more than 15%. Consequently, RON took the third spot among the weekly market losers.

As a researcher analyzing the data from AMBCrypto’s chart, I observed that the downward trend began on April 21st, with the week ending at approximately $3.39.

By the 26th of April, the price had dropped to approximately $2.80, representing a decrease of more than 7%.

On the 27th of April, there was a notable rise of more than 1.5% in its price, pushing it approximately to $2.84.

As a crypto investor, I’ve experienced a disappointing situation where a recent price surge failed to make up for the six consecutive daily losses that resulted in a 15% decrease in value.

When I penned down these words, the market condition as per Relative Strength Index (RSI) showed a significant downtrend with a reading below the 40-mark. On the other hand, its market capitalization surpassed an impressive figure of over $919 million.

Conclusion

In this week’s market summary, let’s examine which stocks experienced significant gains and losses. Keep in mind the market’s inherent volatility, meaning prices are prone to swift fluctuations.

Thus, it is best to do your own research (DYOR) before making any investment decisions.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-04-28 21:28