- Prudent Bitcoin traders might want to stay sidelined instead of bidding.

- A drop below the local low could send prices careening lower by close to 15%.

As an experienced analyst, I believe that caution is warranted for Bitcoin traders at this point in time. The recent price drop of around 7.5% from the local high is a cause for concern, especially when considering the historical patterns following the Bitcoin halving.

Bitcoins [BTC] value took a hit, decreasing by 7.46% from its previous peak reached on April 30. Currently, it is being exchanged slightly above $59,900, hovering near the support level between $59,200 and $61,000.

However, according to crypto-analyst Rekt Capital, Bitcoin is not yet out of the danger zone.

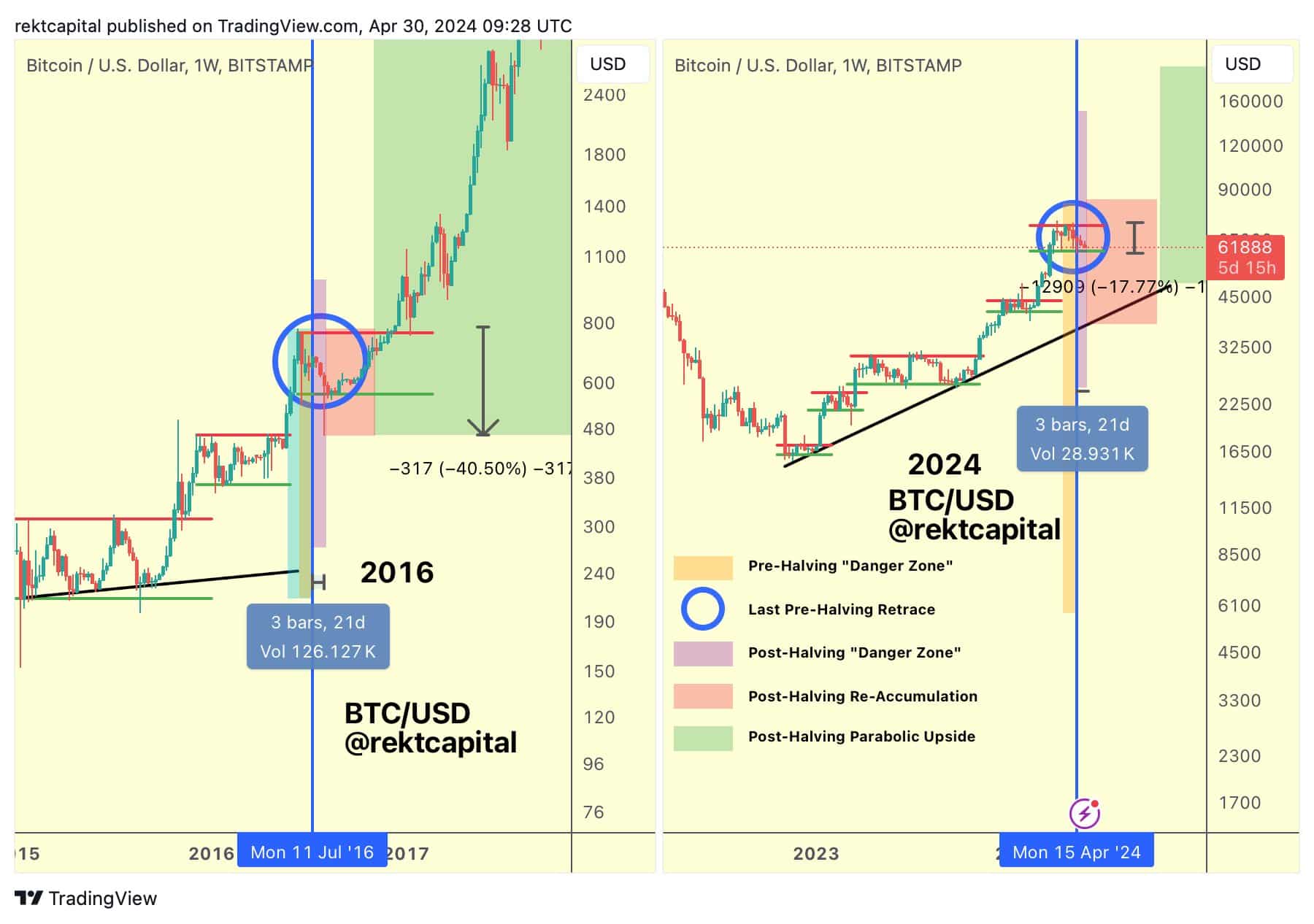

One potential way of paraphrasing this statement could be: An analyst examined the recent Bitcoin price trend following the halving event, drawing parallels with the market behavior during similar periods in 2016 and 2020. Though history may not follow an identical path, it often exhibits comparable patterns.

Are we close to the bottom?

