- Resistance at $3,353 could force ETH to decline to $3,120.

In the midterm, the price might fail to surpass $4,000.

Ethereum’s (ETH) surge to $3,300 on April 28 brought optimism back to the crypto market, but according to AMBCrypto’s analysis, this excitement might be short-lived. One reason for this prediction is a recent transaction where a large amount of ETH was sent to Coinbase exchange. While we don’t know who made the transfer, it could lead to sales and halt the price increase.

The price surge of Ethereum [ETH] to reach $3,300 on the 28th of April brought renewed hope to the cryptocurrency market. Yet, as per AMBCrypto’s assessment, this elation among investors might prove fleeting.

A possible explanation for this forecast might be connected to a previous financial move. Early in the same day, a person transferred 14,999 Ether coins to Coinbase for exchange.

Although it’s unknown who specifically carried out the transaction, it may influence Ethereum’s price due to a significant amount of coins being transferred to an exchange, which often results in selling.

Also, depending on the volume, the sale could stop the value from moving higher.

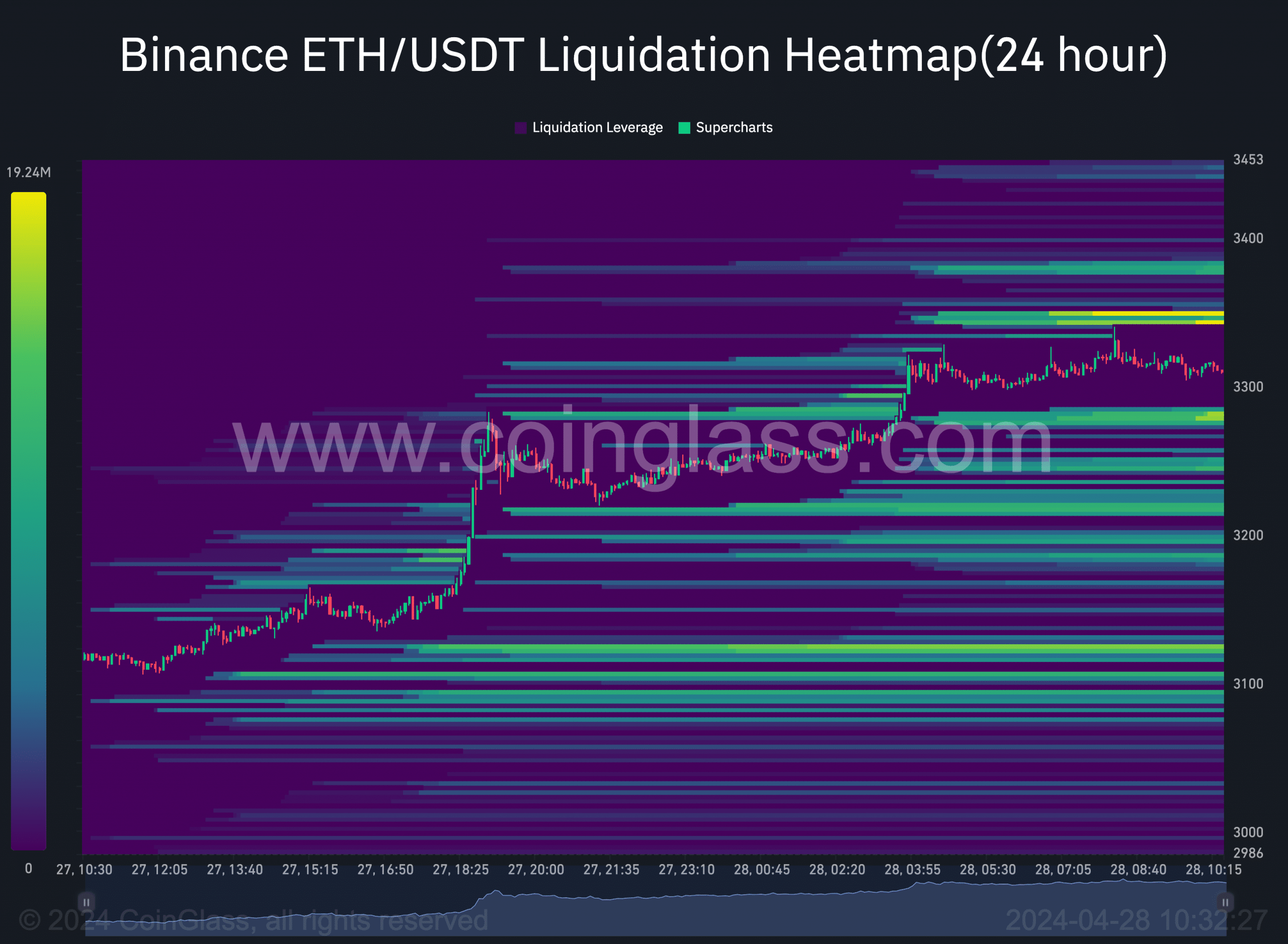

High liquidity comes with resistance

Hence, it could be that ETH’s surge in the last 24 hours was a false breakout.

A false breakout in the context of cryptocurrencies is when the price tries to breach a resistance level but ultimately fails to sustain the upward trend.

Based on the current information alone, jumping to this conclusion could appear premature. To gain a more comprehensive understanding, AMBCrypto chose to explore additional aspects of the altcoin market.

As a crypto investor, I closely monitored the liquidation heatmap to gauge market conditions. This tool provides valuable insights into the level of liquidity within the order book for various cryptocurrencies. In simpler terms, it allows me to keep tabs on where large orders are placed and potentially impact the market.

Though that very same marker plays a pivotal role in signaling potential support and resistance levels, the graph indicates a significant accumulation of market activity around the price point of $3,353.