According to RektCapital’s analysis, the price trend following the 2024 bitcoin halving was more akin to the pattern observed in 2016 than in 2020. In the previous instance, a significant 11% price drop transpired approximately 21 days post-halving.

If the same were to repeat, we could expect BTC prices to plunge to $52k.

In the past two months, the $60,000 mark has served as a robust support level. Nevertheless, with each subsequent test of this support, its strength seems to wane. It’s possible that this could be the wave that ultimately breaks through this barrier.

Until it does, buyers could look to buy the dip.

Walking the tightrope of trading at this $59k mark is a challenging feat for most traders. They may opt to remain on the sideline, biding their time for a favorable response before making a move. Alternatively, they might choose to sell short once the price drops below the $59k threshold.

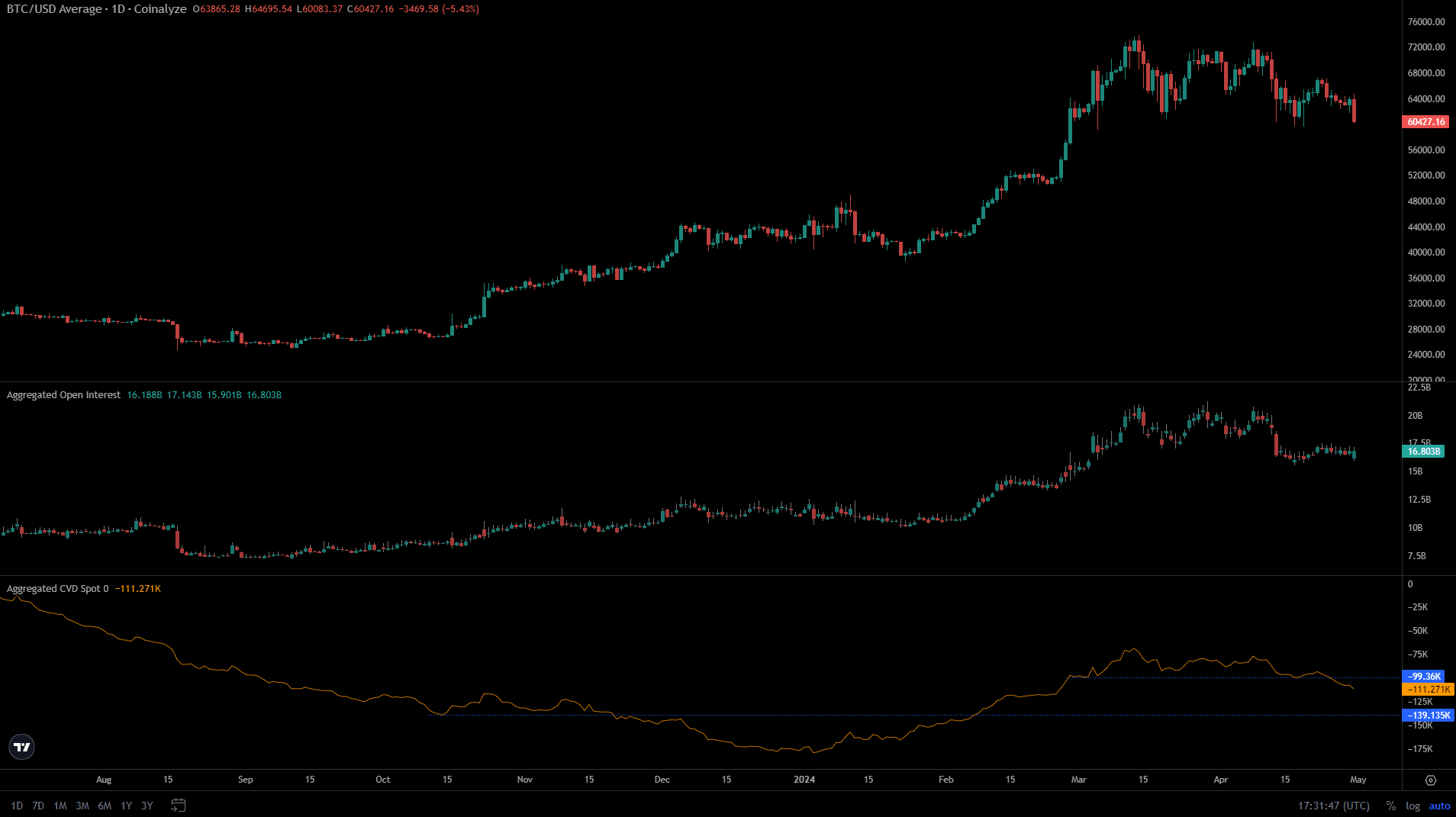

As a crypto investor, I’ve been keeping a close eye on the spot market for Cardano (CVD). Unfortunately, its recent trend has given me cause for concern. Ever since mid-March, CVD has been sliding downward, and things took a turn for the worse when it dipped below a critical support level that had held firm since late February.