As a seasoned crypto investor, I’ve noticed that larger transactions in the Ethereum market can often be executed at favorable prices. However, once these orders hit the market and disrupt the liquidity, there’s a strong possibility of a price reversal. Consequently, the $3,353 level may serve as a resistance point for Ethereum.

$4K is not close

After reaching the stated price, there’s a possibility that the value of Ethereum could decrease. Yet, the significant support was found at $3,276, suggesting Ethereum may not fall beneath that price point.

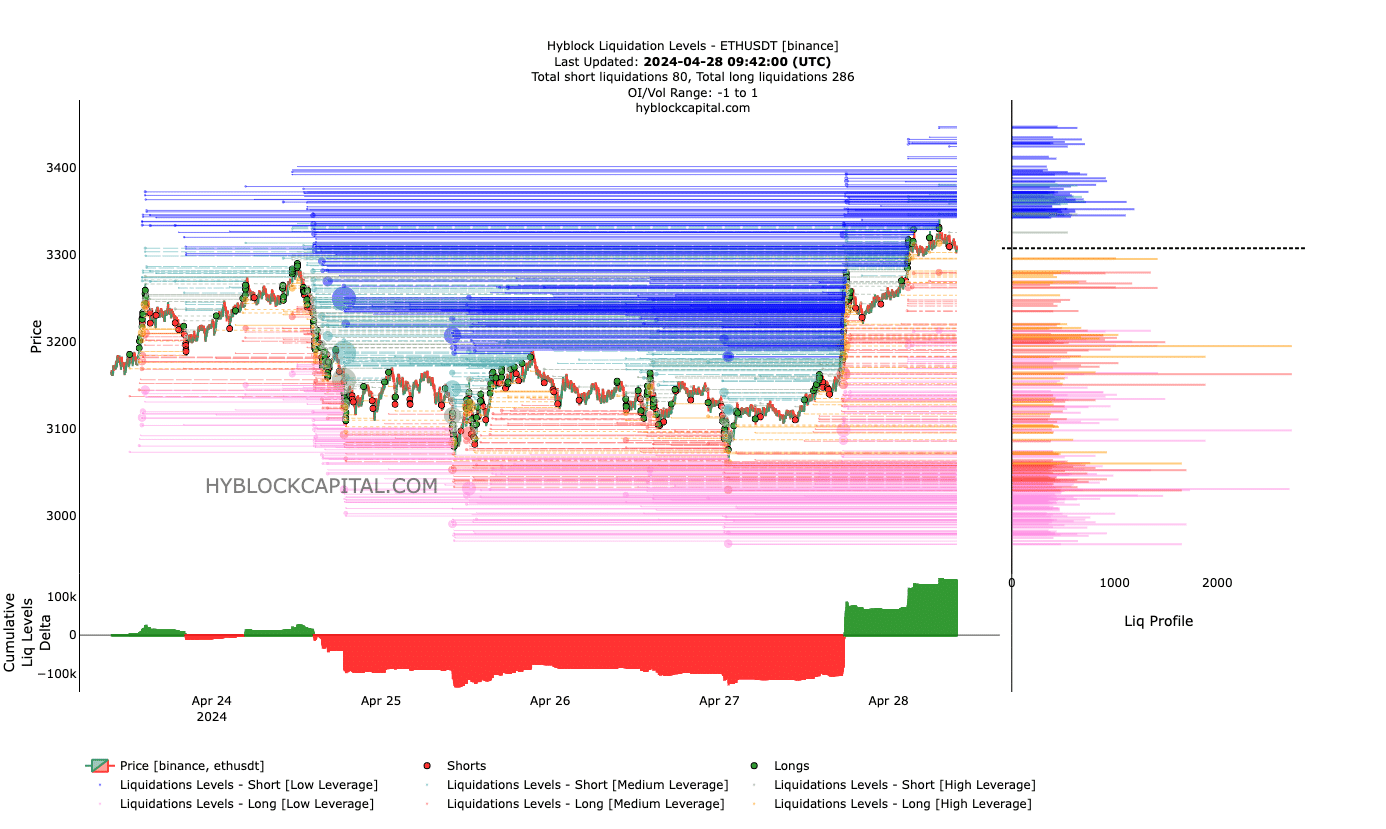

In the following segment of our analysis, we focused on the Cumulative Liquidation Levels Delta (CLLD). A positive value for CLLD signifies a greater number of open long positions being liquidated.

In contrast, a negative Composite Length of Cumulative Distribution (CLLD) implies that there were more short liquidations than long ones in the market. At present, the CLLD is positive. However, it’s essential to note that this indicator can influence pricing trends as well.

Using the indicated position at the press time, the CLLD signaled a potential complete reversal for Ethereum. If this occurs, the value of the cryptocurrency could potentially fall to $3,120.

For now, the cryptocurrency’s price may remain above the $3,300 mark for an extended period. Yet, it’s unlikely that this rise will propel ETH all the way up to $4,000.

Based on our evaluation, the market seemed insufficiently powerful to justify such a significant increase. Furthermore, it may be premature to anticipate that the altcoin would exceed its previous record high in the near future.

Read More

- BRETT PREDICTION. BRETT cryptocurrency

- PHB PREDICTION. PHB cryptocurrency

- VINU PREDICTION. VINU cryptocurrency

- Top gainers and losers

- ARPA PREDICTION. ARPA cryptocurrency

- TANK PREDICTION. TANK cryptocurrency

- SUPER PREDICTION. SUPER cryptocurrency

- MFER PREDICTION. MFER cryptocurrency

- ETH PREDICTION. ETH cryptocurrency

- GST PREDICTION. GST cryptocurrency

2024-04-28 23:03