The HTF’s bearish momentum was reinforced by this development, making it less likely for a rebound from the $60k support level. Additionally, Open Interest indicated a decrease, reflecting a bearish outlook.

Here’s why this retracement is healthy in the long run

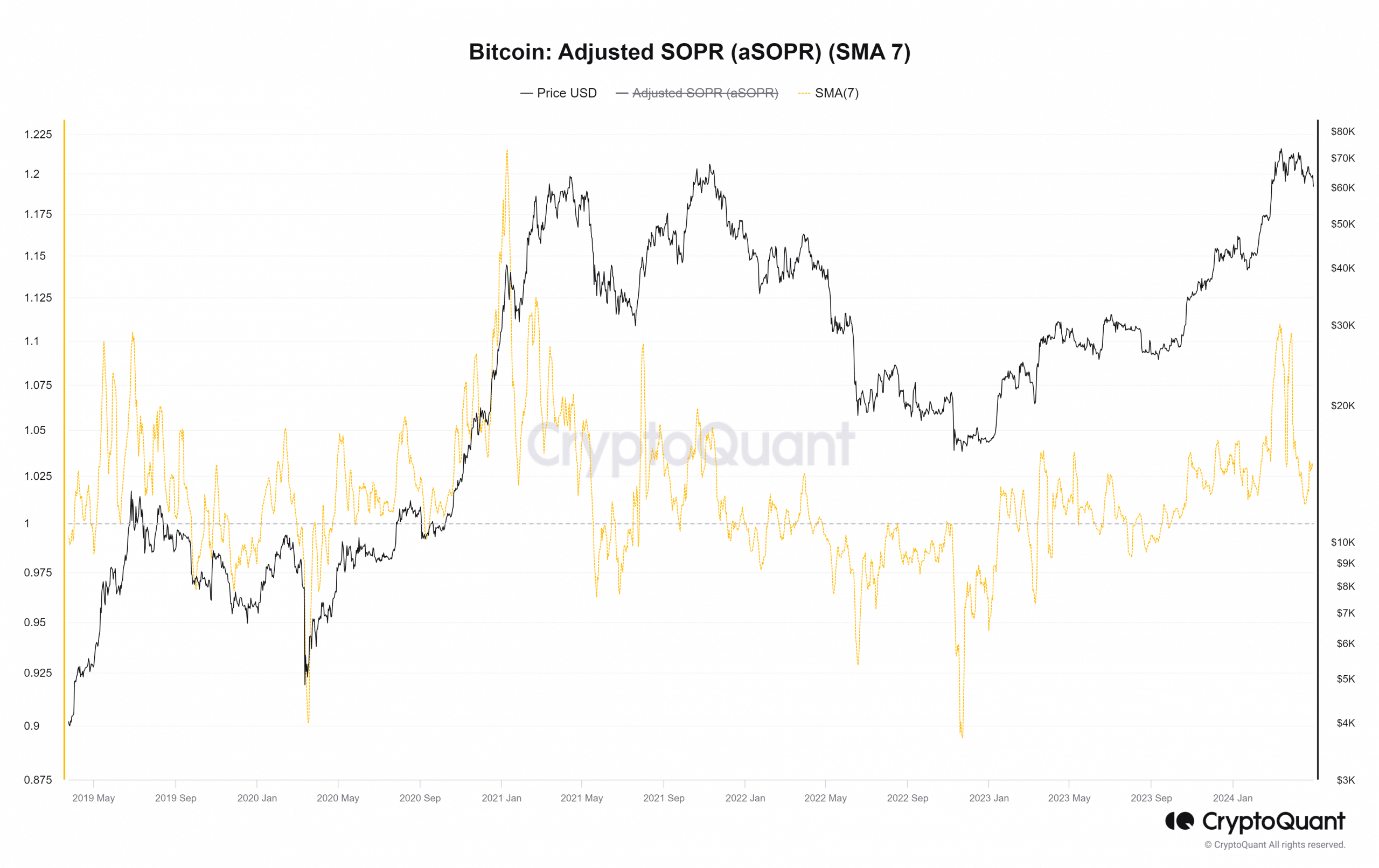

The profit ratio derived from adjusted spent outputs (aSOPR) experienced a significant surge to 1.1 about a month ago, but it has since decreased to 1.029 as of now. In the past, similar patterns occurred in May and August of 2020.

As an analyst, I would rephrase that sentence as follows: After bulls were compelled to reduce their positions due to overexposure, the market witnessed a more stable advance fueled by genuine demand in the spot market.

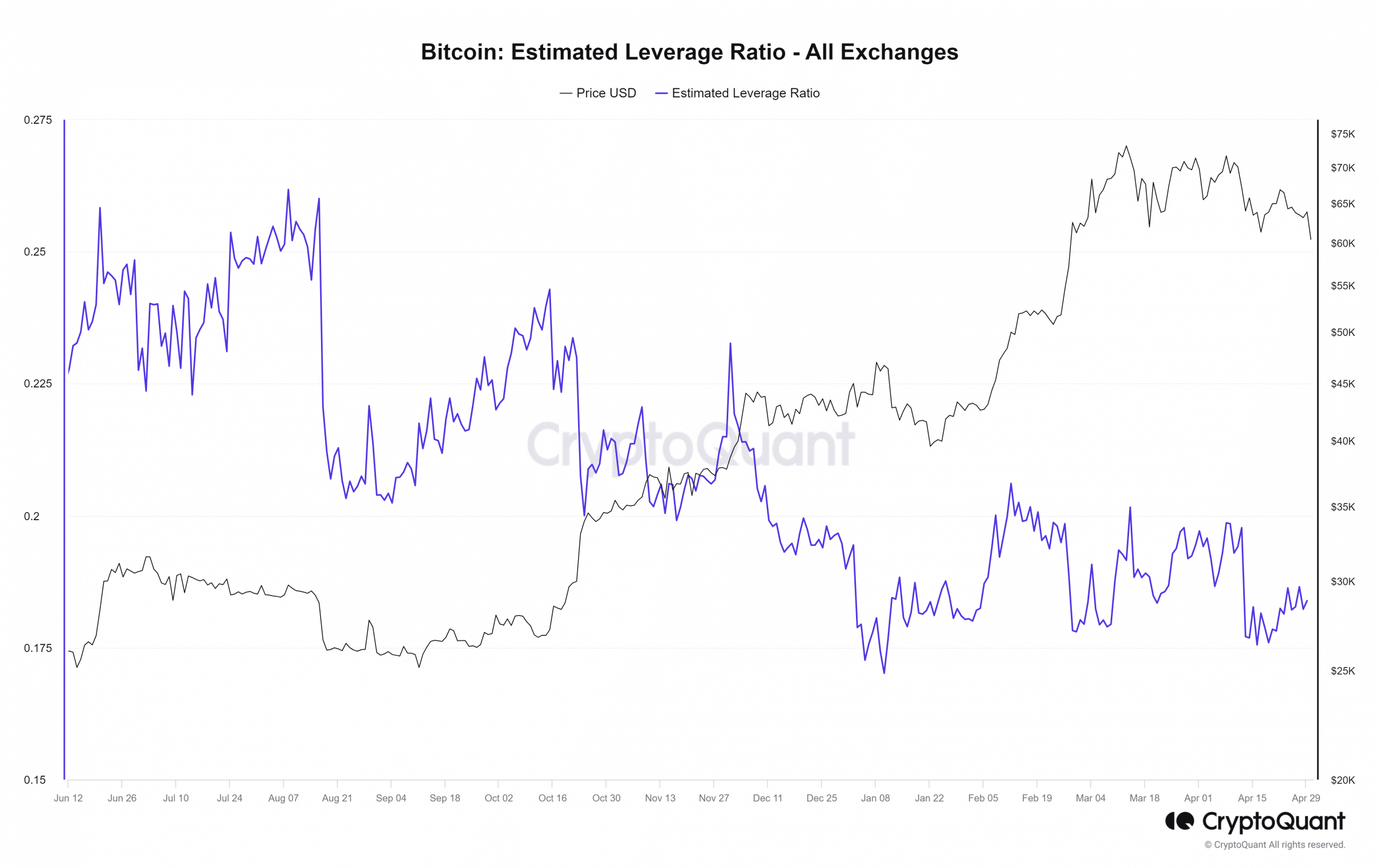

In the year 2024, the predicted debt-to-equity ratio exceeded 0.18 on several occasions, only to retreat afterwards. This occurrence signified that the majority of overextended investments had been reduced due to the recent market downturn.

If BTC drops beneath the $59,400 threshold, a downtrend toward the $55,000 and $52,000 support levels is expected. This doesn’t guarantee an uptick in Bitcoin’s price.

Read More

- AUCTION PREDICTION. AUCTION cryptocurrency

- EPCOT Ceiling Collapses Over Soarin’ Queue After Recent Sewage Leak

- Heartstopper Season 4 Renewal Uncertain, But Creator Remains Optimistic

- Why Aesha Scott Didn’t Return for Below Deck Down Under Season 3

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- The White Lotus Season 3: Shocking Twists and a Fourth Season Confirmed!

- Microsoft Stands Firm on Gulf of Mexico Name Amid Mapping Controversy

- Teyana Taylor & Aaron Pierre: The Romance Confirmed at Oscars!

- BNB PREDICTION. BNB cryptocurrency

- Daredevil: Born Again’s Shocking Release Schedule Revealed!

2024-05-01 10:15